$12,000 Homes in Venezuela: Smart Opportunity or High Risk

Venezuela Residency And Real Estate: A High Risk Optionality Play For HNWIs

Venezuela residency and real estate has become a serious discussion topic again among HNWIs, business owners, and global investors. Not because the country feels simple, but because frontier markets can reprice quickly when trust returns. However, Venezuela still carries political, legal, and operational risks. Disciplined investors must treat every move as a controlled allocation, not an emotional decision.

Why Venezuela Is Back On Sophisticated Investors’ Watchlists

Serious investors do not chase headlines. They track inflection points. Venezuela sits at the intersection of three forces that can move markets quickly:

- A disputed political environment under heavy international scrutiny

- A potential economic reset linked to institutional reform and energy production

- Deeply discounted real assets in selected regions

This combination creates optionality. Optionality means you risk a limited amount for the chance of outsized upside if conditions improve. However, optionality only works when you control downside risk through structure, documentation, and professional oversight.

The Credibility Factor Matters More Than The Price

Many observers focus on low property prices. Experienced investors focus on credibility. If a country improves transparency, strengthens documentation, and builds enforceable systems, capital flows become easier. When capital flows improve, asset prices often follow.

International observers have publicly questioned the integrity of Venezuela’s 2024 presidential election process. That scrutiny matters for markets because global investors demand verification. As documentation improves and processes become clearer, confidence can return in stages.

In frontier markets, credibility always precedes capital.

Oil Is The Macro Engine, But Real Assets Price The Sentiment

Venezuela’s economy remains closely tied to oil. Production once reached approximately 3.2 million barrels per day in 2000. In recent years, that figure dropped to a fraction of its historical level. That decline reflects more than energy output. It signals weakened infrastructure, lost jobs, and reduced investment confidence.

If production stabilizes and institutions strengthen, capital could begin to circulate again. When that happens, demand for housing and land typically rises in areas with livability, tourism appeal, and limited supply.

In early-stage recoveries, real estate often moves before broader macro indicators fully normalize.

The Opportunity Case For HNWIs And Business Owners

For sophisticated investors, Venezuela fits into a portfolio as a small asymmetric allocation. The thesis must remain disciplined and scenario-based.

Land Banking With A Long Horizon

Investors may acquire land in naturally attractive regions and hold through volatility. The strategy does not rely on short-term rental income. It relies on long-term structural recovery.

Selective Residential Property With Renovation Upside

Some assets trade at levels where renovation can create meaningful value. However, investors must validate contractor access, materials supply, and cost assumptions.

Future Hospitality Or Eco Tourism Optionality

Tourism could return if stability improves. A well-located property might support a boutique lodge or retreat concept. Yet this should remain a future option, not an immediate operating business.

Strategic Geographic Diversification

Some HNWIs build geographic redundancy. They hold assets in multiple jurisdictions to enhance lifestyle flexibility and long-term planning resilience.

The Risk Case Is Real, And It Is Not Optional

Venezuela carries structural risks that investors must evaluate seriously.

Title And Registry Risk

You must verify clean title, confirm seller authority, and ensure no hidden liens or disputes exist. Independent legal counsel is essential.

Enforcement And Dispute Risk

Contracts only matter when courts enforce them efficiently. Dispute resolution timelines may extend unpredictably.

Banking And Payment Friction

Cross-border transfers and compliance reviews can delay transactions. Investors must document source of funds clearly and maintain structured payment records.

Liquidity Risk

Selling may take longer than expected. Buyers can demand heavy discounts during uncertain periods.

Operational Complexity

Utilities, maintenance logistics, and property oversight require local verification.

Low entry pricing does not eliminate these risks. It merely compensates for them.

A Disciplined Due Diligence Framework

Professional investors treat frontier markets with a higher compliance standard, not a lower one.

