U.S. Tightens Immigrant Visa Access for High-Risk Nationalities

Starting January 21, 2026, the United States will implement a new U.S. immigrant visa suspension policy that directly affects global mobility and immigration strategies for thousands of individuals worldwide. The U.S. Department of State has confirmed it will pause all immigrant visa issuances for certain nationalities considered “at high risk of public benefits usage.”

This policy shift raises critical questions for international investors, entrepreneurs, and high-net-worth individuals who have been considering the U.S. as a destination for immigration, business expansion, or family relocation.

In a world where access is increasingly restricted, and immigration policies grow more selective, it’s essential to understand what this change means, and how to stay ahead of it.

What Changed: Key Points from the New U.S. Policy

The U.S. government has stated it will temporarily suspend immigrant visa processing for individuals from countries identified as having a high likelihood of future public benefits usage. While the list of affected countries has not been officially released, the criteria appear to be based on:

- Historical patterns of public benefits reliance among immigrants

- Socioeconomic indicators of applicants from specific countries

- Overall visa overstay and dependency trends

This move aligns with the broader U.S. government policy of ensuring immigrant self-sufficiency and minimizing strain on public resources. The pause applies to immigrant visa categories, which include family reunification, employment-based green cards, and diversity visas, not temporary (nonimmigrant) visas.

Why This Policy Matters to Global Investors and HNWIs

While this policy is aimed at general immigration categories, its ripple effects are far-reaching, especially for investors and business owners seeking U.S. presence or expansion.

Here’s why it matters:

Restricted Access Impacts Planning

When a country suspends immigrant visa processing, individuals from the affected nationalities lose the ability to enter through standard long-term channels. This limits options for investors wanting to set up businesses, relocate their families, or build long-term residency.

The U.S. Is Still a Strategic Market

Despite rising immigration barriers, the U.S. remains a top destination for business, education, real estate, and innovation. For those who qualify and gain access, it offers strong legal protections, diverse markets, and a high standard of living.

But that access is no longer guaranteed. Investors must now look for secure, alternative pathways that preserve their ability to engage with U.S. markets without being fully dependent on U.S. immigration systems.

Shift Toward Selectivity

This policy reflects a broader global trend: immigration is becoming more selective. Countries are no longer focused solely on welcoming the largest number of immigrants, they’re seeking specific profiles: skilled, wealthy, and self-sufficient individuals who contribute to the economy rather than draw from it.

For globally minded individuals, this demands a new mindset: immigration planning must be treated like investment planning, proactive, diversified, and responsive to risk.

How High-Net-Worth Individuals Should Respond

Rather than waiting to see if your country will be affected or hoping policies reverse, it’s time to take action. Here’s how smart investors and business leaders can respond strategically.

1. Secure Mobility Through Diversification

Mobility is no longer just about ease of travel. It’s about access, flexibility, and leverage in a world of shifting immigration policies.

For HNWIs, this means:

- Acquiring alternative citizenships or permanent residencies

- Establishing legal and financial ties in countries that offer global access

- Structuring wealth and businesses to remain internationally mobile

These strategies ensure that when one door closes, another remains open.

2. Build a Multi-Jurisdictional Strategy

Relying on a single passport or country of residence is increasingly risky. Visa restrictions, travel bans, and policy shifts can leave even the most prepared individuals suddenly immobile.

A multi-jurisdictional strategy includes:

- Holding citizenship in neutral or internationally connected countries

- Banking and investing in stable, business-friendly jurisdictions

- Structuring companies with flexibility to operate across borders

This is especially critical if your current nationality may fall under future visa suspensions or scrutiny.

3. Shift Focus From Residency to Access

Many investors focus heavily on securing permanent residency or green cards, but in a world of changing regulations, access is often more valuable than residency itself.

Consider these access-first approaches:

- Long-term visas in stable countries that offer visa-free travel to key regions

- Business hubs that allow non-resident ownership and operation

- Countries that provide residency rights without requiring full relocation

These alternatives allow you to retain business presence and lifestyle flexibility without immigration entanglements.

Global Trends: U.S. Policy Is Part of a Larger Pattern

It’s important to view this policy in context. The U.S. is not the only country tightening its immigration pathways. Worldwide, we are seeing:

- Europe scaling back or pausing residency-by-investment programs

- Australia limiting skilled migration and adjusting income thresholds

- Canada revising its intake quotas and emphasizing economic self-sufficiency

- Asia adopting stricter investor and entrepreneur visa policies

The common thread? Governments want immigrants who bring value, and who won’t become liabilities to the system.

This trend reinforces the importance of global planning. Those who anticipate change and structure their lives and wealth accordingly will have the greatest freedom in the years ahead.

Considerations for Families and Legacy Planning

For HNW families, the implications go far beyond visa restrictions.

Education Access

Many families choose the U.S. for its world-class educational institutions. If immigration pathways tighten, students may lose access to residency-linked tuition benefits or post-study work rights.

Securing alternative citizenships or long-term access visas in advance can preserve these opportunities.

