Paraguay Reports 50% Increase in Residency Applications in 2025

In 2025, Paraguay reported a 50% increase in residency applications compared to the previous year, nearly 43,000 individuals filed for legal residency. For high-net-worth individuals (HNWIs), business owners, and global investors, this trend represents far more than a statistical rise. It reflects a fundamental shift in how forward-thinking individuals are building long-term strategies for mobility, asset protection, and global access.

This blog explores the factors driving Paraguay’s residency boom, what this means for international investors, and how residency, especially in well-structured, low-tax jurisdictions, is evolving into a core component of wealth strategy.

Why Residency Has Become a Strategic Asset

For HNWIs and entrepreneurs, residency is no longer simply about relocation. It plays a central role in:

- Tax efficiency – Jurisdictions with territorial tax systems, like Paraguay, can reduce global tax burdens.

- Asset protection – Residency in a stable and neutral jurisdiction can provide a buffer against regional risks.

- Mobility – Residency rights often lead to expanded visa-free access and easier international movement.

- Legacy planning – Families are securing residency for future generations to access better education, business opportunities, and lifestyle choices.

Residency today is part of a broader strategy, one that complements investment diversification, business expansion, and long-term security.

What Caused the Surge?

Paraguay processed nearly 43,000 residency applications in 2025, marking a 50% increase from the previous year. This growth reflects a rising demand for residency options that offer stability, tax efficiency, and accessibility, all of which Paraguay provides. The country’s straightforward immigration process, low cost of living, and territorial tax regime have made it increasingly attractive to internationally mobile individuals.

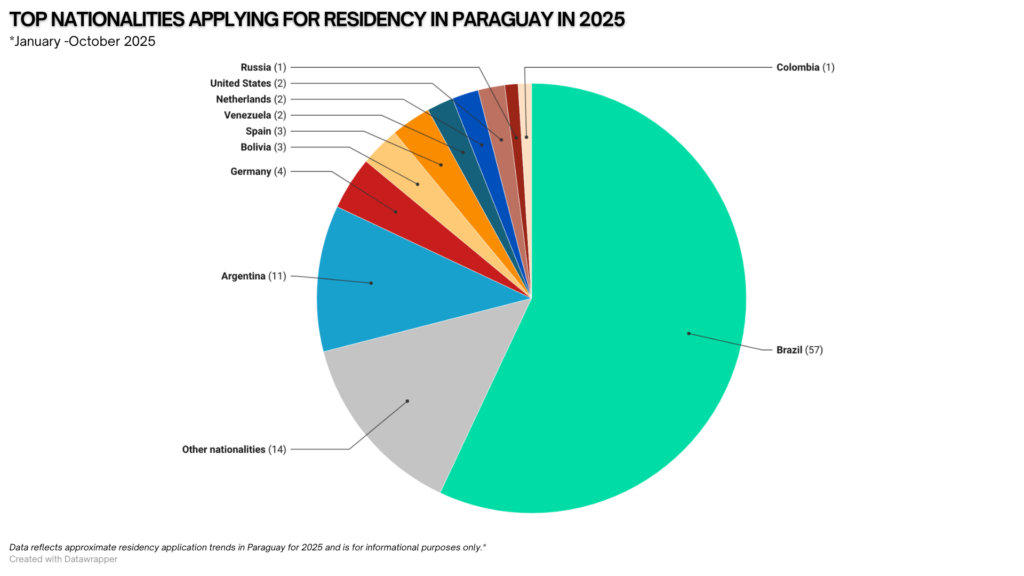

While Brazil and Argentina continue to lead due to proximity, 2025 saw a notable rise in applicants from countries like Germany, the United States, Russia, and the Netherlands. This growing diversity signals Paraguay’s expanding appeal beyond its region, as more investors from Europe and North America look for stable jurisdictions with favorable legal and financial frameworks.

Global uncertainty is also a contributing factor. As economic and political volatility rises in many parts of the world, investors are turning to countries like Paraguay that offer predictability and control. For many, obtaining a second residency is no longer optional, it’s part of a broader strategy to protect assets and ensure long-term freedom.

Paraguay’s Residency Growth: A Look at Issuance Trends

Paraguay’s upward trend in residency interest isn’t just reflected in application numbers, it’s clearly seen in the number of residencies actually issued each year. After a dip during 2020 and 2021 due to global disruptions, the country saw a dramatic rebound in 2022 and continued strength through 2025.

