70% of High Earners Reevaluate Tax Driven Moves Globally

Global wealth mobility has become a defining priority for high earners, business owners, and investors who are rethinking domestic tax driven relocation strategies. Over the last decade, many have relocated within their home countries to reduce taxes, gain more freedom, or improve their quality of life. Yet a growing trend has emerged. A significant share of high earners who make these domestic moves later reassess their decision and consider moving again.

This shift is not a warning sign. It is a sign of sophistication.

Reevaluation shows experience, discernment, and a deeper understanding of what truly drives long-term success. For globally minded individuals, it often marks the moment when thinking evolves from local optimization to strategic global planning.

This article explains why tax-driven domestic moves frequently fall short, why reassessment is a positive step, and how global residence and citizenship strategies align better with the priorities of today’s most successful individuals.

The Rise of Domestic Tax Relocation

Domestic relocation has become a common strategy among high earners. The logic appears simple. Move from a high-tax jurisdiction to a lower-tax state or province and keep more of what you earn.

In theory, this approach promises:

- Lower state or regional income taxes

- Reduced local regulation

- A lifestyle perceived as more aligned with personal values

For some individuals, especially those earlier in their wealth journey, this can provide short-term relief. However, as income grows and lives become more complex, many discover that domestic moves solve only part of the problem.

Experience quickly reveals the limits of this strategy.

Why Domestic Moves Deliver Limited Tax Impact

The first reality many high earners face is structural. In countries with centralized tax systems, federal taxation remains unchanged regardless of where you live domestically.

For example:

- Top federal income tax rates apply nationwide

- Social contributions and payroll taxes remain fixed

- Investment and business income often face uniform treatment

As a result, the actual reduction in total tax burden is often modest. For high earners, the difference between regions may feel meaningful emotionally, but it represents a small percentage of overall taxation.

Sophisticated individuals notice this quickly. Once the numbers are clear, attention naturally shifts from marginal savings to broader questions about efficiency, scalability, and long-term outcomes.

Culture, Lifestyle, and Alignment Matter More Than Expected

Tax considerations rarely exist in isolation. Domestic moves also introduce cultural and lifestyle changes that many underestimate.

Even within the same country, regions differ in:

- Social norms and communication styles

- Business culture and professional networks

- Education systems and community expectations

High performers tend to value momentum, familiarity, and strong networks. When cultural alignment feels off, friction builds. Productivity can suffer. Family satisfaction may decline. Over time, these factors outweigh modest tax savings.

Reevaluation often follows not because the move failed, but because priorities became clearer through experience.

Reevaluation Reflects Strategic Maturity

When high earners reconsider a domestic tax move, it signals growth. It shows the individual now evaluates decisions through a wider lens.

This maturity includes recognizing that:

- Taxes are only one component of wealth strategy

- Lifestyle stability affects performance and well-being

- Optionality matters more than short-term gains

Experienced investors constantly refine their strategies. They rebalance portfolios, exit markets, and redeploy capital based on new information. Relocation decisions deserve the same disciplined approach.

Seen through this lens, reevaluation is a strength, not a setback.

The Shift From Local to Global Thinking

Once domestic limitations become clear, many high earners begin thinking globally. This shift happens naturally and logically.

Global planning introduces tools that domestic moves cannot provide, such as:

- Legal exposure to alternative tax systems

- Greater personal and financial mobility

- Jurisdictional diversification for families and assets

Instead of choosing between regions within one system, individuals gain the ability to choose between systems themselves.

This change in perspective often marks a turning point. Planning becomes proactive rather than reactive. Decisions align with long-term vision instead of short-term relief.

Why Global Mobility Appeals to High Performers

High-net-worth individuals share certain traits. They value control, flexibility, and resilience. Global mobility directly supports these priorities.

A well-structured international plan can offer:

- Predictable and transparent tax treatment

- Access to multiple jurisdictions for residence or business

- Greater security against regulatory or political shifts

Importantly, global strategies do not rely on one single country or assumption. They spread risk and create options.

For investors accustomed to diversification, this approach feels intuitive.

Trust and Credibility in International Programs

As interest in global solutions grows, so does scrutiny. High earners demand legitimacy, compliance, and clarity.

