UAE Golden Visa Real Estate Delivered Up to 20% Returns in 2025

In the world of investment migration, real estate has long been a preferred vehicle, not only for portfolio growth but for gaining global access through residency programs. In 2025, this trend faced significant shifts as major markets restructured their Golden Visa offerings, with some tightening or even removing real estate as a qualifying asset.

Despite these regulatory changes, select markets delivered strong performance, reinforcing real estate’s role as a viable path for strategic investors, particularly those looking to combine return on investment with lifestyle mobility.

This article explores how Golden Visa real estate markets performed in 2025, where investors found the highest returns, and why the UAE emerged as the top destination for capital growth and yield.

The Global Landscape: Shifting Policy, Mixed Returns

Golden Visa programs have historically attracted investors by offering residency or citizenship in return for qualified investments, real estate being one of the most popular assets. In 2025, however, several countries altered course.

Major markets in Europe imposed stricter regulations. Some eliminated real estate from their Golden Visa qualifications entirely, while others raised minimum thresholds or imposed restrictions on location and rental use. These changes were largely aimed at cooling overheated property markets and responding to political pressures.

At the same time, economic challenges such as inflation and currency devaluation in emerging markets impacted the real return investors could achieve, even in countries with high nominal price growth.

Yet in the midst of these disruptions, certain markets stood out, not just for capital appreciation, but for their stability, investor-friendly environments, and long-term potential.

UAE: The Most Profitable Market in 2025

The United Arab Emirates, and specifically Dubai, recorded the strongest performance in real estate-linked Golden Visa investments in 2025. Investors in key areas saw total returns of up to 20%, combining capital growth with high rental yields.

Why UAE Stood Out

- Capital Appreciation: Residential property prices in Dubai rose by approximately 12.8% year-over-year. Prime areas such as Downtown Dubai and Dubai Marina performed particularly well, benefitting from sustained demand and infrastructure development.

- Rental Yields: Dubai continued to offer some of the most attractive rental yields globally, averaging 6% to 8% in popular districts. In some cases, yields exceeded these figures in short-term rental segments.

- Regulatory Environment: The UAE maintained a stable investment migration framework, offering long-term residence visas tied to real estate starting from investments of AED 2 million. The process remained streamlined, with clear guidelines, low bureaucratic burden, and strong government support.

- Global Appeal: Dubai’s tax efficiency, safety, and connectivity made it a top relocation choice for global entrepreneurs, digital nomads, and wealthy families. These factors boosted real estate demand, ensuring long-term value for investors.

For investors prioritizing both return and lifestyle, Dubai in 2025 delivered exceptional value. It not only provided capital growth, but a base in one of the world’s most dynamic and future-oriented cities.

Latvia: Quiet Growth with High Yields

Latvia may not be the first market that comes to mind for international investors, but in 2025, it emerged as a sleeper success in the Golden Visa space.

- Capital Growth: Residential prices in Riga grew approximately 7.3%, while coastal cities like Jurmala experienced closer to 9.1% gains.

- Rental Returns: Rental yields ranged between 4% and 6%, depending on location and asset class.

- Cost Efficiency: Compared to Western Europe, Latvia offers lower entry points for investors, creating a compelling opportunity for those looking to diversify into the European market at a lower capital outlay.

Latvia’s appeal lies in its balance between price growth, yield, and access to the EU Schengen Zone. As a member of the European Union, it offers visa-free travel across most of Europe, something that continues to drive interest among investors from Asia, the Middle East, and beyond.

Greece: Steady, but Impacted by Regulatory Tightening

Greece remained attractive to many investors in 2025, particularly those targeting lifestyle investments in the Mediterranean. However, changes to the Golden Visa program, including higher minimum investment thresholds in key locations, slowed demand in some areas.

- Property Growth: National average property prices increased by 6.4% in 2025. Secondary cities like Thessaloniki and Patras outperformed some saturated markets in Athens.

- Rental Income: Yields were moderate, averaging 3% to 5%, depending on asset type and rental strategy.

- Policy Adjustments: In prime zones such as central Athens, the investment threshold increased to €800,000, limiting access for some investors and reducing buying activity.

