Why 29+ Jurisdictions Keep Pension Taxes Below 10 Percent

Retirement has evolved from a lifestyle decision into a strategic phase of global wealth planning. For high-net-worth individuals, business owners, and internationally active investors, understanding why 29+ jurisdictions keep pension taxes below 10 percent is essential to preserving capital, ensuring predictability, and maintaining long-term flexibility.

Governments across Europe and beyond have recognized that financially independent retirees represent one of the most attractive resident profiles. Their income is stable, foreign-sourced, and long term. As a result, many jurisdictions have intentionally designed pension-specific tax regimes that prioritize consistency and trust over aggressive taxation.

A Deliberate Shift in Government Policy

The rise of cross-border wealth and global mobility has forced governments to adapt. Traditional tax systems were designed for citizens who lived, worked, and retired in the same country. That reality no longer applies to modern investors and entrepreneurs.

Rather than resisting mobility, many countries now compete for it. Retirees with foreign pensions offer predictable economic participation without disrupting labor markets or increasing public spending pressures. This policy shift explains the growing number of jurisdictions that actively court pensioners through favorable tax treatment.

Why Pension Income Is Taxed Differently

Pension income holds a unique position in tax policy. Unlike employment or business income, it does not depend on local economic performance and does not fluctuate with market cycles. Governments understand that lightly taxing this income still delivers long-term economic benefits.

Key reasons pension income receives preferential treatment include:

- It is foreign-sourced, reducing capital flight concerns

- It arrives as stable, recurring cash flow

- It supports local consumption, healthcare, and housing markets

- It does not compete with domestic employment

This framework explains why 29+ jurisdictions keep pension taxes below 10 percent as a sustainable, long-term policy choice rather than a short-term incentive.

Europe’s Structured Pension Tax Frameworks

Several European countries have taken a highly regulated approach to attracting foreign retirees. Instead of informal exemptions, they have introduced clear, legislated pension tax regimes that apply flat or capped rates to qualifying foreign income.

These regimes typically share common characteristics:

- Formal tax residency requirements

- Minimum physical presence thresholds

- Clear income classification rules

- Administration through national tax authorities

Countries such as Cyprus, Italy, and Greece have become reference points for this model. Their appeal lies not only in single-digit tax rates, but in the transparency and predictability of their systems. For investors and HNWIs, this level of structure significantly reduces long-term uncertainty.

Beyond Europe: Territorial and Remittance-Based Systems

Outside Europe, many jurisdictions achieve similar outcomes through different tax philosophies. Rather than taxing global income, they focus on where income is generated or where it is received.

These systems generally fall into two categories:

- Territorial tax models, where only locally sourced income is taxed

- Remittance-based models, where foreign income is taxed only if brought into the country

For retirees with foreign pensions, these frameworks can result in effective tax rates well below 10 percent, and in some cases, no tax at all. However, these benefits depend heavily on correct structuring. Banking arrangements, income flows, and residency definitions must align precisely.

Institutional Trust and Policy Credibility

Low pension tax regimes signal more than generosity. They reflect confidence in legal systems, compliance enforcement, and international reputation. Governments that lack regulatory maturity cannot sustain such policies without risking abuse or instability.

For HNWIs and investors, this distinction is critical. A low tax rate without institutional strength creates risk. A structured regime backed by strong governance creates certainty. This credibility is a key reason these policies persist across multiple jurisdictions.

Strategic Implications for HNWIs and Business Owners

For globally mobile families, pension income rarely exists in isolation. It intersects with dividend distributions, investment portfolios, liquidity events, and estate planning. Business owners who exit later in life often convert active income into long-term pension-style cash flow.

Low pension taxation supports this transition by:

- Improving capital preservation

- Enhancing cash flow predictability

- Simplifying multi-generational planning

- Reducing long-term tax uncertainty

This is where retirement planning becomes inseparable from global wealth architecture.

Residency Rules Still Define the Outcome

Preferential pension tax treatment is never automatic. Jurisdictions require ongoing compliance, physical presence, and proper reporting. These conditions ensure that beneficiaries are genuine long-term residents rather than short-term tax planners.

Failure to meet these standards can remove the benefit entirely. Successful retirees focus on aligning residency, income, and asset structure from the outset.

Why This Trend Is Expanding, Not Reversing

Global competition for capital continues to intensify. Retirees with foreign income offer governments exactly what they seek: stability, predictability, and long-term economic participation. As a result, jurisdictions that have adopted this model are refining their frameworks rather than abandoning them.

Future developments are likely to include clearer eligibility rules, stronger long-term guarantees, and closer alignment with residency and citizenship pathways. These refinements further reinforce why 29+ jurisdictions keep pension taxes below 10 percent as part of a broader global strategy.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Aligning Retirement, Mobility, and Wealth Strategy

Retirement planning today sits at the intersection of mobility, wealth preservation, and long-term security. Understanding why 29+ jurisdictions keep pension taxes below 10 percent allows investors and business owners to engage with jurisdictions that actively welcome structured, compliant, and globally connected residents.

Those who plan early and structure correctly gain clarity, confidence, and optionality for decades ahead.

