Gold Card vs EB-5: Which Is the Smarter U.S. Investment?

As global mobility becomes an essential tool for wealth preservation and expansion, more investors are evaluating strategic immigration routes. Two prominent U.S. residency options have gained attention: the long-established EB-5 Immigrant Investor Program and the recently introduced Gold Card. Both offer pathways to a U.S. green card, but when examined closely, they reveal very different implications for long-term wealth planning. This comparison, Gold Card vs EB-5, matters greatly for those prioritizing legal certainty, family protection, and financial efficiency.

For high-net-worth individuals (HNWIs), entrepreneurs, and global families, this decision is not just about immigration, it’s about future-proofing assets and securing opportunity across generations.

Understanding the EB-5 Program

The EB-5 Immigrant Investor Program was established by U.S. Congress in 1990 to stimulate economic growth. It allows foreign nationals to obtain U.S. permanent residency by investing in qualifying commercial enterprises that create U.S. jobs.

Core Features:

- Investment Requirement: $800,000 in a Targeted Employment Area (TEA) or $1,050,000 elsewhere.

- Job Creation: Must create or preserve 10 full-time U.S. jobs.

- Family Coverage: One investment includes the investor, spouse, and unmarried children under 21.

- Residency Process: Investors receive a conditional green card (2 years), then apply to remove conditions for permanent residency.

The EB-5 is backed by legislation and governed by a defined regulatory structure, offering consistency, transparency, and legal protection.

Introducing the Gold Card

Launched by executive order in 2026, the Gold Card is a new U.S. immigration pathway allowing foreign nationals to acquire permanent residency through a one-time $1 million donation to the U.S. government.

Key Elements:

- Cost: $1 million donation per person.

- No Business or Job Creation Required.

- No Return on Capital: The donation is non-refundable.

- Legal Framework: Created via executive order, not passed by Congress.

- Family Rule: Each dependent must donate separately, increasing total cost significantly.

Though it offers simplicity, the Gold Card raises concerns about permanence, cost efficiency, and legal foundation.

Legal Structure and Program Stability

The EB-5 program is based on U.S. law and must go through Congress for any major changes. It has undergone periods of reform, but those reforms happen through structured, public processes that include input from legal, economic, and immigration experts.

The Gold Card, by contrast, was created through executive action. This means:

- It could be amended, paused, or eliminated by any future president.

- It lacks a formal legislative or regulatory process.

- Legal challenges could jeopardize its continuation.

For investors seeking security, the EB-5 offers significantly more legal stability.

Financial Analysis: Donation vs Investment

| Feature | EB-5 | Gold Card |

|---|---|---|

| Required Capital | $800,000 (TEA) | $1,000,000 donation |

| Return Potential | Yes | None |

| Family Inclusion | One investment covers all | Separate $1M donation per person |

| Risk | Investment risk (with due diligence) | Political and legal risk |

| Wealth Strategy | Capital at work | Capital lost upon donation |

For a family of four, the Gold Card means $4 million in non-refundable donations. The EB-5 route requires only one $800,000 investment, often with potential for return, assuming the project meets USCIS requirements.

Timing and Visa Backlogs

Timelines are often a deciding factor, but they depend on two elements: processing speed and visa quota availability.

EB-5:

- TEA investments currently face no backlogs.

- Rural investments may qualify for expedited processing.

- Adjustment of status is typically available, allowing applicants in the U.S. to stay, work, and travel while waiting.

Gold Card:

- Applications are processed under the EB-1 or EB-2 visa categories, both of which face significant backlogs, especially for India and China.

- The influx of Gold Card applicants may worsen these delays.

- Adjustment of status may not be available based on current government forms, requiring applicants to wait outside the U.S.

So, while the Gold Card promises fast initial approval, actual U.S. entry could be delayed by quota constraints.

Source of Funds and Documentation

Both programs require lawful source of funds documentation, but the burden is heavier with the Gold Card.

- EB-5: Only the principal applicant must document the source and path of funds.

- Gold Card: Each individual making a donation, including dependents, must submit proof of lawful funds.

This adds complexity for families and increases legal and financial scrutiny.

Residency Conditions and Tax Exposure

Both the EB-5 and Gold Card lead to U.S. permanent residency, meaning global taxation applies.

- EB-5: Begins with a two-year conditional green card, followed by removal of conditions upon fulfilling job creation and investment requirements.

- Gold Card: Grants direct permanent residency but lacks conditional oversight, raising compliance and vetting concerns.

Either way, investors should plan their tax affairs carefully before becoming U.S. residents.

Program Risk and Investor Protection

The EB-5 program has decades of case law, oversight, and process behind it. Projects undergo review by USCIS, and investors are protected through structured compliance requirements.

The Gold Card lacks statutory clarity and is vulnerable to:

- Changes in policy with presidential transitions.

- Legal disputes over its validity.

- Delays or denials due to procedural ambiguities.

Experienced investors value programs built on legal certainty, not political trends.

Why Strategic Investors Still Prefer EB-5

When choosing a residency-by-investment program, smart investors weigh cost, control, and continuity. EB-5 aligns with these principles.

- It creates opportunities for return on investment.

- It includes families under one application.

- It is based on law, not temporary policy.

- It supports U.S. job creation, aligning with government priorities.

- It has a clearer, safer path to long-term immigration success.

While the Gold Card may seem easier at first glance, its underlying risks can outweigh its conveniences, especially when legacy, family planning, and asset protection are at stake.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Choose the Program That Aligns with Your Vision

The January 2026 U.S. visa suspension policy is just one sign of a deeper shift in global access. If you’re a citizen of a country that may be impacted, or you simply want to ensure you’re never restricted, it’s time to act.

