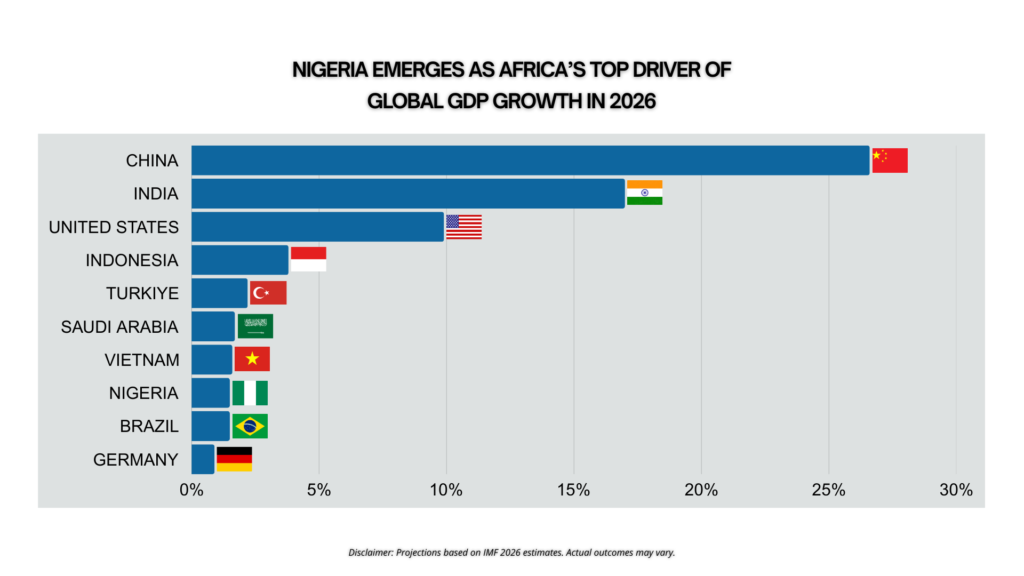

Nigeria Set to Lead Africa’s Global Growth Impact by 2026

Introduction

Nigeria global growth impact 2026 is shaping a new narrative for Africa’s largest economy. By 2026, Nigeria is projected to become the continent’s leading contributor to global economic growth, reflecting renewed confidence in reforms, policy direction, and long-term potential. This shift is not driven by optimism alone, but by measurable changes that global institutions and investors increasingly recognize.

For high net worth individuals, business owners, and global investors, this development deserves close attention. Markets that drive global growth tend to attract capital, talent, and opportunity. Nigeria’s trajectory suggests it is moving into that category.

This article explains what is driving Nigeria’s rise, why it matters to sophisticated investors, and how it strengthens long-term strategies around capital deployment, business expansion, and global mobility.

Nigeria’s Growing Role in the Global Economy

Global growth contribution measures how much a country adds to worldwide economic expansion. Nigeria’s projected 1.5 percent share by 2026 places it ahead of other African economies.

This matters because global institutions and investors track contribution, not just growth rates. A country that meaningfully supports global growth demonstrates scale, resilience, and relevance. Nigeria’s size, demographics, and reform agenda now align to produce that impact.

Several factors reinforce this outlook:

- Africa’s largest population, creating sustained demand

- Expanding services, technology, and financial sectors

- Structural reforms aimed at long-term stability

Together, these elements position Nigeria as a core growth driver rather than a peripheral market.

The Reforms Behind the Momentum

Nigeria’s improving outlook did not happen by chance. Recent reforms addressed long-standing inefficiencies and fiscal pressures. Although difficult in the short term, these changes strengthened credibility.

Key reform areas include currency management, subsidy rationalization, and public finance discipline. These steps improved transparency and reduced structural distortions. Investors often view such reforms as proof of institutional seriousness.

While challenges remain, momentum matters. Markets reward direction, not perfection. Nigeria’s willingness to make hard policy decisions sends a clear signal to global capital.