If retirement, succession, or cross-border structuring is part of your future, professional guidance can help ensure that pension taxation aligns with your broader global strategy and long-term objectives.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

African Citizenship by Investment for Strategic Global Investors

African citizenship by investment is gaining attention among global investors seeking diversification, mobility, and access to emerging markets. As African…

58% of New Trade Growth Happens Outside the U.S.

58% of New Trade Growth Happens Outside the U.S., marking a structural shift in global economic power. As trade momentum…

CBI in Times of Uncertainty: When One Passport Is Not

Global uncertainty has changed the rules of wealth preservation. In today’s environment, one passport may not provide sufficient protection. This…

Nigeria Dangote Refinery Investment Opportunity for Strategic Investors

Nigeria’s Dangote Refinery investment opportunity reflects growing capital market maturity and infrastructure scale. For high net worth individuals and global…

13 CARICOM Nations Attract Over 1 Billion Dollars from 5

13 CARICOM nations attract over 1 billion dollars from 5 global powers, reinforcing regional credibility and investment stability. Sovereign commitments…

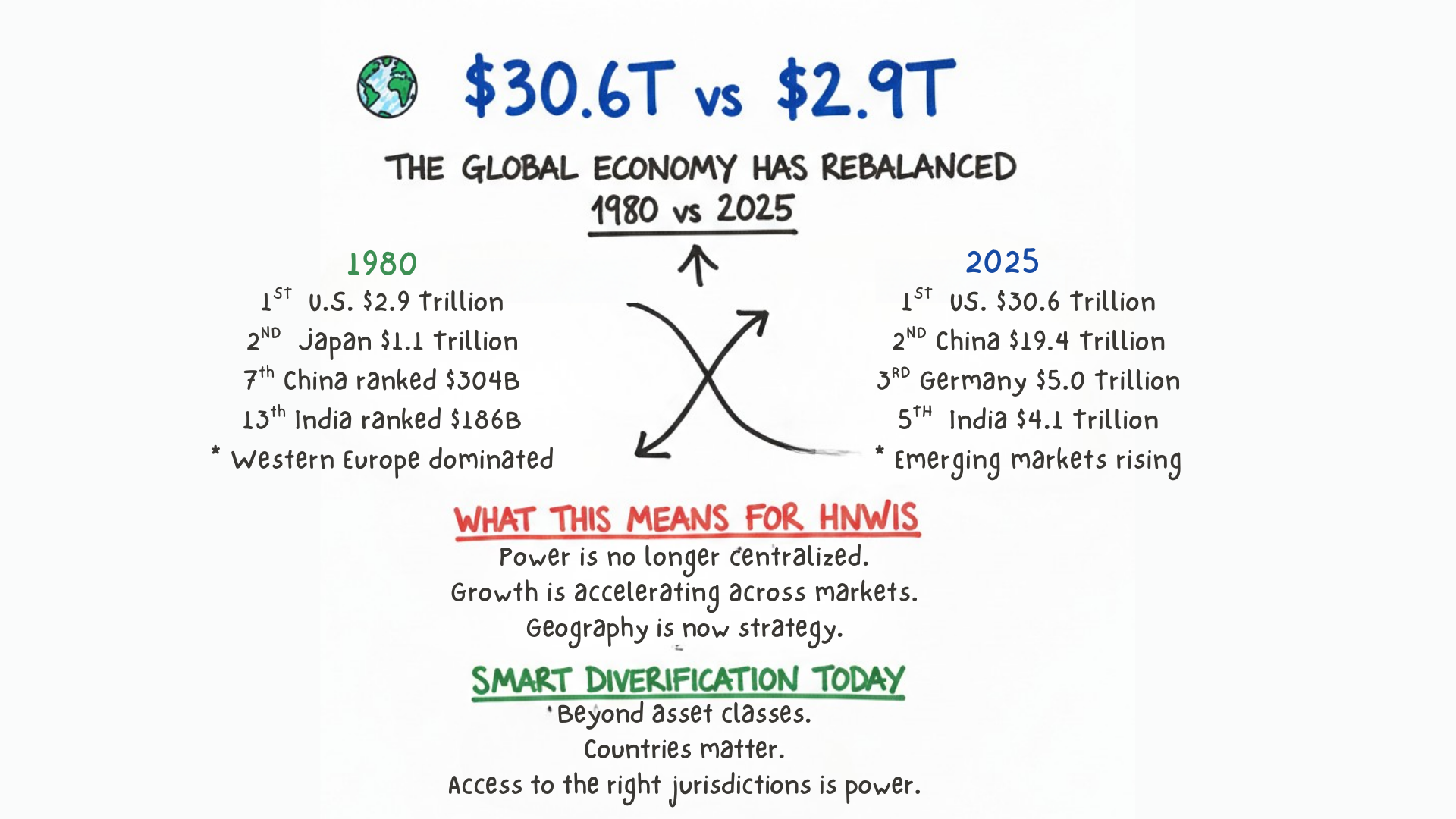

From Western Dominance to a Multipolar Economy (1980–2025)

From 1980 to 2025, global power shifted from Western dominance to a multipolar economy. Economic influence now spans several regions,…