New U.S. Citizenship Bill Drives Global Second Passport Interest

Understanding the New U.S. Citizenship Bill

A newly proposed bill in the U.S. Senate is making headlines and raising eyebrows across global business and investor communities. The Exclusive Citizenship Act of 2025, introduced by Senator Bernie Moreno, aims to eliminate dual citizenship for Americans.

If passed, the law would force U.S. citizens to choose one nationality only. Those who hold another citizenship in addition to their U.S. one would be required to give up one or automatically lose their U.S. citizenship.

This is a dramatic shift from the current U.S. position, where dual citizenship is generally allowed, even if not formally encouraged. For business owners, investors, and high-net-worth individuals (HNWIs), this proposal could reshape how they manage their global affairs.

What the Bill Proposes

Let’s break down what this legislation includes:

- Ban on dual citizenship: Americans cannot legally hold another nationality at the same time.

- One-year deadline: U.S. citizens with a second citizenship would have 12 months to decide which one to keep.

- Automatic loss of U.S. citizenship: If no decision is made within a year, the person is assumed to have voluntarily given up their U.S. nationality.

- No new dual citizens: Going forward, acquiring another citizenship would automatically forfeit U.S. citizenship.

This proposal would impact not just future citizens, but many individuals who were born into dual citizenship or who obtained it through marriage, descent, or investment.

Why It Matters for HNWIs and Global Investors

At first glance, this might seem like a policy targeting immigrants or those with foreign family ties. But the real impact reaches much deeper, especially into the financial and strategic planning of wealthy individuals.

For HNWIs, citizenship is about more than identity, it’s a gateway to global access. It affects where you can live, invest, bank, pay taxes, do business, and even where your children can be educated.

Here’s why this proposed law is a major signal for investors and business owners:

1. Loss of Flexibility

Dual citizenship offers freedom. It allows you to live in one country, bank in another, and send your children to school in a third. Removing that flexibility forces individuals to restructure how and where they operate, both personally and professionally.

2. Disruption to International Business

Many entrepreneurs and investors operate across borders. Whether it’s maintaining operations in Asia while living in Europe, or investing in the Caribbean while being based in the U.S., dual citizenship makes this seamless. The new bill could limit access to foreign markets for Americans, especially in regions where local citizenship opens doors.

3. Inheritance and Estate Planning Complications

Citizenship affects how assets are taxed and transferred across generations. If dual nationality is removed, investors may lose favorable legal arrangements or tax treaties between countries. It also creates risk and uncertainty for global estates.

4. Increased Geopolitical Risk

This bill sends a strong message: national policy can change, even on something as fundamental as citizenship. For investors relying on a single nationality for safety or mobility, this is a wake-up call. A well-balanced portfolio doesn’t just include financial diversification, it includes sovereign diversification.

The Bigger Picture: Rising Nationalism and Restricted Mobility

The Exclusive Citizenship Act is part of a broader trend: governments across the world are tightening control over citizenship, immigration, and mobility.

We’re seeing:

- Stricter naturalization rules

- Tighter tax enforcement on offshore assets

- Visa access being restricted or restructured

- Growing skepticism toward dual loyalties in politics and security

In a global economy where capital, talent, and opportunity cross borders daily, this kind of shift has long-term implications.

Mobility is no longer guaranteed. It must be earned or strategically secured.

Citizenship as a Strategic Asset

For decades, the ultra-wealthy have understood that citizenship is not just about a place to live. It’s a strategic asset, one that can offer:

- Visa-free travel to global hubs

- Investment opportunities in restricted markets

- Legal protection for family members

- Favorable tax conditions depending on jurisdiction

- Emergency relocation options in times of political or financial crisis

When structured correctly, having more than one citizenship allows investors to navigate changing laws, economic shifts, and geopolitical tensions, without sacrificing personal freedom or access.

Why Citizenship by Investment (CBI) Is Now More Relevant Than Ever

The U.S. bill doesn’t just raise alarm, it creates urgency.

With dual citizenship under fire in major nations, more investors are turning to programs that allow them to legally acquire a second passport through investment.

These programs, known as Citizenship by Investment (CBI), allow individuals to obtain nationality in a country in exchange for contributing to its economy, typically through real estate, business development, or government funds.

CBI programs are:

- Legal and government-approved

- Often provide fast-track processing (some in under 6 months)

- Offer access to well-connected, stable countries

- Used by entrepreneurs, executives, and international families to unlock new opportunities

More importantly, they allow individuals to build a future-proof citizenship plan, giving them a choice if their primary citizenship becomes too restrictive or politically unstable.

You should be paying attention to these changes if you are:

- A U.S. citizen with dual nationality

- A foreign national considering U.S. citizenship

- An investor or business owner with global interests

- A parent planning an international education path for your children

- Someone with assets or real estate across borders

- A globally mobile executive or entrepreneur

This is not just about one bill in one country. It’s about a shift in global thinking, where governments tighten their grip, and individuals must act proactively to secure their freedom.