Why Global Investors Are Paying Attention

Sophisticated investors look for three things: scale, trajectory, and credibility. Nigeria now offers all three.

Scale comes from population and market depth. Trajectory comes from reforms and growth projections. Credibility comes from alignment with global economic standards and oversight.

For private investors and family offices, Nigeria offers:

- Exposure to one of the world’s fastest-growing consumer bases

- Opportunities in financial services, infrastructure, technology, and energy

- Early positioning in a market transitioning toward institutional maturity

These factors make Nigeria increasingly relevant in global portfolio construction.

Implications for Business Owners and Entrepreneurs

Nigeria’s rising contribution to global growth also matters for operators, not just investors.

Businesses expanding into Africa need markets that support scale. Nigeria offers access to regional trade, talent pools, and growing middle-class demand. As reforms improve the operating environment, Nigeria becomes more attractive as a base for African operations.

Local and international entrepreneurs benefit from:

- Growing demand across digital, logistics, healthcare, and education

- Increased capital flow into private markets

- Greater integration with global trade and finance

As growth accelerates, first movers gain strategic advantage.

What This Means for Wealth Strategy and Global Mobility

Economic growth strengthens trust. Countries that contribute meaningfully to global growth often see improvements in financial systems, regulation, and international alignment.

For high net worth individuals, this creates stronger foundations for:

- Long-term investment planning

- Geographic diversification

- Residency and global mobility strategies

Economic credibility supports confidence in jurisdictional planning. When growth reflects reform and stability, it reinforces trust in long-term positioning.

Nigeria’s projected rise supports the view that African-linked strategies deserve a place in forward-looking wealth planning.

Nigeria in the African Context

Nigeria’s rise does not diminish other African economies. Instead, it highlights Africa’s growing relevance in global growth discussions.

However, Nigeria’s scale gives it a unique role. When Nigeria grows, regional trade, investment, and financial integration often follow. This multiplier effect benefits neighboring markets and enhances Africa’s overall global position.

As global growth increasingly comes from emerging markets, Nigeria stands out as a central contributor.

Managing Risk with Perspective

No emerging market comes without risk. Nigeria still faces inflation pressures, infrastructure gaps, and social challenges. However, experienced investors assess risk relative to reward and direction.

What matters now is momentum. Nigeria shows policy intent, reform willingness, and demographic advantage. These elements reduce uncertainty over time and improve predictability.

Long-term investors who understand emerging market cycles often find opportunity where others hesitate.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

The Strategic Takeaway

As Nigeria global growth impact 2026 comes into sharper focus, the message for investors and business leaders is clear. The country is moving from promise to performance, supported by reform momentum and rising global relevance. For those thinking long term about capital allocation, business expansion, and global positioning, Nigeria’s trajectory deserves serious consideration at this stage of the cycle.

If you are evaluating where to position capital, structure long-term plans, or explore global mobility and residency strategies aligned with emerging market growth, now is the time to seek informed guidance. Strategic decisions made early often define the strongest outcomes.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

African Citizenship by Investment for Strategic Global Investors

African citizenship by investment is gaining attention among global investors seeking diversification, mobility, and access to emerging markets. As African…

58% of New Trade Growth Happens Outside the U.S.

58% of New Trade Growth Happens Outside the U.S., marking a structural shift in global economic power. As trade momentum…

CBI in Times of Uncertainty: When One Passport Is Not

Global uncertainty has changed the rules of wealth preservation. In today’s environment, one passport may not provide sufficient protection. This…

Nigeria Dangote Refinery Investment Opportunity for Strategic Investors

Nigeria’s Dangote Refinery investment opportunity reflects growing capital market maturity and infrastructure scale. For high net worth individuals and global…

13 CARICOM Nations Attract Over 1 Billion Dollars from 5

13 CARICOM nations attract over 1 billion dollars from 5 global powers, reinforcing regional credibility and investment stability. Sovereign commitments…

