How French Investors Use Second Citizenship for Freedom

Across France’s business elite, investor community, and high net worth families, a notable shift is underway. The pursuit of a second citizenship is no longer simply about travel convenience or holiday perks. It has become a strategic imperative driven by concerns over taxes, economic policy, stability, and future opportunities for children. For those with substantial assets and global interests, the right second citizenship can unlock freedom, security, and long-term resilience.

In this in‑depth analysis, we explore the main drivers behind this growing trend, explain how second citizenship delivers real value, and shed light on what wealthy French citizens should consider when evaluating this transformative step.

Understanding the Changing Needs of High Net Worth Individuals

Today’s globally mobile investors, entrepreneurs, and business owners operate in an environment where geography no longer limits opportunity but it does define risk. Increasingly, individuals with significant capital are seeking ways to:

- Protect wealth from aggressive tax regimes

- Ensure personal and financial security

- Expand business opportunities internationally

- Preserve freedom of movement for themselves and their families

France’s unique combination of high taxation, regulatory complexity, and recent socio‑political pressures has intensified interest in alternative residency and citizenship options. Before exploring the specific reasons behind this trend, it is essential to understand what second citizenship means for high net worth individuals (HNWIs).

What Second Citizenship Provides

Second citizenship is not merely a second passport. It confers:

- Legal nationality in another country, with all associated rights

- Long‑term residency and work rights outside one’s original country

- Alternate legal and tax jurisdictions for personal and business affairs

- Broader travel freedom without visa restrictions

- A contingency plan against political, economic, or regulatory upheaval

For wealthy French citizens, these benefits translate into practical, high‑value possibilities that can safeguard their wealth, lifestyle, and legacy.

1. High Tax Burdens in France Drive Strategic Reconsideration

One of the strongest incentives for second citizenship among French HNWIs centers on taxation. France operates a residency‑based tax system, meaning that French tax authorities may tax individuals on worldwide income and assets, even if they are physically outside the country for extended periods. While France offers exceptional public services and infrastructure, its tax regime for high earners can be among the most demanding in the developed world.

What High‑Income French Taxpayers Face

HNWIs and business owners living in France may contend with:

• Personal income tax rates reaching up to 45%

• Social charges as high as 17.2% on top of income tax

• Wealth tax on global assets, including financial portfolios and real estate

• Inheritance taxes that can exceed 60%

• Complex reporting requirements for foreign investments

These tax pressures can significantly impact capital accumulation, investment decisions, and long‑term financial planning. For many successful professionals and investors, the question becomes not whether they should pay taxes, but how to plan them in a way that supports growth, not erosion of capital.

How a Second Citizenship Creates Tax Flexibility

Obtaining a second citizenship can be a cornerstone of international tax planning when structured properly and legally. It allows individuals to:

• Establish tax residency in jurisdictions with lower or no income tax

• Re‑domicile assets and legal entities

• Reduce or eliminate tax on foreign‑sourced investment returns

• Pass wealth to heirs under favorable inheritance frameworks

It is important to emphasize that this planning must be compliant with international tax laws, including OECD standards and French exit tax rules. Engaging experienced international tax professionals ensures individuals can lawfully optimize their fiscal position without exposure to penalties or disputes.

2. Political and Social Pressures Influence Long‑Term Security Decisions

Beyond taxes, France has experienced prolonged periods of political and social tension in recent years. Repeated nationwide protests, concerns about urban safety, and fluctuating policy frameworks have contributed to a sense of unpredictability for affluent families.

Why Stability Matters for Wealthy Families

For individuals with significant assets and global commitments, stability is not an abstract concept, it is a practical necessity. Political turbulence can lead to:

• Sudden changes in tax policy

• Emergency levies or capital controls

• Fluctuations in financial markets

• Regulatory reforms impacting business operations

When governments face fiscal pressures, they often turn to policy tools that affect those with mobile capital. This reality has shifted behavior among HNWIs, who now actively seek environments where the rule of law and economic conditions are predictable over the long term.

Second Citizenship as a Security Tool

A second passport offers a legal and credible backup strategy. It provides:

• A secondary residence option if conditions deteriorate

• Fast mobility for family relocation during emergencies

• Greater control over where and how assets are managed

• A framework for international contingency planning

Importantly, pursuing second citizenship is not about abandoning one’s homeland. For many, it is an act of preparing for uncertainty, a way to ensure options remain open regardless of political shifts.

3. Wealth Creation and Entrepreneurial Freedom

France’s economic model emphasizes social welfare and worker protection. While these are valuable societal features, they also shape how business owners perceive growth opportunities. Regulatory burdens and high operational costs can create friction for entrepreneurs seeking rapid expansion or international diversification.

