Monaco Golden Visa: Everything You Need to Know

- Real Estate Investment: Firstly, you must either buy or lease property in Monaco that meets the accommodation requirements.

- Financial Self-Sufficiency: Secondly, applicants need to prove they have enough financial means to support themselves without working in Monaco. A deposit of €500,000 in a local bank is required.

- Finally, applicants must also be over 18 and have no criminal record to be eligible for Monaco’s Golden Visa.

- Minimum Investment: €500,000

- Investment Options: Purchase of property or a deposit with a local bank

- Accommodation: Proof of accommodation for the applicant and family

- No Physical Presence Requirement: There is no mandatory minimum stay in Monaco

- Family Eligibility: Spouse, partner, and dependent children above 18 can apply

- Processing Time: Around 3 months

- Contact a Local Agency: Firstly, it is important to work with an agency experienced in Monaco residency applications.

- Gather the Required Documents: This includes proof of accommodation, financial statements, and a criminal background check.

- Submit Your Application: Submit your completed application to Monaco’s Directorate of Public Security.

- Residency Interview: You may be invited for an official residency interview after your application is reviewed.

- Apply for a Long-Stay Visa: If required, apply for a long-stay visa through the French consulate.

- Receive Temporary Residency: After approval, you’ll receive a temporary residency permit for one year.

- No Personal Income Tax: Monaco has no personal income tax on worldwide earnings.

- No Wealth Tax: Monaco does not impose any wealth tax on its residents.

- No Capital Gains Tax: Furthermore, there is no capital gains tax on the sale of assets, including real estate.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Conclusion

The Monaco Golden Visa offers a unique opportunity for high-net-worth individuals to reside in one of the world’s most tax-friendly and luxurious locations. In conclusion, with its numerous benefits and business advantages, Monaco remains a top choice for wealthy investors.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

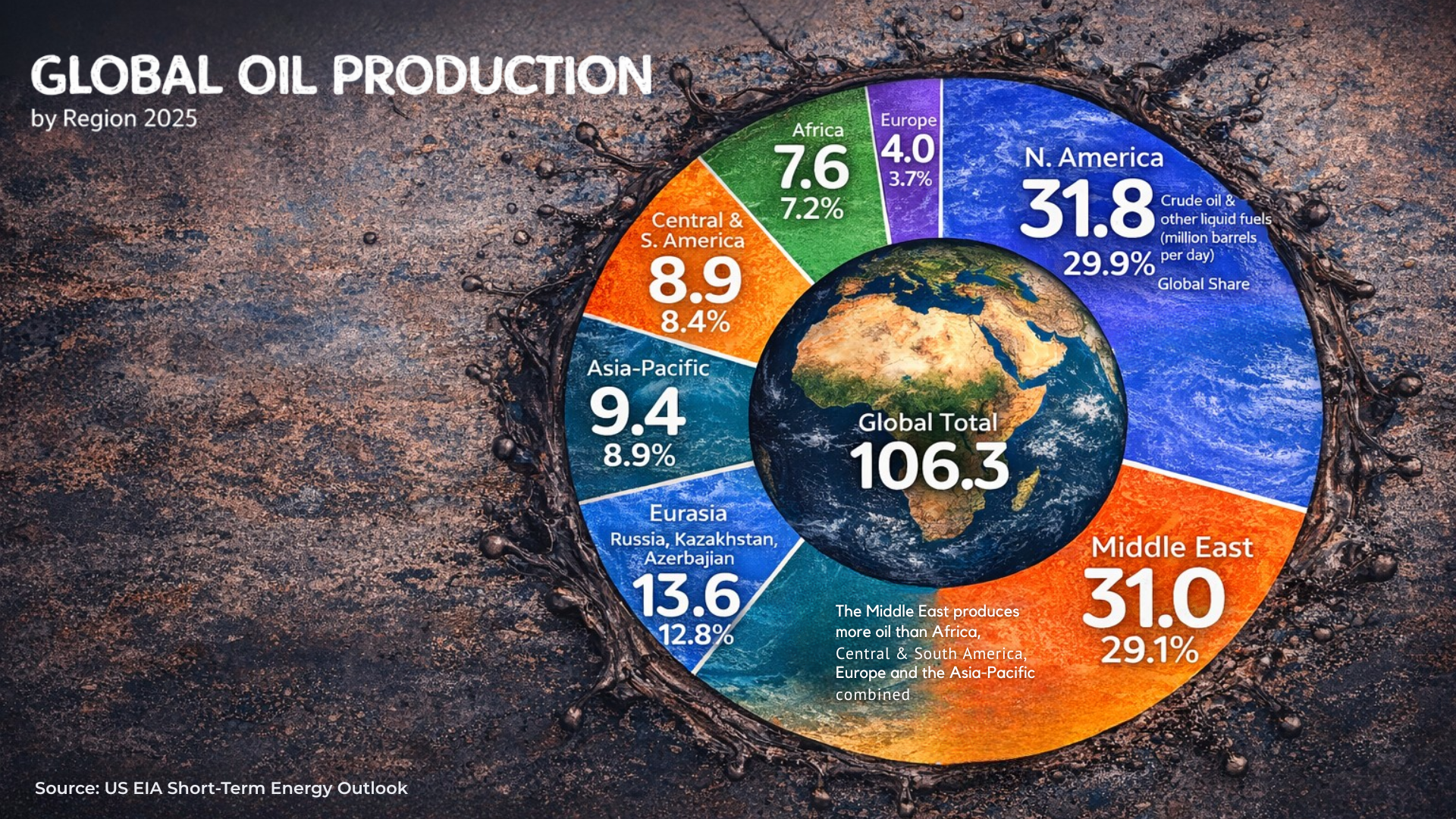

Global Oil: Where the World’s Oil Comes From by Region

Understanding where the world’s oil comes from by region reveals more than energy statistics. It highlights economic power centers shaping…

The USA Moves to Challenge Sharia Law Policies in Nigeria

The United States has introduced legislation addressing Sharia law policies in Nigeria, increasing international scrutiny on governance and religious freedom….