Here’s a breakdown of residency permits issued in Paraguay over the last seven years:

| Year | Residencies Issued |

|---|---|

| 2019 | 25,780 |

| 2020 | 16,217 |

| 2021 | 16,192 |

| 2022 | 37,084 |

| 2023 | 40,660 |

| 2024 | 28,464 |

| 2025 | 36,263 |

This data shows sustained high demand following Paraguay’s residency reform in 2022, with strong issuance numbers in both 2023 and 2025. The country remains an attractive and accessible option for those seeking long-term residency for strategic, financial, and personal reasons.

What Makes Paraguay Attractive for Residency?

Several key factors are driving this trend:

1. Territorial Tax System

Paraguay taxes only income generated within the country. If your income is earned abroad, it is typically not taxed locally. This is ideal for international investors and entrepreneurs with offshore income or foreign-based businesses.

2. Simple and Accessible Residency Process

Paraguay’s residency requirements are considered relatively straightforward:

- No need for high investment thresholds

- Basic documentation requirements

- Opportunities to convert temporary residency to permanent status

- Minimal physical presence requirements

This ease of entry makes it appealing to those seeking flexibility without long bureaucratic delays.

3. Political and Economic Stability

Compared to many regional neighbors, Paraguay enjoys a stable political environment and consistent economic policy. For investors looking for predictability, this creates a favorable backdrop for residency and long-term planning.

4. Strategic Location in South America

Located between Brazil, Argentina, and Bolivia, Paraguay provides access to a large regional market while offering a more cost-effective and investor-friendly environment.

5. Business-Friendly Environment

Low corporate taxes, simple regulations, and an openness to foreign investment make Paraguay a logical base for regional operations or personal wealth management.

Global Trends Driving Demand for Alternative Residency

Paraguay’s rise is part of a wider global trend among HNWIs and entrepreneurs prioritizing optionality, control, and future access. Here’s what’s fueling that movement:

Increasing Global Uncertainty

From geopolitical tensions to currency risks, individuals are securing second residencies as a hedge against instability in their home countries.

International Wealth Mobility

The modern investor is mobile, digital, and borderless. As a result, they seek flexible residency solutions to optimize tax exposure and access new opportunities.

Family and Education Planning

A second residency often unlocks access to global education systems, healthcare, and future citizenship for children and grandchildren.

Succession and Estate Planning

Residency, especially in a stable and tax-efficient country, adds a layer of protection to intergenerational wealth transfers and long-term estate planning.

Considerations for Investors Looking at Paraguay

Before applying for residency in Paraguay, here are some essential factors to evaluate:

- Legal Requirements – Ensure your documentation is valid, translated, and properly certified. While the process is accessible, it must still be managed professionally.

- Tax Strategy – Confirm how Paraguay’s territorial tax system aligns with your global income profile.

- Physical Presence and Residency Conversion – Understand the difference between temporary and permanent residency and the timeline for each.

- Exit Planning – Consider how this residency fits into your broader mobility or eventual citizenship strategy.

Working with experienced legal and tax advisors is key to making the most of your Paraguay residency plan.

Why This Matters for Your Global Strategy

Paraguay’s sharp increase in residency interest highlights a growing awareness: smart residency planning isn’t just about migration, it’s about control, protection, and future access.

Whether you’re looking to diversify risk, build optionality into your legacy, or reduce exposure to over-taxation, alternative residency is a key component in a modern wealth strategy.

Paraguay, with its accessibility, tax benefits, and economic stability, now stands out as a serious option for those seeking to secure their global future.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Take the Next Step

If you’re considering second residency as part of your long-term wealth, business, or lifestyle planning, we’re here to guide you.

Get in touch today to explore whether Paraguay, or another strategic jurisdiction, aligns with your goals. Our team provides tailored, professional advice for investors, entrepreneurs, and global citizens ready to take control of their future.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

7 Key Risks A U.S. Setup Isn’t Always Best for

A cross-border business setup can boost global growth by reducing onboarding delays, payment friction, and concentration risk. This guide explains…

Why Citizenship by Investment Due Diligence Matters for Investors

Citizenship by Investment due diligence protects more than an application. It safeguards international credibility, visa free access, and long term…

Wealthy Americans Lead New Zealand Golden Visa Surge

Wealthy Americans are leading the New Zealand Golden Visa surge as investors prioritize stability and diversification. Billions in committed capital…

Second Residency Is Now A Top Three Global Wealth Priority

Second residency has quietly moved into the top tier of priorities for serious wealth holders. This article explains why investors…

UK Exit Tax 20% and the Future of Strategic Wealth

The UK Exit Tax 20% could significantly impact HNWIs, founders, and investors with substantial unrealized gains. This in depth analysis…

Greek Golden Visa Sees Record Turkish Investor Demand Surge

The Greek Golden Visa is seeing record demand from Turkish investors seeking EU residency, asset protection, and mobility. With participation…