84% of Citizenship by Investment Rejections Are Caused by Five Preventable Mistakes

Citizenship by Investment (CBI) offers global investors unique access to security, freedom, and new opportunities. It’s a legal and structured pathway to obtaining a second citizenship through a qualified economic contribution. But for many applicants, the process does not go as planned.

Despite meeting financial requirements, a significant number of applicants face rejection. According to industry data, 84% of CBI rejections are caused by just five common and preventable mistakes.

For high-net-worth individuals, business owners, and international investors, understanding these risks is crucial. A rejection does more than delay your plans, it may damage your reputation and limit your future application options.

Below, we explore the five most common causes of CBI rejection and explain how avoiding them can protect your investment, streamline the process, and help you access the full benefits of global citizenship.

1. Due Diligence Failures: The Most Critical Barrier

The number one reason CBI applications are denied is failure to pass due diligence checks. These programs rely on strict background verification to preserve their credibility and protect their international reputation.

Governments perform exhaustive checks through:

- Global security and law enforcement databases

- Independent due diligence firms

- Media screening and source reporting

- Political and economic exposure assessments

Applicants are flagged for:

- Past or pending criminal investigations

- Sanctions or connections to blacklisted individuals

- Negative press coverage suggesting reputational risk

- Undisclosed relationships or business ties

Even if an applicant has no legal convictions, perceived risk may still lead to rejection. For example, a businessperson affiliated with a politically sensitive sector or operating in a high-risk jurisdiction could face additional scrutiny.

This should not discourage qualified investors. Instead, it highlights that strong due diligence practices are protecting the integrity of these programs. For approved applicants, this means holding a citizenship that maintains high global standing.

To avoid failure at this stage:

- Disclose all relevant background information up front

- Resolve any legal or reputational issues before applying

- Work with experienced professionals to assess your risk profile

2. Incomplete or Unverified Source of Funds

A common misconception is that having money is enough. However, CBI programs do not just want to know you have the money, they must understand where it came from and that it was legally and ethically earned.

Rejections in this category stem from:

- Unclear financial trails

- Undocumented gifts or loans

- Lack of formal proof of income or business earnings

- Unexplained large transfers or inconsistent banking history

To meet international compliance standards, authorities expect a detailed breakdown of your financial history. This often includes:

- Audited business financials

- Tax returns for several years

- Legally notarized gift declarations

- Bank statements showing the flow of funds from origin to investment

If a fund transfer cannot be traced clearly, or if supporting documents are missing or incomplete, the application will likely fail, even if the funds are legitimate.

Proper documentation should not be viewed as an administrative burden. It is a security feature that protects all stakeholders and ensures only well-qualified applicants progress.

3. Misrepresentation and Omissions

In the CBI world, failing to disclose information is just as serious as providing false information.

Authorities treat incomplete or misleading applications as high-risk. This includes:

- Omitting previous visa denials or citizenship applications

- Failing to declare expunged criminal records or civil cases

- Inconsistencies between different parts of the application

- Leaving out family members or misrepresenting relationships

Even simple oversights can be considered misrepresentation. For example, if a spouse applies under a separate application and provides different answers to shared questions, it may result in both applications being rejected.

To protect your application:

- Double-check every section of your submission

- Ensure full alignment between family or partner applications

- Be transparent, even about minor or resolved issues

Governments have access to increasing levels of data and verification tools. Attempting to “hide” something is no longer possible and not worth the risk.

4. Investment Non-Compliance

CBI is not just about making a payment. Each program has specific investment criteria that must be followed precisely, both in form and process.

Rejections often occur because:

- Real estate does not qualify under the program

- Investors underestimate the required value or equity

- Funds are transferred through unapproved channels

- Investment is made before receiving official approval

Even seemingly minor missteps, such as investing too early or failing to use an approved escrow account, can result in disqualification. That’s because programs have strict controls in place to monitor capital inflows and prevent misuse.

Additionally, properties purchased under real estate options often come with holding periods. If an investor attempts to sell too soon or use the property as collateral, it can void their citizenship status.

