Switzerland’s Tax Vote Was a Warning to Global Investors

Wealth management is experiencing a shift that seasoned investors and business owners cannot afford to ignore. When a country long regarded as a fortress for private capital puts a 50% inheritance tax to a public vote, it sends a powerful message to anyone serious about preserving wealth across generations. This episode was not simply about tax policy; it illustrates the emerging reality that traditional, single‑jurisdiction wealth strategies are increasingly inadequate. For high‑net‑worth individuals (HNWIs), entrepreneurs, and global investors, the lesson is clear: the ability to move, financially, legally, and personally, is no longer an optional advantage. It is essential protection.

This blog explores what wealth mobility means in today’s global economy, why it matters, how it fits into a comprehensive international strategy, and what steps sophisticated investors should consider to safeguard capital, legacy, and lifestyle.

The Context: What Happened in Switzerland

Switzerland has long been synonymous with financial stability, banking privacy, and a favorable tax environment. Its political stability and history of protecting capital made it one of the most trusted global wealth havens. Yet, when a proposal to enact a steep inheritance tax reached national ballots, wealthy residents reacted strongly and swiftly. The measure was ultimately rejected, not due to a moral stance against taxation, but because affluent individuals signaled they would relocate their assets or residences if the policy passed.

This situation carries a deeper lesson than just tax policy. It illustrates that governments, even in traditionally secure jurisdictions, can shift priorities in ways that affect residents and investors. When wealthy capital threatens to leave, policymakers have a powerful incentive to reconsider. But what happens in places without deep financial infrastructures or the same reliance on global capital? The risk for investors tied to a single legal and economic environment is real and growing.

Why Relying on One Country Is Risky

For decades, many investors built strategies around one jurisdiction that offered favorable tax regimes, stable governance, and lifestyle benefits. This approach worked for a long time. However, the global environment has changed:

Policy Volatility: Countries adjust fiscal and social policies in response to economic pressures. A tax regime that seems permanent today may change with new leadership, budget deficits, or public sentiment.

Economic Pressure: Global crises, aging populations, and rising public expenditures increase pressure on governments to broaden tax bases, even if it means targeting wealthy individuals.

Regulatory Shifts: International compliance standards evolve. Regulations like Common Reporting Standard (CRS), anti‑money laundering (AML) frameworks, and other transparency mandates influence how and where investors can hold assets.

Global Competition for Capital: Nations increasingly compete for investment, talent, and economic participation. This competition means jurisdictions can improve conditions, but it also means those that fail to remain competitive may resort to punitive policies.

For any investor who keeps all assets, residence, and legal ties in one place, the result is clear: limited options and increased vulnerability. When pressure mounts, or sentiment turns, your wealth can become a target rather than a protected asset.

What Wealth Mobility Means

Wealth mobility is the capacity to move your financial resources, legal status, and personal residence across borders with relative ease. It is not merely about tax avoidance or seeking a cheaper place to live. It is about strategic positioning and flexibility.

Mobility empowers investors to:

- Adapt to changing jurisdictions

- Optimize tax and regulatory exposure

- Maintain access to global opportunities

- Protect assets from localized risks

- Ensure lifestyle choices align with personal and family goals

In essence, wealth mobility transforms investors from subjects of policy to active participants in global strategy.

Key Components of a Mobility‑Focused Strategy

A comprehensive wealth mobility strategy is not one‑dimensional. It is anchored in three pillars that together provide resilience, flexibility, and long‑term security:

1. A Financial Hub with Favorable Tax and Legal Structures

The first component is creating a base where your financial interests are protected and optimized. This involves choosing jurisdictions with tax systems that align with your goals. It is not about finding a loophole, but about structuring assets in places that reward long‑term planning.

A financial hub may offer:

- Low income and capital gains tax

- Favorable inheritance or estate tax regimes

- Robust banking and investment infrastructures

- Legal systems that protect private property rights

Such hubs serve as the engine of your wealth strategy, ensuring capital can grow efficiently and with legal certainty.

2. A Lifestyle Base That Enhances Quality of Life

Mobility isn’t just financial, it’s personal. Where you and your family live affects education, healthcare, security, and overall well‑being. A lifestyle base should be selected not just for tax reasons but because it supports the life you want to lead.

Important considerations include:

- Political and social stability

- Healthcare quality and accessibility

- Education systems (including international options)

- Cultural and environmental preferences

- Ease of travel and connectivity

For many HNWIs, dual or multiple residences provide a balance of personal fulfillment and strategic flexibility.