Despite the policy shift, Greece continues to be a favored location for lifestyle investors. Those willing to look beyond Athens are still finding high-potential assets in regional cities with growth momentum and tourism-driven demand.

Turkey: Nominal Gains, Real Losses

Turkey offered one of the most striking examples of the gap between nominal and real returns. On the surface, housing prices in Turkish lira surged over 40%. However, persistent inflation and currency depreciation significantly eroded real returns for foreign investors.

- Nominal Growth: Yes, the market surged in local terms.

- Currency Risk: The Turkish lira weakened sharply in 2025, turning double-digit gains into flat or even negative returns when measured in U.S. dollars or euros.

- Political and Economic Volatility: Investors remained cautious due to policy unpredictability and broader macroeconomic instability.

For dollar or euro-based investors, Turkey in 2025 illustrated a critical lesson: nominal growth in unstable economies doesn’t always equal real profit.

Cyprus and Emerging Markets: Low Risk, Lower Returns

Cyprus continued to attract moderate investor interest. Its steady, EU-linked economy and structured Golden Visa framework made it a safe, albeit lower-return, option.

- Capital Growth: Around 3.2% in 2025.

- Rental Yields: Averaged between 3% and 4%.

- Investor Profile: Most investors here valued safety and EU access more than aggressive returns.

Elsewhere, countries like Thailand and others in Southeast Asia showed promise. Property price growth in some emerging markets reached 4% to 6%, with long-term resident visa options tied to real estate investment. While not technically “Golden Visas” in the European sense, these programs offered residence in exchange for lifestyle investment.

What 2025 Taught Global Investors

The Golden Visa real estate market in 2025 reminded global investors of several key truths:

- Not All Markets Are Equal: Strong headlines don’t always reflect underlying risks. Nominal returns mean little without context like inflation, currency stability, and policy transparency.

- Regulatory Changes Matter: Countries that restricted real estate in their Golden Visa programs saw an immediate slowdown in investment. Flexibility and predictability remain critical.

- Long-Term Vision Wins: The most successful investors in 2025 were those who balanced capital growth with long-term residency planning. They chose markets offering more than just a visa, they looked for economic hubs, tax-efficient systems, and high-quality lifestyles.

Beyond Real Estate: A Shift Toward Strategic Residency and Citizenship

As Golden Visa real estate pathways narrow, more investors are exploring broader investment migration strategies. These include:

- Citizenship by Investment (CBI): Programs that offer full citizenship, often within months, through government-approved contributions or investments.

- Non-Real Estate Residency Options: Funds, bonds, business investments, and cultural donations are becoming more popular in countries phasing out real estate from their visa programs.

- Family Legacy Planning: Mobility, education access, and generational security are increasingly driving investment migration decisions.

Residency and citizenship are no longer just about lifestyle, they’re essential tools for global mobility, asset protection, and international business flexibility.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

What This Means for You

If you’re a business owner, investor, or high-net-worth individual, the message from 2025 is clear: investing in global access is no longer just a luxury, it’s a strategic necessity.

Real estate remains a powerful tool, but today, the best outcomes come from combining the right asset class with the right jurisdiction. It’s about more than property, it’s about securing a better future.

Now is the time to evaluate whether your current strategy aligns with the changing investment migration landscape.

Ready to Take the Next Step?

We help investors and their families unlock global opportunities through strategic residency and citizenship solutions. Whether you’re looking for high-return real estate, second citizenship, or long-term global access, our team is here to guide you.

Contact us today to learn how we can help you design a tailored investment migration strategy that fits your goals.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

South Africa Infrastructure Gains $350M World Bank Support

The World Bank $350 million investment in South Africa infrastructure signals growing global confidence in the country’s economic future. For…

10 African Countries Leading Global Soft Power in 2026

Africa’s global influence continues to grow. The African soft power 2026 ranking highlights ten nations shaping global perception through culture,…

African Citizenship by Investment for Strategic Global Investors

African citizenship by investment is gaining attention among global investors seeking diversification, mobility, and access to emerging markets. As African…

