Timing the Future: Argentina’s Citizenship by Investment Strategy

Introduction: Why Timing Now Shapes Future Citizenship Value

The Argentina Citizenship by Investment strategy is drawing interest not because of rapid rollout, but because of measured execution and institutional intent. For high-net-worth individuals, business owners, and investors, citizenship decisions extend far beyond access or convenience. They influence capital positioning, family security, and long-term global mobility.

In today’s environment, timing is no longer about acting first. Instead, it is about acting wisely. A structured approach signals confidence, regulatory strength, and commitment to sustainability.

Citizenship Has Become a Strategic Asset

Second citizenship is no longer treated as a backup option. Sophisticated investors now integrate it into broader wealth and mobility strategies.

Citizenship today impacts:

- Where families can live, study, and retire

- How businesses expand across borders

- How capital is protected and diversified

- How future generations maintain mobility

As a result, investors increasingly assess framework quality over launch speed. The Argentina Citizenship by Investment strategy reflects this shift by prioritizing foundation before scale.

Why a Deliberate Rollout Signals Strength

In investment migration, pace often reveals priorities. Programs launched quickly may attract attention, but they also face higher risks of policy reversal or reputational pressure.

A deliberate rollout demonstrates:

- Clear legal grounding before implementation

- Coordination across government institutions

- Defined oversight and compliance structures

- Alignment with international standards

For HNWIs, this approach reduces uncertainty. Stability protects long-term citizenship value, which matters far more than short-term access.

How Investor Mindset Has Evolved

Investor behavior has changed significantly in recent years. Experienced investors now favor predictability, governance, and long-term alignment.

They ask questions such as:

- Will this citizenship remain respected over time

- Does the framework support multi-generational planning

- How resilient is the program to policy shifts

- Is there clarity around compliance and oversight

The Argentina Citizenship by Investment strategy appeals to this mindset by emphasizing credibility and structure rather than speed.

Argentina’s Strategic Position in Global Mobility

Argentina offers more than a legal framework. Its broader positioning strengthens its relevance in citizenship planning.

Key strategic fundamentals include:

- A major Latin American economy

- Membership in Mercosur with regional access

- A globally recognized passport

- Diverse economic and investment sectors

When combined with a structured citizenship strategy, these factors support long-term mobility and international planning for families and businesses alike.

Governance and Compliance as Value Drivers

Citizenship frameworks succeed when governance leads execution. Strong compliance protects both the issuing country and the investor.

Well-designed programs typically provide:

- Consistent adjudication standards

- Robust due diligence processes

- Clear documentation requirements

- Operational predictability for applicants

The Argentina Citizenship by Investment strategy emphasizes these fundamentals. This focus strengthens trust among international institutions and safeguards the citizenship’s reputation.

Operational Readiness Matters to Investors

From an execution standpoint, timing affects the investor experience directly.

Programs with operational maturity deliver:

- Smoother application journeys

- Reduced processing delays

- Clear expectations for families and advisors

- Lower reputational and regulatory risk

Investors benefit most when frameworks are fully aligned before widespread participation. Operational clarity enhances confidence and outcomes.

Timing as a Strategic Positioning Advantage

Timing does not always mean waiting. Often, it means preparing.

This phase allows investors to:

- Structure assets and residency plans

- Align citizenship decisions with succession strategies

- Monitor regulatory developments carefully

- Engage advisors proactively

Rather than reacting to announcements, investors can position themselves thoughtfully. Preparation often delivers stronger long-term results.

What Sophisticated Investors Look For Today

HNWIs and family offices rarely follow trends. They focus on fundamentals.

Their priorities include:

- Policy stability across political cycles

- Institutional trust and transparency

- Predictable processes and governance

- International acceptance and credibility

The Argentina Citizenship by Investment strategy aligns with these expectations by focusing on durability rather than immediacy.

Citizenship Planning in a More Scrutinized World

Global mobility faces increasing regulatory scrutiny. Cooperation between jurisdictions continues to expand, and standards continue to rise.

In this environment, citizenship frameworks must demonstrate:

- Legitimacy

- Transparency

- Compliance readiness

- Long-term policy commitment

Programs built carefully are better positioned to withstand these pressures. Argentina’s approach reflects this reality.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Looking Ahead with Confidence, Not Speculation

The value of citizenship depends on its foundation. Argentina’s strategy focuses on building that foundation first.

For investors, this creates confidence rather than uncertainty. Citizenship should support life planning, business strategy, and legacy goals without compromise.

As global mobility continues to evolve, the Argentina Citizenship by Investment strategy stands as an example of how timing, structure, and credibility shape long-term value.

If you are considering second citizenship as part of your long-term wealth or mobility strategy, professional guidance is essential. Engage with experienced advisors who understand timing, governance, and global positioning. A well-structured decision today can protect opportunities for generations.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

African Citizenship by Investment for Strategic Global Investors

African citizenship by investment is gaining attention among global investors seeking diversification, mobility, and access to emerging markets. As African…

58% of New Trade Growth Happens Outside the U.S.

