Why UK Billionaires Are Moving Abroad And How You Can Too

Introduction: When Billionaires Make a Move, The World Pays Attention

The recent decision by Nik Storonsky, the billionaire co-founder of Revolut, to leave the United Kingdom and become a resident of the United Arab Emirates (UAE) made headlines around the world. With a net worth close to $8 billion, his decision wasn’t random, it was a strategic shift.

His departure highlights a larger trend: wealthy individuals and entrepreneurs are moving away from high-tax countries and choosing jurisdictions that offer more financial freedom, tax benefits, and long-term security.

This blog explores why these moves are happening, what you can learn from them, and how to build your own “Plan B” for wealth protection and international mobility.

Why Nik Storonsky Left the UK

Nik Storonsky didn’t just pack his bags for sunnier weather. His move was part of a well-thought-out financial strategy.

Here’s what motivated the decision:

- The UK Scrapped Its Non-Dom Tax Regime: For decades, the UK allowed some residents to be taxed only on UK income, not foreign income. This made it a hub for wealthy global citizens. But that rule is now gone, increasing the tax burden for many.

- Regulatory Frustration: Storonsky’s company, Revolut, faced delays in getting a UK banking license. This raised concerns about how friendly the business environment really was.

- Better Opportunities Abroad: Countries like the UAE offer zero personal income tax, investor-friendly policies, and a clear pathway for residency.

Tax-sensitive residency planning is the process of legally changing your tax residence to reduce your personal or corporate tax obligations. This involves:

- Choosing a country with lower or no income taxes

- Meeting legal requirements to become a resident

- Ensuring compliance with exit rules from your previous country

- Planning for asset protection, succession, and mobility

It’s not about tax evasion. It’s about using legal, government-approved paths to better manage your wealth.

Nik Storonsky is not alone. A wave of high-net-worth individuals (HNWIs) are moving their personal and business lives to friendlier environments.

Here’s why:

- Unpredictable Tax Changes

- Countries facing economic pressure often target the wealthy with new tax laws. When tax rules change suddenly, it becomes risky to keep all your assets or income in one place.

- High Personal Taxes

- Some countries charge 40%–60% on personal income. Others, like the UAE, charge 0%. That’s a massive difference over time.

- Better Lifestyle and Infrastructure

- Modern, well-connected cities like Dubai, Singapore, and Lisbon offer high-quality living with strong legal systems and business infrastructure.

- Global Business Needs Global Presence

- If your business serves international clients, why be limited by one country’s rules? A global structure gives more freedom.

The United Arab Emirates, especially Dubai, is emerging as a top destination for entrepreneurs and investors. Here’s why:

- No personal income tax

- No capital gains or inheritance tax

- Straightforward residency options for investors and business owners

- Modern infrastructure and high security

- Growing financial and tech sectors

It’s not just tax-free, it’s business-friendly, globally connected, and increasingly seen as a stable long-term base.

The UAE is not the only option. Several other countries offer investor-friendly programs:

| Country | Highlights |

| Portugal | Golden Visa residency; low tax on foreign income |

| Malta | Citizenship by investment; EU access |

| St. Kitts & Nevis | Fast-track citizenship; tax-neutral |

| Dominica | Affordable citizenship program |

| Greece | Property-based Golden Visa with EU benefits |

Each program comes with different costs, timelines, and requirements. Some focus on residency, others offer full citizenship.

Whether you’re a startup founder, investor, or business executive, here’s what you can learn from Storonsky’s move:

- Don’t Rely on One Country

- If your entire financial life is tied to one country, a single law change can hurt your wealth. Diversification isn’t just for investments, it applies to residency too.

- Have a Second Option

- Second citizenship or residency gives you flexibility. It’s like an insurance policy against political or economic surprises.

- Align Business Location With Growth

- If your company operates globally, your personal and corporate structure should support that, through better tax planning and global reach.

- Start the Process Early

- Changing residency or gaining second citizenship takes time. Start planning before it becomes urgent.

Before relocating or applying for investment residency, make sure you understand:

- Exit Taxes: Some countries tax you when you give up residency.

- Real Residency Rules: You may need to spend a certain number of days in your new country.

- Asset Reporting: Some countries require you to declare global assets even if you live elsewhere.

- Family and Lifestyle: Think about education, healthcare, language, and quality of life before you move.

- Legal Compliance: You must follow immigration, tax, and reporting rules in all relevant jurisdictions.

Creating your Plan B doesn’t mean you’re leaving your home country right away. It means having a clear path to relocate or restructure if needed.

A smart Plan B includes:

- Legal tax residence in a second country

- Global bank accounts and asset protection strategies

- Citizenship or long-term residency rights elsewhere

- Local support to handle legal, tax, and immigration matters

This can give you peace of mind, knowing you’re ready, no matter what happens.

