Malta Makes Permanent Residency Easier and Cheaper for Families

- Relocate quickly and get children enrolled in schools

- Explore neighborhoods and find the right home

- Begin enjoying Malta’s lifestyle without delays

- €37,000 contribution (flat rate, whether buying or renting property)

- €60,000 administration fee (paid in two parts: €15,000 upfront and €45,000 after approval)

- Dependents over 18: now cost €7,500 each instead of €10,000—a 25% discount

- If you buy a property: you can start renting it out immediately and earn income right away.

- If you lease a property: after five years, you’re allowed to sublet the property (with the restriction that you cannot rent it out to other MPRP applicants).

- Faster access with the temporary residency card means less waiting and more certainty.

- Lower costs and reduced dependent fees make the programme more family-friendly.

- Flexibility in renting and leasing helps families see real financial value in their investment.

- Streamlined processes with the RMA reduce bureaucracy and confusion.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Conclusion

Malta’s Permanent Residency Programme has always been attractive, but these latest reforms make it stand out even more. Families now benefit from lower costs, faster residency, and the chance to turn property into an income source.

For investors looking for both security and opportunity in Europe, Malta is positioning itself as one of the top choices in the Mediterranean.

If you’ve been considering residency in Malta, there has never been a better time to start the process.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

African Citizenship by Investment for Strategic Global Investors

African citizenship by investment is gaining attention among global investors seeking diversification, mobility, and access to emerging markets. As African…

58% of New Trade Growth Happens Outside the U.S.

58% of New Trade Growth Happens Outside the U.S., marking a structural shift in global economic power. As trade momentum…

CBI in Times of Uncertainty: When One Passport Is Not

Global uncertainty has changed the rules of wealth preservation. In today’s environment, one passport may not provide sufficient protection. This…

Nigeria Dangote Refinery Investment Opportunity for Strategic Investors

Nigeria’s Dangote Refinery investment opportunity reflects growing capital market maturity and infrastructure scale. For high net worth individuals and global…

13 CARICOM Nations Attract Over 1 Billion Dollars from 5

13 CARICOM nations attract over 1 billion dollars from 5 global powers, reinforcing regional credibility and investment stability. Sovereign commitments…

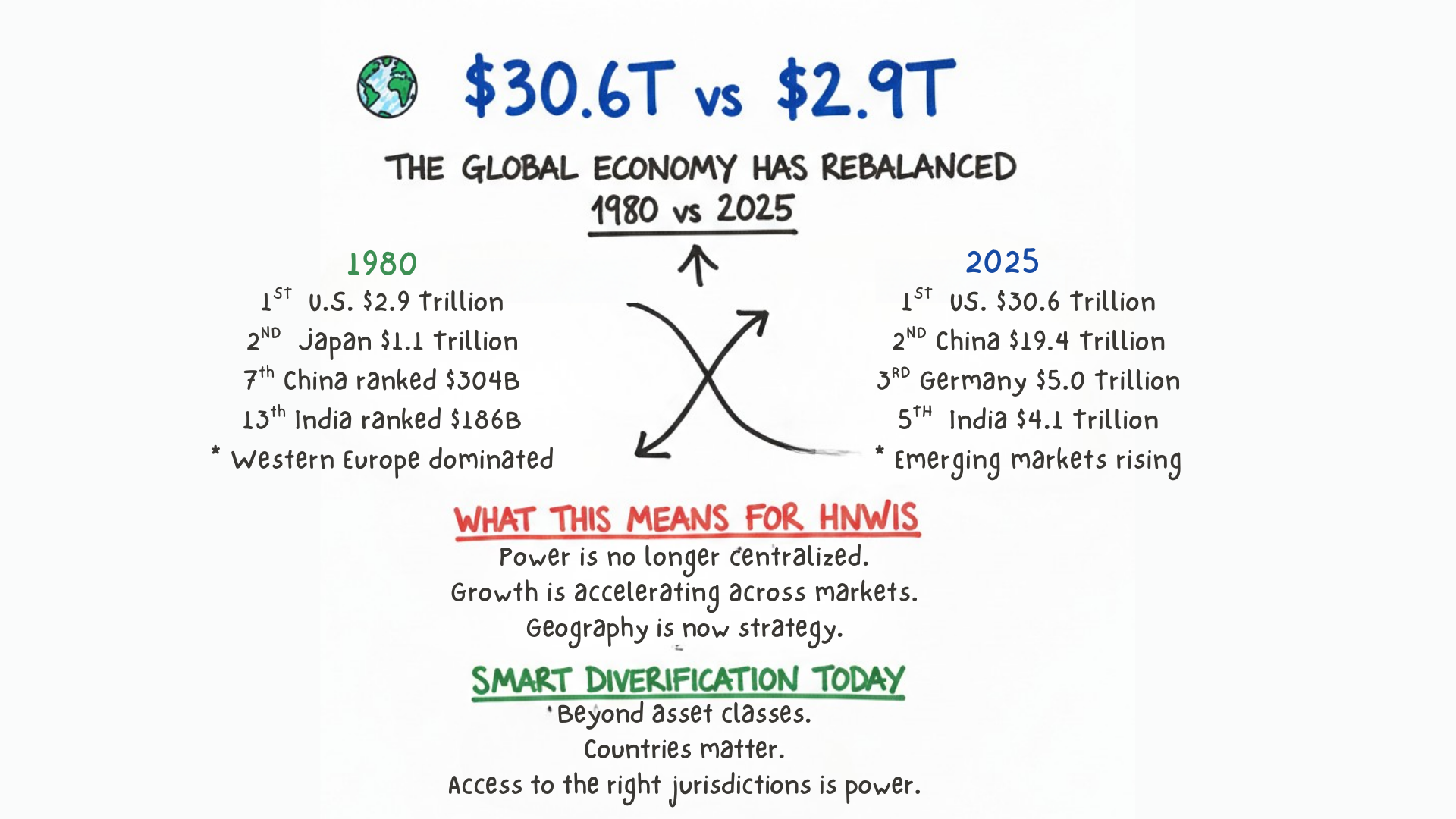

From Western Dominance to a Multipolar Economy (1980–2025)

From 1980 to 2025, global power shifted from Western dominance to a multipolar economy. Economic influence now spans several regions,…