Challenges for Entrepreneurs

Business owners in France may encounter:

• High corporate tax and social contribution obligations

• Complex labor regulations

• Limited flexibility for international structuring

• Regulatory inconsistencies across sectors

These factors can make it difficult to scale operations globally, attract international investment, or remain competitive with peers in more tax‑friendly environments.

How Second Citizenship Can Empower Entrepreneurs

Second citizenship broadens the horizon for businesses in several ways:

• Facilitates establishing companies in favorable jurisdictions

• Enables access to international banking and capital markets

• Allows owners to live in or travel to key markets without visa constraints

• Enhances recruitment options for global talent

For founders and investors with cross‑border aspirations, the ability to navigate multiple legal systems with ease is a significant asset.

4. European Union Financial Surveillance and Restrictions

Until recently, many French investors considered the European Union (EU) a safe financial shelter. However, evolving regulatory frameworks within the EU, such as automatic information exchange, emerging digital currency discussions, and capital movement monitoring, have prompted some to reconsider the degree of financial exposure tied exclusively to EU systems.

Emerging EU‑Wide Financial Measures

Some of the developments affecting investor sentiment include:

• Automatic exchange of financial information across borders

• Digital euro proposals with transactional traceability

• Intra‑EU compliance standards that may limit flexibility

• Exit taxation on cross‑border transfers of investments

These measures, while intended to enhance transparency and prevent tax abuse, also constrain how individuals can move and manage capital internationally.

Second Citizenship and Non‑EU Diversification

Second citizenship outside the EU offers French investors:

• Non‑EU legal status for alternative investment planning

• Broader access to international banking and financial services

• Residency options beyond EU regulatory umbrellas

• Additional asset diversification pathways

Countries that have attracted particular interest from French investors include Caribbean nations and select European partners with favorable citizenship‑by‑investment (CBI) or residency‑by‑investment (RBI) programs. These options provide legal status outside EU constraints while maintaining strong global mobility.

5. Protecting the Future: Citizenship as a Long‑Term Strategy

For many affluent families, a second citizenship represents a long‑term strategic asset rather than a reactive solution. It is a forward‑looking approach to safeguarding wealth, creating opportunities for the next generation, and ensuring continuity of lifestyle and legacy.

What Second Citizenship Offers for Future Generations

Second citizenship can enable:

• Children to live, work, and study internationally without restrictions

• Families to diversify their estate planning strategies

• Enhanced global mobility and access to markets

• Greater choices for where to retire or invest

This strategic dimension distinguishes second citizenship from short‑term travel benefits. It becomes a durable component of personal and financial planning that adapts as family needs evolve.

Choosing the Right Second Citizenship

Selecting an appropriate second citizenship requires careful analysis and professional guidance. Key considerations include:

- Legal Compliance: Understanding home country regulations on dual citizenship and tax obligations.

- Program Credibility: Choosing programs with strong governance and international recognition.

- Mobility Benefits: Passport strength and visa‑free access to key destinations.

- Tax and Residency Outcomes: Alignment with wealth management and lifestyle goals.

- Family Inclusion: Provisions for spouses and children in the citizenship structure.

Working with experienced advisors, including legal, tax, and global mobility experts, ensures that decisions are grounded in principles: real experience, professional expertise, and a strong foundation of trustworthiness and authority.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Strategic Citizenship for a Complex World

For wealthy French citizens, second citizenship is more than an aspirational status symbol. It is an actionable strategy that addresses real challenges, from tax burdens and regulatory constraints to political volatility and global opportunity.

As the world grows more interconnected yet more complex, having legal options beyond a single jurisdiction empowers families and individuals to preserve wealth, protect futures, and pursue opportunities without borders.

If you are a high net worth individual, business owner, or seasoned investor considering second citizenship, informed planning is essential. Start by evaluating your long‑term goals, consulting with qualified advisors, and exploring programs that align with your global vision.

Ready to explore your second citizenship options? Contact our team of specialists today to assess which pathways best match your financial and personal objectives.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

African Citizenship by Investment for Strategic Global Investors

African citizenship by investment is gaining attention among global investors seeking diversification, mobility, and access to emerging markets. As African…

58% of New Trade Growth Happens Outside the U.S.