The most effective strategies are built in advance, not under pressure.

Ready to Secure Your U.S. Residency the Right Way?

At Imperial Citizenship, we work exclusively with HNWIs, entrepreneurs, and global families seeking residency and citizenship through investment. Our experts provide project guidance, source-of-funds compliance support, and full legal coordination tailored to your goals.

Your wealth deserves more than a donation. Let it build your legacy.

Contact us today for a private consultation and take the first step toward U.S. residency through investment.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

African Citizenship by Investment for Strategic Global Investors

African citizenship by investment is gaining attention among global investors seeking diversification, mobility, and access to emerging markets. As African…

58% of New Trade Growth Happens Outside the U.S.

58% of New Trade Growth Happens Outside the U.S., marking a structural shift in global economic power. As trade momentum…

CBI in Times of Uncertainty: When One Passport Is Not

Global uncertainty has changed the rules of wealth preservation. In today’s environment, one passport may not provide sufficient protection. This…

Nigeria Dangote Refinery Investment Opportunity for Strategic Investors

Nigeria’s Dangote Refinery investment opportunity reflects growing capital market maturity and infrastructure scale. For high net worth individuals and global…

13 CARICOM Nations Attract Over 1 Billion Dollars from 5

13 CARICOM nations attract over 1 billion dollars from 5 global powers, reinforcing regional credibility and investment stability. Sovereign commitments…

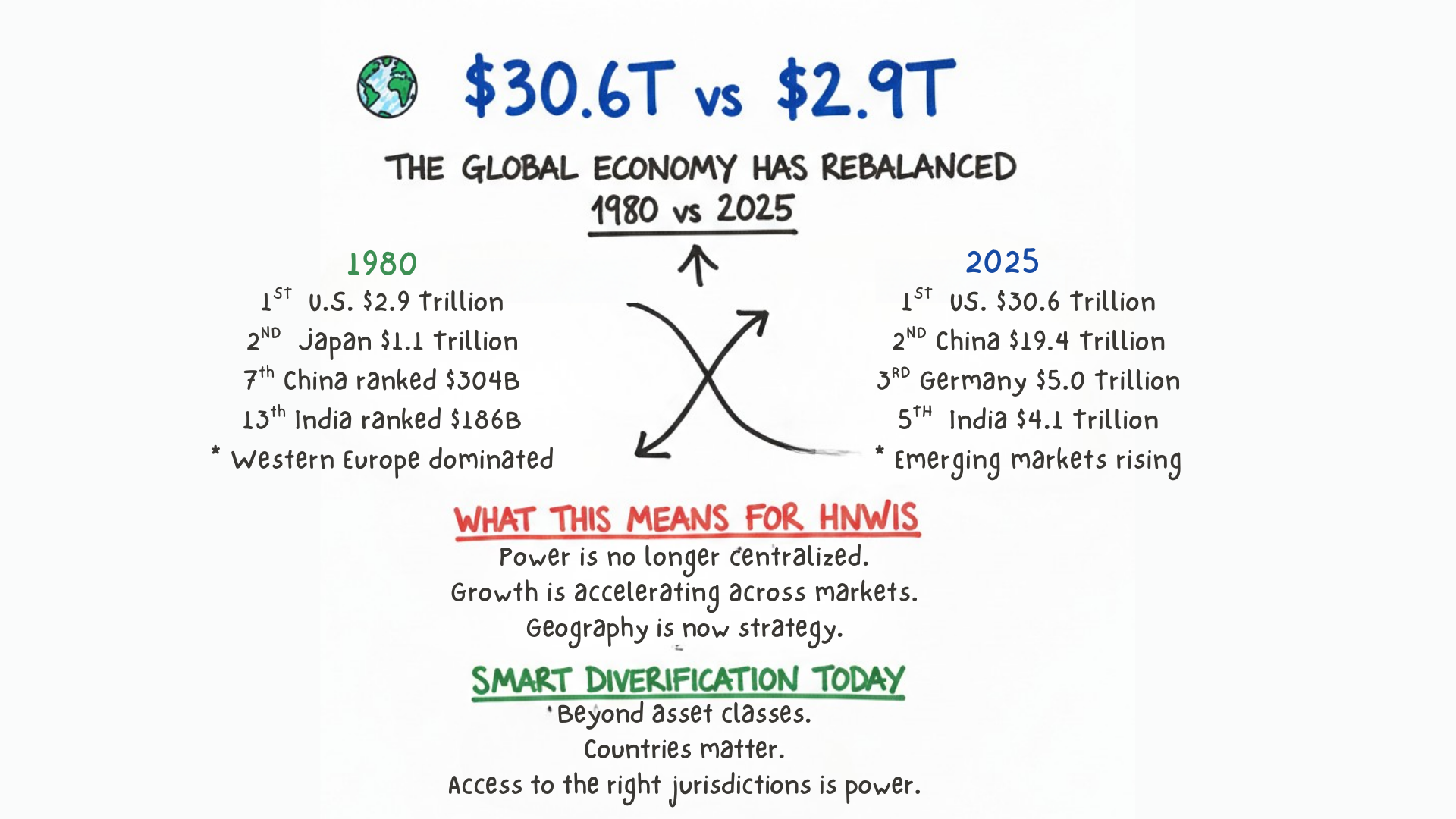

From Western Dominance to a Multipolar Economy (1980–2025)

From 1980 to 2025, global power shifted from Western dominance to a multipolar economy. Economic influence now spans several regions,…