80% of Global Trade Routes Are Shifting, Act Strategically

The world of global commerce is entering a new phase, one where agility, foresight, and strategic positioning matter more than ever. For decades, globalization connected markets, simplified trade, and allowed investors to tap into opportunities across borders with ease. Today, that model is being rewritten by a significant global trade shift that is redefining how and where business gets done.

As of 2026, over 80% of global trade routes are undergoing realignment. Political shifts, economic protectionism, and systemic disruptions are forcing countries and companies to rethink how and where they do business.

For high-net-worth individuals (HNWIs), business owners, and international investors, this isn’t just an economic trend, it’s a direct call to reassess global strategy, risk exposure, and long-term positioning.

Globalization Is Evolving, Not Ending

Globalization hasn’t disappeared, but it’s no longer the all-access system it once was. The free-flowing, interconnected model is now fragmenting into regional blocks and protected economic zones.

This evolution has been driven by:

- Geopolitical conflict: Tensions between superpowers have led to sanctions, tariffs, and reduced cooperation.

- Pandemic aftershocks: COVID-19 exposed the fragility of global supply chains and over-dependence on single production hubs.

- Rising nationalism: Many countries now prioritize self-sufficiency and domestic manufacturing over global integration.

- Energy and security realignments: Nations are rethinking their resource dependencies and trade relationships.

As a result, we’re witnessing a shift toward regionalization, where countries build tighter alliances with neighbors and like-minded economies instead of relying on a single, global network.

What This Means for Investors and Entrepreneurs

This shift disrupts long-standing assumptions. Markets that once offered predictable returns now present regulatory barriers, and formerly stable supply chains now carry heightened risk.

So what can forward-thinking investors do? They must pivot from static strategies to dynamic ones.

Here’s how.

1. Rethink Market Access and Global Reach

Access has become a strategic asset. Where you’re allowed to operate matters more than where you want to operate.

Governments now apply sharper scrutiny to foreign investors. In some cases, they restrict capital movement or limit foreign ownership. In others, they offer incentives, but only to investors with existing ties or residency.

To stay ahead, you need access to the right markets before barriers go up.

This means securing legal, financial, and physical presence in jurisdictions that welcome international investors. The flexibility to enter or exit markets with minimal friction can make all the difference when trade patterns change.

2. Diversify Jurisdictional Risk, Not Just Assets

Asset diversification isn’t enough in a fragmented world. Jurisdictional risk, the legal, political, and financial stability of where your assets and businesses reside, now takes priority.

You must consider:

- Tax predictability: Will today’s low-tax jurisdiction still protect your wealth in 10 years?

- Banking security: Can your capital move freely, or is it vulnerable to currency controls or sanctions?

- Legal environment: Do courts protect private property, contracts, and investments without bias?

- Political neutrality: Is the jurisdiction entangled in conflicts or positioned as a global bridge?

To minimize these risks, many investors are strategically diversifying where they bank, where they hold real estate, and even where they base their companies.

3. Treat Mobility as Leverage

In a world of shifting rules and closing doors, personal and business mobility offer powerful leverage. Being able to relocate your operations, or yourself, quickly and legally can protect both lifestyle and assets.

Mobility creates:

- Opportunity access: Entry into emerging markets and fast-growing economies

- Lifestyle flexibility: Residence in countries with higher safety, healthcare, and quality of life

- Risk mitigation: The option to move if a jurisdiction becomes unstable or hostile to investors

This is why more global entrepreneurs now pursue second citizenships or alternative residencies, not just as a backup, but as part of a proactive, integrated strategy.

4. Follow the Trade Corridors of the Future

With 80% of trade routes shifting, investors need to watch where capital, goods, and growth are heading next.

Emerging “connector economies” are rising, countries that serve as neutral, strategic bridges between economic blocs. These nations often:

- Maintain diplomatic neutrality

- Support business-friendly policies

- Offer tax and investment incentives

- Attract international talent and capital

Regions such as the Middle East, Southeast Asia, the Caribbean, and select European countries are becoming increasingly attractive, not just for short-term gains, but for long-term global positioning.

By anchoring part of your strategy in these emerging hubs, you stay connected to both sides of a divided global economy.

Why Timing Is Everything

Many governments are still drafting new trade policies. Tax regulations, migration rules, and capital controls are all shifting rapidly.

If you wait until these changes are fully in place, your options may be limited.

Acting now allows you to:

- Lock in favorable programs before they close

- Secure residencies or citizenships while they’re still accessible

- Position your capital in stable jurisdictions ahead of economic shifts

- Build relationships in emerging markets before they mature

In a fluid global environment, first-mover advantage is not just a benefit, it’s a necessity.

Build for Resilience, Not Just Growth

For decades, growth dominated the conversation. Today, resilience is just as important. This means building a strategy that withstands shocks and adapts to change without compromising your freedom or your wealth.

Resilience requires:

- A diversified portfolio across jurisdictions

- Flexible legal structures that allow cross-border movement

- Strategic citizenships that open access and provide protection

- Clear succession and legacy planning across multiple regions

With these elements in place, your investments, lifestyle, and legacy remain insulated from the volatility affecting many traditional markets.

Why This Isn’t Just About Business

This global shift affects more than your balance sheet. It touches where your children will grow up, how your assets will be passed on, and how your lifestyle can evolve in the coming decades.

When borders tighten and systems destabilize, those with foresight, those who took the time to position themselves beyond one jurisdiction, will find freedom, safety, and continued opportunity.