58% of New Trade Growth Happens Outside the U.S., marking a structural shift in global economic power. As trade momentum…

CBI in Times of Uncertainty: When One Passport Is Not

Global uncertainty has changed the rules of wealth preservation. In today’s environment, one passport may not provide sufficient protection. This…

Nigeria Dangote Refinery Investment Opportunity for Strategic Investors

Nigeria’s Dangote Refinery investment opportunity reflects growing capital market maturity and infrastructure scale. For high net worth individuals and global…

13 CARICOM Nations Attract Over 1 Billion Dollars from 5

13 CARICOM nations attract over 1 billion dollars from 5 global powers, reinforcing regional credibility and investment stability. Sovereign commitments…

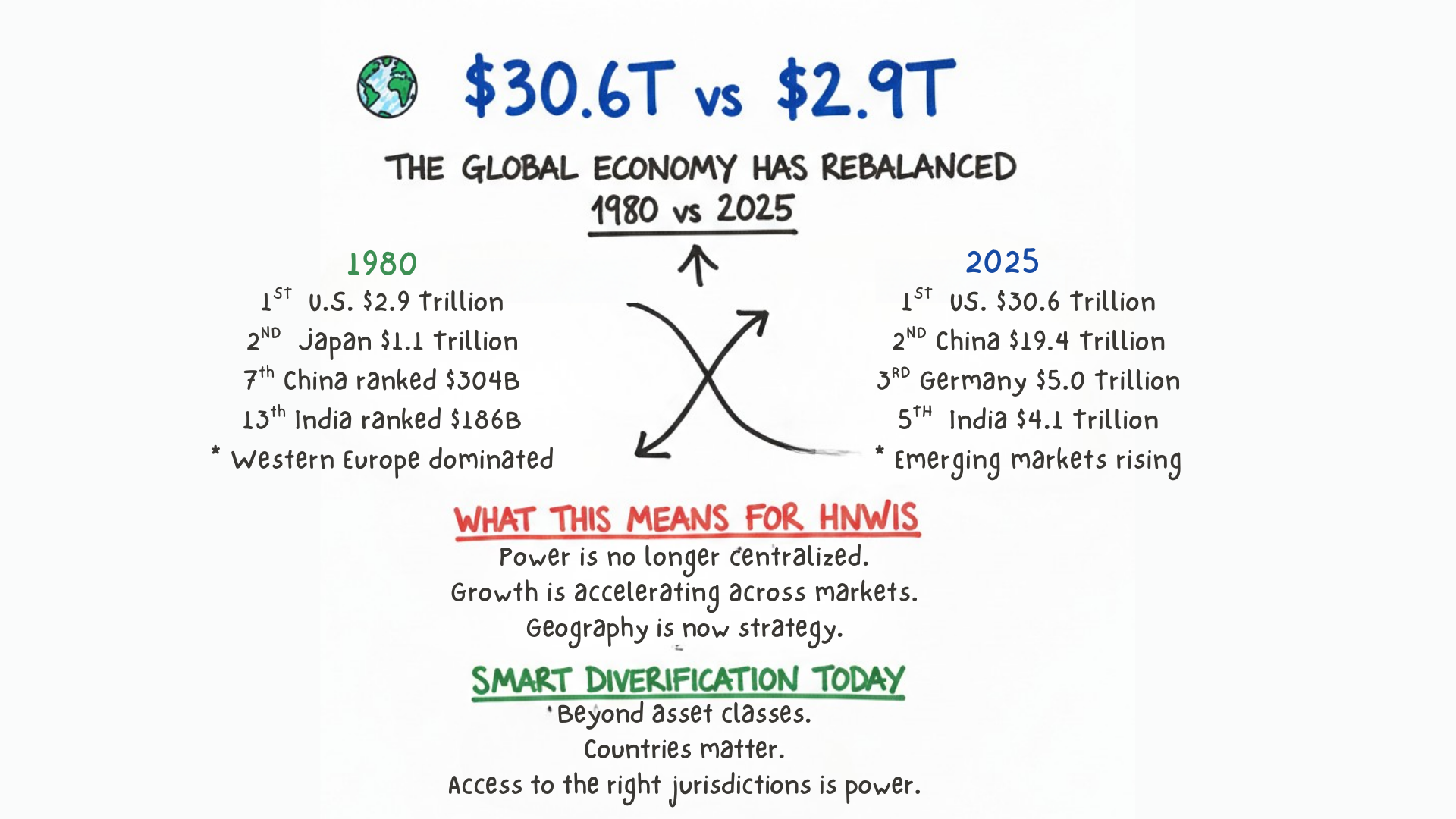

From Western Dominance to a Multipolar Economy (1980–2025)

From 1980 to 2025, global power shifted from Western dominance to a multipolar economy. Economic influence now spans several regions,…