Inheritance and Wealth Transfer

Tax planning is deeply impacted by where you and your heirs are citizens or residents. U.S. estate tax laws, for example, differ significantly for foreign nationals.

Maintaining citizenship in countries with favorable tax treaties or building trusts across multiple jurisdictions can provide peace of mind.

Healthcare and Lifestyle

Many HNWIs seek to live in countries offering strong healthcare systems and political stability. If your primary nationality becomes restricted, having residency elsewhere ensures continued access to services and a comfortable lifestyle.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Don’t Wait for Policy to Catch Up With You

The January 2026 U.S. visa suspension policy is just one sign of a deeper shift in global access. If you’re a citizen of a country that may be impacted, or you simply want to ensure you’re never restricted, it’s time to act.

The most effective strategies are built in advance, not under pressure.

Move Strategically, Not Reactively

In this new era of migration and mobility, access is power. Whether you’re looking to expand your business, secure your family’s future, or diversify your portfolio across borders, your ability to move freely and legally is your greatest asset.

Global uncertainty rewards those who prepare, diversify, and move early. The U.S. visa update is a reminder: access can disappear quickly, but those with options never lose.

Protect your mobility, your business, and your legacy, before policy makes the decision for you.

Contact us today to explore legal strategies for international positioning, risk management, and global access planning.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

African Citizenship by Investment for Strategic Global Investors

African citizenship by investment is gaining attention among global investors seeking diversification, mobility, and access to emerging markets. As African…

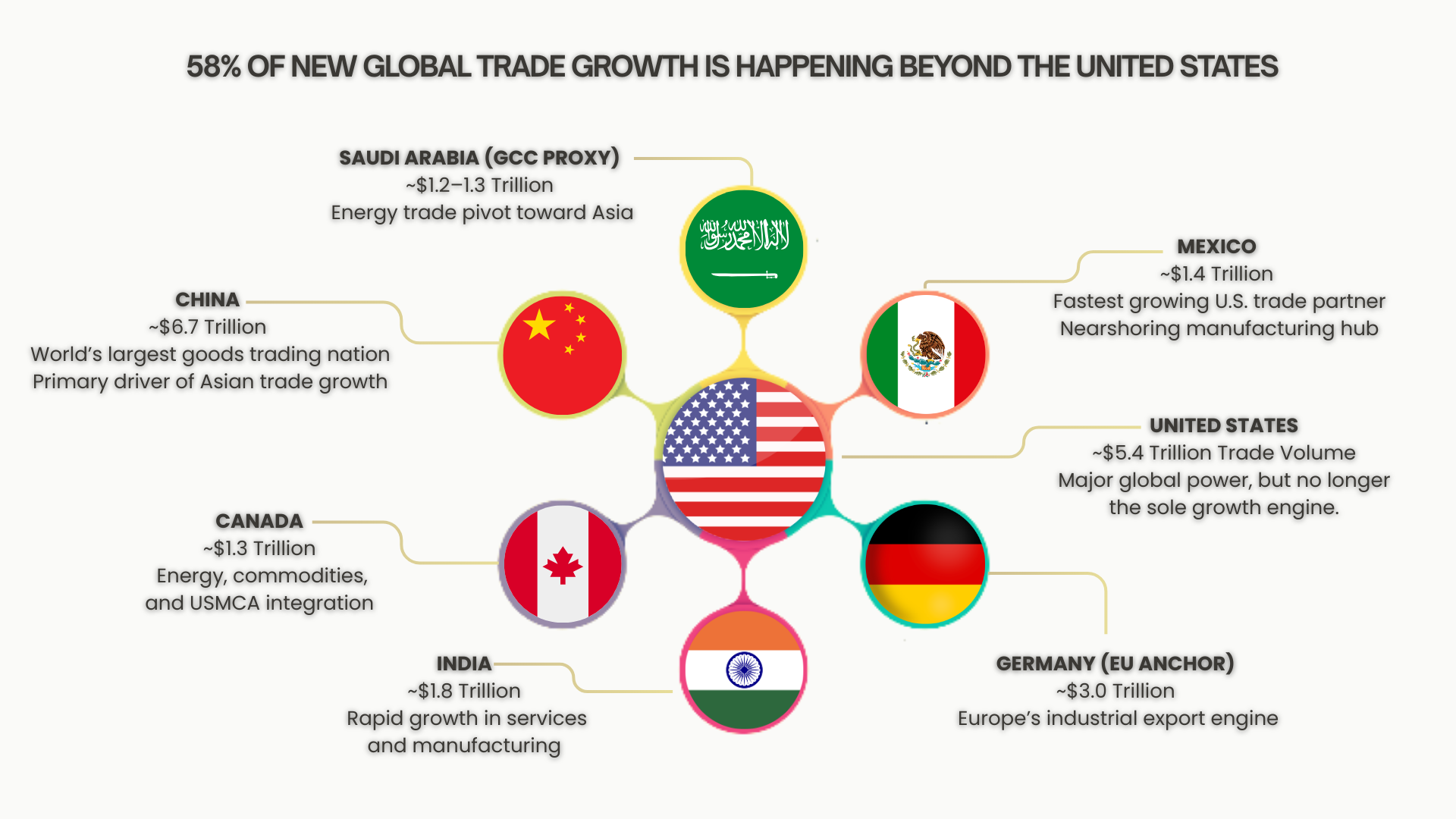

58% of New Trade Growth Happens Outside the U.S.

