Why Citizenship by Investment Due Diligence Matters for Investors

Citizenship by Investment due diligence has become a defining pillar of global mobility strategy. In today’s regulatory climate, investors must evaluate not only opportunity but also credibility. For high net worth individuals and international business owners, strong compliance frameworks protect long term value.

Recently, the Prime Minister of Antigua and Barbuda addressed a European parliamentary forum and firmly defended the strength of the country’s Citizenship by Investment program. Notably, he stated that obtaining Caribbean citizenship can be more rigorous than securing certain EU visas. This statement reflects a broader industry shift. Governments are prioritizing structured compliance and international cooperation.

As a result, serious investors benefit.

Antigua and Barbuda’s Position on Global Standards

When Antigua and Barbuda’s Prime Minister defended the program before European policymakers, he demonstrated institutional confidence. Rather than avoiding scrutiny, the government engaged directly.

This approach sends several signals to investors:

- The program aligns with international regulatory standards

- Leadership stands behind compliance procedures

- Authorities welcome transparency and cooperation

In this context, public defense reflects strength rather than vulnerability.

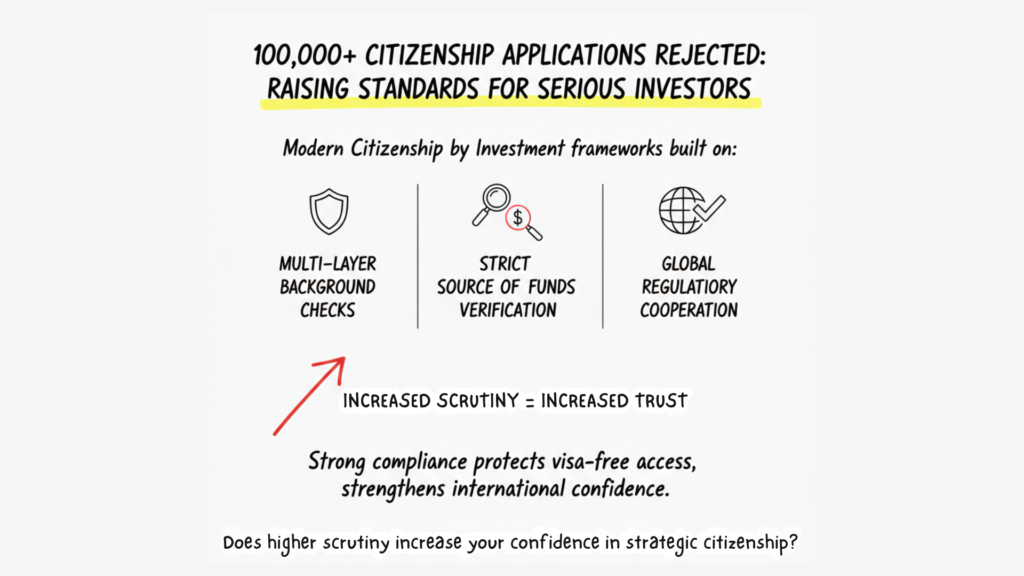

The Meaning Behind 100,000 Rejections

Across the industry, more than 100,000 citizenship applications have reportedly been rejected due to due diligence failures. That figure reflects enforcement, not weakness.

Rejections show that authorities:

- Identify inconsistencies in documentation

- Scrutinize source of funds disclosures

- Conduct independent international background checks

- Decline high risk applications

For high net worth investors, this reinforces trust. Approvals are earned through transparency and compliance.

What Strong Due Diligence Includes

Over the past decade, Citizenship by Investment programs have matured significantly. Initially, frameworks were simpler. However, as international scrutiny increased, governments strengthened their systems.

Consequently, modern programs now implement multilayer screening that includes:

- Independent international background checks

- Strict source of funds verification

- Sanctions and politically exposed person screening

- Enhanced risk assessment procedures

Importantly, these measures protect both the issuing country and approved citizens. By enforcing standards consistently, governments preserve diplomatic relationships and visa free agreements.

Protecting Visa Free Access

Visa free travel remains a core driver of investment migration. However, mobility depends on international trust. If screening weakens, diplomatic relationships may suffer.

Therefore, Citizenship by Investment due diligence plays a direct role in safeguarding:

- Visa free travel privileges

- Bilateral agreements

- Passport reputation

- Long term program sustainability

Programs that withstand scrutiny tend to maintain stronger global standing.

Citizenship as a Strategic Asset

For globally mobile families, citizenship represents more than convenience. Instead, it functions as a strategic asset integrated into broader wealth planning.

Investors often pursue second citizenship to support:

- Cross border business expansion

- Family relocation flexibility

- Education opportunities

- Asset diversification

- Geopolitical risk management

Like any valuable asset, citizenship requires protection. Strong due diligence ensures that its value remains intact over time.

Rising Scrutiny Signals Maturity

Importantly, increased oversight does not indicate instability. On the contrary, it signals program maturity. As investment migration gains global recognition, regulators naturally apply higher standards.

Well regulated jurisdictions respond by strengthening transparency, refining compliance procedures, and enhancing diplomatic dialogue. Antigua and Barbuda’s engagement at the European forum reflects this proactive stance.

Consequently, programs that adapt to scrutiny often emerge stronger.

Why Serious Investors Welcome Higher Standards

High net worth individuals already operate within structured financial systems. They comply with:

- International banking regulations

- Corporate governance standards

- Tax reporting obligations

- Anti money laundering requirements

Citizenship by Investment due diligence aligns with these realities.

Stronger standards deliver:

- Greater international credibility

- Reduced geopolitical risk

- Protection of mobility rights

- Sustainable long term frameworks

Exclusivity and structure enhance value.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Confidence Built on Credibility

Citizenship by Investment due diligence preserves international trust. Strong screening filters risk, protects diplomatic relationships, and safeguards approved citizens.

Antigua and Barbuda’s public defense of its framework reinforces this principle. Programs that withstand scrutiny tend to emerge stronger and more stable.

For serious investors, credibility remains the ultimate asset.

If you are evaluating second citizenship as part of your wealth strategy, focus on jurisdictions that demonstrate strong compliance, transparent leadership, and international cooperation. Our advisory team works closely with investors to structure applications that align with evolving regulatory standards and long term mobility goals.

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

7 Key Risks A U.S. Setup Isn’t Always Best for

A cross-border business setup can boost global growth by reducing onboarding delays, payment friction, and concentration risk. This guide explains…

Wealthy Americans Lead New Zealand Golden Visa Surge

Wealthy Americans are leading the New Zealand Golden Visa surge as investors prioritize stability and diversification. Billions in committed capital…

Second Residency Is Now A Top Three Global Wealth Priority

Second residency has quietly moved into the top tier of priorities for serious wealth holders. This article explains why investors…

UK Exit Tax 20% and the Future of Strategic Wealth

The UK Exit Tax 20% could significantly impact HNWIs, founders, and investors with substantial unrealized gains. This in depth analysis…

Greek Golden Visa Sees Record Turkish Investor Demand Surge

The Greek Golden Visa is seeing record demand from Turkish investors seeking EU residency, asset protection, and mobility. With participation…

Malaysia MM2H Program Nears $1 Billion in Investment Inflows

The Malaysia MM2H program has attracted nearly $1 billion in just 18 months, reflecting renewed global investor confidence. For high…