In a world of rising uncertainty, sovereignty and mobility must be protected. Just as you diversify your portfolio to reduce risk, you should diversify your citizenship and residency options to secure your future.

Here’s what you can do now:

- Review your current citizenship status and those of your family.

- Assess your exposure: How would you be impacted if dual citizenship were removed tomorrow?

- Start exploring legal pathways to obtain a second nationality, whether through descent, residence, or investment.

- Work with a professional who understands both the legal and strategic sides of citizenship planning.

The window of opportunity to secure your global freedom is open, but there’s no guarantee it will stay that way.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Take Control of Your Global Future

Your passport is more than a document. It’s your access key to the world. In a time when laws are shifting and governments are redrawing the rules, now is the time to make sure you control your mobility, your wealth, and your legacy.

If your current citizenship strategy doesn’t align with your long-term goals, it’s time to rethink it.

Book a confidential consultation today and learn how strategic citizenship planning can protect your wealth, expand your opportunities, and give your family true global freedom.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

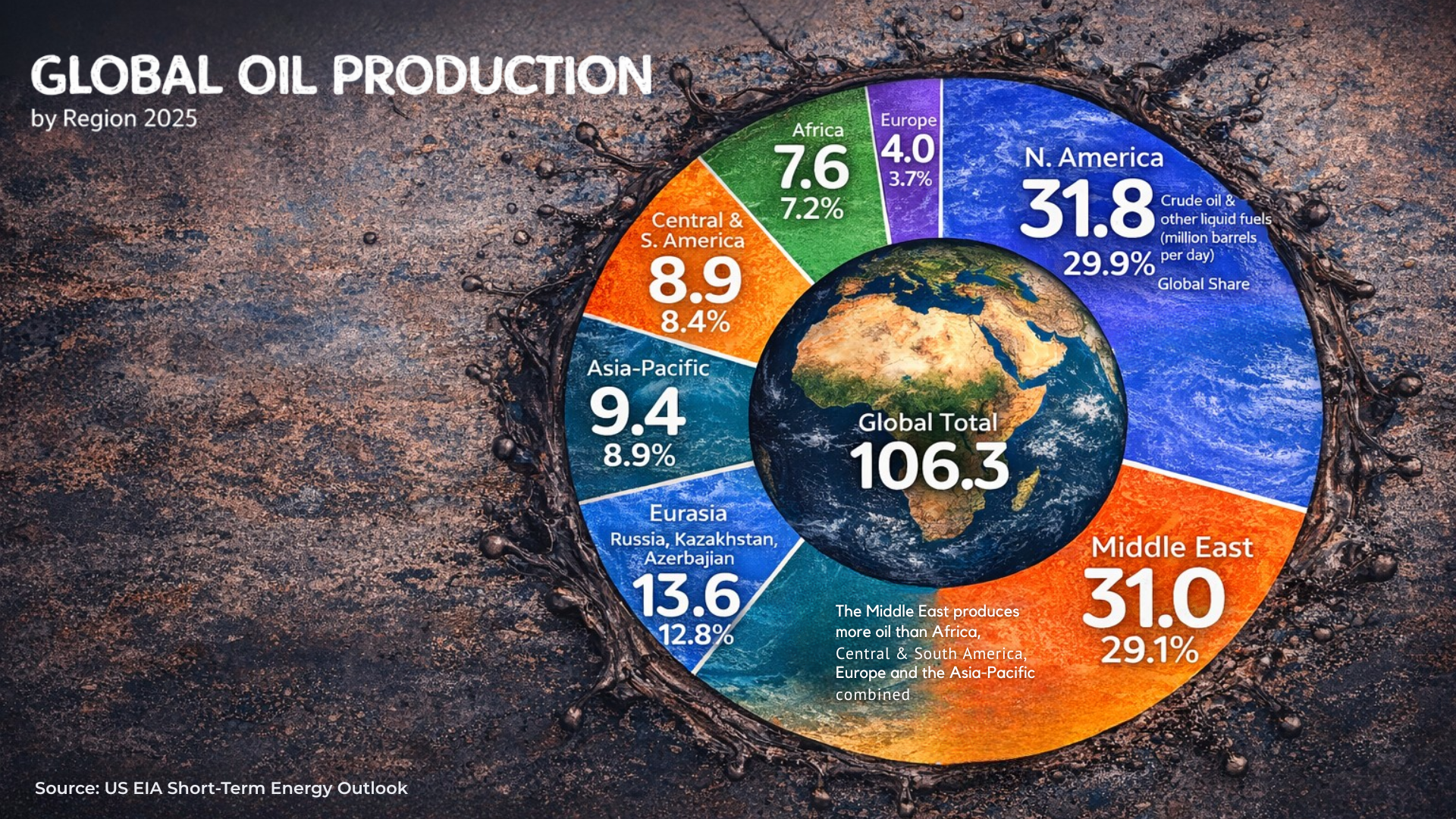

Global Oil: Where the World’s Oil Comes From by Region

Understanding where the world’s oil comes from by region reveals more than energy statistics. It highlights economic power centers shaping…

The USA Moves to Challenge Sharia Law Policies in Nigeria

The United States has introduced legislation addressing Sharia law policies in Nigeria, increasing international scrutiny on governance and religious freedom….

