Neutral Countries: Why Stability Is the New Currency for Investors

Introduction

Uncertainty has become a constant in today’s global environment. Political tensions, shifting alliances, and economic volatility are influencing how high net worth individuals, business owners, and international investors plan for the future. As a result, neutral countries for second residency are gaining strong attention among those seeking stability, predictability, and long term security. These countries stay out of military conflicts, avoid aggressive alliances, and focus on diplomacy and internal governance, making them attractive destinations for strategic planning.

One trend stands out clearly. Neutral countries are gaining renewed attention. These are nations that stay out of military conflicts, avoid aggressive alliances, and focus on diplomacy and internal stability. For investors, neutrality is no longer just a political concept. It is a practical signal of trust, predictability, and long term reliability.

Why Neutrality Matters in Today’s World

Neutrality reflects discipline in governance. Countries that commit to staying out of conflict must invest heavily in diplomacy, strong institutions, and internal cohesion. This approach creates environments where laws remain consistent, policies evolve carefully, and abrupt shifts are less common.

For investors, this matters deeply. Wealth preservation depends on predictability. Business growth relies on regulatory clarity. Family planning requires long term confidence. Neutral countries tend to deliver on all three.

In practical terms, neutrality often aligns with:

- Strong rule of law and independent institutions

- Stable financial and banking systems

- Predictable immigration and residency policies

- High international credibility and recognition

These characteristics explain why neutrality has become a key filter in global residency and citizenship planning.

The Seven Neutral Countries Investors Are Watching Closely

Several neutral countries consistently appear in investor discussions due to their long standing commitment to balance and stability. Switzerland remains the most recognized example, having maintained neutrality for centuries while building one of the world’s most trusted legal and financial systems. Its reputation alone continues to attract globally mobile families.

Austria, constitutionally neutral since the mid twentieth century, combines political balance with high living standards and strong institutional credibility. It appeals to investors seeking long term residence in a stable European environment.

Liechtenstein, despite its small size, holds permanent neutrality and operates with a high level of governance and economic sophistication. Its stability and disciplined approach make it notable among experienced investors.

Beyond traditional European examples, Andorra has gained attention as a politically balanced jurisdiction with clear residency frameworks and a growing reputation for transparency. Mauritius stands out for its non aligned foreign policy and its role as a stable international business and investment hub.

Outside Europe, Oman offers a compelling example of diplomatic neutrality in a complex region. Its balanced foreign policy and controlled development approach have earned it long term regional respect. Costa Rica presents a unique case, having abolished its military decades ago and built a national identity around peace, democracy, and social stability.

Together, these seven countries demonstrate that neutrality is not limited by geography. It is defined by governance choices and long term commitment to stability.

Neutral Countries and Investor Residency Frameworks

Another reason neutral countries appeal to investors is how they structure residency and citizenship pathways. These programs are typically grounded in clear legal frameworks, strong compliance standards, and rigorous due diligence. This is not a weakness. It is a strength.

Well regulated programs signal confidence. Governments that value neutrality also value reputation. They protect their international standing by ensuring that only qualified applicants gain long term status. For investors, this increases credibility and long term acceptance.

Strong due diligence supports smoother interactions with banks, institutions, and global partners. It also protects the integrity of the status itself. Over time, this approach strengthens the value of residency or citizenship obtained through these routes.

Business Owners and Strategic Risk Management

For business owners, neutrality offers more than personal security. It provides strategic flexibility. A second residency in a neutral country can help manage geopolitical exposure, support cross border operations, and create contingency options during disruptions.

Neutral countries often function as connectors rather than sides. This positioning supports international trade, dispute resolution, and diplomatic balance. Business leaders benefit from operating within systems that prioritize continuity over confrontation.

Predictable immigration and regulatory environments also allow entrepreneurs to plan long term. Expansion, succession planning, and capital deployment all require stable foundations. Neutral jurisdictions tend to provide that stability.

Family Security and Long Term Planning

Families play a central role in global mobility decisions. Education, healthcare, safety, and lifestyle quality all factor into where investors choose to secure residency or citizenship. Neutral countries often perform strongly across these areas.

Many investors do not relocate immediately. Instead, they secure a second status as a long term option. Neutral countries serve as reliable alternatives during times of crisis or transition. This optionality has tangible value. It transforms mobility into a form of strategic insurance.

By choosing politically balanced jurisdictions, families reduce exposure to sudden policy shifts, travel restrictions, or geopolitical fallout.

Trust, Reputation, and Long Term Value

Trust is the thread connecting neutrality, investment migration, and investor confidence. Neutral countries guard their reputation carefully. That discipline extends to their immigration systems, regulatory enforcement, and international cooperation.

From an investor perspective, this creates long term value. Status from a trusted jurisdiction retains credibility over time. It does not depend on trends or aggressive marketing. Instead, it rests on institutional strength and international respect.

As scrutiny increases worldwide, programs backed by transparency and governance continue to stand out. Neutral countries often lead in this space.

Neutrality as a Strategic Advantage

Neutrality has evolved into a strategic asset. It represents foresight, balance, and resilience. In a world where alignment can change quickly, neutrality offers consistency.

For high net worth individuals, business owners, and investors, this consistency supports smarter planning. It enables diversification of personal and financial exposure while maintaining legitimacy and access.