This isn’t reactionary thinking. It’s proactive, long-term global strategy.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Navigate the New Global Economy With Confidence

The global trade realignment isn’t a temporary disruption, it’s a new chapter. For those paying attention, it presents a rare opportunity to restructure, relocate, and reinvest in smarter, more resilient ways.

The most successful investors of the next decade won’t be those chasing short-term trends. They’ll be the ones who adapted early, diversified wisely, and moved strategically before the rest of the world caught up.

Are you ready to act before the next trade shift closes more doors?

Let us help you build a future-proof global strategy, one that protects your wealth, enhances your mobility, and secures your legacy.

Contact us today to start the conversation.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

African Citizenship by Investment for Strategic Global Investors

African citizenship by investment is gaining attention among global investors seeking diversification, mobility, and access to emerging markets. As African…

58% of New Trade Growth Happens Outside the U.S.

58% of New Trade Growth Happens Outside the U.S., marking a structural shift in global economic power. As trade momentum…

CBI in Times of Uncertainty: When One Passport Is Not

Global uncertainty has changed the rules of wealth preservation. In today’s environment, one passport may not provide sufficient protection. This…

Nigeria Dangote Refinery Investment Opportunity for Strategic Investors

Nigeria’s Dangote Refinery investment opportunity reflects growing capital market maturity and infrastructure scale. For high net worth individuals and global…

13 CARICOM Nations Attract Over 1 Billion Dollars from 5

13 CARICOM nations attract over 1 billion dollars from 5 global powers, reinforcing regional credibility and investment stability. Sovereign commitments…

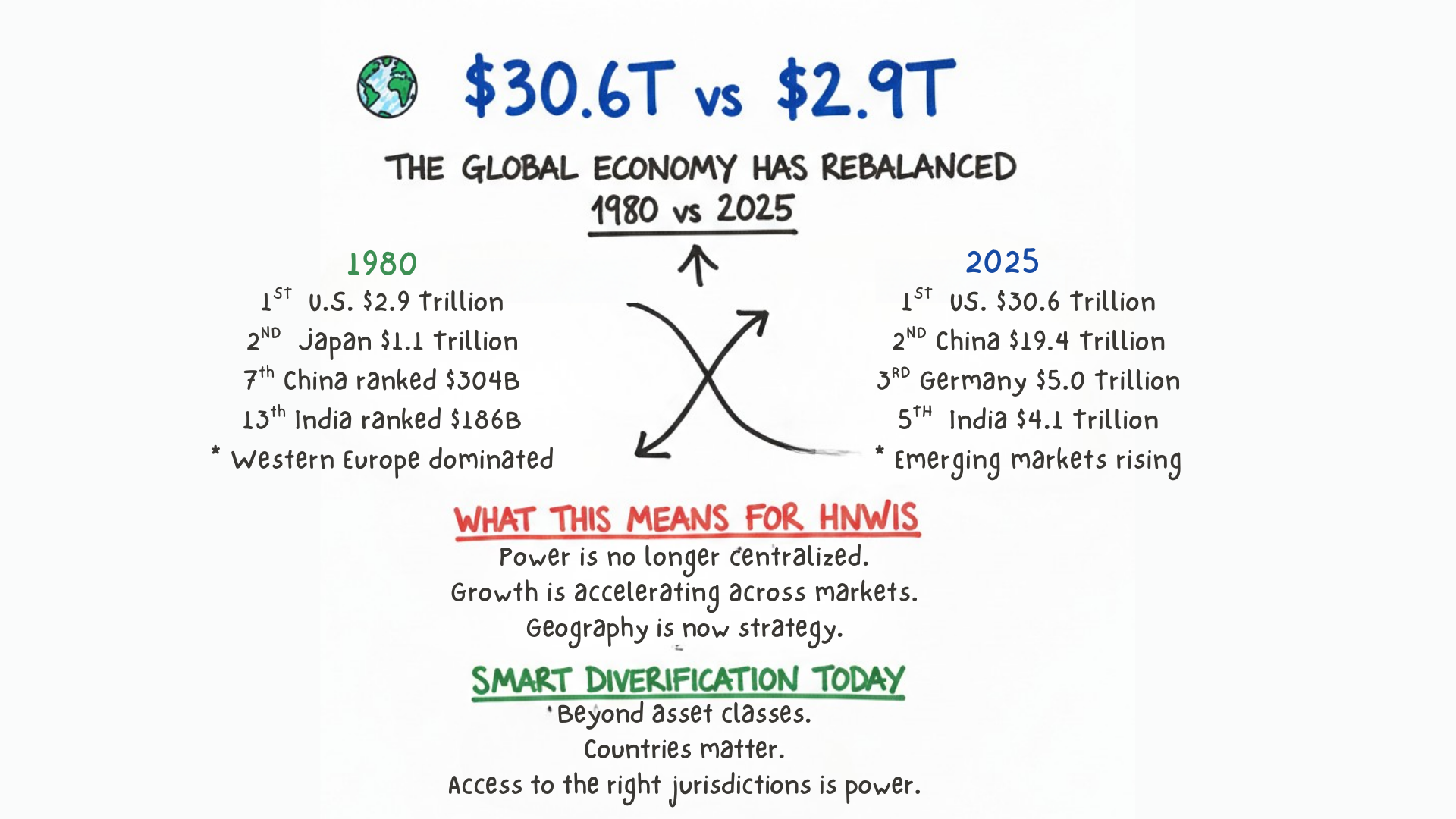

From Western Dominance to a Multipolar Economy (1980–2025)

From 1980 to 2025, global power shifted from Western dominance to a multipolar economy. Economic influence now spans several regions,…