Anthony Joshua’s $50M Tax Lesson in Global Wealth Strategy

When British heavyweight boxer Anthony Joshua stepped into the ring to fight Jake Paul in Miami, most people focused on the fight result. But behind the scenes, a far more important financial lesson unfolded, one that should resonate deeply with high-net-worth individuals (HNWIs), investors, and international entrepreneurs.

Joshua was reportedly paid $93 million for the match. But because of international tax laws, he ended up taking home only about $43 million. The rest? Lost to taxes in both the United States and the United Kingdom. This story is not just about sports or celebrity earnings, it’s a powerful example of how tax residency can dramatically impact real income.

For globally mobile professionals, this event offers a timely and relevant reminder: where you earn matters, but where you’re taxed matters even more.

A High-Earning Fight, A Hefty Tax Bill

Anthony Joshua, a UK tax resident, fought Jake Paul on U.S. soil. Under U.S. tax law, non-resident aliens who earn income from U.S. sources are generally taxed at a federal rate of up to 37%. That means Joshua paid roughly $34 million to the U.S. government just for the privilege of working (or fighting) in the country.

However, it didn’t stop there. As a UK resident, Joshua is also subject to worldwide income taxation by HMRC. That means even though he already paid U.S. taxes, he owed additional UK taxes on his remaining income. Reports estimate this second layer of taxation to be around $15 million.

After these deductions, Joshua’s $93 million paycheck was reduced by about $50 million, leaving him with less than half of what he initially earned.

What HNWIs and Business Owners Must Learn From This

What HNWIs and Business Owners Must Learn From This

Anthony Joshua’s tax outcome highlights a critical issue that affects many wealthy individuals and business owners: failing to strategically manage tax residency can result in significant, avoidable tax losses.

Even if your income streams are legitimate and diversified across global markets, failing to structure your residency and tax base properly could lead to unnecessary double taxation, or worse, inefficient use of your wealth.

1. Residency Drives Taxation

In most countries, your place of tax residency determines how your global income is taxed. For instance:

- UK: Taxes residents on worldwide income.

- US: Taxes citizens and residents on worldwide income, and non-residents on U.S.-sourced income.

- UAE and Caribbean nations: Often offer zero or very low income taxes, especially for residents who qualify under investment or business-based programs.

Joshua’s example shows what happens when residency and income location are mismatched. A better-aligned structure could have saved him millions.

2. Strategic Residency: A Global Wealth Tool

Strategic residency isn’t about “tax dodging.” It’s about understanding the laws, making smart, legal choices, and protecting your financial future. Increasingly, HNWIs and business owners are turning to residency or citizenship by investment (RBI/CBI) programs as part of this strategy.

Many countries now offer legal pathways for individuals to gain residency or citizenship in return for economic contributions. These programs often provide:

- Favorable tax regimes (or no income tax at all)

- Improved global mobility

- Asset protection opportunities

- Diversification of personal and business interests

For example, had Joshua structured his tax residency through a zero-tax country before the fight, his net income could have been close to the full $93 million. Such scenarios aren’t just hypothetical, they are real, actionable strategies used by global professionals.

3. Tax Efficiency in a Global World

The more globally active your business or career is, the more important it becomes to manage not just how much you earn, but where and under what jurisdiction you earn.

Let’s consider a few examples where residency changes have led to increased wealth protection:

- Tech entrepreneurs relocating from high-tax states or countries to tax-neutral nations to preserve IPO wealth.

- Investors shifting base to jurisdictions where capital gains are not taxed.

- Professional athletes planning their competition and endorsement schedules around tax-friendly nations.

Tax laws are not uniform. That means the difference between earning in Country A versus Country B, while living in Country C, can result in a completely different financial outcome.

As the global economy becomes increasingly borderless, smart HNWIs are treating residency and taxation like a business decision.

4. The Cost of Inaction

Too often, individuals wait until after they’ve earned income or worse, after receiving a tax bill, to consider their options. That’s what makes stories like Joshua’s so valuable. They remind us of the importance of proactive planning.

Without a clear structure, international earners can easily:

- Pay multiple layers of tax

- Lose access to tax treaty benefits

- Miss opportunities for legal exemptions or deferrals

- Invite audits or penalties through non-compliance

The cost of inaction isn’t just money, it’s lost time, reduced opportunity, and increased risk.

Planning Ahead: Best Practices for HNWIs and Investors

Here are a few practical steps wealthy individuals and global business owners should consider:

Review Your Current Tax Residency:

Are you a tax resident in a high-tax jurisdiction? Are you paying taxes on worldwide income even when it’s earned abroad?

Explore Strategic Residency Options:

Countries like the UAE, Monaco, St. Kitts and Nevis, and others offer low-tax or tax-free environments for legal residents and citizens.

Understand Tax Treaties:

Double taxation agreements (DTAs) between countries can offer relief, but only if your residency and income are structured correctly.

Consult International Tax Experts:

Every situation is different. A global tax advisor can help you develop a personalized plan that meets your goals while staying compliant.

The Bigger Picture: Wealth Isn’t Just About Earning

At the end of the day, wealth isn’t measured by what you earn, it’s measured by what you keep.

Anthony Joshua is a world-class athlete who earned a record-breaking payday. But his story shows us that even with the best talent, poor tax structuring can cut your wealth in half.

For entrepreneurs, investors, and HNWIs, this means looking beyond traditional business decisions and taking a global view of wealth management. It’s not just about growing capital, it’s about protecting it through smart, lawful, and strategic residency planning.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Secure Your Wealth Through Smarter Residency Choices

Whether you’re managing business profits, investment returns, or global income streams, your tax residency plays a powerful role in your financial outcome.

