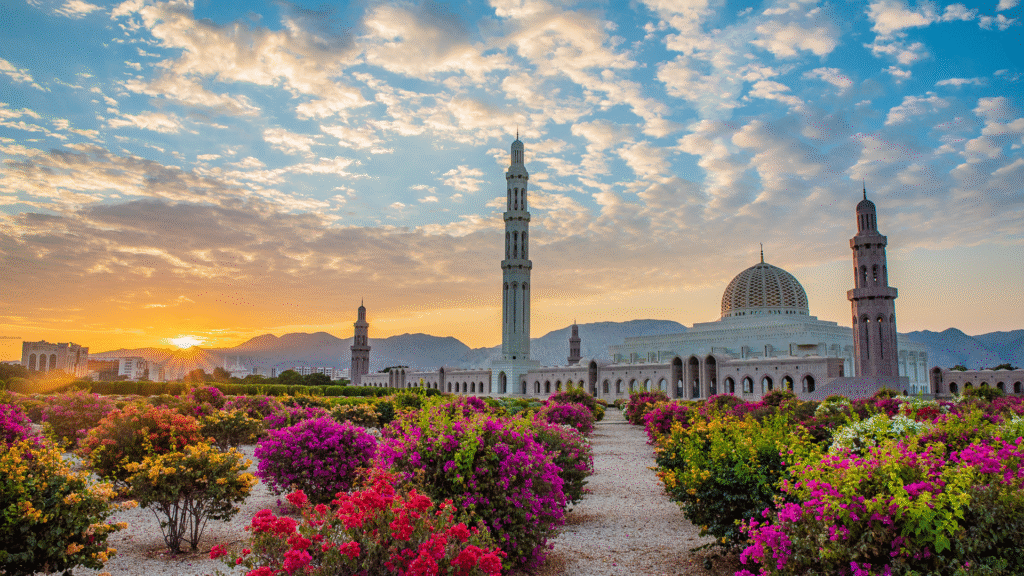

Oman’s Next Big Step: Golden Visa & Digital Trade Reform for Global Investors

1. Multiple Investment Paths with Flexible Terms

- Family inclusion: Residency extends to spouses, children under 25, and dependent parents.

- No sponsorship required: Investors can apply on their own, simplifying the process.

2. Diverse Investment Vehicles—Choose What Works for You

- Property ownership: Buy residential property worth at least 500,000 OMR.

- Business equity: Invest 500,000 OMR in a company or purchase shares worth the same.

- Job creation: Start a business that employs at least 50 Omanis.

- Government bonds: Invest in Omani government development bonds.

3. Transparent Costs—Know What You’ll Pay

- Al Majida (Mujeedah) Companies Initiative: This new programme rewards high-performing Omani businesses with incentives to grow both at home and abroad.

- Digital Commercial Transfers: Through the “Oman Business” (or “Invest Oman”) platform, commercial registration transfers will now be fully digital—cutting time, cost, and red tape.

- Sultan Qaboos University

- German University of Technology

- Oman Energy Association

- Binaa (or Ebinaa) Professional Services

- Long-Term Stability:

Renewable five- and ten-year visas offer peace of mind and family security. - Ownership and Control:

Investors can fully own businesses and properties, with no sponsorship hurdles. - Time & Cost Efficiency:

Digital registration slashes bureaucracy and makes Oman more business-friendly. - Local Growth, Global Integration:

The Al Majida initiative supports Omani firms, while academic ties build a knowledge-driven economy. - Vision 2040 Aligned:

These reforms fit into Oman’s broader plan to diversify its economy into technology, tourism, logistics, and more.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Conclusion

Oman’s Golden Visa relaunch and digital trade transformation signal a new era of openness and strategic planning. By streamlining business processes, expanding investment avenues, and promoting long-term stability, Oman stands out as a thoughtful and forward-looking destination for global capital.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

10 African Countries Leading Global Soft Power in 2026

Africa’s global influence continues to grow. The African soft power 2026 ranking highlights ten nations shaping global perception through culture,…

African Citizenship by Investment for Strategic Global Investors

African citizenship by investment is gaining attention among global investors seeking diversification, mobility, and access to emerging markets. As African…

58% of New Trade Growth Happens Outside the U.S.

58% of New Trade Growth Happens Outside the U.S., marking a structural shift in global economic power. As trade momentum…

CBI in Times of Uncertainty: When One Passport Is Not

Global uncertainty has changed the rules of wealth preservation. In today’s environment, one passport may not provide sufficient protection. This…

Nigeria Dangote Refinery Investment Opportunity for Strategic Investors

Nigeria’s Dangote Refinery investment opportunity reflects growing capital market maturity and infrastructure scale. For high net worth individuals and global…

13 CARICOM Nations Attract Over 1 Billion Dollars from 5

13 CARICOM nations attract over 1 billion dollars from 5 global powers, reinforcing regional credibility and investment stability. Sovereign commitments…