3. A Safety Haven for Contingency Planning

Even the best‑planned strategies must anticipate the unexpected. A safety haven acts as an insurance policy for your wealth and personal freedom. It should offer:

- Strong legal protections

- Clear immigration and residency frameworks

- Options to relocate quickly if needed

- Favorable conditions in times of economic or political stress

This pillar effectively gives you a fallback plan, ensuring that you and your assets can withstand volatility or sudden changes in your primary jurisdictions.

Citizenship and Residency: Tools for Mobility

One of the most powerful elements of wealth mobility is legal status. Citizenship and residency options provide rights and freedoms that go beyond financial planning.

Residency allows you to live, work, and access services in a new country. Citizenship confers additional rights, including security, travel freedom, and political stability.

Strategic planning often includes exploring options that provide alternative legal footholds. These options do not require immediate relocation or drastic life changes. Rather, they are about building optionality over time so that when circumstances shift, you have established legal pathways to act.

Legal residency or citizenship in more than one jurisdiction:

- Expands personal and family freedom

- Mitigates geopolitical risk

- Enhances business and investment opportunities

- Reduces reliance on a single legal system

For global investors, this is not an exploration of identity, it is a deliberate strategy to safeguard legacy.

What Mobility Looks Like in Practice

Consider an international entrepreneur with business interests, residences, and family ties in one country. Over time, the economic environment changes. Taxes rise. Regulations tighten. Public sentiment shifts. Suddenly, the cost of doing business and living, rises sharply.

An investor with wealth mobility options might respond by:

- Structuring holdings through a favorable financial hub

- Spending more time in a lifestyle base with better personal benefits

- Relocating immediately or gradually to a safety haven as needed

The key advantage? Control. Instead of being subject to whatever the local environment imposes, the investor can choose where and how to position their wealth and family.

Common Misconceptions About Mobility

Despite its benefits, some investors hesitate to pursue mobility for reasons including:

Complexity: Many believe that moving assets or obtaining residency is too complicated. While it requires planning and expert guidance, modern options are structured to be accessible to serious investors.

Cost: Some assume costs outweigh benefits. In reality, when measured against long‑term tax liabilities and risk exposure, strategic mobility can be cost‑effective.

Identity: Others feel loyalty to their home country. Mobility does not require abandoning one’s roots. It simply provides choices.

Each of these concerns stems from a lack of clarity. With expert advice and careful planning, mobility becomes a practical and empowering strategy.

How to Begin Building Wealth Mobility

Taking the first step can feel overwhelming. But the process is best approached systematically:

- Assess Your Current Exposure: Understand where your assets, liabilities, and legal ties are concentrated.

- Define Your Objectives: Are you prioritizing tax efficiency, lifestyle benefits, security, or all three?

- Evaluate Potential Jurisdictions: Research financial hubs, lifestyle bases, and safe havens that align with your goals.

- Consult Experts: International lawyers, tax advisors, and investment strategists can guide structure and compliance.

- Plan for the Long Term: Mobility is not a quick fix; it is a strategic evolution of your wealth plan.

By following these steps, you create a roadmap that reflects your personal ambitions and safeguards your wealth across changing global conditions.

Why Time Matters

Switzerland’s recent tax vote illustrates a broader truth: policy environments can change quickly and with little warning. What seems stable today may not remain so. Investors who wait until change happens may find options limited or more costly.

Building mobility now means creating opportunities before they are needed. When geopolitical, economic, or social pressures intensify, those who planned ahead will have choices others do not.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Strategic Mobility Is the Future of Wealth Protection

Wealth mobility is not a trend. It is a strategic necessity for high‑net‑worth individuals, business owners, and global investors who want to preserve capital, protect family futures, and maintain quality of life in an unpredictable world. The shift away from single‑jurisdiction reliance toward multi‑jurisdictional strategies reflects a deeper understanding of risk and opportunity.

Mobility empowers choice. It gives investors control over where they live, how they structure assets, and how they respond to global changes. By integrating legal residency or citizenship options into broader financial planning, investors can unlock flexibility that traditional models no longer provide.

Are you building a strategy that allows you to act before change forces your hand? If not, now is the time to explore your options.

If you are ready to evaluate how wealth mobility can strengthen your strategy, our team can help you assess opportunities, clarify your objectives, and design a roadmap tailored to your goals. Contact us to begin a personalized consultation.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

African Citizenship by Investment for Strategic Global Investors

African citizenship by investment is gaining attention among global investors seeking diversification, mobility, and access to emerging markets. As African…

58% of New Trade Growth Happens Outside the U.S.

