Wealth Management Strategies for Investors with Multiple Residencies

- Utilize Tax Treaties: Take advantage of tax treaties that prevent double taxation, providing credits or exemptions on foreign-earned income.

- Residency-Based Tax Planning: Establish residency in a low-tax jurisdiction to reduce overall tax liability. Countries with favorable tax regimes can help minimize income, capital gains, or inheritance taxes.

- Tax-Deferred Accounts: Leveraging retirement accounts in countries where tax-deferred growth is possible can help defer taxes and increase long-term gains.

Cross-border estate planning can be complex due to varying inheritance laws. Here’s how to prepare:

- Use Trusts and Foundations: These structures offer flexibility in asset distribution and help reduce estate taxes.

- Cross-Border Wills: Drafting separate wills in each jurisdiction ensures legal compliance and facilitates asset transfer.

- Gifting Strategies: Lifetime gifts to family members can lower the taxable estate, benefiting from exemptions in some countries.

Insurance is essential for safeguarding wealth across borders. Key considerations include:

- Life Insurance: Can provide tax-efficient wealth transfer while reducing estate tax exposure.

- Umbrella Insurance: Offers extra liability protection beyond standard coverage, which is valuable in multi-country situations.

- Health Insurance: Ensures access to quality care and covers long-term care needs in different countries, especially where standards vary.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Conclusion

Investors with multiple residencies must address specific challenges to optimize their wealth management strategies. By diversifying investments, planning taxes effectively, using cross-border estate strategies, and leveraging insurance, HNWIs can enhance their financial stability and safeguard their legacy. With a proactive approach, they can successfully navigate the complexities of international wealth management.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

The USA Moves to Challenge Sharia Law Policies in Nigeria

The United States has introduced legislation addressing Sharia law policies in Nigeria, increasing international scrutiny on governance and religious freedom….

South Africa Infrastructure Gains $350M World Bank Support

The World Bank $350 million investment in South Africa infrastructure signals growing global confidence in the country’s economic future. For…

10 African Countries Leading Global Soft Power in 2026

Africa’s global influence continues to grow. The African soft power 2026 ranking highlights ten nations shaping global perception through culture,…

African Citizenship by Investment for Strategic Global Investors

African citizenship by investment is gaining attention among global investors seeking diversification, mobility, and access to emerging markets. As African…

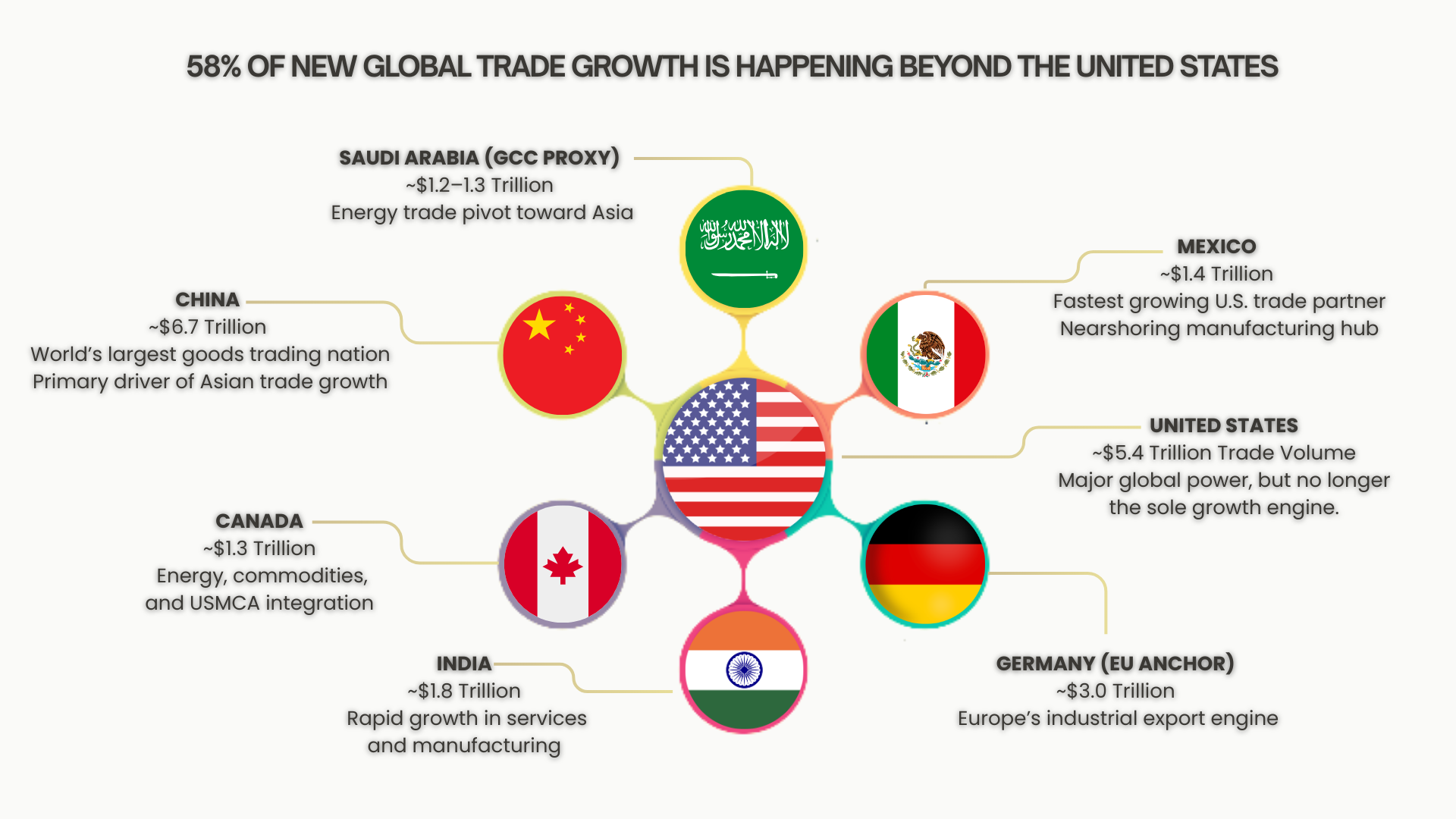

58% of New Trade Growth Happens Outside the U.S.

58% of New Trade Growth Happens Outside the U.S., marking a structural shift in global economic power. As trade momentum…

CBI in Times of Uncertainty: When One Passport Is Not

Global uncertainty has changed the rules of wealth preservation. In today’s environment, one passport may not provide sufficient protection. This…