Inside Próspera’s $5,000 Tax Residency Program Explained

Introduction

Próspera $5000 lump-sum tax residency has drawn attention from HNWIs, founders, and internationally active investors for one reason: it aims to reduce uncertainty. Most cross-border “tax problems” do not start with a high rate. They start when banks, auditors, and counterparties ask a simple question and the answer sounds unclear. Where are you tax resident.

In our work with globally mobile clients, we see how quickly uncertainty becomes expensive. A bank account opening turns into weeks of emails. A capital call triggers more questions. A property purchase gets delayed. These issues often have one root cause: the client cannot show a clean residency narrative backed by documents, substance, and consistent behavior.

This is where Próspera’s program becomes interesting. It combines a fixed annual payment, a defined physical presence rule, an entity requirement, and a tax residency certificate. The tax number makes headlines, yet the compliance structure creates the real value for serious clients.

This guide explains what the program offers, why it may appeal to business owners and investors, what it does well, and how to evaluate it with disciplined due diligence.

Why Tax Residency Now Affects Banking, Deals, And Wealth Planning

Tax residency used to feel like a personal topic. Today it functions like an institutional filter. Compliance teams want consistency, because regulators expect it.

If your residency looks unclear, you can face:

- Slower onboarding at private banks and brokerages

- Higher risk ratings and deeper source-of-funds reviews

- Delays in closing transactions and moving capital

- More questions during audits, exits, or liquidity events

- Complications in succession and family planning across borders

For HNWIs, these frictions cost time, optionality, and sometimes reputation. That is why residency planning has moved from tax optimization to operational readiness.

What Próspera Is, In Plain Terms

Próspera operates within a special economic framework in Honduras designed to support a distinct administrative and regulatory environment. Próspera positions itself as a modern, digital-first jurisdiction with systems intended to simplify setup and compliance for international entrepreneurs and investors.

You do not need to be a policy expert to evaluate the program. You only need to focus on what matters for wealth planning:

- The legal basis that supports the framework

- The requirements you must meet each year

- The documentation you receive and can present to third parties

- The stability and durability of the structure over time

Those four points should drive your decision.

The Core Promise: A $5,000 Annual Lump-Sum Income Tax

The headline feature is the annual $5,000 payment described as a lump-sum approach to income tax within the program’s scope. That creates predictability. Predictability matters to founders and investors because it improves planning and reduces surprises.

However, sophisticated clients should evaluate the program as a package, not as a price tag. The real question is not Is $5,000 low. The real question is Does this framework help me prove and maintain tax residency in a way that holds up under scrutiny.

What You Must Do To Qualify And Stay Compliant

Próspera’s program uses a small set of requirements that aim to create visible ties and a more credible residency position. From a compliance standpoint, simple rules can work well because they are easy to document and repeat.

Key requirements include:

- A declaration that you do not hold tax residency elsewhere, and you will not create tax residency in another country during the relevant period

- Creation and maintenance of a Próspera-registered business entity

- A minimum physical presence requirement of seven days per year

- Completion of onboarding steps, including identity and compliance checks, through the program process

- Payment of the annual lump sum and adherence to program timelines

For business owners, the entity requirement can serve more than one purpose. It can support an administrative footprint, and it can align with real commercial needs such as contracting, invoicing, or holding certain business activities in a structured vehicle.

For investors, the presence rule can strengthen the residency narrative because it creates a measurable, repeatable connection.

Why The Structure Supports Trust And Authentication

HNWIs care about more than legality. They care about recognizability. A framework can be legal and still fail in the real world if it looks too thin for banks and counterparties.

This program includes several elements that support trust:

- A formal process that leads to an official tax residency certificate

- A defined annual presence rule that you can document

- An entity requirement that creates an administrative and economic footprint

- A repeatable annual payment that supports a consistent narrative

These features can help you move from I claim residency to I can prove residency. That difference matters in enhanced due diligence.

This is also why the program can be viewed positively. It aims to build authentication into the design, rather than relying on vague self-declarations.

What The $5,000 Covers And What It Does Not Cover

Clear planning requires clear boundaries. The annual payment relates to income tax within the program’s scope as described. Yet other taxes and fees can still apply depending on your activities and assets.

You should plan for potential additional obligations such as:

- Consumption taxes, where applicable

- Property-related taxes if you hold qualifying assets

- Regulatory or administrative fees connected to maintaining an entity

- Filing requirements tied to business activity and reporting standards

A disciplined client separates the analysis into three buckets:

- What you owe

- What you must file

- What evidence you must keep

This approach prevents surprise compliance, which is one of the most common causes of stress for global families.

