Why Europe Keeps Losing Entrepreneurs to Global Opportunities

Europe has no shortage of talent, capital, or ambition. It produces world-class engineers, respected institutions, and globally recognized brands. Yet despite these strengths, a growing number of entrepreneurs, investors, and high-net-worth individuals are quietly reducing their exposure to Europe or at least refusing to rely on it alone.

This is not a story of decline, but of friction. And for business owners and investors, friction matters.

This article explores why Europe is becoming harder for entrepreneurs to stay fully committed, what that means for wealth and business strategy, and why globally minded individuals are increasingly focused on flexibility, diversification, and jurisdictional choice.

Europe’s Challenge Is Structural, Not Personal

Europe’s difficulty in retaining entrepreneurs is rarely about lifestyle, culture, or opportunity. In fact, many founders deeply value Europe’s quality of life, education systems, and social stability.

The challenge is structural.

Over the last two decades, Europe has steadily moved toward:

- More centralized decision-making

- Heavier regulation

- Slower policy response

- Less competitive capital markets

For entrepreneurs and investors operating in fast-moving global industries, these trends create delays, uncertainty, and rising costs.

Capital does not leave because it dislikes Europe. It leaves because it seeks efficiency, clarity, and predictability.

Decision-Making Has Become Slower and More Complex

One of Europe’s defining features is its multilevel governance structure. While cooperation across nations has benefits, it also introduces complexity.

When policies require alignment across many countries with different languages, cultures, and economic priorities, outcomes tend to be:

- Slower to implement

- Built on compromise

- Designed to avoid risk

For entrepreneurs, this often means waiting longer for approvals, adapting to overlapping rules, and planning around policies that may change after long negotiations.

In competitive global markets, speed is not a luxury. It is a necessity.

Regulation: Protection or Constraint?

Europe has long positioned itself as a protector of consumers, workers, and social stability. These goals are legitimate and important. However, regulation becomes a problem when it begins to discourage innovation rather than guide it.

Many founders cite:

- Complex compliance requirements

- High administrative costs

- Limited flexibility for new business models

Startups and scale-ups feel this most acutely. While large corporations can absorb regulatory costs, smaller and faster-growing businesses often cannot.

As a result, many European entrepreneurs choose to:

- Incorporate abroad

- Raise capital outside Europe

- Scale globally from non-European bases

This is not regulatory avoidance. It is regulatory optimization.

Capital Markets Remain a Weak Point

Access to risk capital is one of the most important factors in entrepreneurial success. Here, Europe continues to lag behind other major markets.

While Europe has strong private wealth and institutional capital, it often lacks:

- Depth in venture and growth funding

- Appetite for high-risk innovation

- Unified capital markets across borders

By contrast, larger and more integrated markets make it easier to:

- Raise funding quickly

- Exit investments efficiently

- Scale businesses across regions

For investors, this affects returns. For founders, it affects survival.

The result is predictable: capital and companies structure themselves where funding flows more freely.

Taxation and Long-Term Planning Uncertainty

Taxation alone does not drive entrepreneurs away. But unpredictability does.

Across Europe, business owners and investors face:

- Frequent tax changes

- Rising compliance obligations

- Limited ability for jurisdictions to compete

For high-net-worth individuals, long-term planning requires stability. When tax frameworks shift frequently or are influenced by short-term political pressures, confidence erodes.

This does not necessarily trigger relocation. Instead, it encourages diversification:

- Multiple holding structures

- Multiple operating bases

- Multiple personal options

In modern wealth planning, concentration risk is no longer acceptable.

Innovation Policy and Global Competition

Europe remains a leader in research, education, and scientific talent. However, policy decisions increasingly influence where innovation is commercialized.

When incentives for:

- Research and development

- Intellectual property protection

- Advanced manufacturing

are weaker or less predictable, companies adapt by locating key operations elsewhere.

This is particularly visible in sectors such as:

- Technology

- Life sciences

- Advanced manufacturing

Entrepreneurs follow ecosystems, not borders.

Energy, Infrastructure, and Cost Pressures

Energy policy and infrastructure decisions also affect competitiveness. Rising energy costs, supply uncertainty, and uneven infrastructure development increase operational risk.

For industrial businesses and technology firms alike, input costs matter. When those costs rise faster than productivity, margins suffer.

Business owners respond rationally by reassessing where growth should happen.

For high-net-worth individuals, the conversation goes beyond business.

HNWIs think in terms of:

- Multi-generational planning

- Asset protection

- Family mobility

- Access to global markets

From this perspective, reliance on a single jurisdiction, no matter how familiar or comfortable, creates vulnerability.

The most successful families increasingly adopt a global mindset:

- One country for lifestyle

- Another for business

- Another for investment structuring

This is not about abandoning home countries. It is about building resilience.

In today’s world, optionality is one of the most valuable assets a person or family can hold.

Optionality means:

- The ability to respond to change

- Freedom to allocate capital efficiently

- Protection against political or economic shifts

For entrepreneurs, it allows businesses to grow without being constrained by one system.

For investors, it reduces exposure to policy risk.

For families, it provides security and flexibility across generations.

What was once considered niche is now becoming standard practice among globally active individuals.

International structuring, alternative residency, and strategic citizenship planning are increasingly viewed as:

- Risk management tools

- Business enablers

- Wealth preservation strategies

These approaches allow individuals to legally and transparently align their personal and business lives with jurisdictions that support their goals.

Importantly, this is not about secrecy or avoidance. It is about alignment.

Europe will continue to play a major role in global business and investment. Its markets, talent, and institutions remain highly valuable.

However, the most successful entrepreneurs and investors are no longer making Europe their only pillar.

They are building portfolios of jurisdictions, just as they build portfolios of assets.