58% of New Trade Growth Happens Outside the U.S., marking a structural shift in global economic power. As trade momentum…

CBI in Times of Uncertainty: When One Passport Is Not

Global uncertainty has changed the rules of wealth preservation. In today’s environment, one passport may not provide sufficient protection. This…

Nigeria Dangote Refinery Investment Opportunity for Strategic Investors

Nigeria’s Dangote Refinery investment opportunity reflects growing capital market maturity and infrastructure scale. For high net worth individuals and global…

13 CARICOM Nations Attract Over 1 Billion Dollars from 5

13 CARICOM nations attract over 1 billion dollars from 5 global powers, reinforcing regional credibility and investment stability. Sovereign commitments…

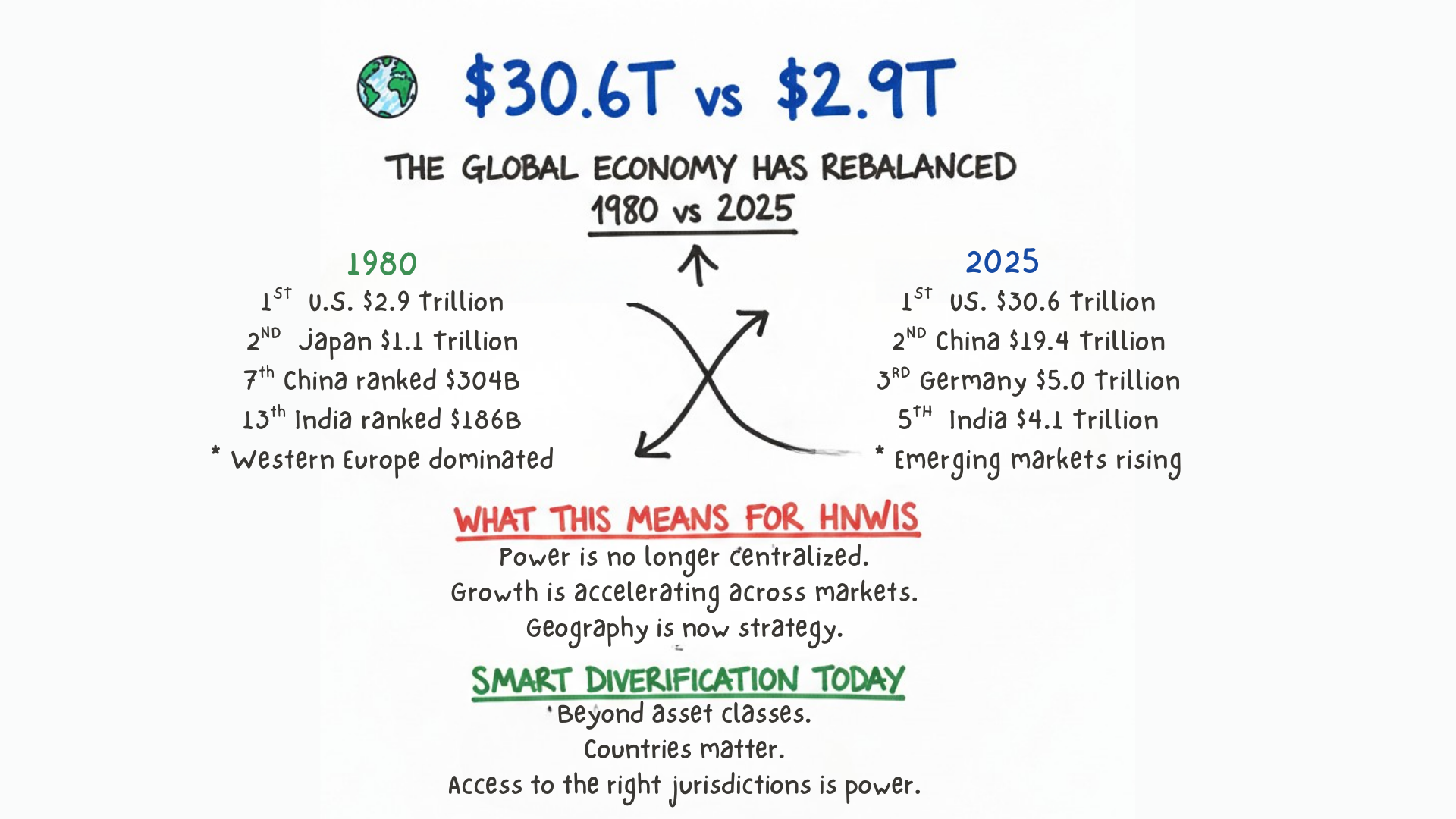

From Western Dominance to a Multipolar Economy (1980–2025)

From 1980 to 2025, global power shifted from Western dominance to a multipolar economy. Economic influence now spans several regions,…