Our firm specializes in helping entrepreneurs, high-net-worth individuals, and global families:

- Identify the best residency or citizenship-by-investment options

- Navigate legal, tax, and immigration challenges

- Create a personal wealth protection strategy

- Build global freedom with structure and compliance

Whether you want to move today or just prepare for the future, we’ll guide you through every step.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

What This Means for Your Future

Nik Storonsky’s decision to leave the UK wasn’t about avoiding taxes, it was about smart planning. He chose to protect his capital, grow his company, and live in a country aligned with his goals.

In a world where governments can change tax laws overnight, the smartest move you can make is to be prepared.

You don’t need to be a billionaire to benefit from the same strategy. Residency and citizenship planning is more accessible than ever and it could be the key to protecting your legacy.

Take control of your future. Start your Plan B today.

Visit our website or contact our team to learn how we can help.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

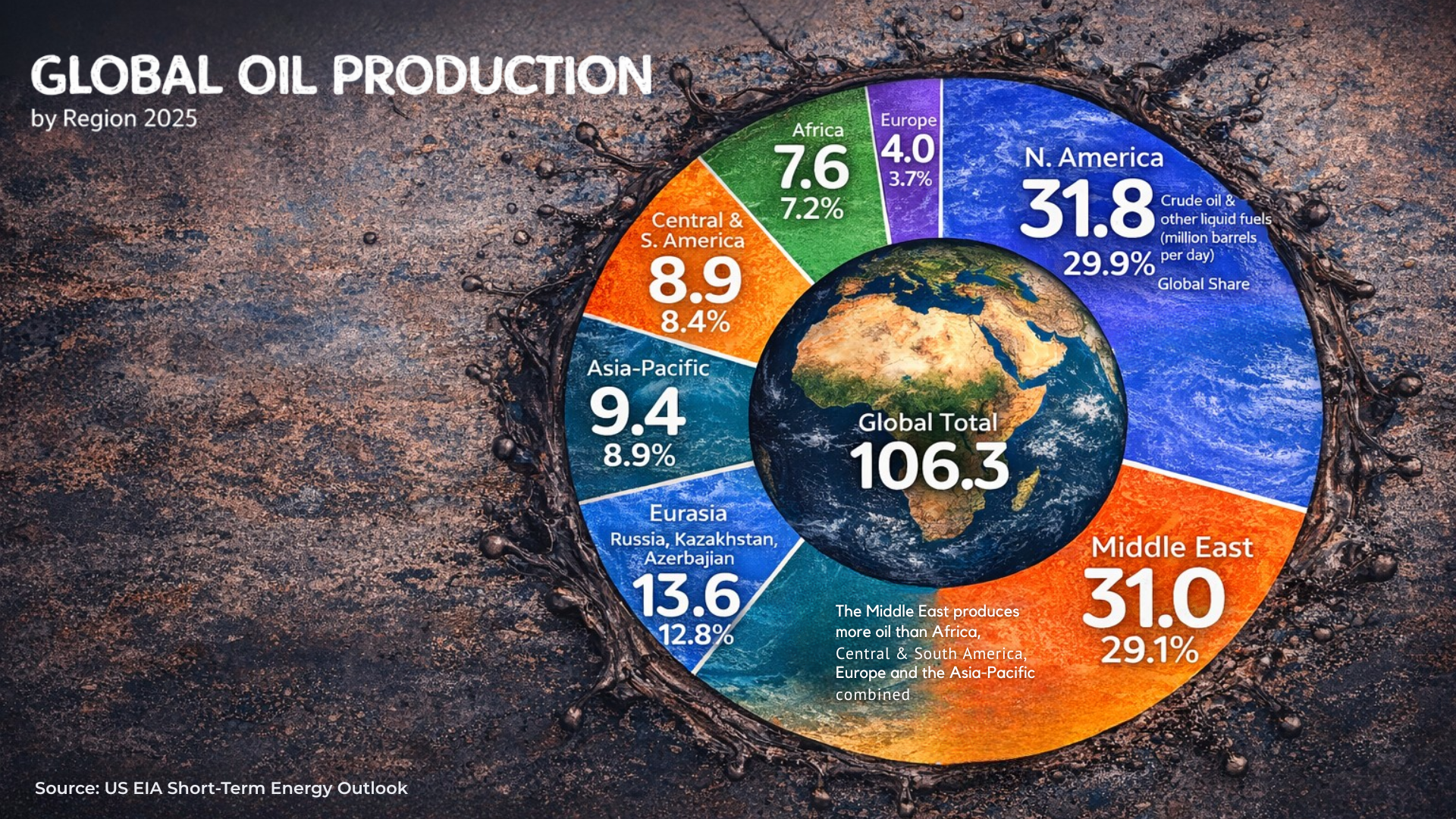

Global Oil: Where the World’s Oil Comes From by Region

Understanding where the world’s oil comes from by region reveals more than energy statistics. It highlights economic power centers shaping…

The USA Moves to Challenge Sharia Law Policies in Nigeria

The United States has introduced legislation addressing Sharia law policies in Nigeria, increasing international scrutiny on governance and religious freedom….