Legal Due Diligence That Is Independent

- Engage a local attorney who does not represent the seller

- Verify full chain of title

- Confirm cadastral alignment and boundary accuracy

- Validate tax status and municipal compliance

- Document seller identity and authority

Commercial Due Diligence That Is Practical

- Confirm reliable water and power access

- Model renovation budgets conservatively

- Assess contractor availability and supply chains

- Evaluate security arrangements

- Stress-test resale timelines

Compliance Due Diligence That Protects Your Global Profile

- Maintain clear source-of-funds documentation

- Route transfers through regulated institutions

- Avoid informal agreements that create future banking concerns

- Seek structured advice for any sanctions-sensitive exposure

Sophisticated investors understand that reputation risk can outweigh financial risk.

Where Residency Fits, And What Investors Misunderstand

Property ownership and residency status are separate matters. Investors must not assume that buying property automatically creates a clear residency pathway.

Residency frameworks can change during political transitions. If residency is part of your strategy, you must confirm:

- Eligibility criteria

- Required documentation

- Renewal conditions

- Physical presence obligations

Residency should align with tax planning, banking comfort, and long-term family objectives.

The Smart Investor’s Model Optionality Plus Mobility

Frontier exposure works best when paired with stable mobility planning. While a small allocation may provide upside, a structured residency or citizenship strategy provides certainty.

Citizenship by investment programs in established jurisdictions offer:

- Predictable legal frameworks

- Strong due diligence standards

- Banking familiarity

- Travel flexibility

- Family security planning

When investors combine frontier optionality with structured mobility planning, they build resilience instead of concentration risk.

Portfolio Sizing For Frontier Exposure

Experienced investors follow sizing discipline.

- Allocate only a small percentage of net worth

- Avoid excessive leverage

- Maintain liquidity in stable jurisdictions

- Prepare to hold long-term without forced selling

If volatility forces emotional decisions, the allocation was too large.

How Business Owners Should Think About Venezuela

Business owners must evaluate operational realities beyond asset appreciation.

Ask direct questions:

- Can profits move compliantly across borders

- Can banking relationships withstand scrutiny

- Are contracts enforceable

- Is local partnership risk manageable

If answers remain uncertain, treat Venezuela as a strategic asset position rather than an operating base.

What Sophisticated Investors Should Remember

Venezuela presents a high-variance environment. The upside depends on institutional rebuilding, regulatory clarity, and improved credibility. Investors who approach this market with discipline, documentation, and realistic expectations can structure controlled optionality. Those who rely on price alone expose themselves to avoidable risk.

Frontier exposure should never replace core stability. It should complement it.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Create A Risk Managed Residency And Citizenship Roadmap

If you are considering Venezuela residency and real estate as part of a broader diversification strategy, you should align that decision with a structured mobility plan. Our team helps HNWIs and business owners design compliant residency and citizenship strategies that support banking resilience, tax efficiency, and long-term family security.

We analyze jurisdictional fit, risk tolerance, documentation requirements, and long-term mobility goals. If you want to explore how frontier optionality can align with a stable global plan, contact us to build a tailored roadmap.

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

African Citizenship by Investment for Strategic Global Investors

African citizenship by investment is gaining attention among global investors seeking diversification, mobility, and access to emerging markets. As African…

58% of New Trade Growth Happens Outside the U.S.

58% of New Trade Growth Happens Outside the U.S., marking a structural shift in global economic power. As trade momentum…

CBI in Times of Uncertainty: When One Passport Is Not

Global uncertainty has changed the rules of wealth preservation. In today’s environment, one passport may not provide sufficient protection. This…

Nigeria Dangote Refinery Investment Opportunity for Strategic Investors

Nigeria’s Dangote Refinery investment opportunity reflects growing capital market maturity and infrastructure scale. For high net worth individuals and global…

13 CARICOM Nations Attract Over 1 Billion Dollars from 5

13 CARICOM nations attract over 1 billion dollars from 5 global powers, reinforcing regional credibility and investment stability. Sovereign commitments…

