/

China’s Bold Move with Dollar Bonds in Riyadh Attracts Billions

- Enhancing Riyadh’s Position: The choice of Riyadh over traditional financial centers signifies international confidence in Saudi financial markets. This includes supporting Riyadh’s Vision 2030 goal to establish itself as a leading global financial hub.

- Deepening Economic Relations: This decision highlights the growing economic partnership between two major trading nations. Also paving the way for new investments and collaborations that align with both nations’ strategic goals.

- Diversifying the Economy: By attracting global investor interest, Saudi Arabia can accelerate the diversification of income sources beyond oil.

- Global Investor Attraction: The bond issuance draws global investor interest. Which increases capital inflows into Saudi Arabia, positioning it as a new investment hub in the Middle East.

- Strengthening Economic Sovereignty: Choosing Riyadh over traditional Western financial centers reflects a shift toward greater independence. This plays a huge role in enhancing Saudi Arabia’s role in shaping new economic alliances.

- Facilitating Knowledge Transfer: Hosting such issuances contributes to building Saudi expertise and enhancing capabilities in managing global financial operations, promoting long-term growth.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Conclusion

China’s issuance of dollar bonds in Riyadh represents a significant development in the global financial landscape. For investors, it opens up new opportunities for engagement and growth in the Middle East. The strong investor response underscores the confidence in both China bonds and Riyadh’s financial markets. And also marking a new chapter in global economic relations. Explore this opportunity further and consider how this strategic move might align with your investment goals.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

South Africa Infrastructure Gains $350M World Bank Support

The World Bank $350 million investment in South Africa infrastructure signals growing global confidence in the country’s economic future. For…

10 African Countries Leading Global Soft Power in 2026

Africa’s global influence continues to grow. The African soft power 2026 ranking highlights ten nations shaping global perception through culture,…

African Citizenship by Investment for Strategic Global Investors

African citizenship by investment is gaining attention among global investors seeking diversification, mobility, and access to emerging markets. As African…

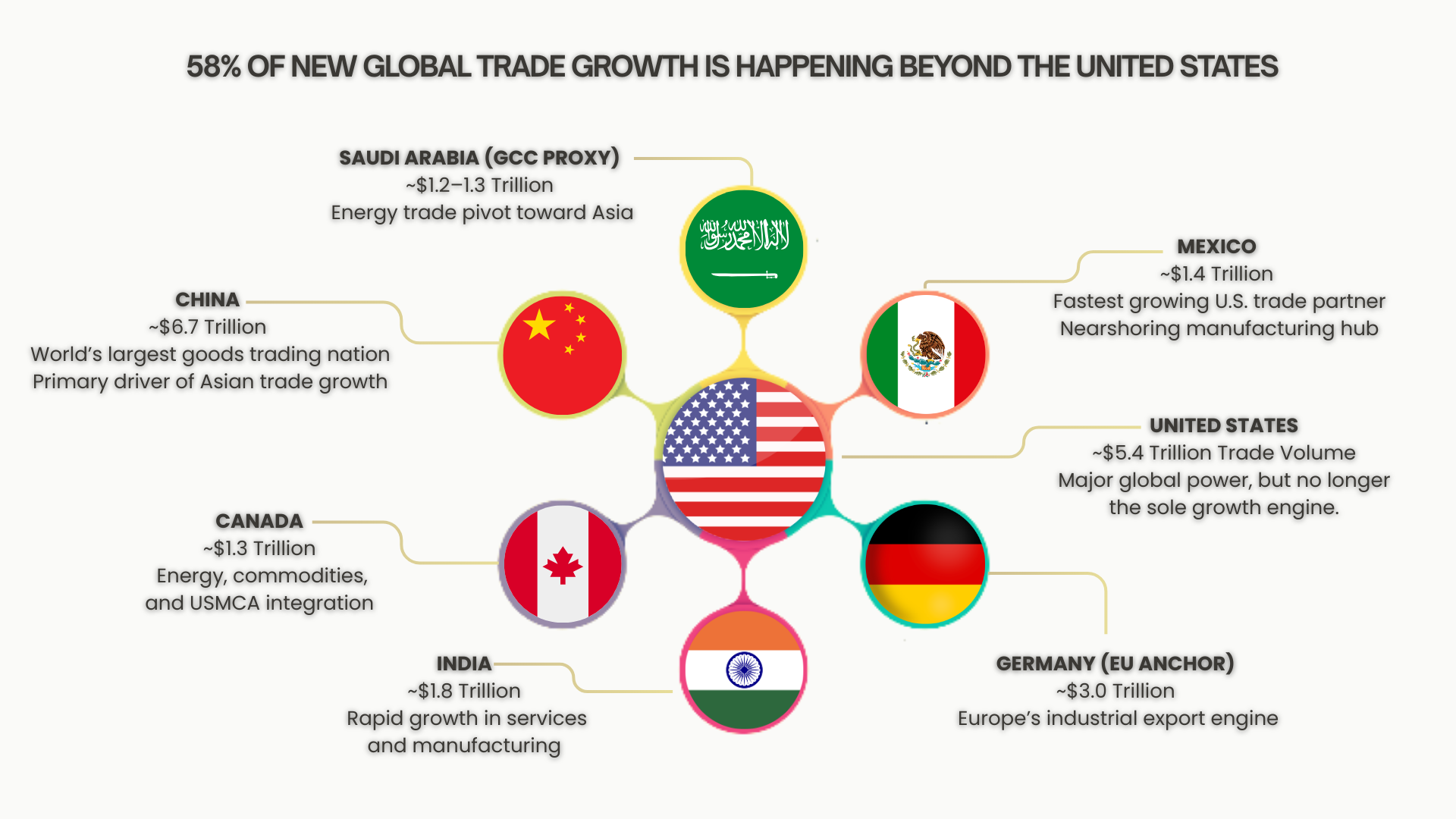

58% of New Trade Growth Happens Outside the U.S.

58% of New Trade Growth Happens Outside the U.S., marking a structural shift in global economic power. As trade momentum…

CBI in Times of Uncertainty: When One Passport Is Not

Global uncertainty has changed the rules of wealth preservation. In today’s environment, one passport may not provide sufficient protection. This…

Nigeria Dangote Refinery Investment Opportunity for Strategic Investors

Nigeria’s Dangote Refinery investment opportunity reflects growing capital market maturity and infrastructure scale. For high net worth individuals and global…