Mercosur Residency: A Smart Second Citizenship Strategy

Mercosur Residency is becoming a powerful regional mobility solution for high net worth individuals, business owners, and globally active families. In a world shaped by regulatory tightening and geopolitical shifts, Mercosur Residency provides structured access to nine South American countries under one legal framework.

For investors who think long term, this is not simply about relocation. It is about regional positioning, diversification, and optionality.

Understanding Mercosur Residency

Mercosur, the Southern Common Market, is a regional bloc that promotes economic integration and coordinated immigration policies among member states. Under the Mercosur Residence Agreement, nationals of participating countries can obtain temporary and permanent residency in other member states with simplified documentation requirements.

Active participating countries include:

- Argentina

- Brazil

- Paraguay

- Uruguay

- Bolivia

- Chile

- Peru

- Colombia

- Ecuador

Venezuela signed the agreement but remains suspended.

Once an investor naturalizes in one Mercosur country, they benefit from mobility and settlement rights across much of the bloc. This creates a regional advantage that goes beyond traditional single-country citizenship planning.

Why Regional Mobility Matters More Than Ever

Many investors focus only on visa-free travel. However, serious wealth planning requires more than airport access.

Settlement rights create structural value. Mercosur Residency supports:

- Access to a combined market of nearly 300 million people

- Expansion into one of the largest trading blocs globally

- Diversification across multiple political and economic systems

- Western Hemisphere positioning

- Long-term family relocation options

Instead of relying on one jurisdiction, investors gain flexibility across a region.

This distinction is critical. Travel access provides convenience. Regional settlement provides resilience.

The Pathway Structure

Mercosur Residency typically follows a structured legal process:

Temporary residency is granted upon submission of a valid passport, birth certificate, and clean criminal record. This status often lasts two years.

Permanent residency becomes available after maintaining lawful status.

Citizenship eligibility depends on the specific country. In some jurisdictions, investors may qualify in as little as two to three years, subject to physical presence and integration requirements.

Each country maintains sovereign control over naturalization. However, the regional agreement enhances mobility once citizenship is granted.

For investors, clarity in legal process is essential. Mercosur Residency operates under formal treaties, not informal policy discretion.

Comparing Mercosur Residency with Traditional CBI

Citizenship by Investment programs provide speed and efficiency. They remain valuable tools for global families who require immediate travel mobility.

Mercosur Residency offers something different. It provides a strategic second citizenship pathway rooted in regional integration.

Key distinctions include:

- CBI often grants direct citizenship without residence

- Mercosur Residency requires lawful residence before naturalization

- CBI prioritizes travel mobility

- Mercosur prioritizes settlement mobility

For sophisticated investors, these strategies are not mutually exclusive. Many families combine direct investment citizenship with regional residency planning to create layered protection.

This approach strengthens global mobility portfolios.

Economic Significance of the Mercosur Bloc

Mercosur represents one of the largest economic zones in the developing world. Its member states control substantial natural resources, agricultural production, and energy reserves.

Brazil ranks among the world’s major economies. Argentina remains a global agricultural exporter. Chile and Peru lead in mining. Colombia contributes growing technology and energy sectors. Uruguay and Paraguay offer stable regulatory and tax environments.

This economic depth matters for investors who seek:

- Market expansion

- Asset diversification

- Exposure to commodity growth

- Supply chain integration

Regional integration reduces trade friction and enhances cross-border operations. Business owners who establish presence within the bloc gain credibility and operational flexibility.

Strategic Benefits for Business Owners

Entrepreneurs and investors evaluating Mercosur Residency should consider its broader implications.

Benefits may include:

- Corporate expansion opportunities across multiple markets

- Geographic diversification of assets

- Alternative tax residency options depending on jurisdiction

- Enhanced access to agricultural and energy sectors

- Improved risk management against currency volatility

For example, Paraguay operates a territorial tax system. Uruguay offers investor-friendly policies. Argentina provides relatively accelerated citizenship timelines compared to many developed countries.

Selecting the right jurisdiction requires careful structuring aligned with estate planning and corporate strategy.

Risk Mitigation and Wealth Protection

Wealth preservation increasingly depends on geopolitical diversification. Concentrated exposure to one region can create vulnerability.

Mercosur Residency supports jurisdictional diversification within a unified framework. If political or economic conditions shift in one country, investors retain mobility within the bloc.

Additionally, South America holds strategic global importance due to:

- Lithium reserves critical for battery production

- Agricultural exports feeding global markets

- Renewable energy capacity

- Water and natural resource security

Long-term investors recognize the value of positioning in resource-rich regions.

Optionality is not a luxury. It is a safeguard.

Compliance, Credibility, and Institutional Strength

Investors must evaluate the credibility of any second citizenship pathway. Mercosur Residency benefits from multilateral coordination among member states.

Regional agreements require:

- Standardized documentation practices

- Governmental cooperation

- Legal harmonization

- Cross-border recognition of residence rights

This framework reflects institutional trust. For globally mobile families, that trust enhances long-term confidence.

Reputation matters. Citizenship obtained through lawful residence and naturalization within recognized legal systems often carries durability.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Who Should Consider Mercosur Residency?

Mercosur Residency may suit:

- HNWIs seeking Western Hemisphere positioning

- Business owners expanding into Latin America

- Families pursuing multi-passport strategies

- Investors focused on long-term diversification

- Entrepreneurs building regional supply chains

It may not suit individuals who require immediate second citizenship without residence obligations. In such cases, direct investment programs may align better.

Strategic planning determines the correct path.

