The Growing Importance of Jurisdiction in Wealth Planning

Jurisdictional wealth planning has become a central concern for high net worth individuals, business owners, and global investors. Where wealth is structured today shapes outcomes tomorrow. In a world defined by policy shifts, regulatory change, and geopolitical uncertainty, relying on a single country exposes capital, operations, and families to unnecessary risk.

One country means one tax system, one legal framework, and one political direction. While that concentration may feel familiar, it limits flexibility. Jurisdictional wealth planning addresses this challenge by allowing individuals to design structures that work across borders rather than depend on a single system.

This approach is not about constant relocation or complexity for its own sake. It is about clarity, control, and preparedness.

The Hidden Risk of Single-Jurisdiction Dependence

Many successful individuals spend years building wealth but give little thought to jurisdictional exposure. Businesses scale internationally, investments diversify globally, yet personal and corporate structures often remain tied to one country.

This imbalance creates risk.

Tax policies change. Capital controls appear. Regulations tighten. Political priorities shift. Even stable jurisdictions adjust their approach when economic pressure rises. When all assets, residency, and legal ties sit in one place, those changes affect everything at once.

Jurisdictional wealth planning reduces this vulnerability by spreading exposure across carefully selected locations. Each jurisdiction serves a defined purpose, whether for residence, business operations, asset holding, or succession planning.

Choosing a Base Instead of Chasing Locations

A common misconception is that global planning requires living everywhere. In reality, effective jurisdictional wealth planning starts with choosing the right base.

A strong base jurisdiction offers:

- Legal clarity and predictability

- Competitive or territorial tax treatment

- Stable banking and financial systems

- Respect for private property and contracts

- Access to international markets

From that base, additional jurisdictions complement the structure. One country may host a holding company. Another may provide residency options. A third may serve as a banking or investment hub.

This layered approach creates resilience without unnecessary disruption to lifestyle or operations.

Why Jurisdictional Planning Signals Sophistication

For global investors, jurisdictional planning reflects maturity, not avoidance. Governments design formal residency and citizenship frameworks to attract capital, talent, and long-term commitment. These frameworks operate within regulated environments that prioritize transparency and compliance.

Structured application processes, enhanced due diligence, and government oversight strengthen trust. For investors and families, this oversight provides assurance. It confirms legitimacy and reinforces confidence in the system.

Jurisdictional wealth planning, when done properly, aligns with international standards. It respects laws, supports compliance, and builds long-term credibility.

Supporting Entrepreneurs and Business Owners

Business owners face additional challenges. Operations span multiple markets. Supply chains cross borders. Customers and teams operate globally. Yet many businesses remain legally anchored in high-cost or high-risk jurisdictions out of habit.

Jurisdictional planning helps entrepreneurs:

- Optimize corporate structures

- Reduce exposure to sudden regulatory shifts

- Improve access to global banking

- Strengthen cross-border operations

- Support international expansion

Strategic jurisdictional choices also support exits, succession planning, and long-term valuation. Investors increasingly examine where companies operate, not just what they sell.

Asset Protection Through Geographic Balance

Asset protection does not rely on secrecy. It relies on structure.

Jurisdictional wealth planning places assets in environments that respect the rule of law and creditor rights while maintaining transparency. This approach protects wealth from excessive litigation risk, political interference, and sudden policy changes.

Geographic balance strengthens resilience. When assets span multiple jurisdictions, no single event can disrupt the entire structure. This balance supports continuity and peace of mind for families and investors alike.

Preparing Families for Long-Term Security

For families, jurisdictional planning is about more than wealth. It is about continuity, access, and opportunity.

Future generations face a different world. Mobility, education, and opportunity increasingly depend on legal status and jurisdictional access. Strategic residency or citizenship options can support education pathways, lifestyle flexibility, and long-term security.

Importantly, these options do not replace identity or heritage. They complement them. Families retain their roots while expanding their global reach.

Compliance as a Competitive Advantage

Compliance often receives negative attention, yet it plays a critical role in modern wealth planning. Jurisdictional strategies that prioritize compliance gain durability.

Regulated frameworks reduce uncertainty. Clear reporting obligations build credibility with financial institutions. Transparent structures attract long-term partners and investors.

For sophisticated individuals, compliance becomes a competitive advantage. It enables confident planning rather than reactive adjustments.

Jurisdictional Wealth Planning in Practice

Effective jurisdictional planning follows a disciplined process:

- Assess personal, family, and business goals

- Evaluate current exposure and risks

- Identify jurisdictions aligned with those goals

- Design multi-layered structures with clear purposes

- Implement with professional oversight

- Review regularly as laws and circumstances evolve

This process favors long-term thinking over short-term tactics. It prioritizes sustainability and adaptability.

The Difference Between Reaction and Preparation

Many individuals explore global planning only after facing pressure. By then, options narrow and costs rise.

Prepared investors act early. They design structures before change forces action. This foresight preserves flexibility and protects outcomes.

Jurisdictional wealth planning rewards preparation. It supports calm decision-making in uncertain times and allows individuals to focus on growth rather than defense.

Why This Matters Now

Global policy environments continue to evolve. Tax transparency increases. Governments reassess capital flows. Investors face heightened scrutiny alongside growing opportunity.

Jurisdictional wealth planning responds to this reality. It acknowledges change and designs around it. Rather than resisting the global environment, it works within it.

For high net worth individuals, business owners, and investors, this approach has become a core pillar of responsible wealth management.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Building Wealth That Performs Across Borders

The most successful global investors do not chase trends. They build optionality. They design structures that perform across systems rather than rely on one environment remaining favorable forever.