The increasing adoption of structured residence and citizenship programs reflects this demand. These programs have matured significantly over time. Governments now emphasize due diligence, transparency, and long-term commitment from participants.

This evolution builds trust. It also reinforces the idea that global mobility is no longer niche or experimental. It is an established planning tool used by informed individuals worldwide.

The fact that many high earners arrive at this conclusion after testing domestic options adds to its credibility. Experience validates the process.

Beyond Taxes: Designing a Sustainable Global Life

For business owners and investors, wealth strategy extends beyond numbers. It includes family, education, succession planning, and lifestyle design.

Global planning supports these goals by allowing individuals to:

- Choose environments aligned with personal values

- Access diverse education systems for children

- Structure businesses across stable jurisdictions

Instead of adapting life to a single system, individuals adapt systems to fit their lives.

This level of alignment often leads to greater satisfaction and performance. When daily life supports long-term goals, decision-making becomes clearer and more confident.

The Importance of Personalization

No two high earners share identical circumstances. Income sources, family size, risk tolerance, and future goals all vary.

Effective global planning reflects this reality. A single entrepreneur requires a different approach than a multi-generational family. Investors with international portfolios face different considerations than operating business owners.

Reevaluation of domestic moves often leads individuals to seek tailored solutions rather than generic answers. This personalization separates serious planning from surface-level strategies.

Learning From Experience, Not Assumptions

Many people begin with domestic relocation because it feels familiar and accessible. That step provides valuable insight. It clarifies assumptions and highlights constraints.

Those insights should not be ignored. Instead, they should inform the next phase of planning.

High performers build success by learning quickly and adjusting decisively. The same principle applies to mobility and wealth structuring.

Experience becomes the foundation for better decisions.

A Broader Definition of Optimization

True optimization goes beyond minimizing a single expense. It balances efficiency, stability, growth, and quality of life.

For high earners, this broader definition includes:

- Legal certainty and compliance

- Geographic flexibility

- Long-term family planning

Domestic moves can initiate this journey, but they rarely complete it. Global strategies provide the full framework.

This is why so many individuals reassess and expand their approach. They seek solutions that scale with success rather than limit it.

Why This Trend Strengthens Global Programs

The fact that many high earners reconsider domestic moves strengthens confidence in international planning. It demonstrates that global strategies attract informed individuals who understand trade-offs and act deliberately.

This dynamic enhances the credibility of residence and citizenship programs. Participants arrive with experience, clarity, and realistic expectations. Governments benefit from committed applicants, while individuals gain reliable options.

Trust builds on both sides.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Looking Ahead: Planning Without Borders

As mobility increases and wealth becomes more international, planning confined to one jurisdiction feels increasingly restrictive. High earners recognize this shift earlier than most.

Reevaluation marks the point where strategy catches up with reality.

The future belongs to individuals who design lives and businesses that operate across borders with confidence and control. Global thinking does not replace domestic identity. It complements it.

Reevaluate Your Long-Term Global Strategy

If you are reassessing a domestic move or questioning whether your current structure truly serves your long-term goals, this is the right moment to think globally. Experienced guidance can help you evaluate options, compare jurisdictions, and design a compliant strategy that aligns with your lifestyle, business, and family needs.

The most effective plans start with clarity and evolve through informed decisions. Consider exploring how global residence and citizenship solutions can fit into your broader wealth strategy and provide the flexibility that high performance demands.

For those ready to think beyond borders, global wealth mobility offers a more resilient, flexible, and future-focused approach to building and protecting long-term prosperity.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

