$537M U.S. Investment Anchors Eko Atlantic City Lagos by 2028

Introduction

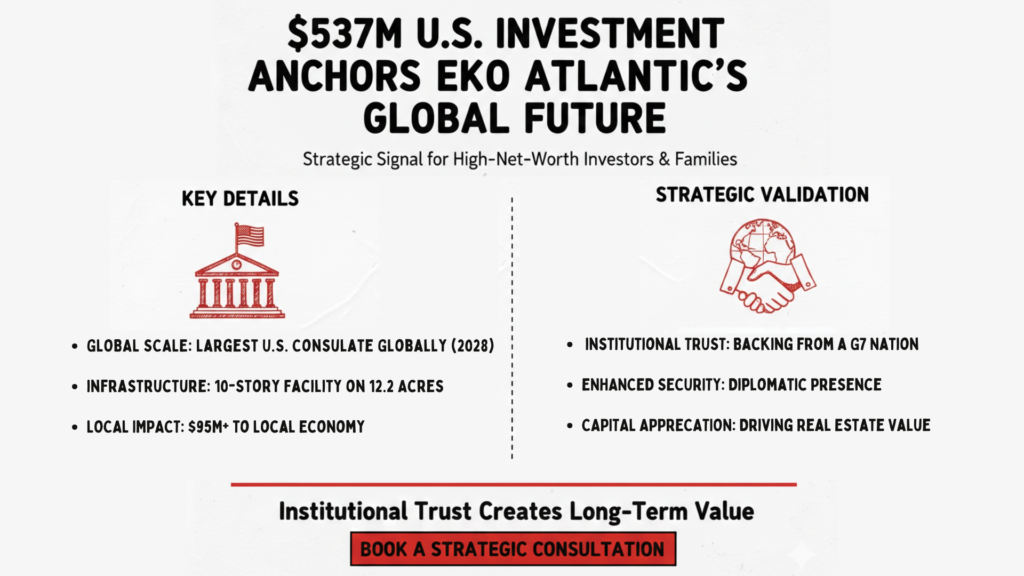

The $537M U.S. Investment Anchors Eko Atlantic City, Lagos by 2028 and marks a defining milestone for strategic investors assessing West Africa. In February 2026, the United States confirmed it is constructing a $537 million consulate complex in Eko Atlantic City, with completion scheduled for 2028. Importantly, this decision reflects long-term institutional planning rather than short-term expansion.

For high net worth individuals, business owners, and global investors, this development deserves close attention. Governments conduct extensive geopolitical, economic, and security assessments before allocating capital at this scale. Therefore, when a global power commits over half a billion dollars to a specific district, the signal carries measurable weight.

This is not speculative enthusiasm. Instead, it represents structured commitment backed by institutional analysis.

Why This Investment Commands Attention

Governments operate on multi-decade timelines. Before deploying capital abroad, they examine infrastructure reliability, political stability, regulatory predictability, and economic trajectory. Consequently, large-scale foreign government investment often reshapes investor perception.

The $537M U.S. investment in Eko Atlantic City signals:

- Confidence in long-term infrastructure viability

- Commitment to diplomatic engagement in Nigeria

- Trust in Lagos as a regional economic anchor

- Strategic positioning in West Africa

Moreover, institutional capital frequently precedes private capital. Historically, when governments establish a durable presence, multinational corporations and financial institutions reassess regional exposure. As a result, diplomatic infrastructure often accelerates surrounding economic activity.

Perception influences capital flow. However, institutional validation strengthens perception with credibility.

Eko Atlantic City’s Strategic Position

Eko Atlantic City was designed as a master-planned urban district built on reclaimed Atlantic coastline. Unlike organic urban sprawl, master-planned developments integrate zoning discipline, infrastructure coordination, and security protocols from inception.

Specifically, Eko Atlantic City offers:

- Structured road networks and drainage systems

- Coastal defense engineering

- Controlled development guidelines

- Modern commercial and residential planning

Initially, some observers viewed the project as ambitious. However, the $537M U.S. investment anchors Eko Atlantic City, Lagos by 2028 within a framework of international validation.

When diplomatic missions select a district, they evaluate resilience, access, and long-term operational viability. Therefore, this decision reinforces the city’s structural credibility.

Institutional trust does not emerge casually. It develops through measurable standards.

Lagos as an Economic Powerhouse

Lagos remains Nigeria’s commercial nucleus and one of Africa’s largest metropolitan economies. With a population exceeding 20 million, the city drives trade, financial services, technology innovation, and cultural production.

Furthermore, Lagos serves as:

- A major port gateway for West Africa

- A financial services ecosystem

- A fast-growing startup environment

- A logistics and manufacturing base

Scale creates momentum. However, infrastructure quality determines sustainability.

Eko Atlantic City functions within this economic ecosystem while offering controlled infrastructure. Consequently, it bridges emerging market growth with structured urban planning.

The $537M U.S. investment anchors Eko Atlantic City, Lagos by 2028 at the intersection of scale and structure. That positioning matters for serious investors.

