Botswana CBI Launch: Strong Start with 464 Early Registrations

Botswana, a stable democracy in southern Africa, recently launched a citizenship by investment (CBI) program. In its first week, it garnered 464 registrations of interest from people around the world.

While these are expressions of interest, not formal applications, they offer insight into early market dynamics, demand, and investor priorities.

- Registrations & Geographic Spread

- The 464 registrations came from 77 countries

- India and the United States led, with 47 and 46 registrations, respectively

- Other active countries included South Africa (39), Pakistan (36), Nigeria (30), and Zimbabwe (29)

This global spread suggests investors are watching Botswana’s program closely, even before its formal opening.

- Family vs Individual Applications

- 47% of registrants plan to apply with family

- 37% intend to apply individually

- 14% are undecided; 2% are intermediaries (agents) registering on behalf of clients

Nearly half expect to include dependents or spouses, something program designers must account for.

- Reported Net Worth & Applicant Profiles

- 70% of registrants claimed net worth below USD 1 million

- 24% between USD 1 million and 10 million

- 6% above USD 10 million

Note: These are self‑reported figures and will be verified through due diligence once the application phase begins.

Program Structure & Costs

Contribution Floor

The program mandates a contribution floor between USD 75,000 and USD 90,000, depending on family size.

- Due Diligence & Government Fees

- Due diligence fees are expected to be around USD 5,000 per adult

- Government fees are projected between USD 2,000 and USD 5,000, based on family structure

- Total Cost Estimate

- A single applicant may pay under USD 100,000

- Families could see total costs between USD 100,000 and 120,000

These costs place Botswana’s program as a competitive new entrant in the CBI market.

Timing, Legal Framework & Next Steps

- These are registrations of interest, not formal applications

- Formal applications are expected to begin in early 2026

- Parliament plans to pass citizenship legislation by November 2025

- This will set key rules

- Establish a regulatory agency

- Legalize dual citizenship, which is not currently allowed

Once the law is passed, the government will begin building the institutional structure, hiring staff, and deploying technology systems.

Until then, the program remains in its pre-launch phase.

What This Means for Investors & Market Players

- Strong early interest: 464 registrations in one week shows pent-up demand

- Competitive pricing: Attracts both individuals and families

- Family-friendly structure: Essential for nearly half of interested applicants

- Dual citizenship advantage: Appeals to investors unwilling to renounce existing nationality

- Due diligence critical: Early net worth figures are self-reported and unverified

- Legislative follow-up needed: Final laws and procedures will shape the real opportunity

Challenges & Risks

- Legal clarity: Final details await Parliament’s approval

- Capacity building: The government must set up reliable, efficient processes

- Reputation management: New programs face intense scrutiny; Botswana must meet global AML and transparency standards