58% of New Trade Growth Happens Outside the U.S., marking a structural shift in global economic power. As trade momentum…

CBI in Times of Uncertainty: When One Passport Is Not

Global uncertainty has changed the rules of wealth preservation. In today’s environment, one passport may not provide sufficient protection. This…

Nigeria Dangote Refinery Investment Opportunity for Strategic Investors

Nigeria’s Dangote Refinery investment opportunity reflects growing capital market maturity and infrastructure scale. For high net worth individuals and global…

13 CARICOM Nations Attract Over 1 Billion Dollars from 5

13 CARICOM nations attract over 1 billion dollars from 5 global powers, reinforcing regional credibility and investment stability. Sovereign commitments…

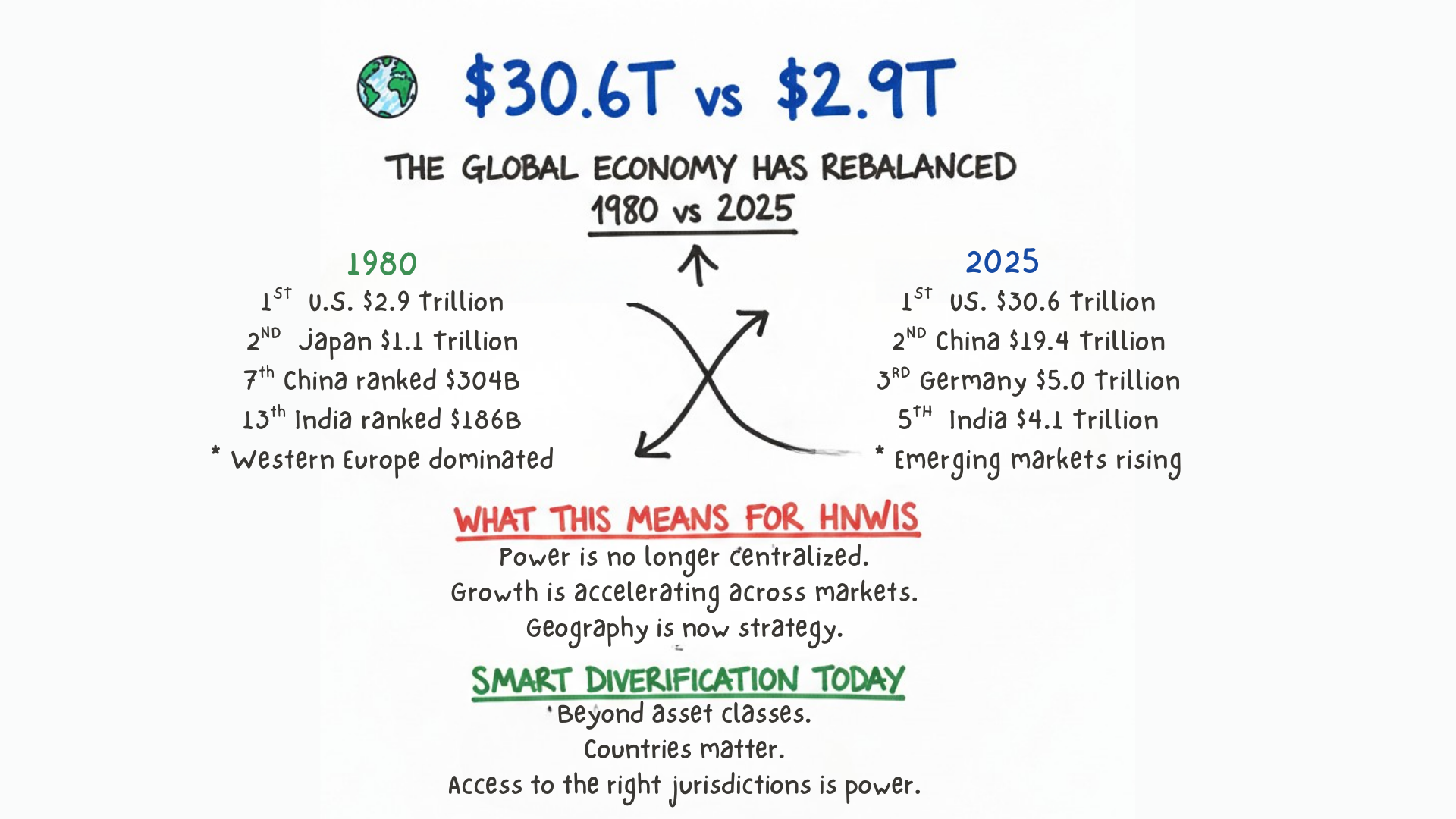

From Western Dominance to a Multipolar Economy (1980–2025)

From 1980 to 2025, global power shifted from Western dominance to a multipolar economy. Economic influence now spans several regions,…