This approach reflects experience, not pessimism.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

A Smarter Way to Think About the Future

For business owners, investors, and high-net-worth individuals, the key question is no longer where to be based, but how to be positioned.

The global environment is more competitive, more regulated, and more unpredictable than ever. Those who prepare early enjoy more freedom later.

Strategic flexibility is no longer optional. It is foundational.

Planning Ahead in a Changing Global Landscape

If you are a business owner, investor, or high-net-worth individual assessing how to protect your capital, expand your global access, and reduce jurisdictional risk, now is the time to review your structure.

The right strategy does not require disruption. It requires foresight.

A confidential, well-planned approach can help you build optionality, protect long-term interests, and position yourself for a rapidly changing world.

Consider whether your current setup truly supports where you want your business, capital, and family to be in the next decade and take steps today to ensure you are not limited tomorrow.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

7 Key Risks A U.S. Setup Isn’t Always Best for

A cross-border business setup can boost global growth by reducing onboarding delays, payment friction, and concentration risk. This guide explains…

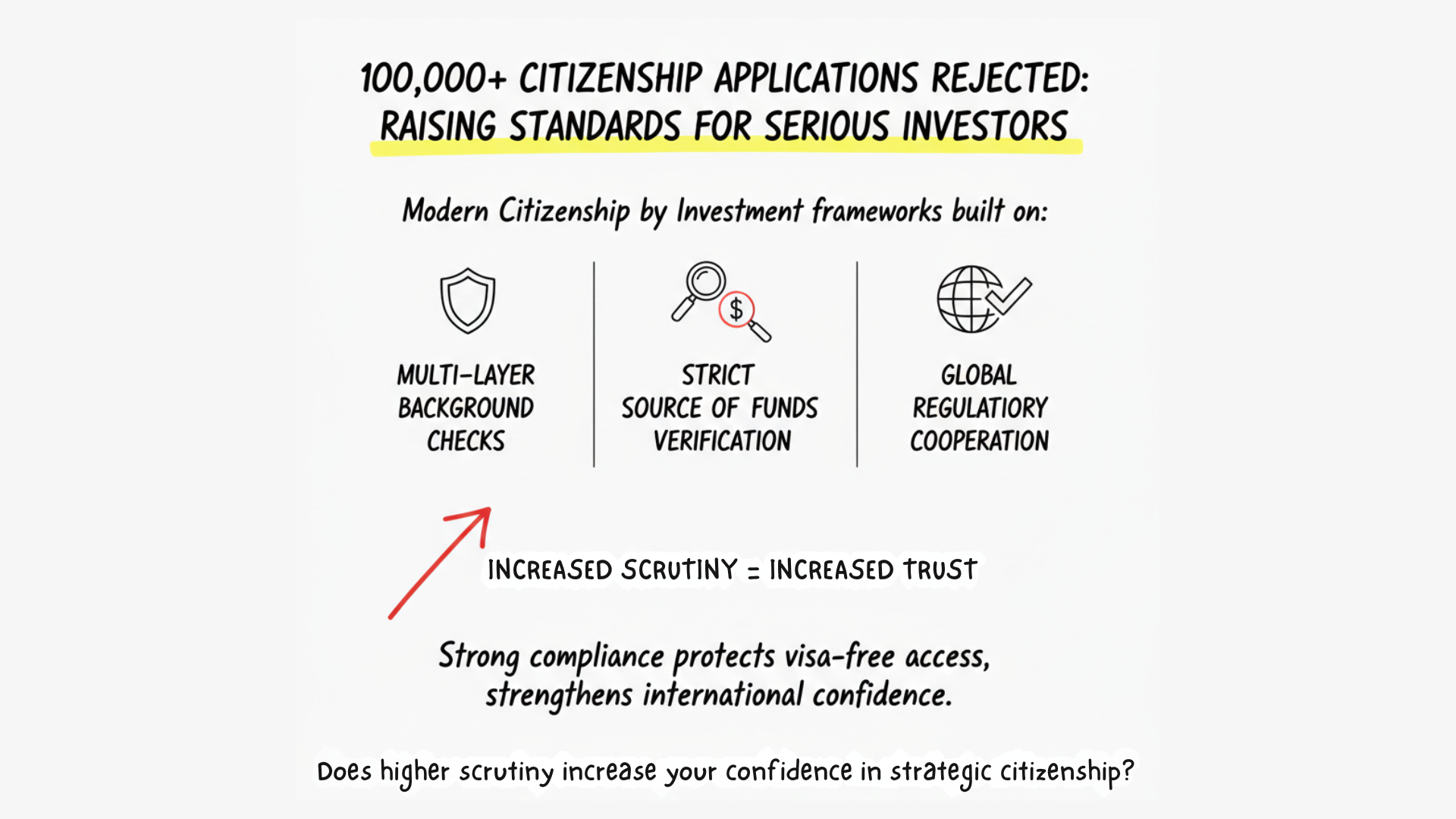

Why Citizenship by Investment Due Diligence Matters for Investors

Citizenship by Investment due diligence protects more than an application. It safeguards international credibility, visa free access, and long term…

Wealthy Americans Lead New Zealand Golden Visa Surge

Wealthy Americans are leading the New Zealand Golden Visa surge as investors prioritize stability and diversification. Billions in committed capital…

Second Residency Is Now A Top Three Global Wealth Priority

Second residency has quietly moved into the top tier of priorities for serious wealth holders. This article explains why investors…

UK Exit Tax 20% and the Future of Strategic Wealth

The UK Exit Tax 20% could significantly impact HNWIs, founders, and investors with substantial unrealized gains. This in depth analysis…

Greek Golden Visa Sees Record Turkish Investor Demand Surge

The Greek Golden Visa is seeing record demand from Turkish investors seeking EU residency, asset protection, and mobility. With participation…