Who This Program May Suit Best

This model can fit well for clients who live internationally and want a cleaner, more documented residency story.

It may suit:

- Founders who operate remotely and want predictable obligations

- Investors who split time across jurisdictions and need stronger documentation for banking and deal execution

- Business owners who can use a structured entity for contracts or holdings

- Globally mobile families who can meet the annual presence requirement without disrupting life

Practical reasons HNWIs may like it:

- Predictable annual cost that supports cash flow planning

- Defined rules that are easier to document than complex center-of-life arguments

- A certificate that can support banking and compliance conversations

- A framework that encourages consistency and repeatability

Who Should Approach With Caution

Residency does not live on paper. It lives in your calendar, your homes, and your family ties. If your real life anchors you elsewhere, another country may still argue you are resident there.

This requires caution for:

- Clients who spend substantial time in high-tax countries that apply strict day-count or habitual abode tests

- Clients with a primary home, spouse, or minor children living in another jurisdiction

- Clients who frequently return to the same country and maintain strong social and economic ties there

- Clients who want a passive solution but do not want to track travel and maintain documentation

Common mistakes that create risk:

- Treating a certificate as a universal shield

- Ignoring day counts and local residency triggers in other countries

- Keeping a main home elsewhere while claiming residency here

- Failing to document travel, accommodation, and ties consistently

A strong residency plan needs alignment between paperwork and behavior.

The Due Diligence Checklist Serious Investors Should Use

HNWIs should evaluate this like any investment decision. That means asking hard questions early and documenting answers.

Legal and structural diligence:

- What legal framework supports the program, and how has it evolved

- What authority issues the tax residency certificate, and what it states

- What contractual terms govern participation, renewal, and termination

- What dispute resolution mechanisms exist

Practical compliance diligence:

- What documents you must keep to support residency

- How you will prove the seven-day annual presence

- What entity filings you must complete each year

- What recordkeeping supports banking and audit readiness

Cross-border interaction diligence:

- Where you spend time, and what residency tests those countries apply

- Where your permanent homes exist and who lives there

- Where your business management and control occurs

- Whether your overall structure creates reporting obligations elsewhere

If you complete these checks, you reduce the chance of building a plan that fails at the first compliance review.

How HNWIs Can Make The Program Stronger In Practice

If you choose to pursue a residency framework like this, the best results come from strengthening substance and documentation.

Practical steps that can help include:

- Keeping a clean travel log and saving entry and exit evidence

- Maintaining a clear residential narrative that matches your calendar

- Aligning your entity activity with real commercial purpose

- Creating a bank-ready residency packet with certificate, proof of presence, entity records, and supporting statements

- Coordinating filings and professional advice so your story stays consistent across jurisdictions

For founders, structure matters as much as the program. Where you sign contracts, where you manage teams, and where you direct strategy can influence how other countries view your tax position. Planning should reflect real operations.

Why This Connects To Long-Term Mobility And Citizenship Planning

Residency often solves a near-term need: a place to stand for tax and compliance. Citizenship can add long-term resilience: deeper mobility, stronger permanence, and diversified optionality.

For many HNWIs, the smartest approach blends both.

A clear residency framework can reduce immediate friction. A well-structured citizenship strategy can diversify geopolitical risk, protect family mobility, and reduce dependence on a single jurisdiction’s policy direction.

This blog does not suggest a one-size-fits-all path. It suggests a layered mindset. Serious wealth planning works best when each layer supports the next.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

The Bottom Line For Globally Mobile Wealth

Próspera $5,000 lump-sum tax residency stands out because it aims to turn modern mobility into a clearer compliance story. It combines predictable annual obligations with defined requirements and documentation that can support trust and authentication for HNWIs, founders, and investors. If your lifestyle facts support the residency position, and if you complete proper due diligence, this framework can reduce friction in banking, deal execution, and cross-border planning. Próspera $5,000 lump-sum tax residency can also fit into a broader strategy that includes long-term mobility and citizenship planning, which many sophisticated families now treat as essential risk management.

A Confidential Roadmap For Your Residency And Mobility Strategy

If you want a private, investor-grade review of your tax residency exposure, banking readiness, and long-term mobility options, we can help. Our team supports HNWIs, business owners, and investors with structured residency planning and citizenship-by-investment strategies designed for clarity, compliance, and long-term optionality.