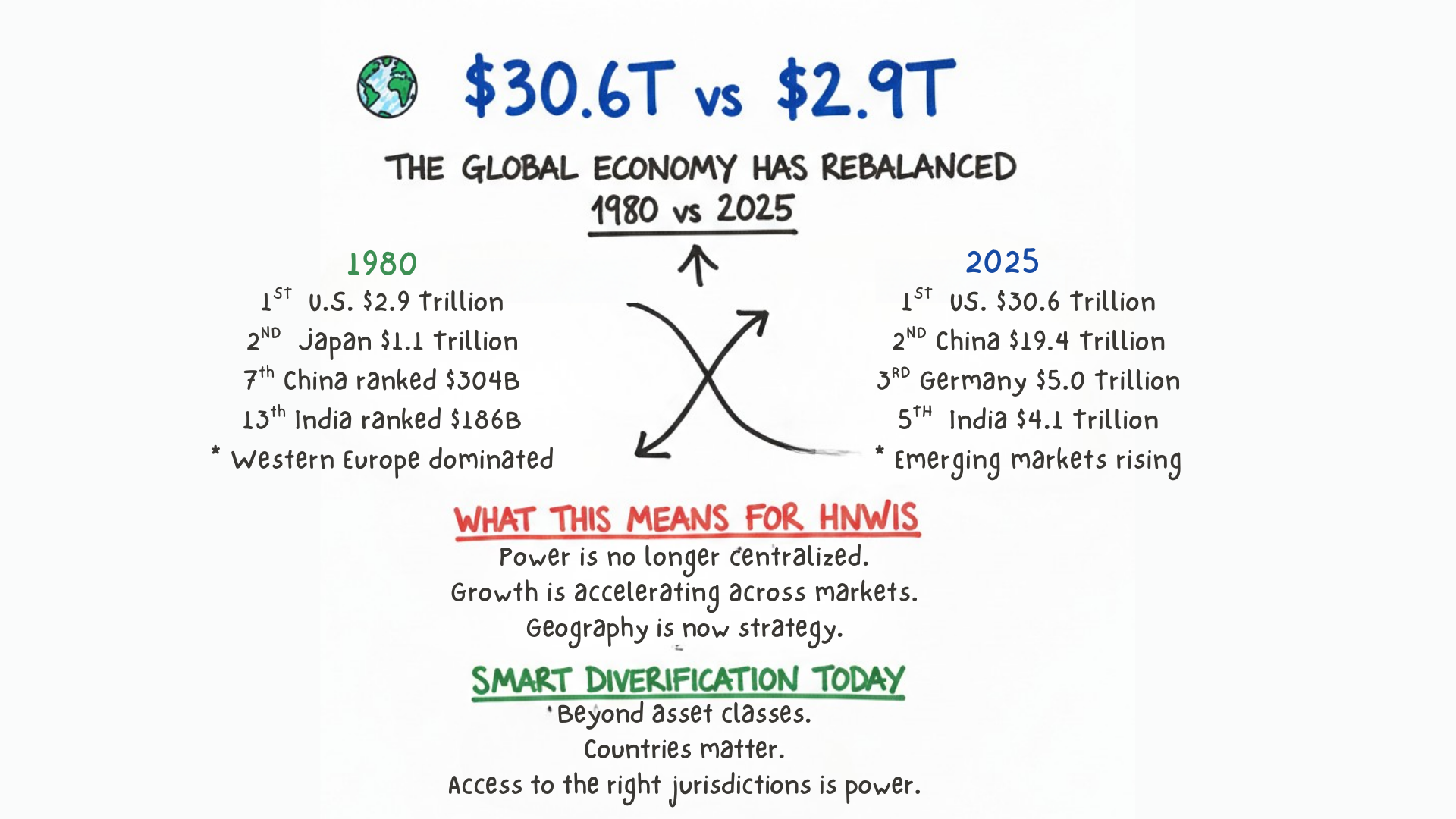

From Western Dominance to a Multipolar Economy (1980–2025)

From 1980 to 2025, global power shifted from Western dominance to a multipolar economy. Economic influence now spans several regions,…