30% Limited Time Discount on Nauru Citizenship Contribution

Strategic mobility planning has changed. Today, founders manage cross-border teams, investors diversify across markets, and families plan for education, banking, and lifestyle in more than one jurisdiction. In that environment, Nauru citizenship by investment offers a structured way to add a second citizenship as a practical insurance policy. You hope you never need it, yet you benefit from the options it creates.

Nauru just made a set of updates that deserves attention because they focus on two things sophisticated applicants care about most: total cost clarity and family coverage. On February 3, 2026, the Nauru Economic and Climate Resilience Citizenship Program announced a restructured pricing model, plus a limited time offer that runs through June 30, 2026.

This article explains what changed, why it matters, and how to evaluate the program with a serious investor mindset.

Why Nauru’s Update Matters Now

When a newer program adjusts pricing and eligibility after its first year, it sends a signal. Sometimes that signal means the program needs demand. Other times it means the program has learned what the market needs, and it can now improve the offer without weakening controls.

Nauru’s changes look like the second scenario for one reason: the program reduced fees that create friction, while leadership emphasized that vetting standards remain strict.

For HNWIs and entrepreneurs, that combination matters. A passport is only as useful as the program’s credibility and the confidence it creates with banks, partners, and border authorities.

What Changed And Why It Matters

A 30% Limited Time Discount On The Main Contribution

Nauru introduced a limited time offer that reduces the main contribution amount to USD 90,000 for applications the program office receives before June 30, 2026.

That discount equals USD 25,000 off the base contribution amount of USD 115,000.

Lower Fees That Reduce The Real All In Cost

The program also lowered government fees significantly. For many applicants, those fee reductions drive the biggest improvement in the total budget. The permanent pricing changes include:

- Application fee: USD 5,000 for the principal applicant

- Application fee: USD 2,000 per dependent

- Due diligence fee: USD 6,000 for the principal applicant

- Due diligence fee: USD 3,000 per dependent

- Contribution amount: USD 115,000 base plus USD 2,000 per additional applicant

- Limited time offer contribution: USD 90,000 for the principal applicant through June 30, 2026

The Program Says Savings Reach Roughly 30%

Illustrative totals show how the new structure compares with prior pricing. Under the limited time offer:

- Single applicants may see total costs drop from USD 141,700 to USD 101,000, about 29% lower.

- A family of four may see total costs drop from USD 173,700 to USD 122,000, about 30% lower.

These examples do not include professional fees, and actual totals depend on family composition and documentation complexity. Still, the direction is clear: Nauru wants to compete on total cost, not only headline pricing.

Family Inclusion Became More Flexible

In practice, many HNWIs and business owners reject programs that force them into narrow family definitions. Mobility planning rarely involves only a spouse and two minor children. It can include adult children, parents, and sometimes siblings, especially when families operate businesses together.

Nauru removed several restrictions that limited who could apply as a dependent. The program:

- Removed age limits for children and parents

- Removed financial dependency requirements for these family members

- Accepted married children

- Allowed siblings as eligible dependents

This change supports multi-generational planning. It also reduces the likelihood that a family will split into multiple files or delay the decision for years.

From a governance perspective, broader family inclusion can also indicate a program’s confidence in its screening. When screening works, programs can expand eligibility without increasing risk.

Integrity And Screening: Why Cheaper Does Not Always Mean Weaker

Fee cuts can create skepticism. That skepticism makes sense because some jurisdictions chase volume. However, Nauru framed the fee changes as a business decision, not a compliance concession, and it emphasized that financial integrity and compliance remain central to the program.

Reporting on the update also described a multi-step screening process that includes mandatory interviews and checks completed with international due diligence providers.

That matters to serious applicants. Strong screening protects the passport’s long-term reputation, and it lowers the risk that future partners treat it as high friction during onboarding or enhanced checks.

The UK Decision: A Reality Check Investors Should Understand

No credible advisor sells second citizenship as a fixed visa-free list. Governments change entry rules. That is normal, and it will keep happening.

The UK introduced visa requirements for Nauruan nationals effective December 9, 2025, citing national and border security reasons.

