Malaysia MM2H Program Nears $1 Billion in Investment Inflows

The Malaysia MM2H program has re-emerged as one of Asia’s most compelling residency-by-investment frameworks. Notably, it has attracted nearly $1 billion in investment inflows within just 18 months of its restructuring. As a result, the Malaysia MM2H program is once again gaining the attention of high net worth individuals, business owners, and globally mobile investors.

Capital does not move without reason. Instead, it flows toward stability, clarity, and long-term opportunity. Therefore, when sophisticated investors allocate close to a billion dollars into a residency framework, they validate governance and strategic direction.

Understanding the Malaysia MM2H Program

The Malaysia MM2H program, also known as Malaysia My Second Home, is a government-backed long-term residency initiative designed to attract financially qualified foreign nationals. Specifically, it allows approved participants to reside in Malaysia under renewable visa terms. In return, applicants contribute economically through structured financial commitments.

Moreover, the program underwent significant restructuring in 2024. Previously, shifting requirements had slowed participation. However, authorities introduced clearer tier categories and recalibrated financial thresholds. Consequently, investor interest rebounded.

Participants contribute through:

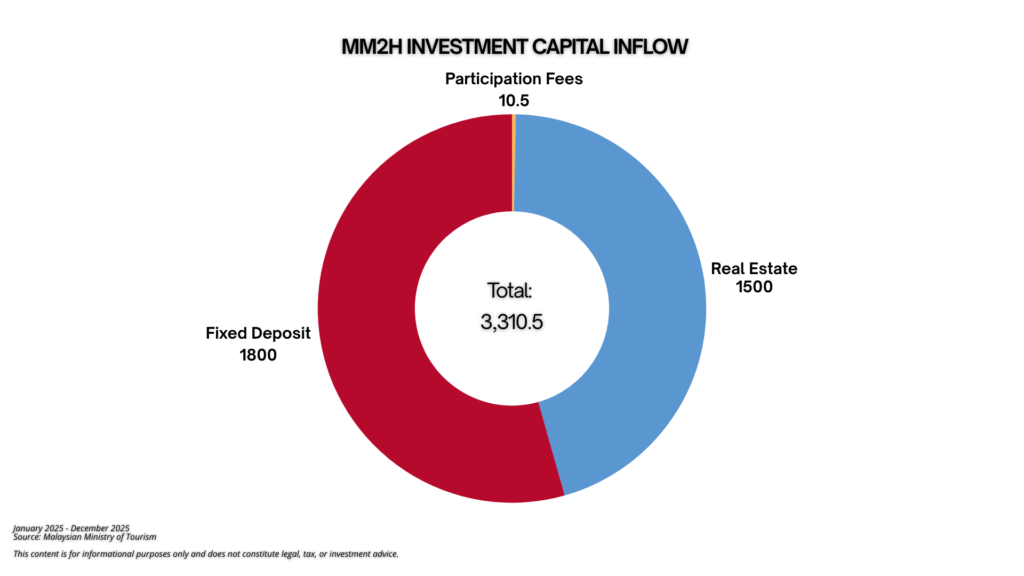

- Fixed deposits placed in Malaysian financial institutions

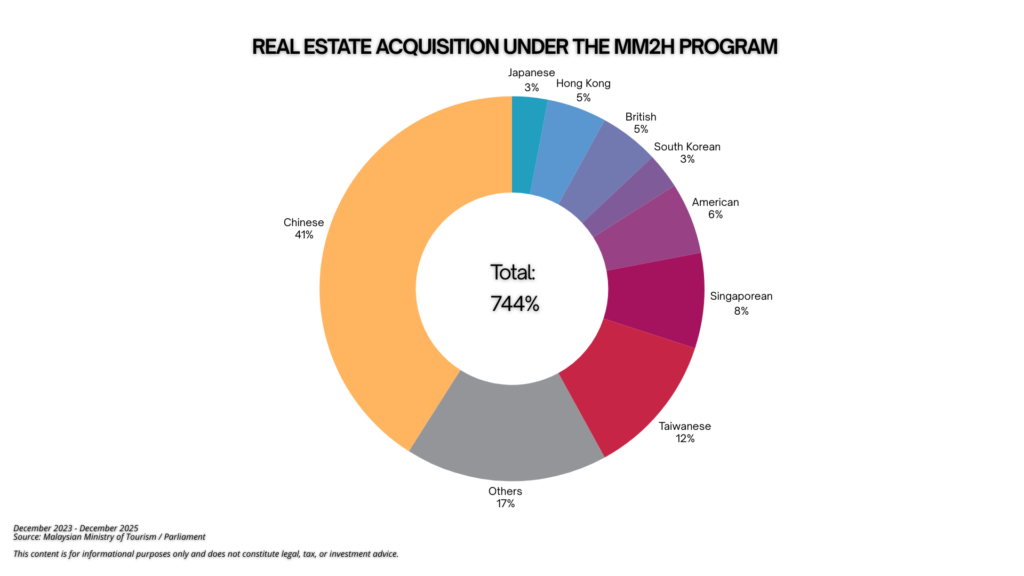

- Approved real estate acquisitions

- Government participation fees

Therefore, the framework ensures that capital directly strengthens Malaysia’s banking and property sectors.

The $1 Billion Milestone

Within 18 months of its relaunch, the Malaysia MM2H program recorded close to $1 billion in inflows and approved nearly 9,500 applicants. Importantly, this acceleration contrasts with the slower approval pace before reform.

