Investment May Soon Be Required for Italy’s €200K Flat Tax

Italy has long been a favorite destination for wealthy individuals looking to enjoy the beauty, culture, and lifestyle of the Mediterranean—while benefiting from a special flat tax regime. But now, change may be coming.

What is the Italy Flat Tax Regime?

In 2017, Italy launched a special tax program to attract high-net-worth individuals. Often called the “CR7 Law” (after Cristiano Ronaldo used it), this regime offers a big tax advantage:

- Flat tax of €200,000 per year on all foreign income

- Additional €25,000/year for each dependent family member

- Available for up to 15 years

- Only for those who haven’t lived in Italy for at least 9 out of the last 10 years

This means that no matter how much you earn abroad—millions in dividends, capital gains, or business income—you only pay the flat fee. Domestic income (earned in Italy) is taxed normally.

What’s Changing?

Italian lawmakers are proposing a new requirement: to tie the €200,000 flat tax to a mandatory investment in the Italian economy.

Proposed Investment Options:

- Government bonds

- Startups or innovative companies

- Venture capital funds

- Regulated investment vehicles

However, real estate may not count toward this investment.

This idea is part of a broader goal: to ensure that wealthy newcomers also contribute directly to the local economy—not just through taxes, but through actual capital investments.

How Much Investment Might Be Required?

- €500,000 or more in eligible Italian assets

This number could change depending on what sectors the government wants to support. The key point is: you may need to invest a large sum—on top of paying the €200,000 annual tax.

Why is Italy Making This Change?

There are a few reasons:

- To ensure economic benefits from wealthy migrants go beyond just tax payments

- To address criticism from the European Union about unfair tax competition

- To align with other investment migration models around Europe

Some Italian officials also worry that many beneficiaries simply live in luxury villas and pay their flat tax—without contributing to jobs or innovation in Italy.

- Apply only to new applicants (not current beneficiaries), or

- Apply retroactively, affecting people already under the regime

Right now, it’s unclear. That’s why anyone considering this route should stay updated and consult with professionals.

Here’s what we recommend:

- Act Quickly

If you qualify and are serious about relocating to Italy, applying before the new law passes might save you from the investment requirement. - Prepare for Flexibility

Even if the new rule becomes law, it’s likely to include a list of acceptable investments. Be ready to allocate capital to government bonds, VC funds, or startups. - Get Legal and Tax Advice

Work with experts to understand:- How much you might need to invest

- What sectors or vehicles are eligible

- Whether early application protects you from the rule

A professional advisor can also help secure an advance tax ruling—giving you certainty on your tax treatment.

Pros and Cons of the New Proposal

| Pros | Cons |

| Encourages real investment into Italy | Adds cost and complexity |

| Improves public and EU perception of the program | May discourage some applicants |

| Can lead to more innovation and jobs | Investment options may be limited or risky |

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

If you’re considering Italy for residency:

- Now may be the best time to apply

- Get ahead of the legislative curve

- Plan both your tax and investment strategy carefully

Italy offers sunshine, culture, and an incredible quality of life—and with the right guidance, it can also be a smart financial move.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

