Americans Take the Lead in Global Investment Migration

Introduction

The global investment migration industry has reached a turning point. For years, demand came mainly from emerging markets. Today, that picture looks very different. Americans are now the largest source market for investment migration clients, a shift that reflects deeper changes in how wealthy individuals approach mobility, risk, and long term planning.

This trend is not about urgency or reaction. Instead, it reflects confidence, planning, and trust in established residency and citizenship by investment programs. High net worth individuals from the United States increasingly see global mobility as a strategic asset, not a backup plan. As a result, the industry has entered a new phase, one shaped by experience, compliance, and mature investor behavior.

How the Market Looked Just a Few Years Ago

Six years ago, American participation in investment migration remained limited. Most clients came from regions facing political instability, currency controls, or travel restrictions. These investors focused primarily on access to stronger passports and visa free travel.

At that time, the industry evolved around urgency driven decisions. Speed, access, and escape dominated conversations. While those motivations still exist in some regions, they no longer define the market as a whole.

The rise of American demand signals a shift away from reactive migration toward intentional global planning.

Why Americans Are Leading Client Demand Today

Several factors explain why Americans now represent the largest source market for investment migration clients.

Strategic Wealth Planning

US investors increasingly treat residency and citizenship as part of a broader wealth strategy. Much like portfolio diversification, global mobility offers flexibility, protection, and optionality. Business owners want freedom of movement. Investors want jurisdictional balance. Families want long term stability.

Preference for Low Presence Solutions

Americans favor programs that do not require relocation. Low presence residencies allow investors to maintain their lifestyle and businesses while securing legal ties abroad. This preference has driven strong demand for fund based, business focused, and regulated real estate routes.

Confidence in Structured Programs

American investors come from one of the most regulated financial environments in the world. Their growing participation reflects confidence in due diligence standards, legal clarity, and program credibility. This strengthens the reputation of the industry as a whole.

What This Shift Means for the Industry

The rise of the American market does more than change client demographics. It raises standards.

When sophisticated investors enter at scale, expectations increase. Transparency, compliance, and professional advisory structures become essential. Programs that succeed today do so because they withstand scrutiny.

This trend reinforces trust. It confirms that modern investment migration operates within established legal frameworks and serves long term planning goals rather than short term solutions.

Regional Demand Still Matters

While Americans now lead client demand, other regions remain active and influential. Markets such as the Middle East, China, the Indian subcontinent, and Russia continue to contribute significantly. Each market brings distinct motivations and preferences.

However, the balance of power has shifted. The presence of Americans at the top of the demand curve confirms that investment migration has matured into a globally accepted planning tool.

Residency First, Citizenship Later

Another defining feature of this trend is patience. American investors rarely pursue immediate citizenship. Instead, they prioritize residency options that preserve future pathways. This approach aligns with long term thinking.

Residency offers access, flexibility, and legal grounding. Citizenship becomes a potential outcome, not the primary objective. This mindset supports sustainable program growth and reduces speculative pressure.

Trust as the Core Driver

Trust sits at the center of this transformation. Americans engage with programs they believe will last. They value predictability, rule of law, and institutional stability.

Their participation validates existing frameworks and encourages governments to maintain high standards. Over time, this strengthens the ecosystem for all stakeholders.

What HNWIs and Business Owners Should Take From This

For high net worth individuals and entrepreneurs, this shift sends a clear message. Global mobility planning has entered the mainstream of wealth management. It no longer belongs to a niche audience.

Those who plan early gain flexibility. Those who wait may face higher costs, fewer options, or tighter rules. The most successful investors treat residency as infrastructure, not insurance.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Looking Ahead

As American demand continues to shape the market, programs will adapt. Expect stronger compliance, more fund based routes, and greater focus on long term value.

The industry will continue to reward informed, strategic investors who understand the importance of timing and structure.

The fact that Americans now represent the largest source market for investment migration clients confirms one thing clearly. Global mobility has become a trusted and essential component of modern wealth planning.

If you are a high net worth individual, business owner, or investor considering global mobility, now is the time to approach it strategically. Work with experienced advisors who understand program integrity, compliance, and long term outcomes. The right structure today creates flexibility for decades to come.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

African Citizenship by Investment for Strategic Global Investors

African citizenship by investment is gaining attention among global investors seeking diversification, mobility, and access to emerging markets. As African…

58% of New Trade Growth Happens Outside the U.S.