Two important points for investors:

- Do not choose a passport for one destination. Build a mobility plan around real travel patterns, business needs, and long-term risk.

- Watch how a program responds. Responsiveness and transparency matter, especially for newer programs.

What We Look For When Advising HNWIs On Newer Programs

When a program sits in its early years, we shift the due diligence lens. We still analyze cost, processing, and dependents. Yet we also ask governance questions that protect clients.

Operational Clarity

A program must have clear rules, defined steps, and reliable documentation standards. Recent updates highlighted the program’s push toward smoother processing mechanics, including more digital processes.

Compliance Posture

Serious applicants want a program that prioritizes screening, not shortcuts. The program’s stated approach includes layered checks and interviews.

Longevity Logic

Nauru positions the program as supporting national resilience priorities, including climate resilience. A clear national purpose can support political durability when the program runs cleanly and avoids controversy.

Market Signal

Early volume was modest, based on industry reporting. Low early volume can mean strict screening, cautious distribution, or market hesitation. It can also mean the program has room to scale without operational strain. Either way, it supports a careful, case-by-case assessment.

Who This Program May Fit Best

Every mobility plan has a why. Here are profiles that often match what Nauru currently offers.

Founders With Cross Border Exposure

If you travel frequently across regions, you may value an additional citizenship that supports contingency planning and travel flexibility, even if it does not solve every destination need.

Investors Building A Family Governance Plan

Expanded dependent rules can help families unify strategy. This matters when adult children live abroad, parents travel often, or siblings co-invest.

HNWIs Who Value Optionality And Resilience

A second citizenship can add flexibility in how you structure travel, residency decisions, and long-term family planning. It can also provide a neutral alternative identity in certain contexts, depending on your risk profile and compliance needs.

Important note: applicants should not treat any citizenship solution as a way to avoid lawful obligations. A strong plan aligns with tax, reporting, and compliance rules in every relevant jurisdiction.

How To Evaluate The Limited Time Offer With An Investor Mindset

A discount is not automatically a reason to act. Use a disciplined framework:

- Confirm timeline risk: the limited time offer ends June 30, 2026, and deadlines often depend on the program office receiving a complete submission.

- Build a full cost model: include dependents, due diligence, document preparation, legal support, and translation or legalization where required.

- Stress-test reputational outcomes: consider banking relationships, where you invest, and how counterparties perceive various passports.

- Focus on your use case: education access, travel frequency, family security, business continuity, or geopolitical risk mitigation.

- Choose process quality over speed: rushed submissions create problems in any program, especially newer ones.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

A Practical Takeaway For 2026

Nauru’s update does not only lower cost. It improves product design. It reduces friction through lower fees, and it increases utility through broader dependent inclusion, while reaffirming screening strength.

For HNWIs and business owners, this is the right way to think about second citizenship: not as a trophy, but as a resilience tool.

