Where the Wealth Goes: 2025’s Top Countries for Wealth Migration

Why Are Millionaires on the Move?

- Economic and political stability

- Favorable tax regimes

- Business-friendly environments

- Access to quality education and healthcare

- Long-term security for families

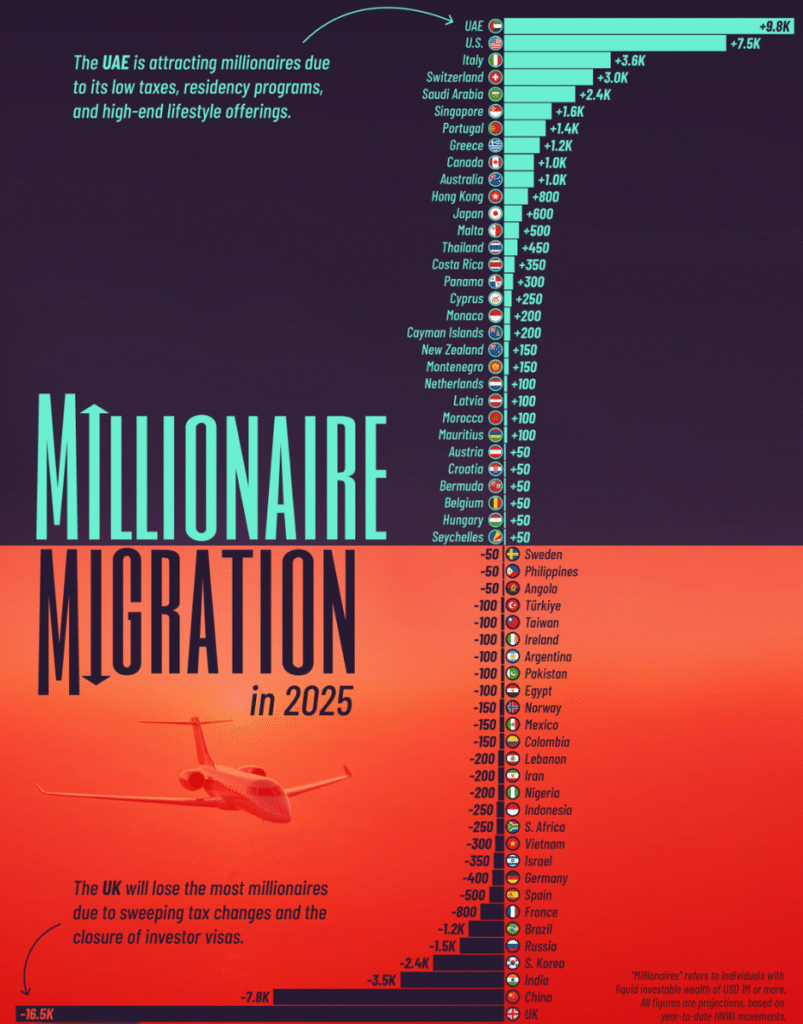

Top Destinations for Millionaire Migration in 2025

Countries attracting the most millionaire migrants are offering more than just low taxes. They offer vision, legal stability, and global access.

- United Arab Emirates – Projected 10,000 New Millionaires

- The UAE is leading the way in 2025. Dubai and Abu Dhabi are becoming global wealth hubs, offering everything from high-end real estate to free trade zones.

- Zero personal income tax

- World-class infrastructure

- Safe, luxury-oriented living

- Business-friendly laws

- Growing tech and finance sectors

- The UAE is leading the way in 2025. Dubai and Abu Dhabi are becoming global wealth hubs, offering everything from high-end real estate to free trade zones.

- United States – Estimated 7,500 New Millionaires

- Despite recent economic shifts, the U.S. remains a top destination. Many investors also see the U.S. as a springboard to North American and Latin American markets.

- Innovation centers like Silicon Valley and New York

- Strong legal protections

- Diverse investment opportunities

- Global business influence

- Despite recent economic shifts, the U.S. remains a top destination. Many investors also see the U.S. as a springboard to North American and Latin American markets.