Strengthening Your Global Mobility Strategy

Mercosur Residency offers investors structured access to nine South American countries under a legally established regional framework. For high net worth individuals and business owners, Mercosur Residency provides more than relocation. It creates regional mobility, diversification, and long-term positioning within one of the world’s most resource-rich economic zones.

When integrated into a broader citizenship strategy, Mercosur Residency strengthens optionality and resilience.

If you are evaluating second citizenship or regional mobility options, our advisory team can structure a tailored Mercosur Residency strategy aligned with your global objectives. Contact us to explore how this pathway can enhance your long-term mobility and wealth protection plan.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

African Citizenship by Investment for Strategic Global Investors

African citizenship by investment is gaining attention among global investors seeking diversification, mobility, and access to emerging markets. As African…

58% of New Trade Growth Happens Outside the U.S.

58% of New Trade Growth Happens Outside the U.S., marking a structural shift in global economic power. As trade momentum…

CBI in Times of Uncertainty: When One Passport Is Not

Global uncertainty has changed the rules of wealth preservation. In today’s environment, one passport may not provide sufficient protection. This…

Nigeria Dangote Refinery Investment Opportunity for Strategic Investors

Nigeria’s Dangote Refinery investment opportunity reflects growing capital market maturity and infrastructure scale. For high net worth individuals and global…

13 CARICOM Nations Attract Over 1 Billion Dollars from 5

13 CARICOM nations attract over 1 billion dollars from 5 global powers, reinforcing regional credibility and investment stability. Sovereign commitments…

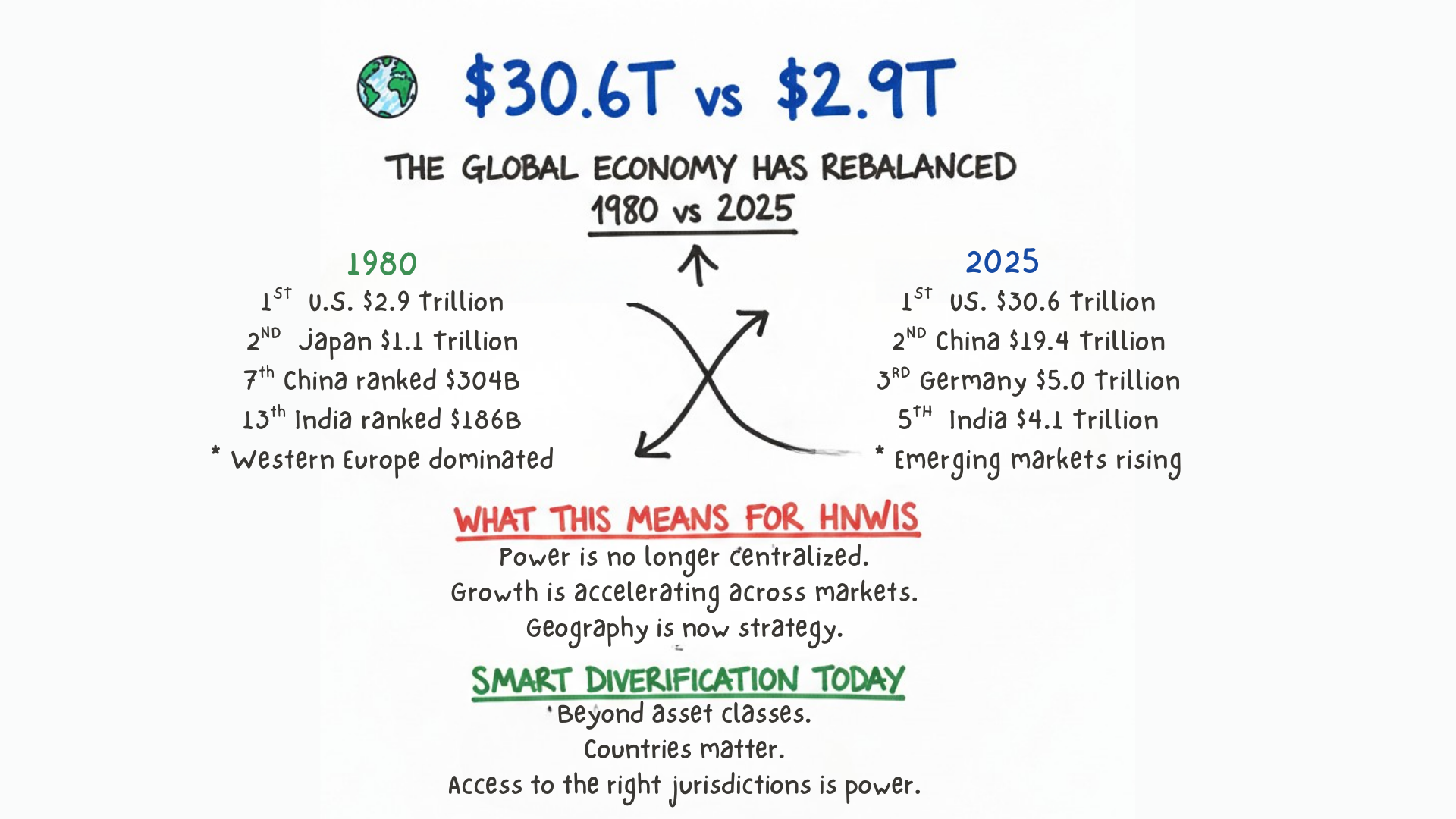

From Western Dominance to a Multipolar Economy (1980–2025)

From 1980 to 2025, global power shifted from Western dominance to a multipolar economy. Economic influence now spans several regions,…