Jurisdictional wealth planning supports this mindset. It creates stability through diversification, clarity through structure, and confidence through compliance.

In an interconnected world, jurisdiction is no longer a background detail. It is a strategic decision that shapes long-term outcomes.

If you are serious about protecting capital, preserving opportunity, and building long-term resilience, now is the time to assess your jurisdictional exposure. Strategic planning today creates flexibility tomorrow.

A well-designed jurisdictional wealth plan can help you stay ahead of change rather than react to it.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

Why 29+ Jurisdictions Keep Pension Taxes Below 10 Percent

Why 29+ jurisdictions keep pension taxes below 10 percent reflects a deliberate global policy shift. Governments are attracting stable foreign…

How Investors Can Pursue Two Citizenships Strategically

Pursuing two citizenships simultaneously is legal but complex. For investors and business owners, success depends on coordination, transparency, and consistency….

Timing the Future: Argentina’s Citizenship by Investment Strategy

The Argentina Citizenship by Investment strategy is unfolding with structure and intent. For HNWIs, business owners, and investors, timing now…

Neutral Countries: Why Stability Is the New Currency for Investors

Neutral countries are becoming a top choice for investors seeking stability, trust, and long term mobility. From Europe to emerging…

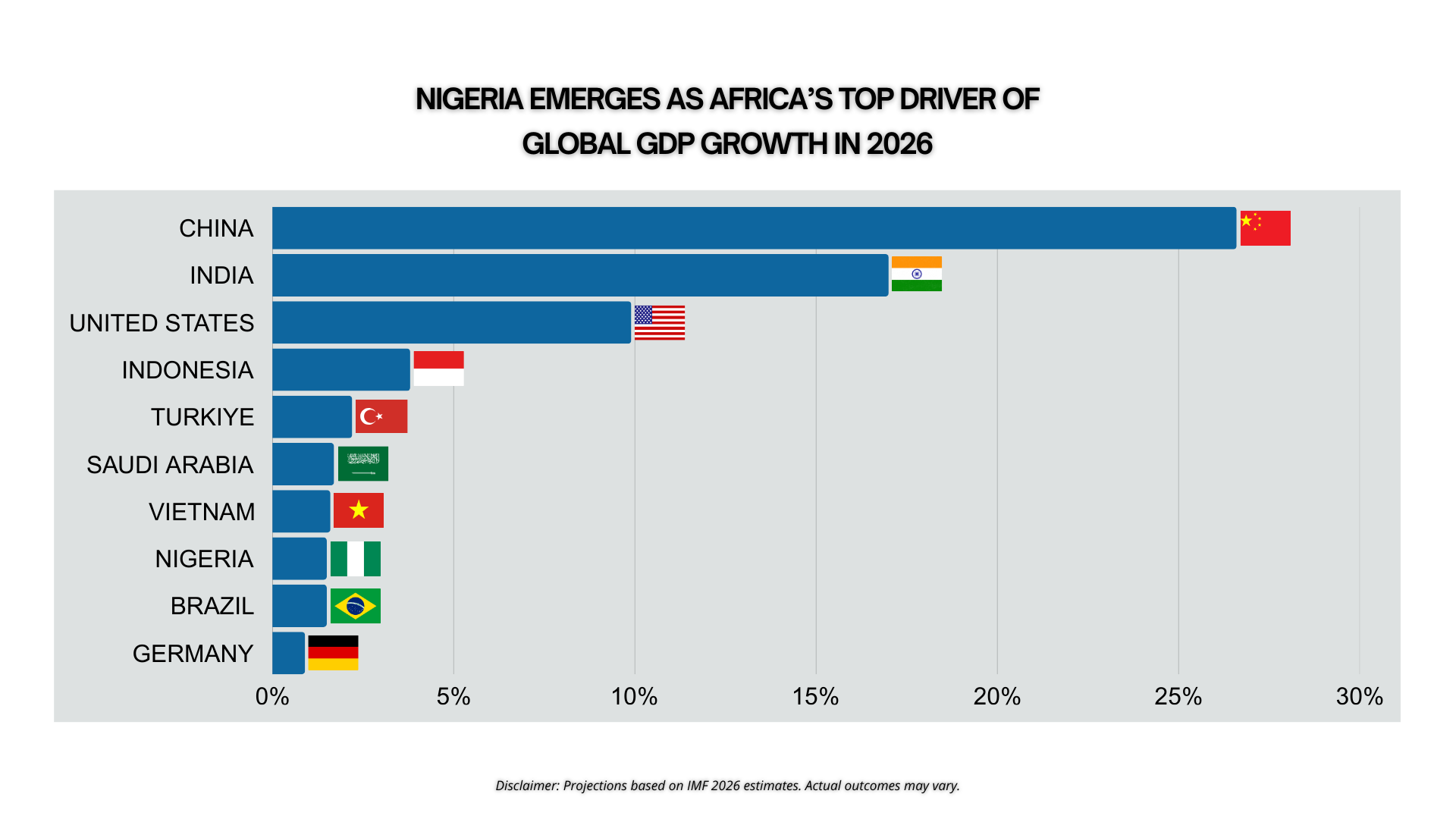

Nigeria Set to Lead Africa’s Global Growth Impact by 2026

Nigeria is projected to become Africa’s largest contributor to global economic growth by 2026. This shift reflects reform momentum, rising…

30% Limited Time Discount on Nauru Citizenship Contribution

Nauru reshaped its citizenship program with lower fees, broader family inclusion, and a limited time 30% contribution discount through June…