- Political/economic shifts: Any instability could affect investor confidence

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

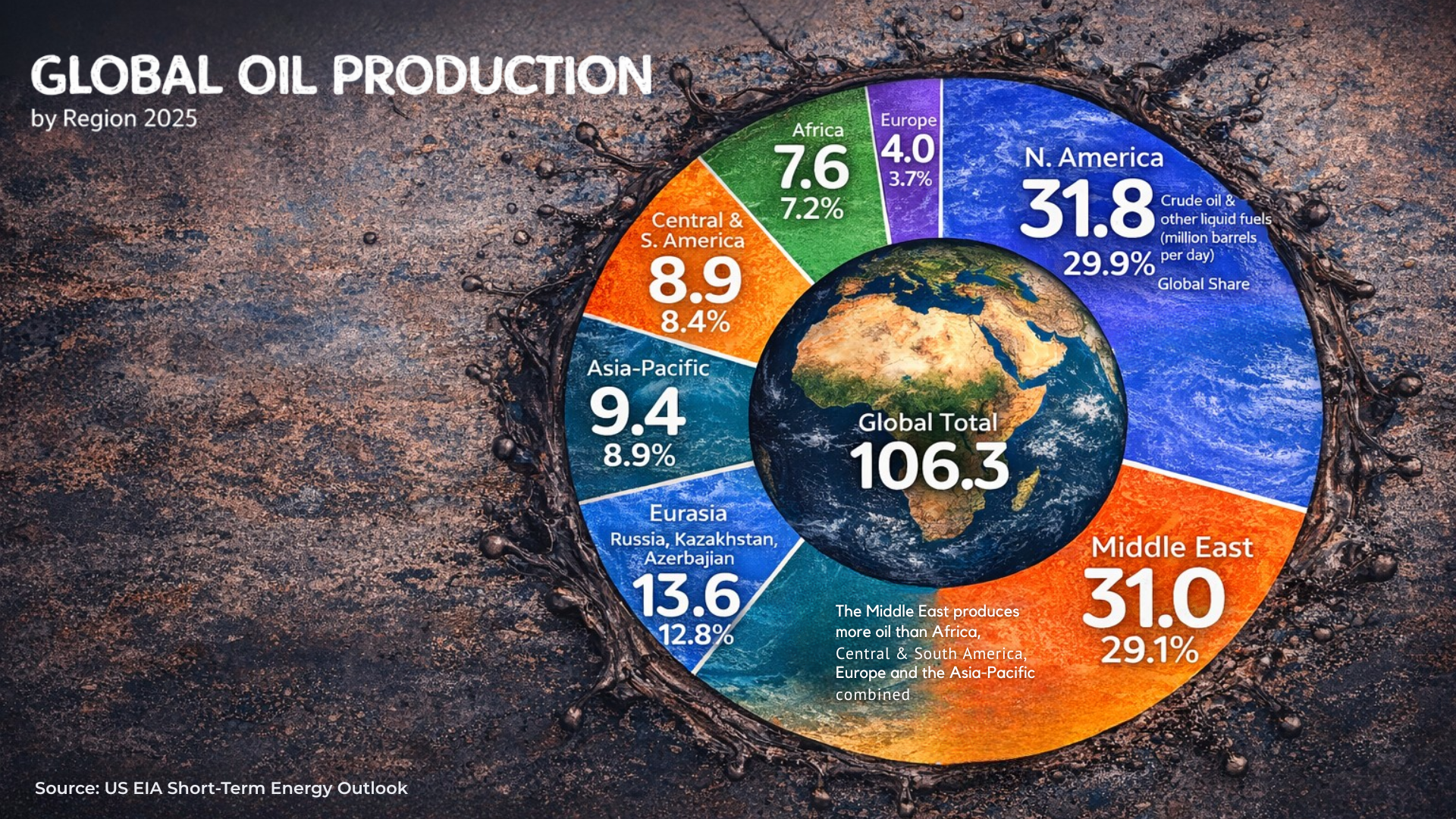

Global Oil: Where the World’s Oil Comes From by Region

Understanding where the world’s oil comes from by region reveals more than energy statistics. It highlights economic power centers shaping…

The USA Moves to Challenge Sharia Law Policies in Nigeria

The United States has introduced legislation addressing Sharia law policies in Nigeria, increasing international scrutiny on governance and religious freedom….

South Africa Infrastructure Gains $350M World Bank Support

The World Bank $350 million investment in South Africa infrastructure signals growing global confidence in the country’s economic future. For…

10 African Countries Leading Global Soft Power in 2026

Africa’s global influence continues to grow. The African soft power 2026 ranking highlights ten nations shaping global perception through culture,…

African Citizenship by Investment for Strategic Global Investors

African citizenship by investment is gaining attention among global investors seeking diversification, mobility, and access to emerging markets. As African…

