Why 16,500 Millionaires Left the UK in 2025 Wealth Migration Wave

A Record-Breaking Shift in Global Wealth

In 2025, a historic shift occurred that caught the attention of governments, financial experts, and high-net-worth individuals (HNWIs) across the globe. Known as the UK millionaire exodus 2025, 16,500 millionaires left the United Kingdom, the largest wealth outflow from any single country in recorded history. This movement wasn’t just a reaction to short-term issues; it was a calculated decision by business leaders, investors, and affluent families to seek environments more aligned with their financial goals and personal values.

This event signals a deeper transformation in how wealth is managed, protected, and positioned in today’s global economy.

What Prompted the UK Wealth Exodus?

High-net-worth individuals rarely move on impulse. Their decisions often follow careful planning with private bankers, legal advisors, and wealth managers. The decision to leave the UK in such large numbers was based on several converging factors:

1. Rising Taxes and Fiscal Pressure

The UK has implemented and proposed several tax measures in recent years that directly impact wealthy individuals:

- Potential increases to capital gains tax

- Inheritance tax concerns

- New rules targeting non-domiciled residents

- Greater scrutiny on offshore wealth structures

For many HNWIs, these changes not only raise financial burdens but also add long-term uncertainty to wealth planning strategies.

2. Policy Uncertainty and Political Risk

The broader political landscape in the UK has become increasingly unpredictable. Frequent leadership changes, shifting economic policies, and a lack of clear long-term direction have left many private clients uneasy about the future.

For investors and entrepreneurs, uncertainty limits confidence, not only in personal taxation but also in the investment climate and business operations.

3. Cost of Living and Quality of Life

Even for the wealthy, cost-efficiency matters. The UK’s rising property costs, energy prices, and general inflation have added to the appeal of other jurisdictions offering higher value for money, especially when coupled with better weather, lower crime, and more favorable business regulations.

Where Did They Go?

The millionaires who left the UK in 2025 didn’t just disappear, they strategically relocated to countries offering financial advantages, global access, and long-term security.

This UK millionaire exodus 2025 was not a retreat, it was a global repositioning of wealth.

United Arab Emirates (UAE)

Dubai and Abu Dhabi continue to attract affluent individuals with:

- No personal income tax

- Business-friendly laws

- High-end lifestyle and global connectivity

- Secure residency pathways through investment

United States

Despite higher income taxes, the U.S. remains attractive due to:

- A strong, diversified economy

- Access to world-leading investment markets

- High-quality education and healthcare

- Entrepreneurial freedom

Portugal

Portugal continues to gain popularity thanks to:

- A low cost of living for the quality offered

- Favorable tax regime for foreign residents

- Stable political and economic climate

- Lifestyle benefits including climate, safety, and culture

Italy

Italy has risen in the rankings due to:

- A special flat-tax regime for new residents

- Cultural and lifestyle appeal

- Affordable real estate in non-central areas

- Attractive legal structures for international wealth

Singapore

Singapore is consistently ranked among the best places to live and do business:

- Low corporate taxes and efficient bureaucracy

- Strong rule of law and stable governance

- Access to Asian markets

- Global banking and private wealth services

What This Means for the UK Economy

When HNWIs relocate, the effects are far-reaching, not only for the individuals but for the countries they leave and the ones they move to.

The UK millionaire exodus 2025 represents more than just a loss of tax revenue. It reflects broader challenges that could affect the UK’s attractiveness to both domestic and international wealth.

Loss of Tax Revenue

While the wealthiest make up a small percentage of the population, they contribute a disproportionately large share of total tax revenues. A sustained outflow of these individuals could widen the fiscal gap in public finances.

Decline in Domestic Investment

Affluent individuals often invest locally in businesses, startups, and real estate. Their departure can reduce domestic investment flows, leading to slower growth in key sectors.

Talent and Innovation Drain

Many millionaires are also entrepreneurs and job creators. Their exit could signal a weakening innovation ecosystem and fewer opportunities for younger professionals and startups.

Why Global Mobility Matters for HNWIs

In today’s world, wealth is more global than ever. High-net-worth individuals are building international portfolios, operating cross-border businesses, and raising globally mobile families. As such, where you choose to reside matters more than ever before.

Key Reasons HNWIs Seek Global Relocation:

- Asset protection: Countries with strong legal systems and privacy laws can better protect assets.

- Access to international markets: Strategic relocation can open new investment opportunities.

- Family security and education: Safer environments and access to top international schools are major decision factors.

- Tax efficiency: While not the only factor, tax structure often plays a major role in long-term planning.

- Lifestyle and health: Better weather, less pollution, and access to high-quality healthcare are increasingly important.

Residency and citizenship planning is no longer a luxury, it is a key element of any robust wealth strategy.

Strategic Relocation Through Investment

For many HNWIs, investment-based residency and citizenship programs offer an efficient, legal pathway to relocate. These programs allow individuals to acquire a second residence or passport in exchange for a qualified investment, often in real estate, government bonds, or national development funds.

The benefits include:

- Greater mobility with visa-free travel

- Better security for families

- Diversified assets across jurisdictions

- Generational planning for heirs

- Optional tax benefits, depending on destination

Programs are designed to suit business owners, investors, retirees, and internationally mobile families.

Positioning for the Future

The 2025 UK millionaire exodus is not a temporary reaction, it’s part of a long-term shift in how wealth is protected and grown globally. It reflects a new reality where individuals must be proactive, not reactive, in their personal and financial planning.