South Africa Infrastructure Gains $350M World Bank Support

The World Bank $350 million investment in South Africa infrastructure signals growing global confidence in the country’s economic future. For…

10 African Countries Leading Global Soft Power in 2026

Africa’s global influence continues to grow. The African soft power 2026 ranking highlights ten nations shaping global perception through culture,…

African Citizenship by Investment for Strategic Global Investors

African citizenship by investment is gaining attention among global investors seeking diversification, mobility, and access to emerging markets. As African…

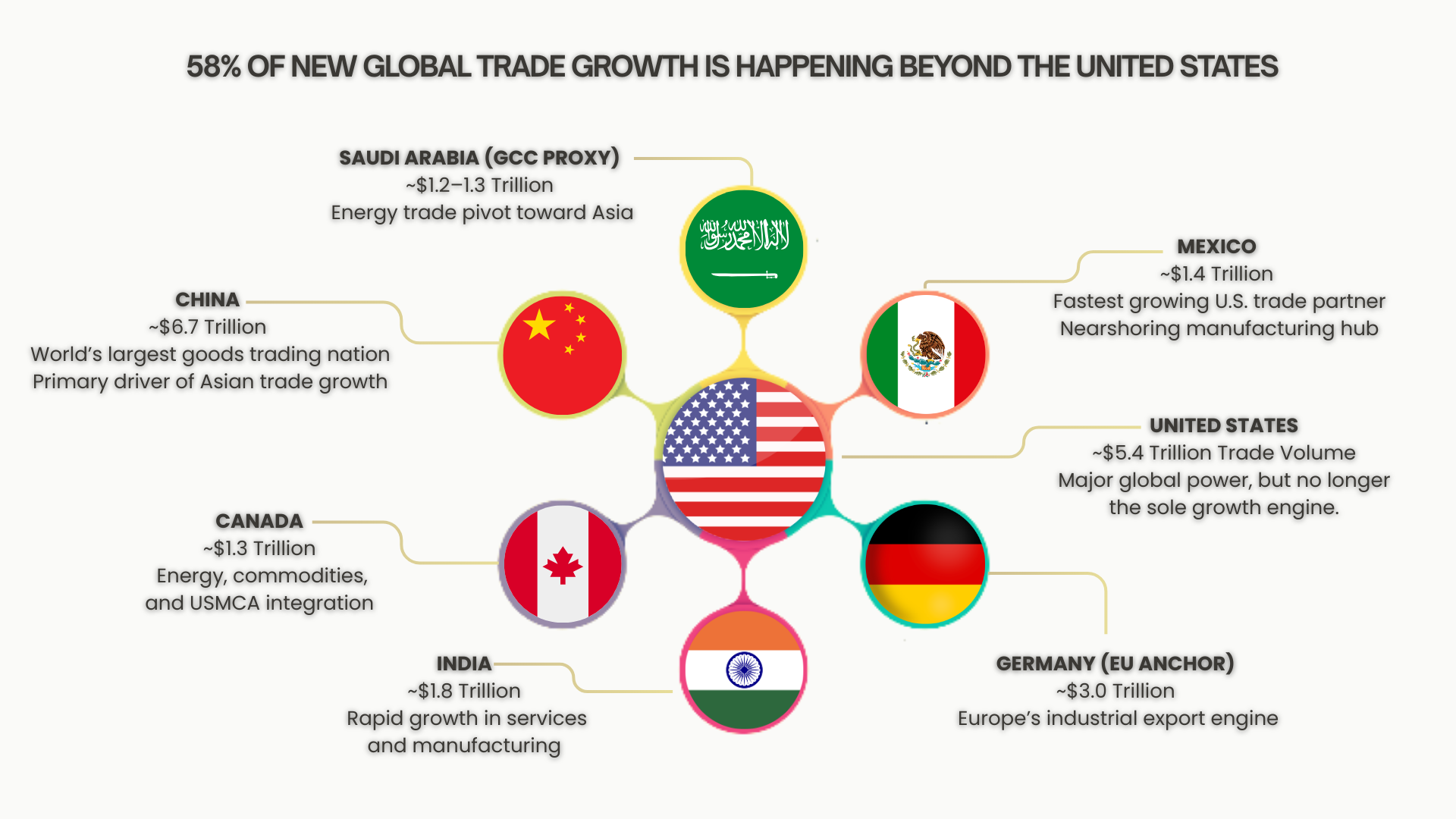

58% of New Trade Growth Happens Outside the U.S.

58% of New Trade Growth Happens Outside the U.S., marking a structural shift in global economic power. As trade momentum…