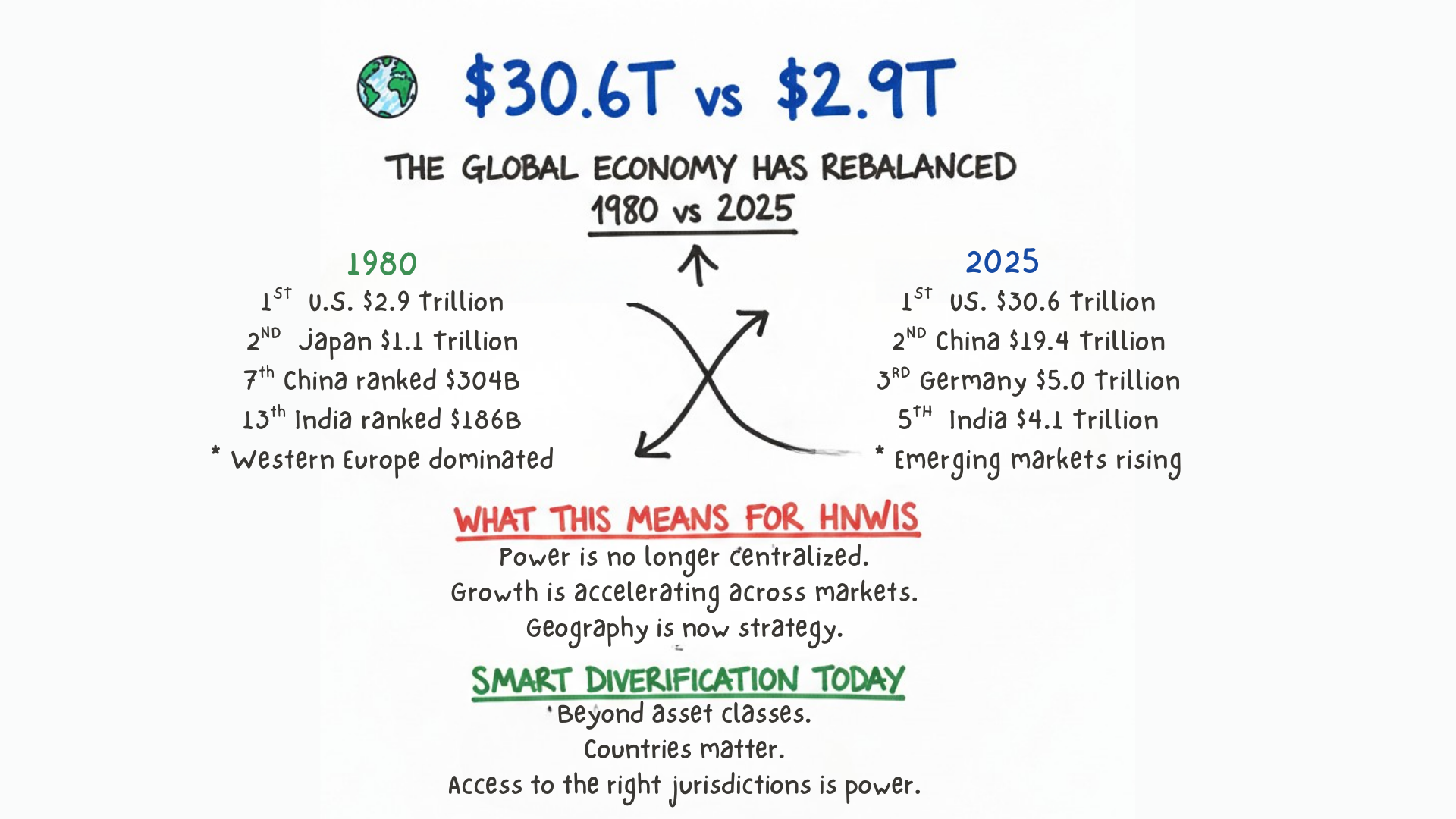

From Western Dominance to a Multipolar Economy (1980–2025)

From 1980 to 2025, global power shifted from Western dominance to a multipolar economy. Economic influence now spans several regions,…