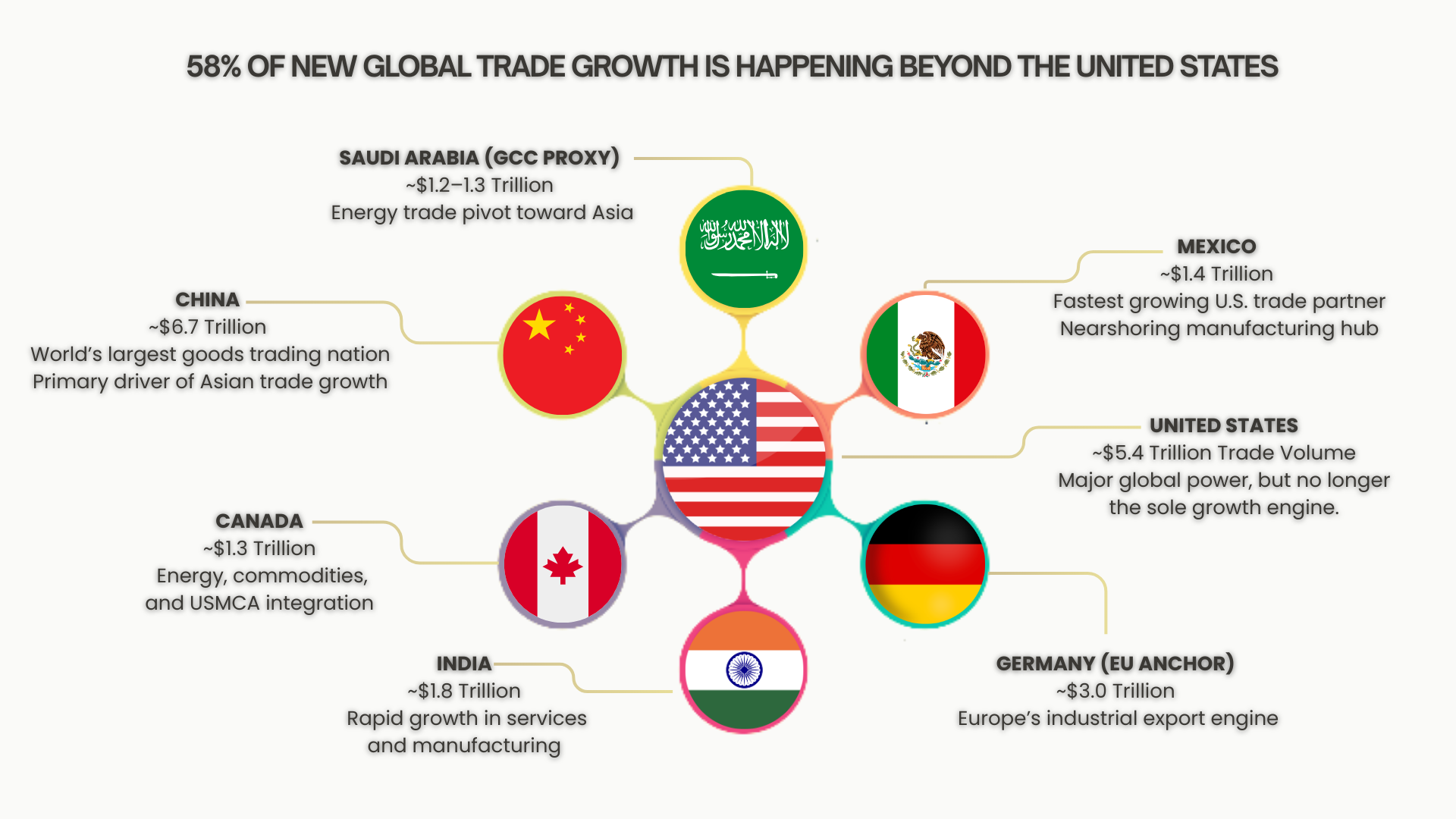

58% of New Trade Growth Happens Outside the U.S.

58% of New Trade Growth Happens Outside the U.S., marking a structural shift in global economic power. As trade momentum…