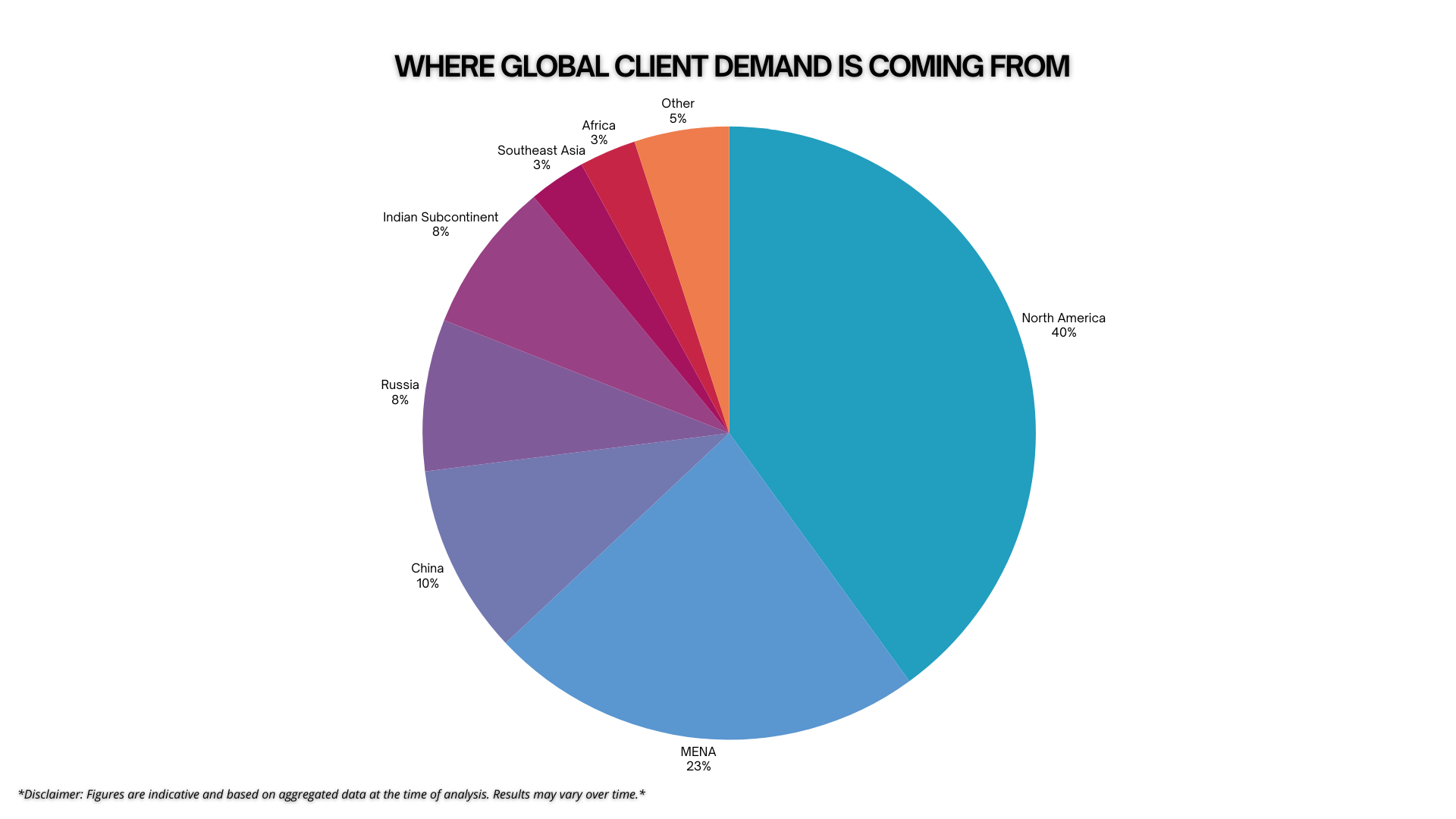

Americans Take the Lead in Global Investment Migration

Americans now lead global demand for investment migration. This shift reflects strategic planning, trust in structured programs, and a mature…

