62% of the Wealthy Are Strategically Planning Their Exit

Across Europe and beyond, high-net-worth individuals (HNWIs) are quietly preparing for a future that looks vastly different from the one they once expected. While traditional assumptions held that wealth would guarantee comfort and mobility within the world’s most developed countries, that picture is rapidly changing.

Today, the wealthy are not only seeking new investments and business opportunities, they’re actively reassessing their citizenships, tax residences, and legal affiliations.

According to recent data, 62% of millionaires plan to relocate for tax or freedom reasons within the next five years. This is not a passing trend, it’s a deliberate response to political, financial, and legislative developments that are reshaping the relationship between governments and wealth creators.

Let’s examine the details of this promising program and why it may be worth considering.

The New Reality for HNWIs in Europe

In recent months, countries like France and the Netherlands have been at the forefront of an EU initiative to restrict the tax flexibility of individuals who move abroad. These efforts include plans to:

- Crack down on individuals who relocate to take advantage of lower tax jurisdictions

- Monitor and report tax residency changes

- Penalize those who leave through “exit taxes”

- Impose ongoing tax obligations on former residents

At the heart of these measures is a growing belief that the wealthy should not be free to structure their financial lives in more favorable environments. This is not just about closing tax loopholes, it’s about limiting personal freedom in the name of “solidarity.”

But for many successful entrepreneurs, investors, and business owners, the issue isn’t about avoiding responsibility. It’s about preserving autonomy, protecting capital, and choosing jurisdictions that reward success rather than punish it.

Control Is Replacing Competition

In past decades, countries competed to attract capital and talent through better tax policy, faster bureaucratic processing, and more favorable regulatory climates. That spirit of competition helped spur innovation, build infrastructure, and create opportunities globally.

Now, some governments are shifting their approach. Rather than making themselves more attractive to global citizens, they are aiming to restrict exits and impose higher obligations on those who seek better alternatives.

This change is driven by two key factors:

- Mounting government debt: Many countries have fiscal deficits that require funding. The wealthy are viewed as a solution.

- Political pressure: Populist narratives increasingly pit wealth creators against the public good, casting relocation or tax planning as disloyal or unjust.

These developments make it essential for successful individuals to stay ahead of the curve.

What Does Strategic Exit Planning Look Like?

Strategic exit planning isn’t simply about changing residence. It’s about creating a flexible, secure, and sustainable lifestyle structure that protects freedom, wealth, and mobility.

This typically includes:

- Second citizenships in neutral or tax-friendly jurisdictions

- Residency-by-investment options that offer freedom of movement without full taxation

- Banking and asset relocation to diversified international institutions

- Tax domicile strategies that comply with international laws while reducing exposure

- Legacy planning that ensures heirs inherit a globally portable lifestyle

It’s not about abandoning one’s home, it’s about not being dependent on any one system that may turn hostile toward wealth.

Countries That Welcome Success

While some nations tighten their grip on citizens’ financial lives, others are building reputations as havens for investors and innovators.

For example:

- Italy offers a lump-sum tax regime where HNWIs pay a fixed amount regardless of income level, currently around €100,000–€300,000 annually.

- Greece and Portugal provide tax-friendly residence permits and lifestyle benefits that appeal to both retirees and active business owners.

- Caribbean countries such as St. Kitts & Nevis or Dominica provide straightforward paths to citizenship for qualified investors, without global taxation or restrictive financial policies.

These countries understand that attracting high-value residents drives domestic development, innovation, and employment. More importantly, they treat global citizens with respect rather than suspicion.

The Role of Citizenship in Wealth Planning

In a globalized world, a passport is more than just a travel document. It’s a symbol of the rights, and responsibilities, you carry.

For many HNWIs, holding only one passport has become a liability. Governments are increasingly tying taxation, surveillance, and compliance to citizenship. In extreme cases, policies like citizenship-based taxation (as practiced by the U.S.) are being considered by other nations as well.

That’s why wealthy individuals are acquiring alternative citizenships. These additional legal identities offer:

- Geographic flexibility

- Legal protection

- Enhanced privacy

- Improved access to markets and financial institutions

Owning a second passport allows you to make choices based on opportunity rather than obligation.