- Italy – Growing Interest from Global Wealth

- Italy is catching the eye of wealthy migrants. For many HNWIs, Italy combines quality of life with financial flexibility.

- Investor visa programs

- Flat tax option for new residents

- Rich culture and lifestyle

- Safe and stable political climate

- Italy is catching the eye of wealthy migrants. For many HNWIs, Italy combines quality of life with financial flexibility.

- Switzerland – Traditional and Timeless

- Switzerland remains a trusted destination. It continues to attract those who prioritize discretion and stability.

- Strong banking system

- Political neutrality

- High standard of living

- Secure legal system

- Switzerland remains a trusted destination. It continues to attract those who prioritize discretion and stability.

- Saudi Arabia – A New Wealth Magnet

- With major reforms under Vision 2030, Saudi Arabia is rising fast. The kingdom is becoming a serious choice for investors looking at the Middle East’s future.

- Large infrastructure investments

- Growing business sectors

- New residency options

- Modernizing cities like Riyadh and NEOM

- With major reforms under Vision 2030, Saudi Arabia is rising fast. The kingdom is becoming a serious choice for investors looking at the Middle East’s future.

Where Are Millionaires Leaving?

- United Kingdom – Projected Loss of 15,500 Millionaires

- The UK is expected to lose more millionaires than any other country in 2025. This shift reflects a need for predictability and investor confidence—which some feel the UK is currently lacking.

- Economic uncertainty

- Political instability

- Taxation concerns

- The UK is expected to lose more millionaires than any other country in 2025. This shift reflects a need for predictability and investor confidence—which some feel the UK is currently lacking.

- China & India – Smaller but Noticeable Departures

- Both China and India are seeing smaller outflows of wealth. In both cases, HNWIs are diversifying their bases, not necessarily cutting ties completely.

- Concerns over regulation

- Changing tax laws

- Desire for global mobility

- Both China and India are seeing smaller outflows of wealth. In both cases, HNWIs are diversifying their bases, not necessarily cutting ties completely.

Why It Matters: Capital Flows Toward Certainty

The big insight? Capital flows where certainty exists.

Wealthy individuals are looking for countries with:

- Stable economies

- Clear legal systems

- Safe environments

- Smart tax laws

- Growth potential

This global movement tells us which nations are building futures that attract talent and capital—not just tourists.

- Diversifying risk

- Protecting your family’s future

- Accessing global markets

- Taking control of your mobility

- Gain second citizenship or residency rights

- Legally reduce tax exposure

- Expand business operations globally

- Access better healthcare, education, and lifestyle

Popular programs include:

- Golden Visas (Portugal, Greece, Spain)

- Citizenship by Investment (Caribbean, Vanuatu, Malta)

- Investor Visas (Italy, UAE, U.S.)

Working with a trusted advisor ensures you choose the right path based on your goals.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

$537M U.S. Investment Anchors Eko Atlantic City Lagos by 2028

The $537M U.S. Investment Anchors Eko Atlantic City, Lagos by 2028 signals institutional trust and long-term confidence in Lagos. For…

7 Key Risks A U.S. Setup Isn’t Always Best for

A cross-border business setup can boost global growth by reducing onboarding delays, payment friction, and concentration risk. This guide explains…

Why Citizenship by Investment Due Diligence Matters for Investors

Citizenship by Investment due diligence protects more than an application. It safeguards international credibility, visa free access, and long term…

Wealthy Americans Lead New Zealand Golden Visa Surge

Wealthy Americans are leading the New Zealand Golden Visa surge as investors prioritize stability and diversification. Billions in committed capital…

Second Residency Is Now A Top Three Global Wealth Priority

Second residency has quietly moved into the top tier of priorities for serious wealth holders. This article explains why investors…

UK Exit Tax 20% and the Future of Strategic Wealth

The UK Exit Tax 20% could significantly impact HNWIs, founders, and investors with substantial unrealized gains. This in depth analysis…