To ensure compliance:

- Confirm all investment options are pre-approved by the program

- Follow the exact timing and process required

- Use authorized legal and financial intermediaries

- Maintain the investment for the legally required period

These rules are in place to ensure that economic contributions are genuine and impactful. Adhering to them protects both your application and the long-term value of your new citizenship.

5. Technical Errors and Administrative Oversights

Many rejections stem from avoidable technicalities. These mistakes are not about eligibility, but about presentation, accuracy, and timing.

Common errors include:

- Expired police certificates or passports

- Missing apostilles or notarizations

- Inaccurate translations or unsigned documents

- Inconsistencies in birth, marriage, or education records

When governments process applications, they do not have time to request corrections for every issue. A poorly prepared application suggests a lack of seriousness and increases the risk of rejection.

To avoid this:

- Use a comprehensive document checklist

- Ensure every form is completed accurately

- Authenticate all documents according to program guidelines

- Submit translations and certifications from approved providers

Time is also a critical factor. Certain documents, such as police certificates or health screenings, may only be valid for a few months. Coordinating your timeline is essential to prevent rejections due to expiration.

Working with experienced professionals helps manage these details and ensures your application is both complete and compliant at every stage.

Why Citizenship by Investment Rejections Show Program Strength

It’s important to understand that a high rejection rate does not mean the program is unstable or unfair. On the contrary, it shows that CBI programs are being managed with discipline and oversight.

This benefits investors in several ways:

- It protects the value of your new citizenship

- It ensures global trust and visa-free access remains strong

- It reinforces international standards of transparency and accountability

- It keeps the applicant pool exclusive and credible

Programs with low standards quickly lose credibility. When governments take the time to properly assess and filter applicants, it builds a foundation of trust that future citizens benefit from.

As a qualified investor, you don’t want to be part of a rushed or lenient system. You want to be part of a respected program that holds its citizens to a higher standard, because that’s what gives the passport its real power.

Take the Right Approach From the Start

Citizenship by Investment offers tremendous advantages, from global mobility and asset protection to long-term security for your family and business. But these benefits come with responsibility.

To ensure a successful application:

- Prepare early and thoroughly

- Be fully transparent at every stage

- Structure your investment correctly

- Follow the technical guidelines with precision

- Seek qualified guidance with proven experience in CBI

Your future citizenship is not a transaction. It’s a transformation. And how you approach the process determines the quality and stability of what you gain.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Ready to Secure Global Access the Right Way?

Citizenship by Investment offers a powerful pathway to greater mobility, security, and opportunity, but success starts with getting every detail right. As programs become more regulated and selective, the importance of a fully compliant, transparent application cannot be overstated.

Avoid costly rejections by approaching your application with precision and strategy. From due diligence to proper investment structuring, every step should reflect your long-term goals and financial integrity. This process is more than a formality, it’s a gateway to meaningful global access.

Contact us today to begin your journey. Our experienced team provides tailored guidance to ensure your application meets the highest standards and aligns with your vision. Make your move with confidence, clarity, and complete support.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

African Citizenship by Investment for Strategic Global Investors

African citizenship by investment is gaining attention among global investors seeking diversification, mobility, and access to emerging markets. As African…

58% of New Trade Growth Happens Outside the U.S.

58% of New Trade Growth Happens Outside the U.S., marking a structural shift in global economic power. As trade momentum…

CBI in Times of Uncertainty: When One Passport Is Not

Global uncertainty has changed the rules of wealth preservation. In today’s environment, one passport may not provide sufficient protection. This…

Nigeria Dangote Refinery Investment Opportunity for Strategic Investors

Nigeria’s Dangote Refinery investment opportunity reflects growing capital market maturity and infrastructure scale. For high net worth individuals and global…

13 CARICOM Nations Attract Over 1 Billion Dollars from 5

13 CARICOM nations attract over 1 billion dollars from 5 global powers, reinforcing regional credibility and investment stability. Sovereign commitments…