Whether you’re considering a move for lifestyle, business, or wealth reasons, understanding the broader trends and the available legal pathways, is crucial. With the right planning and guidance, you can secure your legacy and access new opportunities worldwide.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Start Your Global Strategy Today

If you’re an investor, business owner, or high-net-worth individual evaluating your future, now is the time to act. The world is changing quickly, and your success depends on staying ahead of the curve.

Explore strategic residency and citizenship options that align with your financial goals and lifestyle preferences. Gain freedom, flexibility, and future-proof your wealth through expert-guided investment migration.

Contact our team today to begin your confidential consultation.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

African Citizenship by Investment for Strategic Global Investors

African citizenship by investment is gaining attention among global investors seeking diversification, mobility, and access to emerging markets. As African…

58% of New Trade Growth Happens Outside the U.S.

58% of New Trade Growth Happens Outside the U.S., marking a structural shift in global economic power. As trade momentum…

CBI in Times of Uncertainty: When One Passport Is Not

Global uncertainty has changed the rules of wealth preservation. In today’s environment, one passport may not provide sufficient protection. This…

Nigeria Dangote Refinery Investment Opportunity for Strategic Investors

Nigeria’s Dangote Refinery investment opportunity reflects growing capital market maturity and infrastructure scale. For high net worth individuals and global…

13 CARICOM Nations Attract Over 1 Billion Dollars from 5

13 CARICOM nations attract over 1 billion dollars from 5 global powers, reinforcing regional credibility and investment stability. Sovereign commitments…

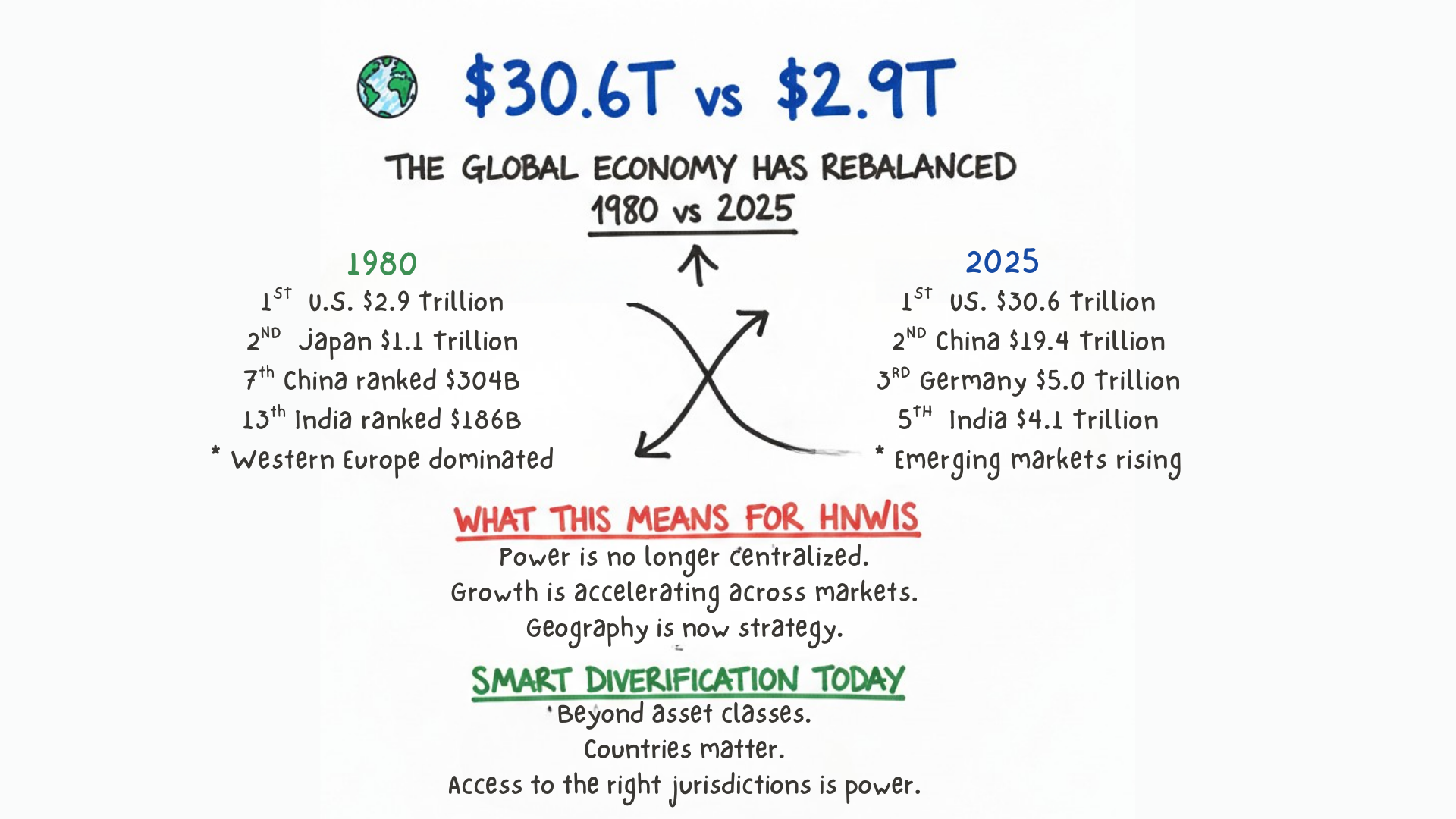

From Western Dominance to a Multipolar Economy (1980–2025)

From 1980 to 2025, global power shifted from Western dominance to a multipolar economy. Economic influence now spans several regions,…