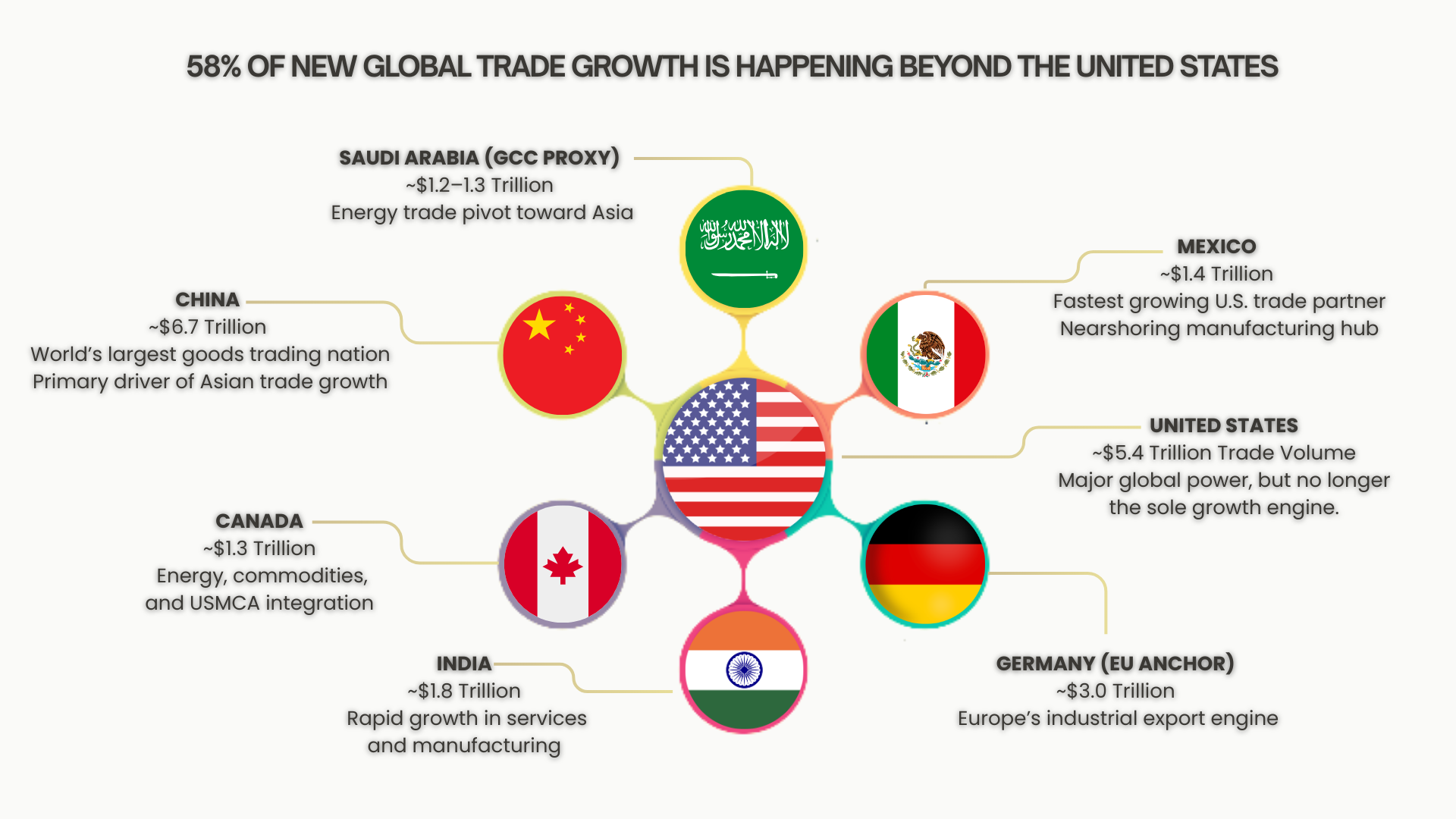

58% of New Trade Growth Happens Outside the U.S.

58% of New Trade Growth Happens Outside the U.S., marking a structural shift in global economic power. As trade momentum…

CBI in Times of Uncertainty: When One Passport Is Not

Global uncertainty has changed the rules of wealth preservation. In today’s environment, one passport may not provide sufficient protection. This…

Nigeria Dangote Refinery Investment Opportunity for Strategic Investors

Nigeria’s Dangote Refinery investment opportunity reflects growing capital market maturity and infrastructure scale. For high net worth individuals and global…