Contact us to schedule a confidential consultation and receive a tailored roadmap.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

30% Limited Time Discount on Nauru Citizenship Contribution

Nauru reshaped its citizenship program with lower fees, broader family inclusion, and a limited time 30% contribution discount through June…

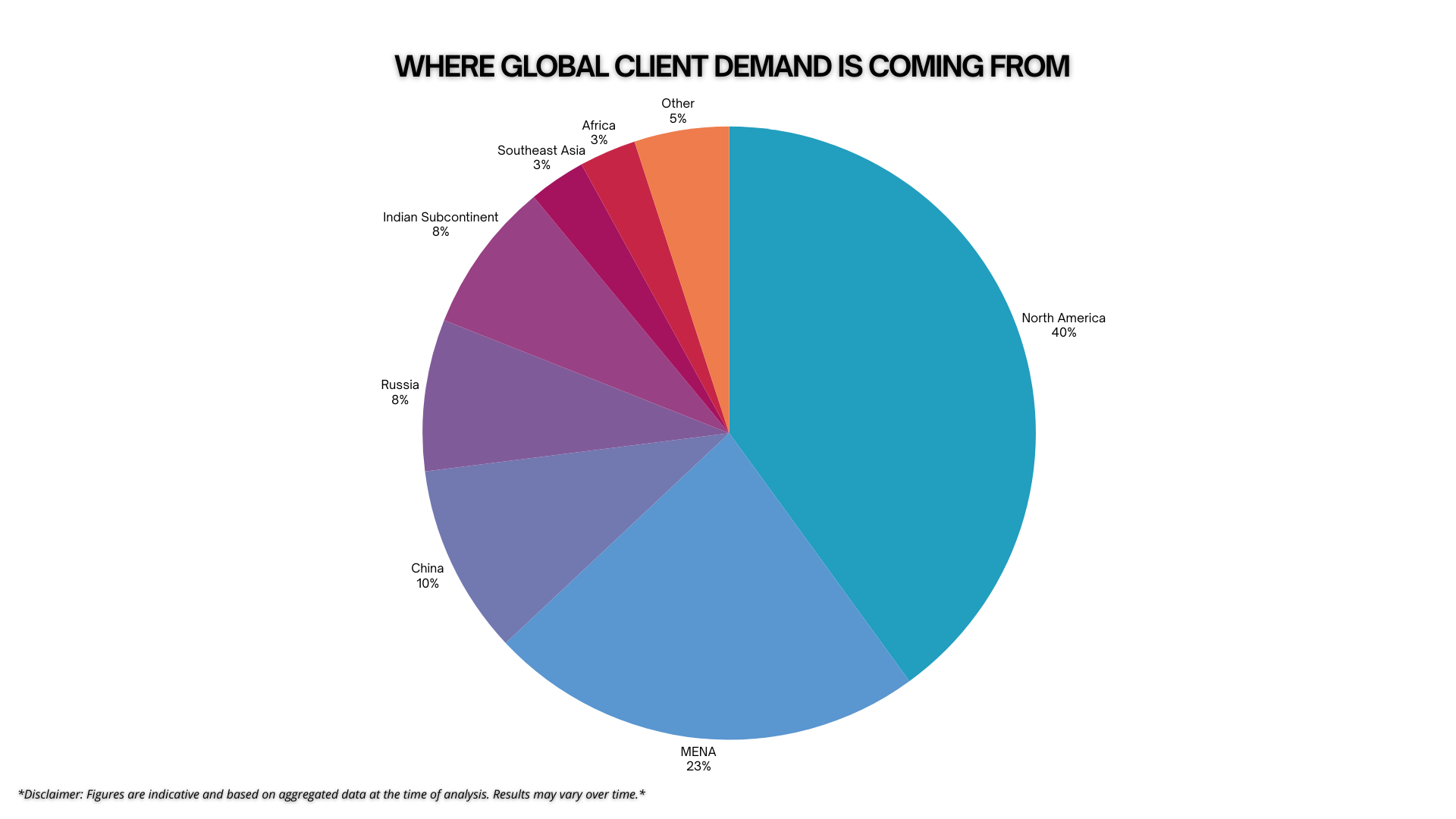

Americans Take the Lead in Global Investment Migration

Americans now lead global demand for investment migration. This shift reflects strategic planning, trust in structured programs, and a mature…

70% of High Earners Reevaluate Tax Driven Moves Globally

Many high earners move domestically to reduce taxes, only to later reassess their strategy. This shift reflects experience, not failure….