Debunking the Myth of Disloyalty

One of the most common critiques of HNWIs relocating or acquiring new citizenships is that it reflects a lack of loyalty. But this argument overlooks a crucial point: loyalty must be mutual.

When governments increase taxes, restrict movement, or impose post-exit penalties, they change the implicit contract between citizen and state. In this new climate, individuals are not leaving because they don’t care. They’re leaving because they are no longer welcome, at least not as they are.

Choosing to relocate or diversify citizenship is not a betrayal. It’s a practical response to policies that treat success as a liability.

Timing Is Everything

While policies are tightening, opportunities still exist. The key is acting before your options become limited. The longer you wait to build a plan B, the more difficult and expensive it becomes to implement.

For example:

- Exit taxes may apply retroactively to appreciated assets

- New rules may restrict dual citizenship or impose renunciation penalties

- Some golden visa programs may close or raise investment thresholds

- Countries may begin extending tax obligations years after relocation

By planning now, you not only avoid these complications, you gain time to find the right combination of residences, citizenships, and structures that support your goals.

Building a Resilient Global Lifestyle

Successful people don’t rely on one income stream, and increasingly, they don’t rely on one passport either.

Just as you diversify your investments, your legal and tax exposure should also be diversified. This means:

- Having at least two citizenships from non-aligned countries

- Establishing a primary residence in a low-tax or territorial tax nation

- Maintaining business structures across safe, stable jurisdictions

- Opening banking relationships in countries with strong legal systems

This approach doesn’t just shield you from financial risk, it protects your freedom of movement, your privacy, and your ability to respond to global changes.

Where the Wealthy Are Moving

Trends show increasing interest in:

- Southern Europe: Countries like Italy, Greece, and Portugal for lifestyle and tax advantages

- The Caribbean: For fast-track citizenship and favorable tax treatment

- Latin America: For cost-effective second residencies and naturalization routes

- Asia and the Middle East: For business-friendly regulations, especially in the UAE, Malaysia, and Singapore

These destinations offer more than lower taxes. They represent systems that are working to attract, not repel, global citizens.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Strategic Freedom Starts with a Choice

In today’s world, mobility is a form of protection. It is also an expression of freedom. The wealthy understand that staying locked into one legal identity or one nation-state is no longer sustainable in a global economy.

Instead, they are using their resources not just to grow wealth, but to protect and enjoy it.

As governments tighten controls and increase their demands, individuals who are prepared with legal, diversified alternatives will be best positioned to maintain not just their net worth, but their autonomy.

Take the Next Step

Your wealth gives you the power to choose. Use that power wisely. Now is the time to evaluate where your passport, your residency, and your assets are taking you, and whether they align with your values and your future.

If you’re ready to start building a plan that gives you more freedom, greater flexibility, and stronger protection for your assets, the next step is simple: take action before you’re forced to.

Begin building your global exit strategy today.

Share this blog

Frequently Asked Questions

Related Articles

Why Greece Is Becoming a Top Destination for Wealthy Investors

Greece is attracting global attention for all the right reasons, economic stability, lifestyle, and strategic investment opportunities. With 1,200 millionaires…

27 Approvals in 4 Months for São Tomé and Príncipe

São Tomé and Príncipe’s Citizenship by Investment program has taken off with 27 approvals in just 4 months. This efficient,…