Next Steps

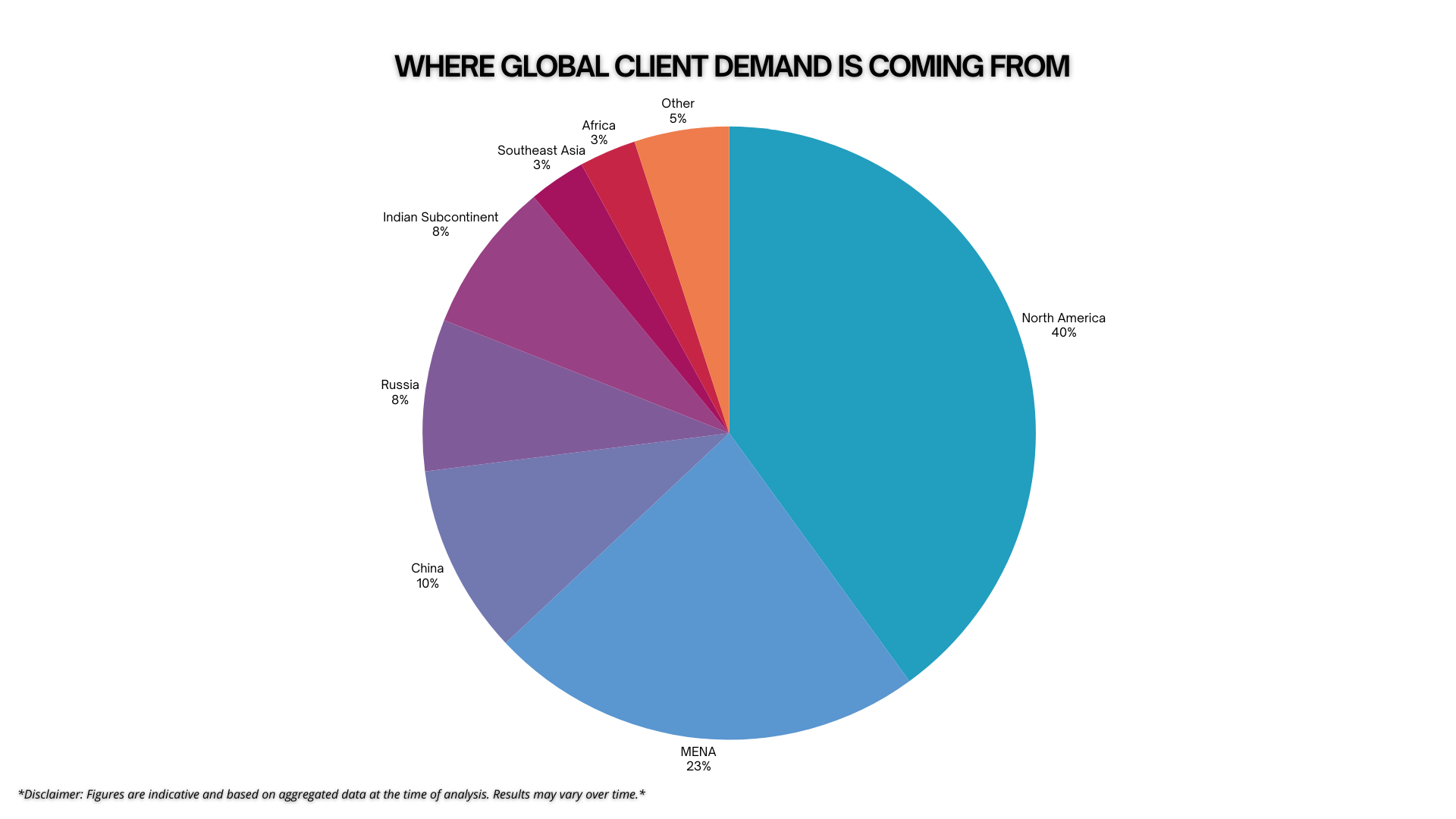

The fact that Americans now represent the largest source market for investment migration clients confirms one thing clearly. Global mobility has become a trusted and essential component of modern wealth planning.

If you are a high net worth individual, business owner, or investor considering global mobility, now is the time to approach it strategically. Work with experienced advisors who understand program integrity, compliance, and long term outcomes. The right structure today creates flexibility for decades to come.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

Inside Próspera’s $5,000 Tax Residency Program Explained

Próspera $5,000 lump-sum tax residency is drawing attention because unclear tax residency can slow banking, delay onboarding, and add scrutiny…

Americans Take the Lead in Global Investment Migration

Americans now lead global demand for investment migration. This shift reflects strategic planning, trust in structured programs, and a mature…

70% of High Earners Reevaluate Tax Driven Moves Globally

Many high earners move domestically to reduce taxes, only to later reassess their strategy. This shift reflects experience, not failure….