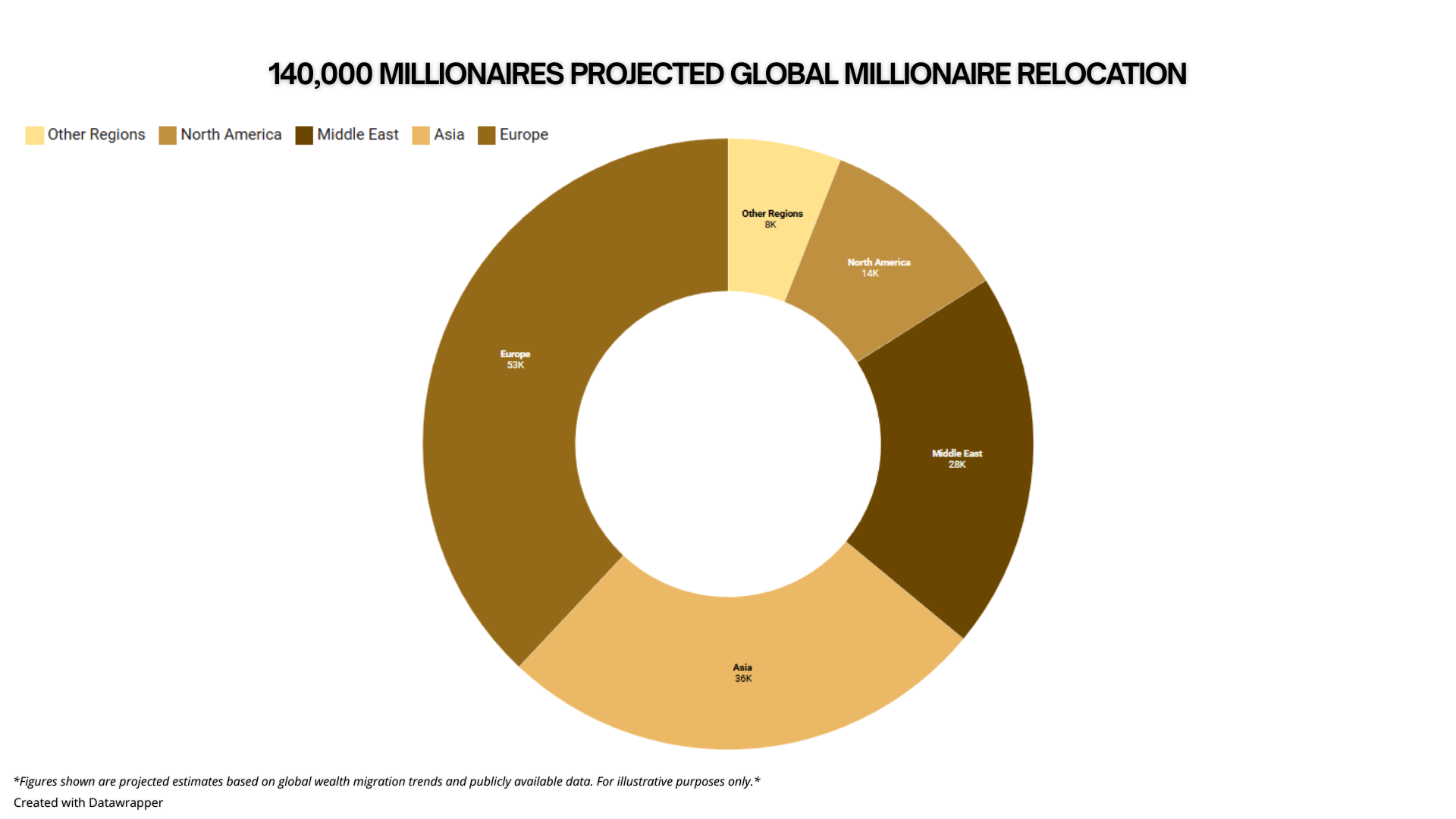

Portugal Leads Europe as 140,000 Millionaires Relocate Globally

More than 140,000 millionaires are projected to relocate globally, with Portugal leading Europe as a preferred destination. This shift reflects…

The Hidden Cost of Staying in High-Tax Countries for Wealth

Staying in a high-tax country could cost you more than just money, it could cost you opportunity, legacy, and control….

$5 Billion in Bilateral Trade Targeted Between Nigeria and Türkiye

Nigeria and Türkiye are deepening economic ties with a $5 billion annual trade target. This strategic move signals trust, investor…