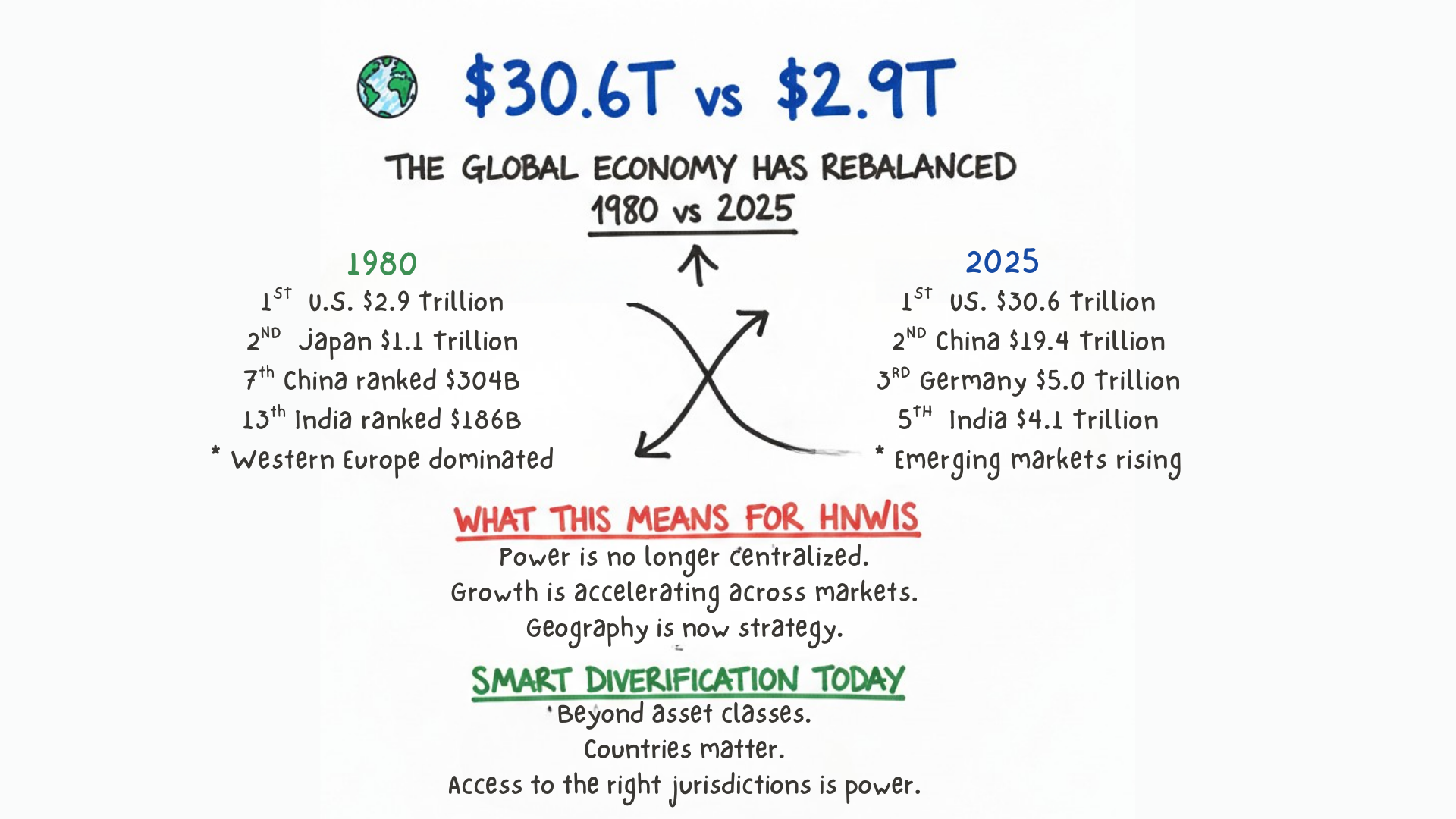

From Western Dominance to a Multipolar Economy (1980–2025)

From 1980 to 2025, global power shifted from Western dominance to a multipolar economy. Economic influence now spans several regions,…