Global Opportunities: Residency by Real Estate Investment Programs

- Potential for property appreciation

- Rental income opportunities

- A tangible asset in a foreign country

- Possible pathway to citizenship

- Visa-free travel to certain countries

- Access to healthcare and education systems

- Tax planning opportunities

- Fast processing time (around 2 months)

- Residency includes the entire family

- No language requirement

- Access to Spain’s public healthcare system

- No minimum stay requirement

- High standard of living with diverse real estate options

- Lowest real estate investment threshold in Europe

- Visa-free travel within the Schengen Area

- No minimum stay requirement

- Immediate permanent residency

- Access to the Schengen Area

- High-quality healthcare and education

- Tax-free income

- World-class infrastructure and amenities

- Diverse and multicultural environment

- Due Diligence:

Research the country’s real estate market, economic stability, and property value trends before investing. - Legal and Financial Advice:

Consult immigration lawyers and real estate professionals to ensure you meet program requirements and understand tax implications. - Site Visit:

Visit the country and properties if possible to assess their potential firsthand. - Understand All Costs:

Factor in additional expenses like property taxes, legal fees, and program application costs. - Exit Strategy:

Understand resale restrictions and plan for future sale opportunities. - Tax Implications:

Know the tax consequences in both your home country and the country of investment. - Family Inclusion:

Ensure the program covers family members and understand the rules for including dependents. - Rental Income and ROI Potential:

Consider properties that offer rental income potential as part of your investment strategy. - Citizenship Pathway:

Verify if the program provides a route to citizenship and the residency requirements. - Healthcare and Education Access:

Check the quality of healthcare and education, especially if relocating with family.

Contact us if you are interested in Residency by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Conclusion

Residency by real estate investment offers a unique way to diversify your portfolio while gaining residency in another country. Whether seeking a vacation home, retirement spot, or a business base, these programs cater to different preferences and budgets. However, careful research and professional advice are essential to making informed decisions.

As regulations may change, always verify current requirements. With the right approach, residency by real estate investment can open doors to new opportunities and experiences.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

The USA Moves to Challenge Sharia Law Policies in Nigeria

The United States has introduced legislation addressing Sharia law policies in Nigeria, increasing international scrutiny on governance and religious freedom….

South Africa Infrastructure Gains $350M World Bank Support

The World Bank $350 million investment in South Africa infrastructure signals growing global confidence in the country’s economic future. For…

10 African Countries Leading Global Soft Power in 2026

Africa’s global influence continues to grow. The African soft power 2026 ranking highlights ten nations shaping global perception through culture,…

African Citizenship by Investment for Strategic Global Investors

African citizenship by investment is gaining attention among global investors seeking diversification, mobility, and access to emerging markets. As African…

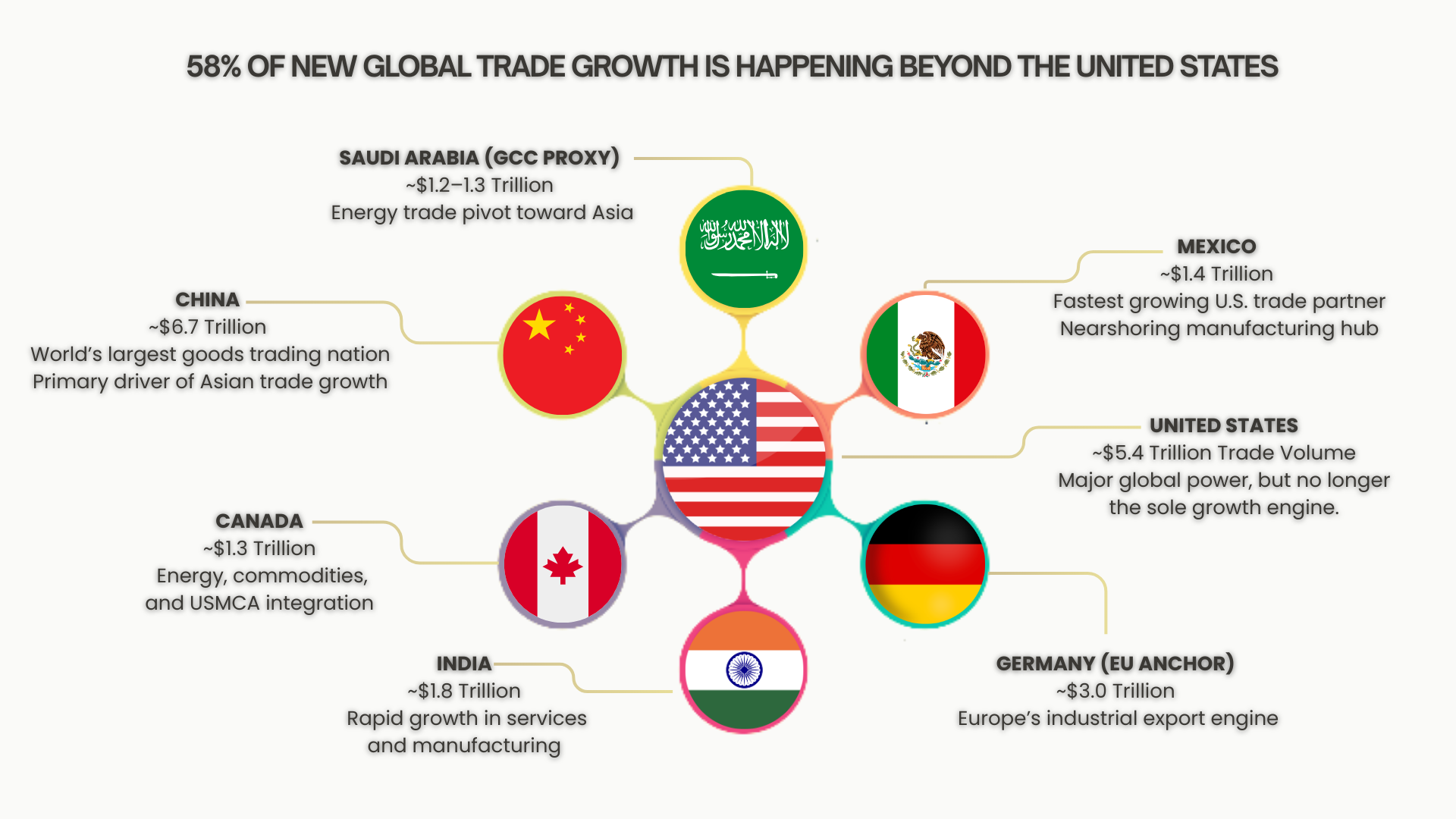

58% of New Trade Growth Happens Outside the U.S.

58% of New Trade Growth Happens Outside the U.S., marking a structural shift in global economic power. As trade momentum…

CBI in Times of Uncertainty: When One Passport Is Not

Global uncertainty has changed the rules of wealth preservation. In today’s environment, one passport may not provide sufficient protection. This…