South Africa Infrastructure Gains $350M World Bank Support

The World Bank $350 million investment in South Africa infrastructure signals growing global confidence in the country’s economic future. For…

10 African Countries Leading Global Soft Power in 2026

Africa’s global influence continues to grow. The African soft power 2026 ranking highlights ten nations shaping global perception through culture,…

African Citizenship by Investment for Strategic Global Investors

African citizenship by investment is gaining attention among global investors seeking diversification, mobility, and access to emerging markets. As African…

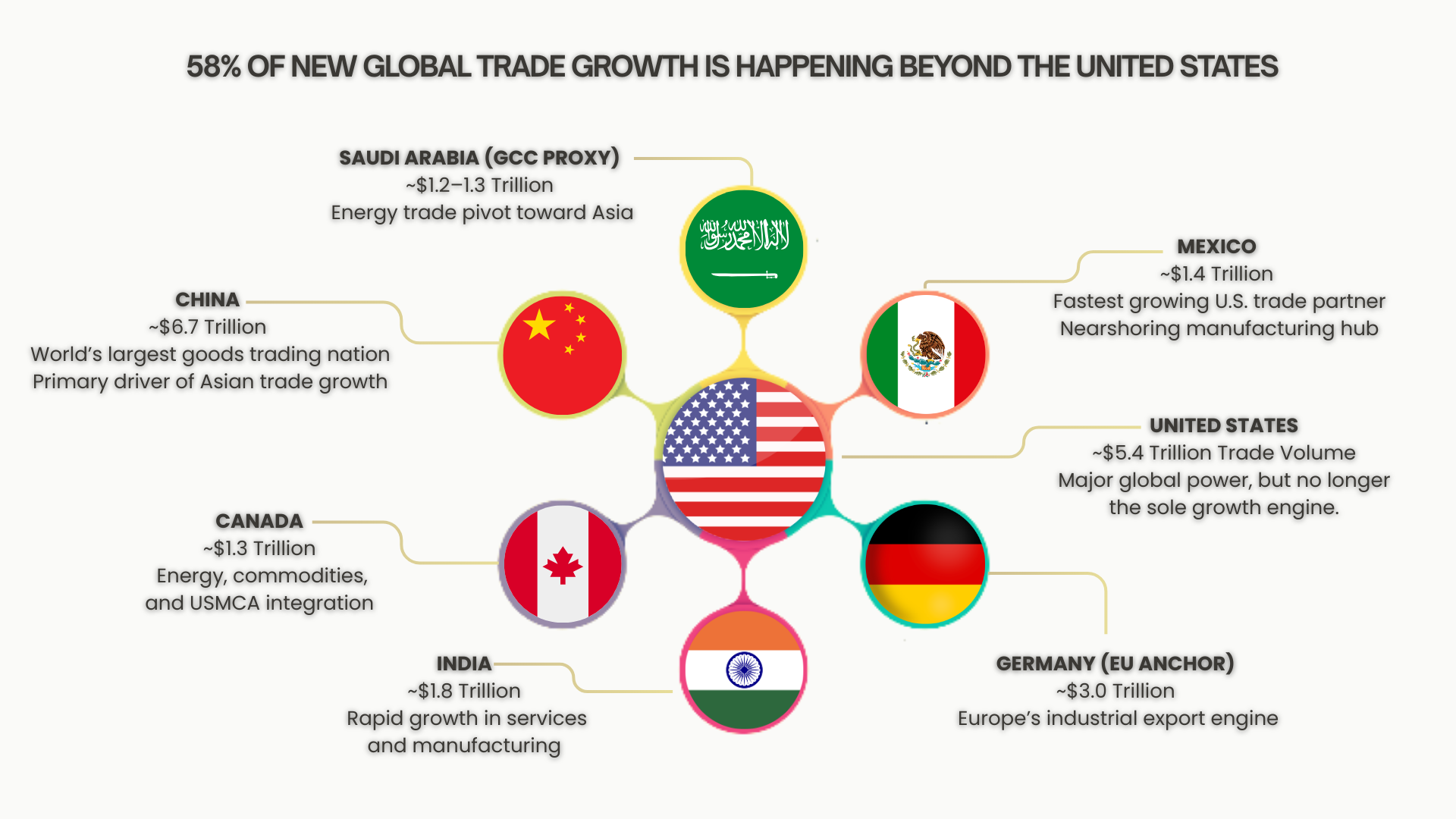

58% of New Trade Growth Happens Outside the U.S.

58% of New Trade Growth Happens Outside the U.S., marking a structural shift in global economic power. As trade momentum…