If you’re serious about preserving wealth, achieving greater global freedom, and securing a stronger legacy, it may be time to rethink where you call “home” for tax purposes.

Our team specializes in helping high-net-worth individuals explore strategic residency options tailored to your financial and personal goals. From evaluating tax impacts to guiding you through legal residency programs, we offer trusted insight built on global experience.

Contact us today to learn how to legally reduce your tax exposure, increase your financial flexibility, and protect more of what you earn.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

The USA Moves to Challenge Sharia Law Policies in Nigeria

The United States has introduced legislation addressing Sharia law policies in Nigeria, increasing international scrutiny on governance and religious freedom….

South Africa Infrastructure Gains $350M World Bank Support

The World Bank $350 million investment in South Africa infrastructure signals growing global confidence in the country’s economic future. For…

10 African Countries Leading Global Soft Power in 2026

Africa’s global influence continues to grow. The African soft power 2026 ranking highlights ten nations shaping global perception through culture,…

African Citizenship by Investment for Strategic Global Investors

African citizenship by investment is gaining attention among global investors seeking diversification, mobility, and access to emerging markets. As African…

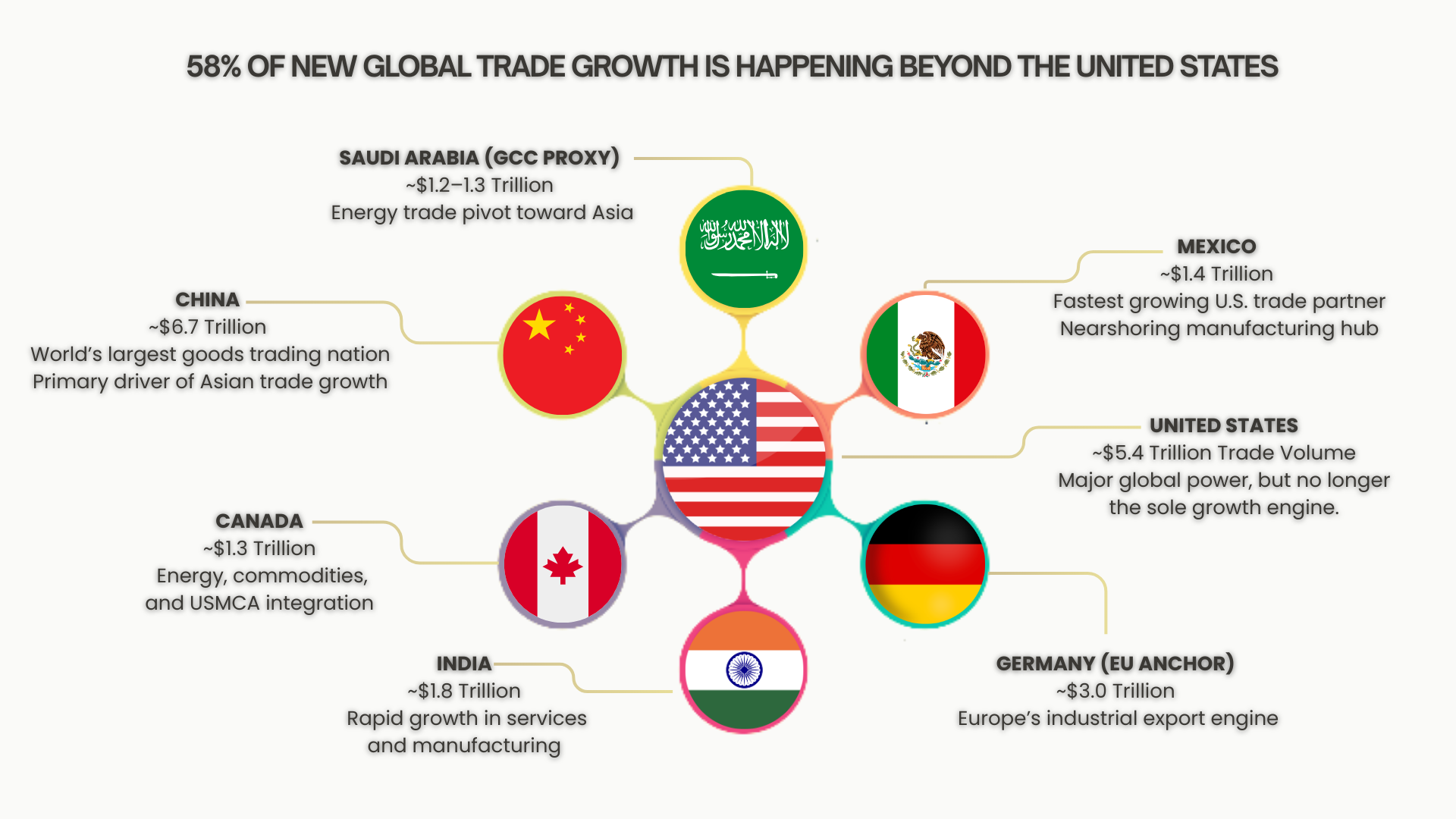

58% of New Trade Growth Happens Outside the U.S.

58% of New Trade Growth Happens Outside the U.S., marking a structural shift in global economic power. As trade momentum…

CBI in Times of Uncertainty: When One Passport Is Not

Global uncertainty has changed the rules of wealth preservation. In today’s environment, one passport may not provide sufficient protection. This…