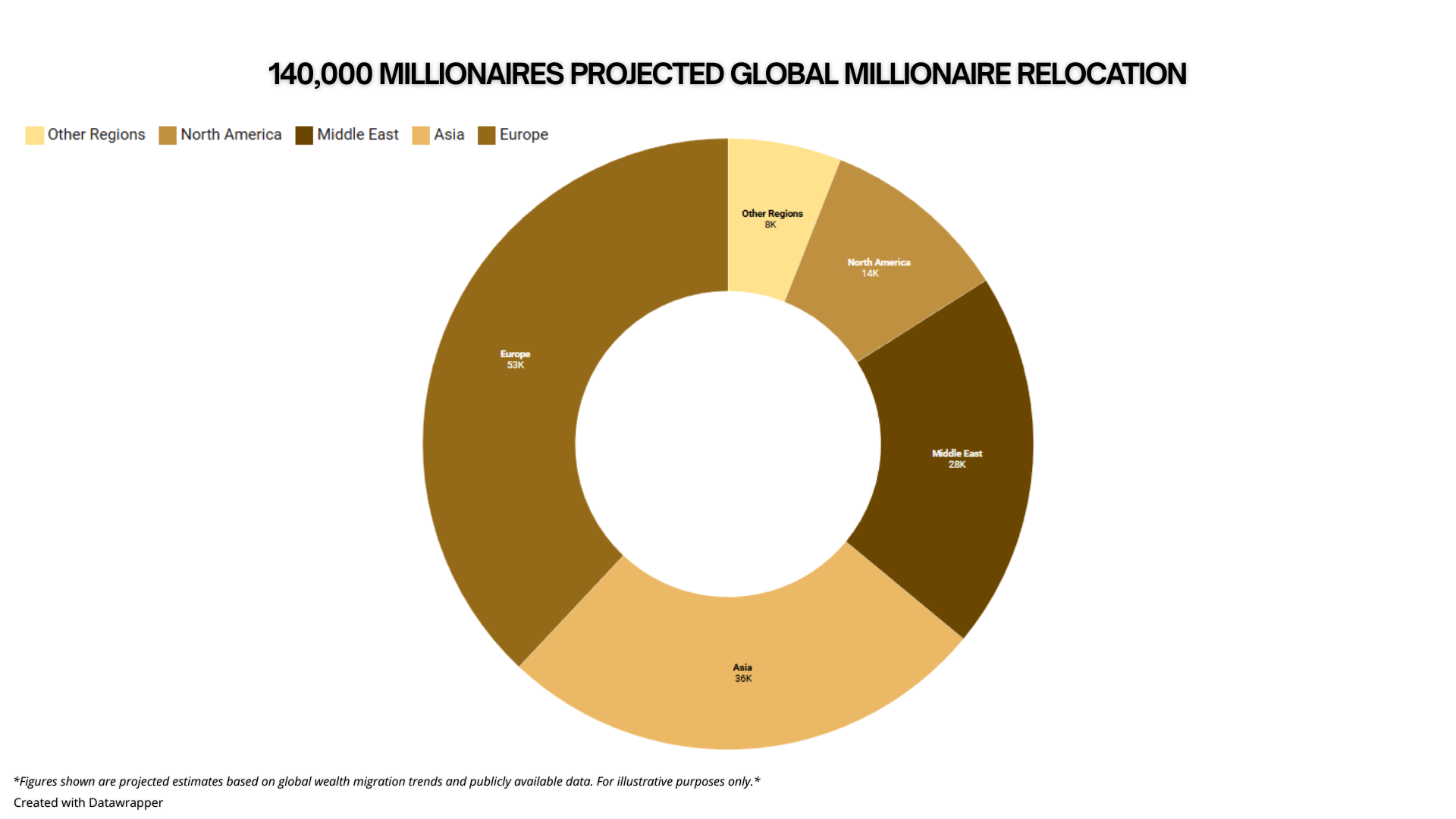

Portugal Leads Europe as 140,000 Millionaires Relocate Globally

More than 140,000 millionaires are projected to relocate globally, with Portugal leading Europe as a preferred destination. This shift reflects…

The Hidden Cost of Staying in High-Tax Countries for Wealth

Staying in a high-tax country could cost you more than just money, it could cost you opportunity, legacy, and control….

$5 Billion in Bilateral Trade Targeted Between Nigeria and Türkiye

Nigeria and Türkiye are deepening economic ties with a $5 billion annual trade target. This strategic move signals trust, investor…