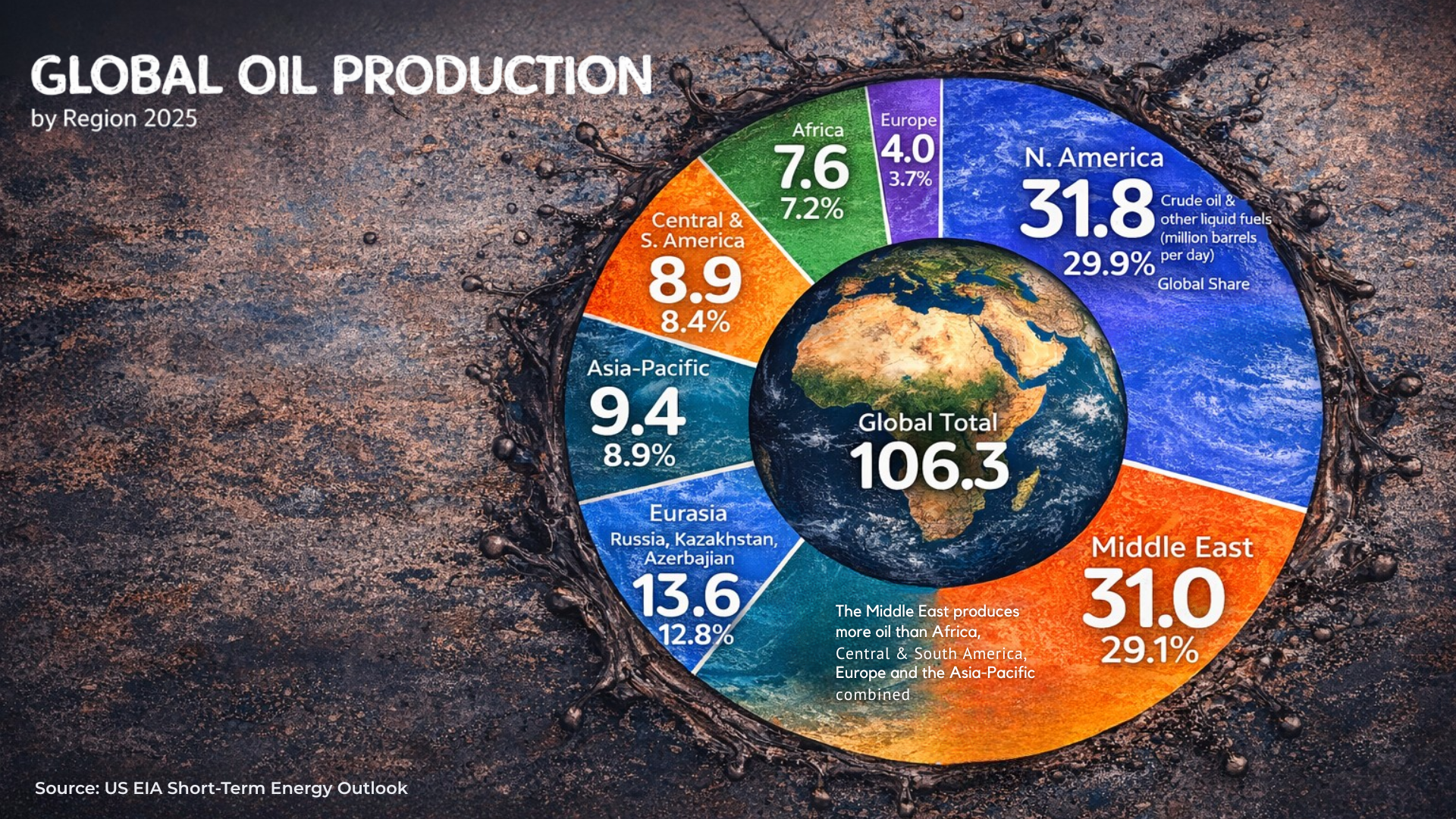

Global Oil: Where the World’s Oil Comes From by Region

Understanding where the world’s oil comes from by region reveals more than energy statistics. It highlights economic power centers shaping…

The USA Moves to Challenge Sharia Law Policies in Nigeria

The United States has introduced legislation addressing Sharia law policies in Nigeria, increasing international scrutiny on governance and religious freedom….