58% of New Trade Growth Happens Outside the U.S., marking a structural shift in global economic power. As trade momentum…

CBI in Times of Uncertainty: When One Passport Is Not

Global uncertainty has changed the rules of wealth preservation. In today’s environment, one passport may not provide sufficient protection. This…

Nigeria Dangote Refinery Investment Opportunity for Strategic Investors

Nigeria’s Dangote Refinery investment opportunity reflects growing capital market maturity and infrastructure scale. For high net worth individuals and global…

13 CARICOM Nations Attract Over 1 Billion Dollars from 5

13 CARICOM nations attract over 1 billion dollars from 5 global powers, reinforcing regional credibility and investment stability. Sovereign commitments…

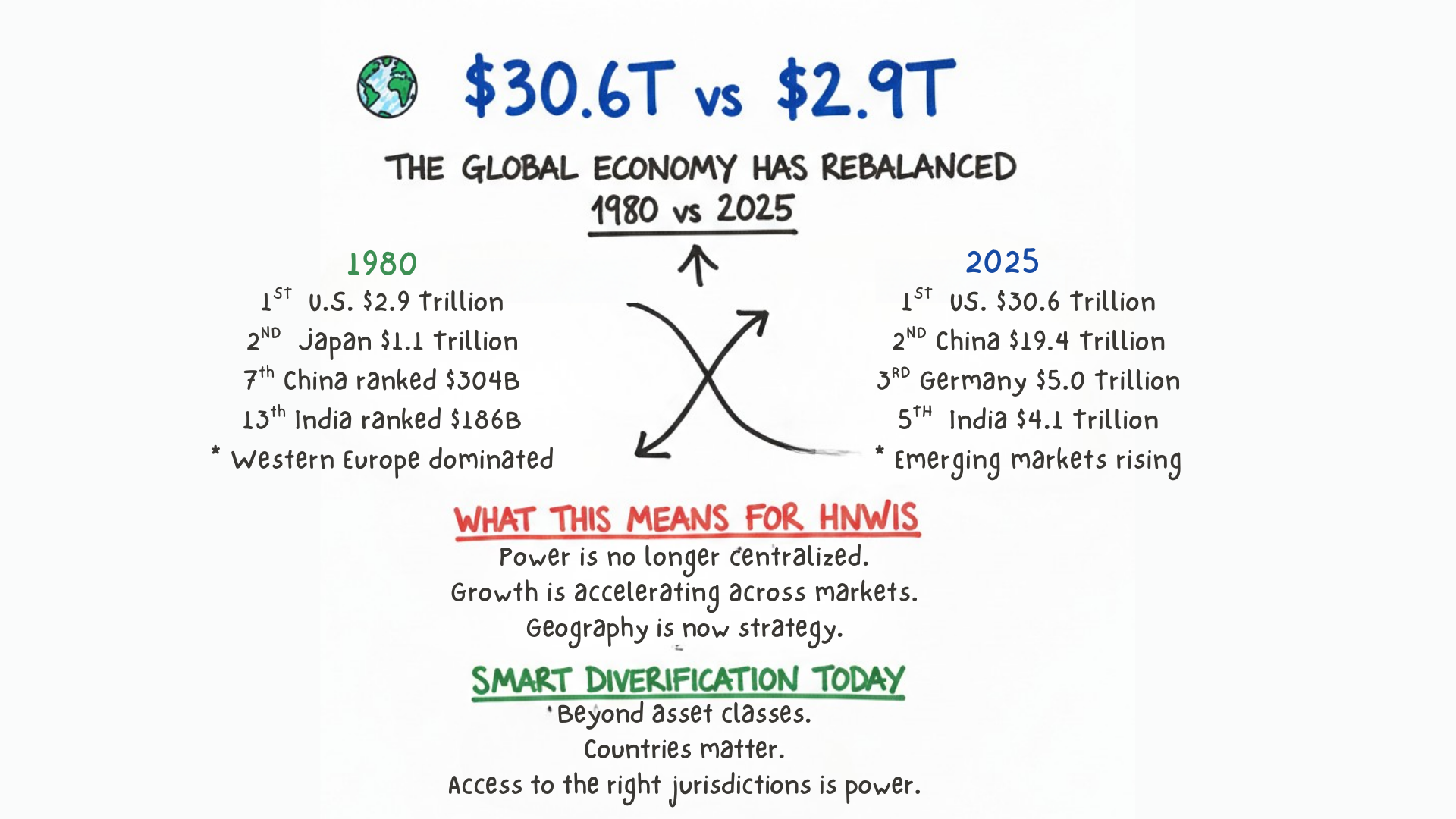

From Western Dominance to a Multipolar Economy (1980–2025)

From 1980 to 2025, global power shifted from Western dominance to a multipolar economy. Economic influence now spans several regions,…