58% of New Trade Growth Happens Outside the U.S., marking a structural shift in global economic power. As trade momentum…

CBI in Times of Uncertainty: When One Passport Is Not

Global uncertainty has changed the rules of wealth preservation. In today’s environment, one passport may not provide sufficient protection. This…

Nigeria Dangote Refinery Investment Opportunity for Strategic Investors

Nigeria’s Dangote Refinery investment opportunity reflects growing capital market maturity and infrastructure scale. For high net worth individuals and global…

13 CARICOM Nations Attract Over 1 Billion Dollars from 5

13 CARICOM nations attract over 1 billion dollars from 5 global powers, reinforcing regional credibility and investment stability. Sovereign commitments…

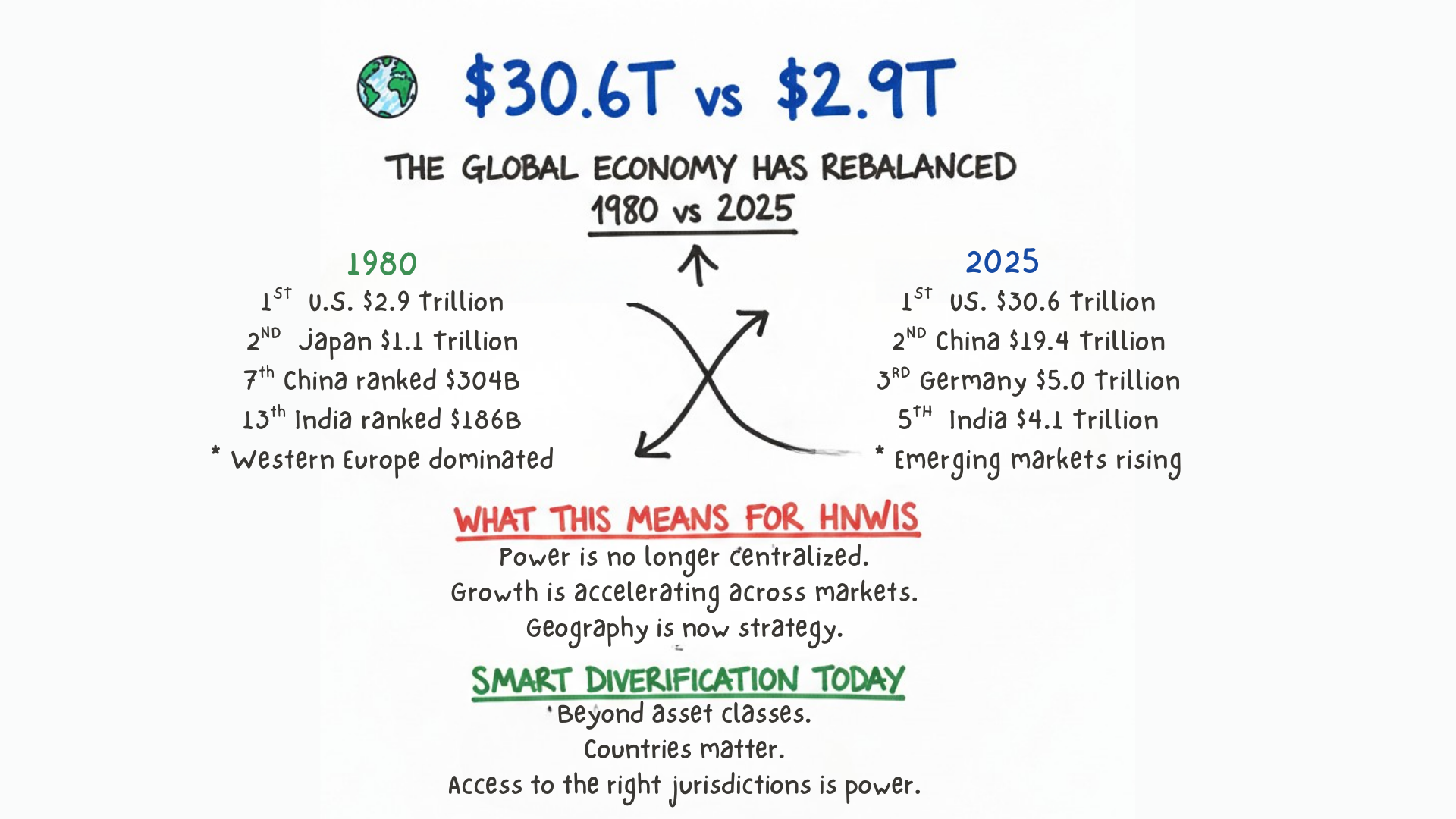

From Western Dominance to a Multipolar Economy (1980–2025)

From 1980 to 2025, global power shifted from Western dominance to a multipolar economy. Economic influence now spans several regions,…