South Africa Infrastructure Gains $350M World Bank Support

The World Bank $350 million investment in South Africa infrastructure signals growing global confidence in the country’s economic future. For…

10 African Countries Leading Global Soft Power in 2026

Africa’s global influence continues to grow. The African soft power 2026 ranking highlights ten nations shaping global perception through culture,…

African Citizenship by Investment for Strategic Global Investors

African citizenship by investment is gaining attention among global investors seeking diversification, mobility, and access to emerging markets. As African…

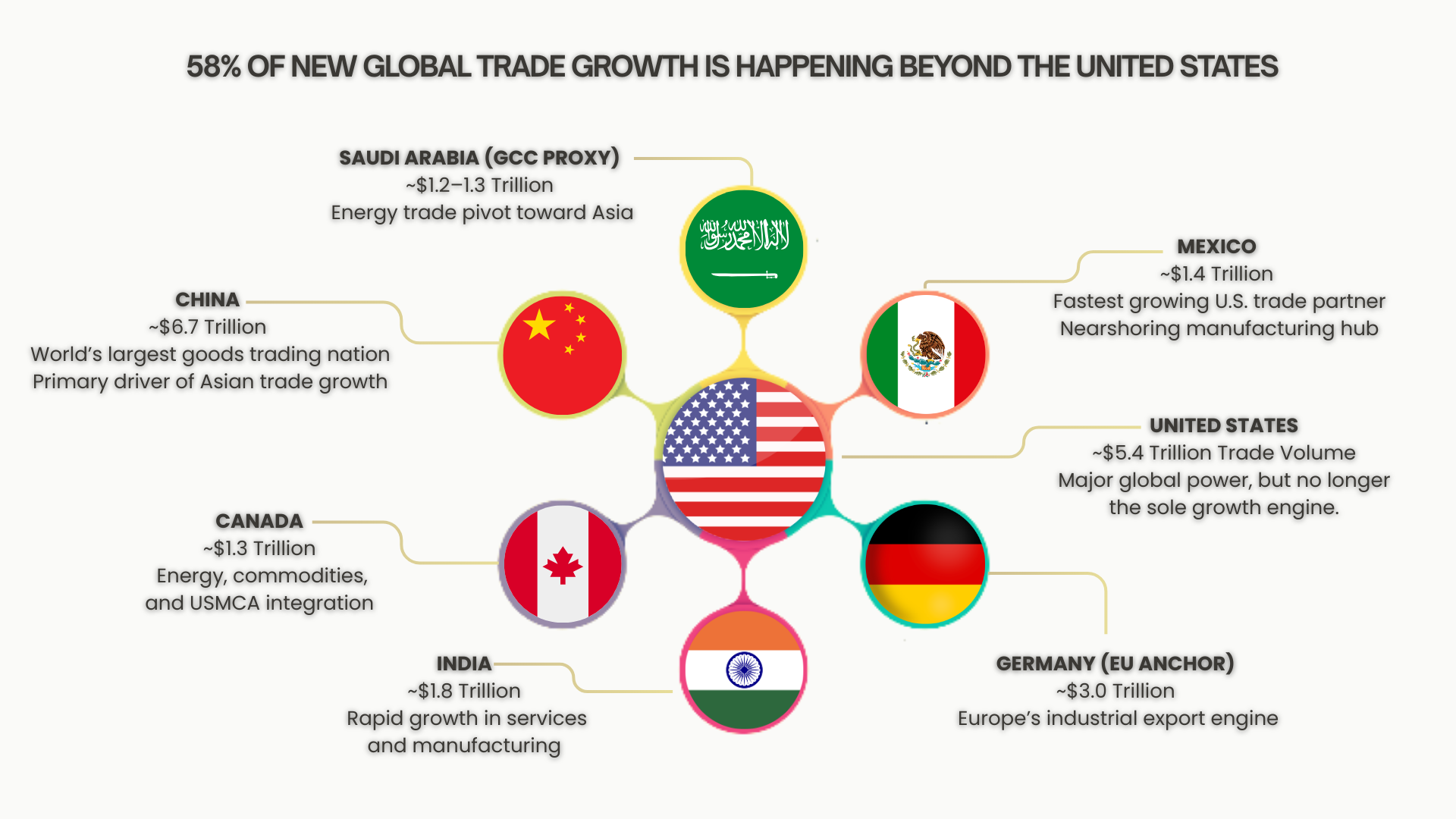

58% of New Trade Growth Happens Outside the U.S.

58% of New Trade Growth Happens Outside the U.S., marking a structural shift in global economic power. As trade momentum…