Are CBI Programs Creating Tax Havens?

- Attractive Tax Policies: Many countries offering CBI programs implement tax-friendly policies to lure foreign investors. This includes no global income tax, no capital gains tax, and lenient corporate tax laws.

- Economic Growth vs. Tax Avoidance: Proponents claim these programs boost local economies by attracting foreign capital. Critics, however, argue they provide legal loopholes for tax avoidance, potentially harming global taxation fairness.

- Impact on Global Tax Systems: Organizations like the OECD warn that tax havens disrupt international tax agreements, leading to reduced tax revenues for many nations.

- No Global Income Tax: Residents are only taxed on income earned within the country.

- Privacy Protections: Strict banking and corporate secrecy laws.

- No Wealth or Inheritance Taxes: Wealth can be transferred without additional tax burdens.

- Double Taxation Treaties: Agreements that prevent being taxed twice on the same income.

- Low Corporate Tax Rates: Favorable for businesses relocating their headquarters.

- Asset Protection: Secure legal frameworks to protect wealth from economic instability.

- Enhanced Global Mobility: Visa-free travel and residency in countries with favorable tax systems.

- Business Opportunities: Access to tax-efficient markets for entrepreneurs.

- Legal Tax Planning: Structured options for reducing tax obligations while complying with international laws.

- Diversification of Assets: Opportunity to hold assets in stable, low-tax environments.

- Wealth Disparity Issues: Critics argue these programs widen the gap between wealthy individuals and average taxpayers. When HNWIs benefit from tax havens, it shifts the tax burden to others.

- Global Policy Responses: Lastly, governments and organizations are implementing measures like the Global Minimum Corporate Tax to counteract the impact of tax havens. This seeks to ensure fair taxation and reduce profit shifting.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Conclusion

In conclusion, CBI programs undeniably provide financial benefits for investors and stimulate local economies. However, their association with tax havens raises concerns about global taxation fairness and economic ethics. As scrutiny grows, countries offering these programs may need to balance their attractiveness with transparency and compliance with international tax standards.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

The USA Moves to Challenge Sharia Law Policies in Nigeria

The United States has introduced legislation addressing Sharia law policies in Nigeria, increasing international scrutiny on governance and religious freedom….

South Africa Infrastructure Gains $350M World Bank Support

The World Bank $350 million investment in South Africa infrastructure signals growing global confidence in the country’s economic future. For…

10 African Countries Leading Global Soft Power in 2026

Africa’s global influence continues to grow. The African soft power 2026 ranking highlights ten nations shaping global perception through culture,…

African Citizenship by Investment for Strategic Global Investors

African citizenship by investment is gaining attention among global investors seeking diversification, mobility, and access to emerging markets. As African…

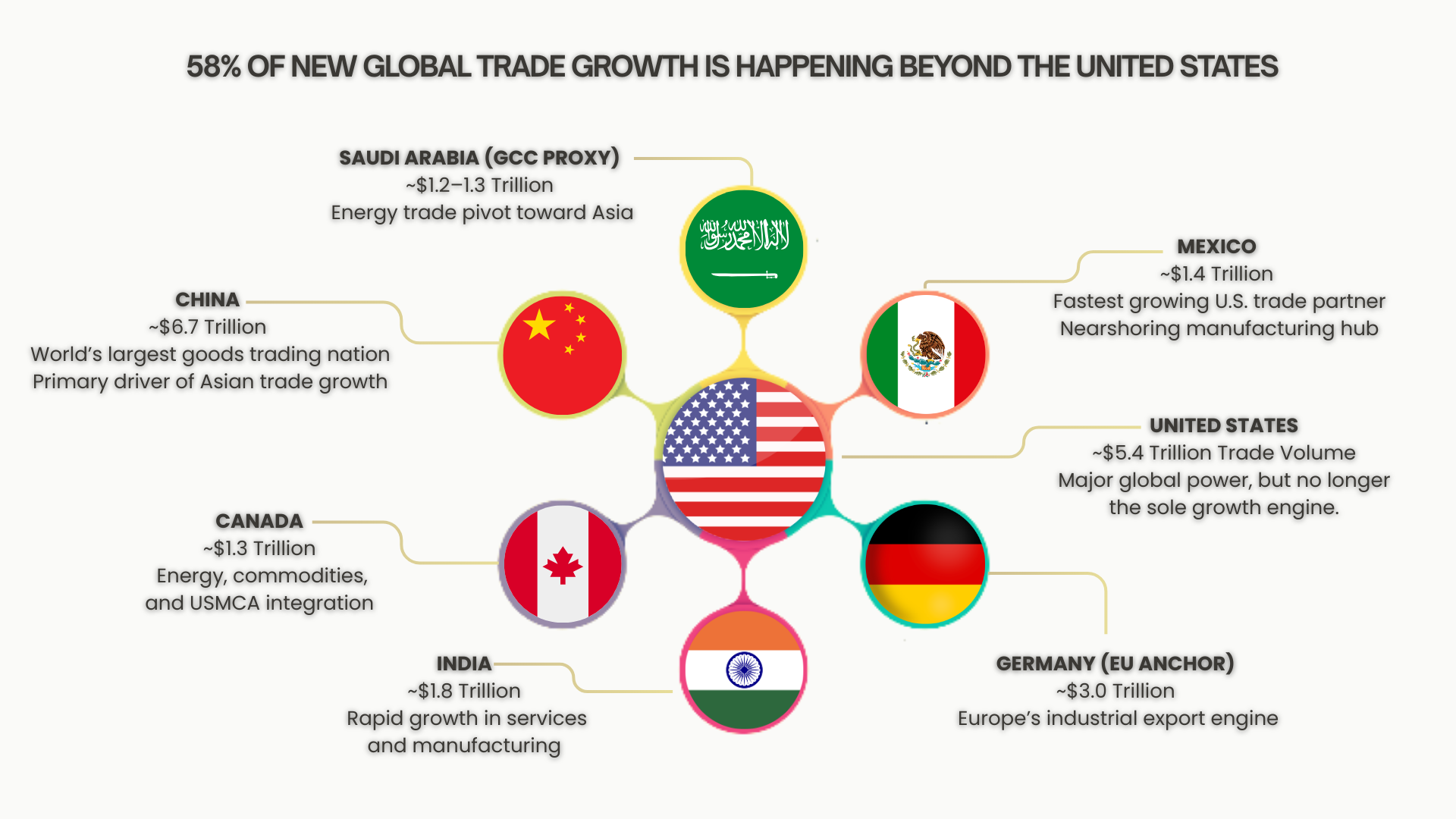

58% of New Trade Growth Happens Outside the U.S.

58% of New Trade Growth Happens Outside the U.S., marking a structural shift in global economic power. As trade momentum…

CBI in Times of Uncertainty: When One Passport Is Not

Global uncertainty has changed the rules of wealth preservation. In today’s environment, one passport may not provide sufficient protection. This…