South Africa Infrastructure Gains $350M World Bank Support

The World Bank $350 million investment in South Africa infrastructure signals growing global confidence in the country’s economic future. For…

10 African Countries Leading Global Soft Power in 2026

Africa’s global influence continues to grow. The African soft power 2026 ranking highlights ten nations shaping global perception through culture,…

African Citizenship by Investment for Strategic Global Investors

African citizenship by investment is gaining attention among global investors seeking diversification, mobility, and access to emerging markets. As African…

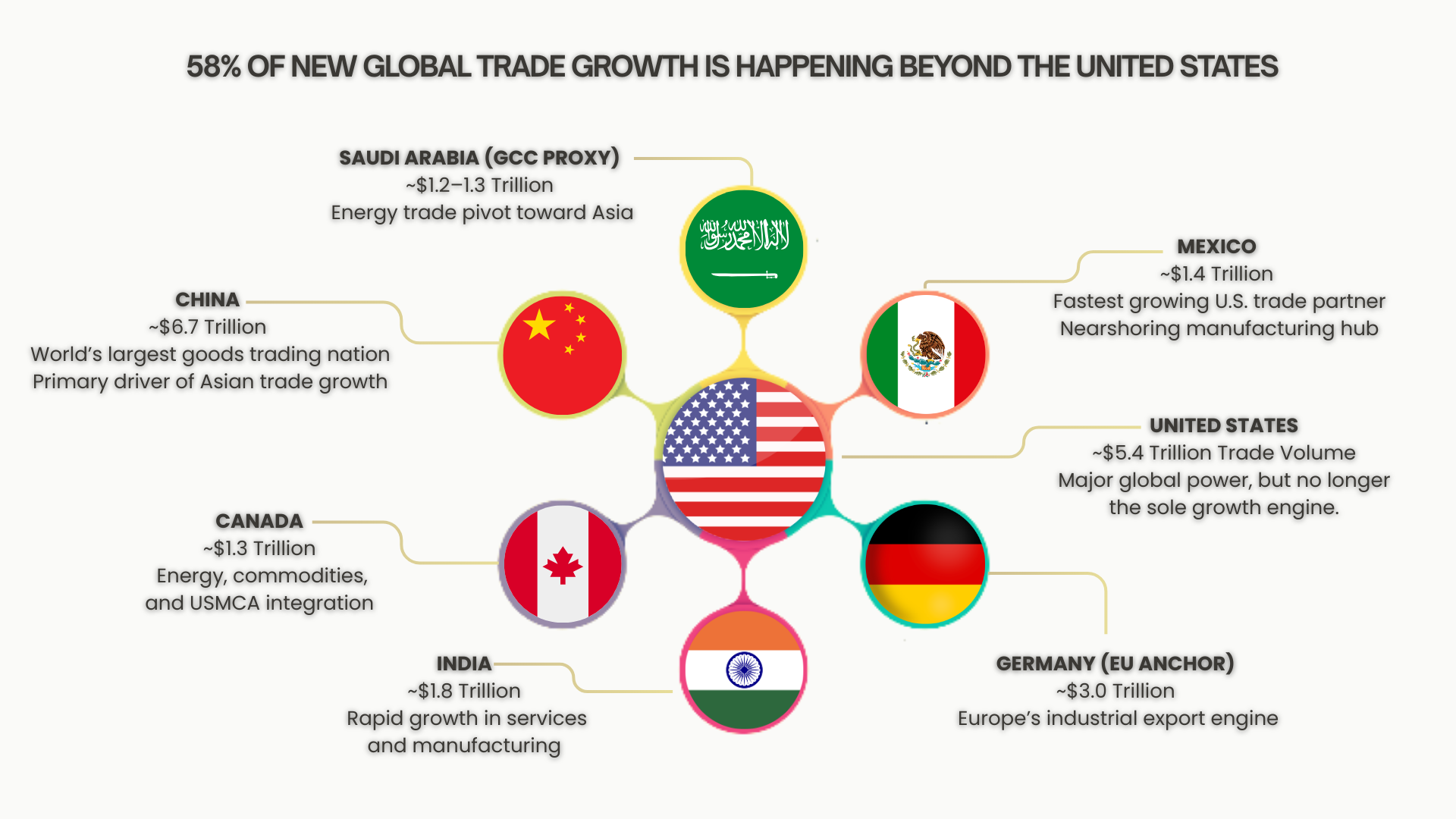

58% of New Trade Growth Happens Outside the U.S.

58% of New Trade Growth Happens Outside the U.S., marking a structural shift in global economic power. As trade momentum…