As a result, the milestone signals renewed international confidence.

High net worth families do not commit capital impulsively. Instead, they conduct structured due diligence. For example, they evaluate:

- Legal and regulatory consistency

- Political and economic stability

- Long-term visa security

- Banking system reliability

- Property market fundamentals

Therefore, the surge in participation confirms that Malaysia currently satisfies these critical benchmarks.

For HNWIs and family offices, these reforms reduce systemic uncertainty and improve program credibility.

Why Southeast Asia Is Regaining Investor Attention

Global wealth patterns continue to shift toward Asia-Pacific. Meanwhile, Southeast Asia offers demographic growth, industrial expansion, and infrastructure development.

In this context, Malaysia occupies a strategic regional position. It provides:

- Access to major ASEAN markets

- Established financial infrastructure

- Competitive property pricing

- High-quality healthcare and education

- Strong international connectivity

Furthermore, business owners expanding into the region benefit from geographic proximity to supply chains and emerging consumer markets. Although the Malaysia MM2H program does not automatically grant employment rights, it enables principals to establish a long-term base while structuring operations separately.

Therefore, location becomes both a lifestyle and strategic advantage.

Residency as Strategic Infrastructure

Increasingly, experienced investors treat residency as strategic infrastructure rather than a lifestyle upgrade. In recent years, global volatility has reinforced the importance of jurisdictional diversification.

As a result, residency planning now supports:

- Geographic risk diversification

- Banking access in alternative jurisdictions

- Education planning for the next generation

- Estate structuring flexibility

- Regional commercial positioning

While the Malaysia MM2H program does not provide direct citizenship, it can function as one layer within a broader mobility portfolio. Consequently, many HNWIs combine residency with second citizenship strategies to build layered optionality.

Ultimately, optionality enhances resilience.

Program Integrity and Economic Alignment

Sustainable residency programs must balance accessibility with credibility. If requirements become overly restrictive, participation declines. Conversely, if standards fall too low, long-term trust erodes.

The Malaysia MM2H program appears to have recalibrated that balance. By clarifying tier structures and strengthening oversight, authorities reinforced program integrity. At the same time, they aligned financial commitments with investor expectations.

Therefore, the nearly $1 billion inflow reflects improved equilibrium.

Importantly, fixed deposits increase liquidity within domestic banks. Similarly, property acquisitions stimulate development activity, particularly in urban centers. As a result, investor capital integrates directly into national economic sectors.

Programs that deliver measurable economic impact typically demonstrate stronger durability.

Risk and Due Diligence Considerations

Nevertheless, investors must evaluate residency decisions carefully. No jurisdiction operates without exposure to currency, regulatory, or macroeconomic risk.

Accordingly, key considerations include:

- Currency exposure between the Malaysian ringgit and home currency

- Domestic and cross-border tax implications

- Renewal compliance requirements

- Liquidity planning for fixed deposits

- Exit strategies for property holdings

Therefore, coordinated advisory support remains essential. Experienced professionals assess cross-border taxation, inheritance planning, and long-term suitability.

Residency planning should reinforce wealth architecture rather than complicate it.

Strategic Outlook for Global Investors

The resurgence of the Malaysia MM2H program reflects a broader global trend. As wealth becomes increasingly international, mobility evolves into a strategic asset class.

Families seek education pathways and jurisdictional flexibility. Meanwhile, entrepreneurs seek regional access and expansion. Investors, in turn, seek resilience.

Malaysia now demonstrates measurable demand, improved regulatory clarity, and regional relevance. Consequently, the nearly $1 billion milestone validates renewed investor confidence.

For high net worth individuals and business owners, jurisdictional diversification remains central to wealth protection. Therefore, the Malaysia MM2H program provides a structured pathway within Southeast Asia that aligns with both lifestyle and financial objectives.

As global uncertainty continues to shape capital allocation decisions, the Malaysia MM2H program stands as a credible residency option for long-term positioning in Asia.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Take the Next Step

If you are evaluating global mobility solutions, now is the time to assess whether the Malaysia MM2H program fits within your broader diversification strategy and long-term wealth architecture. Engage experienced advisors to structure your participation carefully and position your family for strategic global mobility under the Malaysia MM2H program.

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

Greek Golden Visa Sees Record Turkish Investor Demand Surge

The Greek Golden Visa is seeing record demand from Turkish investors seeking EU residency, asset protection, and mobility. With participation…

Citizenship by Investment Expansion Across 14 Global Markets

Citizenship by Investment expansion across 14 global markets marks a significant shift in global mobility strategy. Governments are exploring structured…

EB5 Investment Program Enters a New Institutional Era

The EB5 Investment Program is evolving into an institutional-grade strategy for U.S. residency. Regulatory reforms, disciplined structuring, and growing capital…

Saudi Premium Residency for HNWIs: A Middle East Plan B

Saudi Arabia is becoming a serious second pillar for globally mobile investors. Premium Residency options, expanding market access, and a…

$12,000 Homes in Venezuela: Smart Opportunity or High Risk

Venezuela has returned to global headlines, and contrarian investors are watching closely. With some property pricing still deeply discounted, the…

Mercosur Residency: A Smart Second Citizenship Strategy

Mercosur Residency offers structured access to nine South American countries under one regional agreement. For high net worth investors and…