Neutral countries are not reacting to global uncertainty. They are built to withstand it.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Planning Your Next Move

Stability, trust, and long term credibility now define smart global planning. Neutral countries continue to offer these qualities through disciplined governance and well regulated residency frameworks. If you are considering a second residency or citizenship as part of your wealth or business strategy, explore options rooted in neutrality and long term confidence.

Engage with experienced advisors who understand both the regulatory environment and the strategic value of politically balanced jurisdictions.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

African Citizenship by Investment for Strategic Global Investors

African citizenship by investment is gaining attention among global investors seeking diversification, mobility, and access to emerging markets. As African…

58% of New Trade Growth Happens Outside the U.S.

58% of New Trade Growth Happens Outside the U.S., marking a structural shift in global economic power. As trade momentum…

CBI in Times of Uncertainty: When One Passport Is Not

Global uncertainty has changed the rules of wealth preservation. In today’s environment, one passport may not provide sufficient protection. This…

Nigeria Dangote Refinery Investment Opportunity for Strategic Investors

Nigeria’s Dangote Refinery investment opportunity reflects growing capital market maturity and infrastructure scale. For high net worth individuals and global…

13 CARICOM Nations Attract Over 1 Billion Dollars from 5

13 CARICOM nations attract over 1 billion dollars from 5 global powers, reinforcing regional credibility and investment stability. Sovereign commitments…

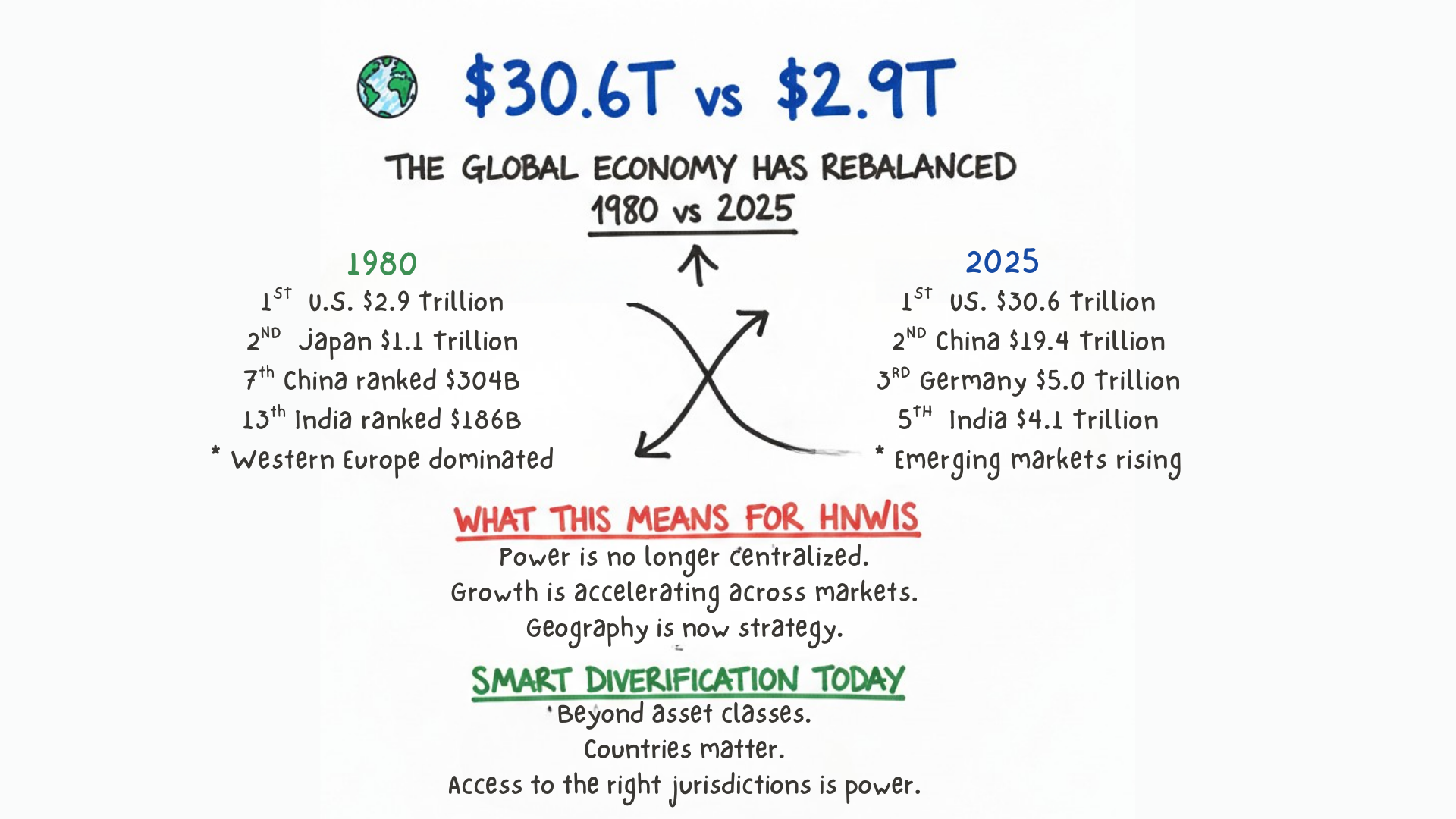

From Western Dominance to a Multipolar Economy (1980–2025)

From 1980 to 2025, global power shifted from Western dominance to a multipolar economy. Economic influence now spans several regions,…