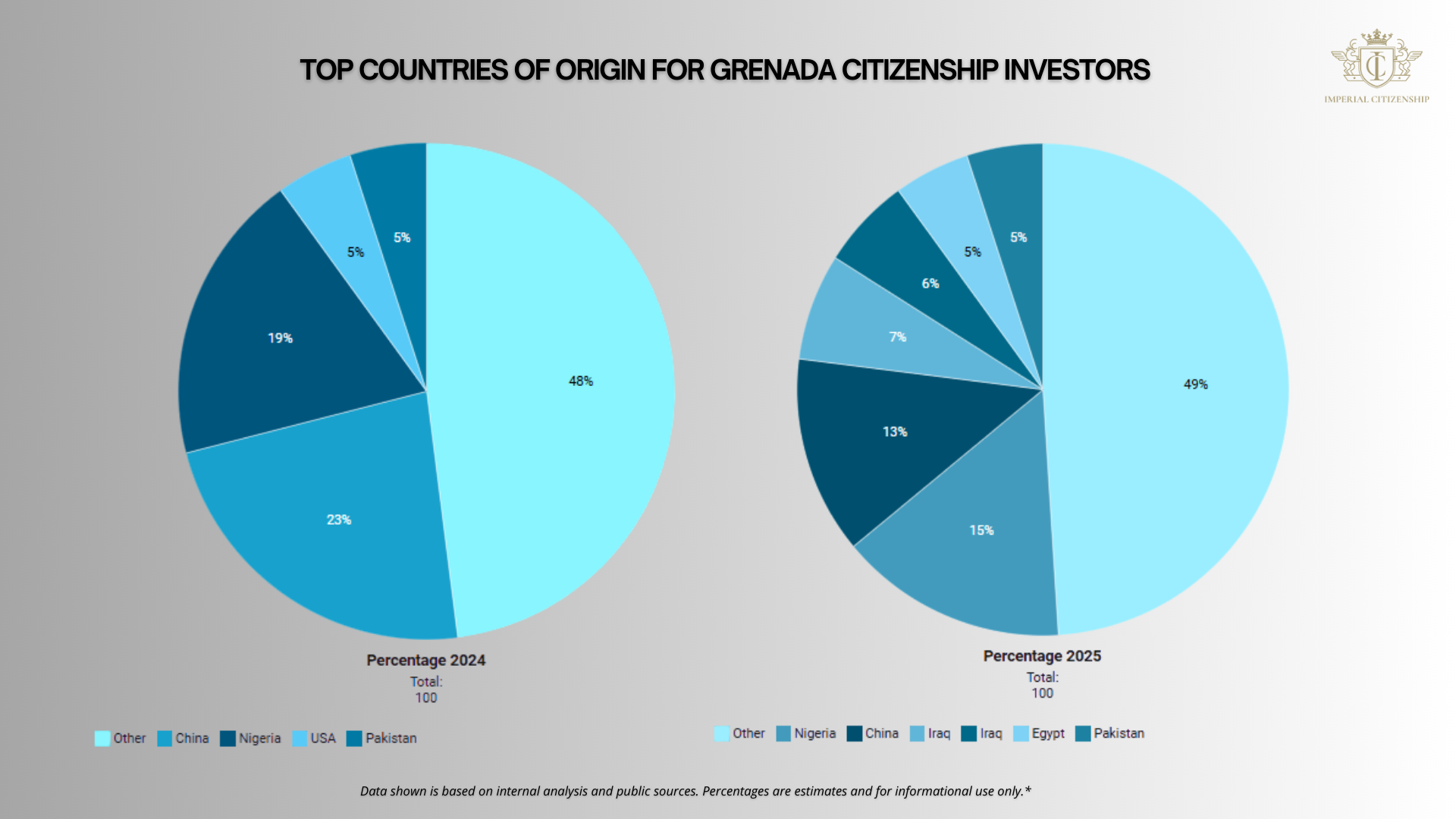

Grenada Citizenship by Investment: A Quiet Giant for Global Investors

Grenada’s Citizenship by Investment Program continues to attract global investors in 2025 with strategic benefits like US E-2 visa access,…

Gold Card vs EB-5: Which Is the Smarter U.S. Investment?

We compare the U.S. Gold Card and EB-5 programs for investors seeking smart, secure residency options. Learn how each option…

U.S. Tightens Immigrant Visa Access for High-Risk Nationalities

The new U.S. immigrant visa suspension policy starting in 2026 signals a major shift in global mobility. For HNWIs and…

80% of Global Trade Routes Are Shifting, Act Strategically

Global trade is being redefined. With over 80% of trade routes shifting, high-net-worth individuals and investors must rethink access, mobility,…