Real Estate Implications for High Net Worth Investors

Diplomatic complexes influence surrounding property markets. They generate consistent demand from expatriates, government personnel, international consultants, and corporate executives.

In established global cities, diplomatic districts often experience:

- Increased rental stability

- Premium pricing dynamics

- Infrastructure upgrades

- Heightened security standards

Eko Atlantic City may experience similar dynamics over time.

Although no market eliminates risk, long-term foreign government commitment strengthens district stability. Investors who evaluate real estate through a long-term lens should consider how anchor institutions influence growth cycles.

Real estate markets evolve around certainty. Institutional presence enhances certainty.

Strategic Considerations for Business Owners

Entrepreneurs and corporate boards analyzing West Africa must evaluate both opportunity and risk. A major U.S. diplomatic complex improves business confidence by signaling long-term engagement.

Such infrastructure supports:

- Trade facilitation

- Commercial engagement

- Visa processing efficiency

- Diplomatic cooperation

Business leaders prioritize environments where global relationships remain active and stable. The U.S. investment in Eko Atlantic City demonstrates ongoing strategic partnership with Nigeria.

Confidence encourages expansion. Stability encourages capital deployment.

For companies considering regional headquarters or market entry, developments like this can influence timeline decisions.

Global Mobility and Wealth Structuring

High net worth families increasingly prioritize global mobility, asset protection, and jurisdictional diversification. They evaluate residency and citizenship pathways as part of broader wealth preservation strategies.

When assessing jurisdictions, experienced investors consider:

- International diplomatic engagement

- Economic resilience

- Infrastructure reliability

- Long-term political direction

The $537M U.S. investment in Eko Atlantic City reinforces Nigeria’s integration within global diplomatic networks. While investors must conduct thorough due diligence, institutional validation strengthens perception of long-term engagement.

Global wealth planning requires alignment with structural shifts, not short-term sentiment.

Families planning generational legacies should monitor where global powers allocate sustained capital.

Risk Management and Long-Term Vision

Nigeria presents both opportunity and complexity. Currency volatility, regulatory adjustments, and infrastructure scaling remain relevant considerations. Experienced investors acknowledge these realities rather than ignoring them.

However, demographic expansion, urbanization, and entrepreneurial growth continue to shape long-term potential.

Eko Atlantic City offers a structured micro-environment within this broader economy. The $537M U.S. investment reduces perception-based uncertainty regarding district viability and strengthens its long-term narrative.

Balanced portfolios often include exposure to growth markets supported by improving institutional frameworks. Strategic investors differentiate between unmanaged risk and calculated opportunity.

Discipline remains essential. So does vision.

What Investors Should Monitor

As construction progresses toward 2028, investors should monitor:

- Additional foreign direct investment

- Corporate tenancy announcements

- Infrastructure enhancements

- Policy reforms supporting international business

Capital clusters around anchors. Diplomatic infrastructure often becomes a focal point for secondary investment activity.

Forward-looking investors evaluate leading indicators rather than waiting for late-cycle validation.

Timing influences outcome.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Strategic Positioning for the Next Decade

The $537M U.S. Investment Anchors Eko Atlantic City, Lagos by 2028 represents structured commitment from a global power. It validates the district’s infrastructure and signals long-term confidence in Lagos as a regional anchor.

High net worth individuals, business owners, and global investors should evaluate this development within broader strategic planning. Governments think decades ahead. Investors who align with structural momentum often position themselves for sustained advantage.

If you are exploring opportunities connected to Eko Atlantic City, international diversification, or global mobility planning, now is the time to conduct disciplined due diligence and structured portfolio assessment.

Strategic positioning today shapes generational outcomes tomorrow.

Take the Next Strategic Step

If you would like a confidential consultation to assess investment positioning in Eko Atlantic City or explore structured residency and global mobility strategies, contact our advisory team. We provide tailored guidance for high net worth individuals and international business leaders seeking long-term security and growth.

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

7 Key Risks A U.S. Setup Isn’t Always Best for

A cross-border business setup can boost global growth by reducing onboarding delays, payment friction, and concentration risk. This guide explains…

Why Citizenship by Investment Due Diligence Matters for Investors

Citizenship by Investment due diligence protects more than an application. It safeguards international credibility, visa free access, and long term…

Wealthy Americans Lead New Zealand Golden Visa Surge

Wealthy Americans are leading the New Zealand Golden Visa surge as investors prioritize stability and diversification. Billions in committed capital…

Second Residency Is Now A Top Three Global Wealth Priority

Second residency has quietly moved into the top tier of priorities for serious wealth holders. This article explains why investors…

UK Exit Tax 20% and the Future of Strategic Wealth

The UK Exit Tax 20% could significantly impact HNWIs, founders, and investors with substantial unrealized gains. This in depth analysis…

Greek Golden Visa Sees Record Turkish Investor Demand Surge

The Greek Golden Visa is seeing record demand from Turkish investors seeking EU residency, asset protection, and mobility. With participation…