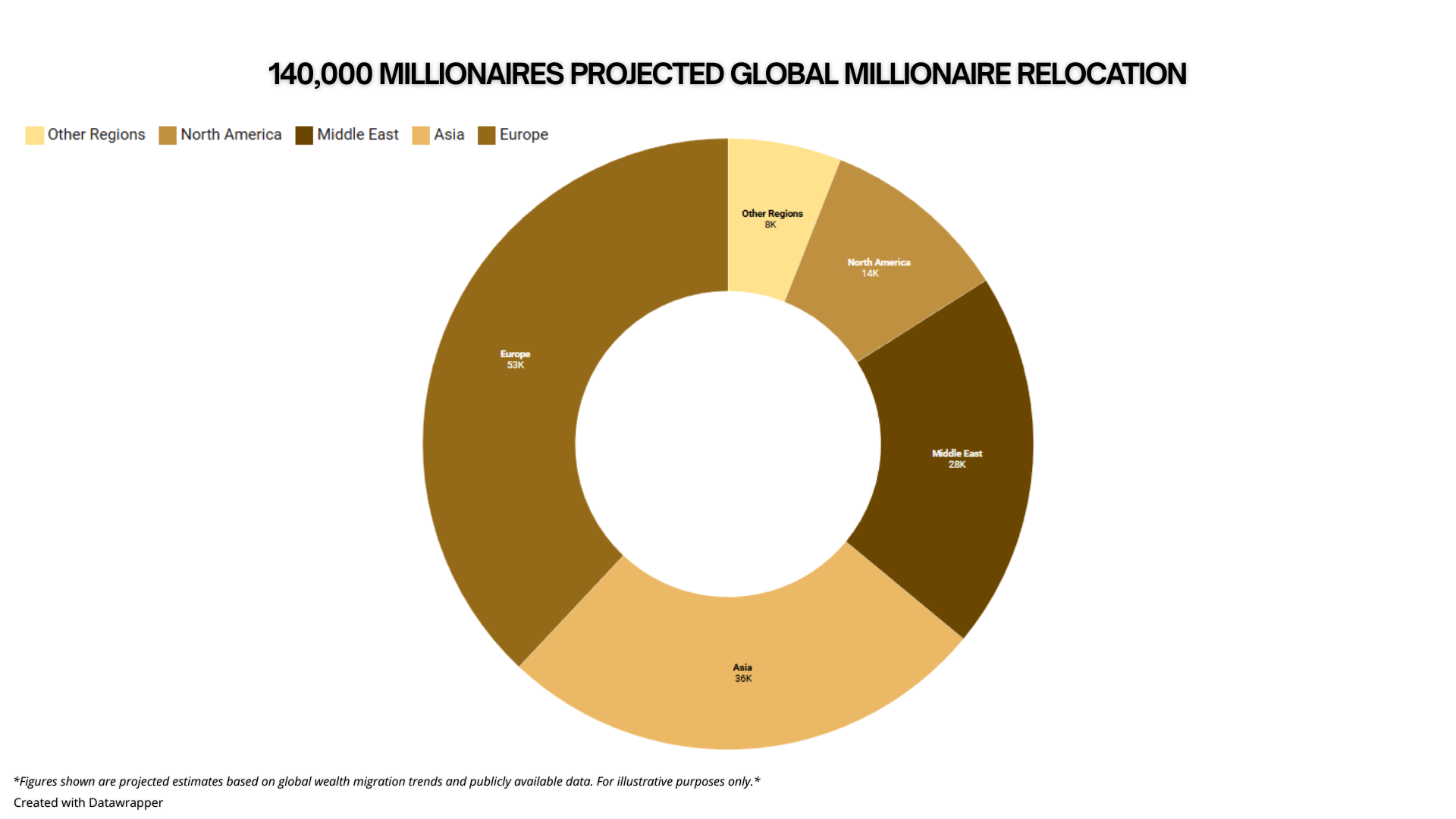

Portugal Leads Europe as 140,000 Millionaires Relocate Globally

More than 140,000 millionaires are projected to relocate globally, with Portugal leading Europe as a preferred destination. This shift reflects…

The Hidden Cost of Staying in High-Tax Countries for Wealth

Staying in a high-tax country could cost you more than just money, it could cost you opportunity, legacy, and control….

$5 Billion in Bilateral Trade Targeted Between Nigeria and Türkiye

Nigeria and Türkiye are deepening economic ties with a $5 billion annual trade target. This strategic move signals trust, investor…

Why Europe Is Tightening Control Over Wealth and Tax Freedom

Governments across Europe are taking a tougher stance on wealth, mobility, and personal tax planning. As proposals tighten, successful investors…

The Hidden Strength Behind CBI Real Estate Resale Rules

CBI real estate resale rules are often misunderstood. Rather than a drawback, these rules provide structure, preserve market stability, and…