Belarus Eyes Citizenship by Investment to Attract Global Capital

As geopolitical and economic tides shift, countries are rethinking how to attract investment while offering meaningful value in return. Belarus, a nation often under the global radar, is now taking significant steps to introduce a citizenship-by-investment (CBI) program, a move that could redefine its position in the world of investor migration.

This emerging development is not just another policy announcement. For high-net-worth individuals (HNWIs), international entrepreneurs, and strategic investors, the proposed program represents a potential gateway to both regional access and asset diversification in a changing global landscape.

Understanding Belarus’s Strategic Move

Belarus is advancing a legal framework to allow foreign nationals to acquire citizenship through a defined investment process. While the program has not yet launched, draft legislation is under parliamentary review, with a timeline suggesting implementation could occur by mid-to-late 2026.

This proposal is more than a financial tool, it’s a strategic play. Belarus has been navigating Western sanctions, economic headwinds, and increasing economic interdependence with Russia. By creating a route to citizenship tied to capital inflow, the government aims to bring in much-needed foreign investment while offering international investors a new base in Eastern Europe.

What Is Citizenship by Investment?

Citizenship by Investment is a legal process through which individuals can acquire citizenship in a country by making a significant investment, often in real estate, government bonds, national development funds, or business enterprises.

The model has existed for decades in various parts of the world, offering dual benefits:

- For investors: global mobility, business expansion, personal security, and asset protection

- For host countries: foreign direct investment, economic development, and talent attraction

If Belarus moves forward with its program, it would join a growing group of nations utilizing this model to attract strategic capital.

Why Belarus Could Be an Unconventional Opportunity

While not currently considered a mainstream destination for second citizenship, Belarus offers unique geopolitical advantages that may interest sophisticated investors.

1. Access to the Eurasian Economic Union (EAEU)

Belarus is a full member of the EAEU, alongside Russia, Armenia, Kazakhstan, and Kyrgyzstan. Citizens of Belarus enjoy visa-free travel and work rights across these nations. This kind of regional mobility is rare and provides an operational edge for investors eyeing cross-border logistics, manufacturing, or trade hubs.

2. Legal Right to Live in Russia

Through the Union State treaty between Belarus and Russia, Belarusian citizens have the right to live and work permanently in Russia. This feature alone could make the CBI program appealing to investors looking to establish or maintain presence in Russia, despite its geopolitical isolation from the West.

3. Undervalued Real Estate and Low Cost of Entry

Although investment thresholds have not yet been finalized, Belarus remains one of Europe’s most affordable economies. Real estate, infrastructure, and commercial sectors may offer long-term upside for investors entering at an early stage.

What We Know So Far About the Program

While full details are still being finalized, here are the early insights into what Belarus is proposing:

- Legislative Framework Under Review: The Belarusian House of Representatives has reviewed the draft law, with broad approval for the concept. Specific guidelines are expected to be added via presidential decrees.

- Investment Amount Not Disclosed: There has been no official word yet on the minimum investment threshold or qualifying sectors, but it’s expected to be competitive with other markets.

- Language and Integration Requirements: Discussions are ongoing regarding potential language proficiency and cultural knowledge requirements. Some exemptions may apply, particularly for minor children or elderly applicants.

- Security Vetting: Like all legitimate programs, applicants will likely undergo background and security checks, ensuring the program maintains credibility and international standards.

Who Should Consider This Opportunity?

The proposed Belarusian program is not for everyone. However, it may appeal to a specific profile of investor:

Business Owners with Eurasian Interests

If your operations touch Eastern Europe, Central Asia, or Russia, having citizenship in a country like Belarus could streamline visa processes, residency logistics, and business registration.

Global Investors Seeking First-Mover Advantage

Early adopters of lesser-known CBI programs often benefit from lower entry thresholds, direct dialogue with authorities, and tailored support in shaping their investment journey.

Individuals Focused on Portfolio Diversification

Citizenship is increasingly seen as an asset class. Just as investors diversify across real estate, equities, and currencies, a second citizenship adds geopolitical and mobility diversification.

In fact, a 2025 investor sentiment report found that 82% of global HNWIs now view second citizenship as a strategic asset, not just a luxury perk. This shift reflects deeper concerns around market volatility, global conflict, and regulatory unpredictability.

Risks and Considerations

While the opportunity is notable, every investor should proceed with caution and informed judgment.

Geopolitical Complexity

Belarus has strong political and economic ties to Russia, which may be a concern depending on your global exposure or existing sanctions compliance needs.

Due Diligence

The CBI program is still under development. Lack of clarity on the final requirements and legal framework means that early participation should be guided by experienced legal and investment advisors.

Exit Strategy

Consider your long-term goals. While citizenship opens doors, the liquidity of your initial investment (particularly in real estate or local business ventures) may vary.

How to Prepare as an Investor

If you’re considering participating in the Belarusian CBI program once it launches, here are a few steps to start preparing now:

Plan for Integration: Think beyond the passport. How will this benefit your business, family, or long-term lifestyle?

Consult an Expert: Work with professionals who understand both investment migration and the Eastern European market.

Monitor Legislation: Stay updated on the evolving legal landscape. The final structure may offer windows of opportunity.

Assess Your Risk Profile: Weigh the geopolitical risks against the mobility and market advantages.

Why This Matters Now

In an increasingly fractured world, mobility is no longer just about travel. It’s about freedom of choice, strategic positioning, and economic resilience.

The concept of owning a second citizenship is evolving from being a “nice-to-have” to a core pillar of modern wealth strategy. And programs like the one proposed in Belarus may become attractive tools for early movers willing to explore non-traditional opportunities.

In the same way investors once looked at emerging markets for alpha, today’s smart capital is looking at emerging citizenships for access, security, and long-term value.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Explore Your Next Move

If you are a high-net-worth individual, business leader, or strategic investor interested in leveraging global citizenship to future-proof your mobility and assets, now is the time to explore your options.

While Belarus’s CBI program is still in development, opportunities like this don’t stay under the radar for long.

Stay informed, act early, and position yourself globally.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

African Citizenship by Investment for Strategic Global Investors

African citizenship by investment is gaining attention among global investors seeking diversification, mobility, and access to emerging markets. As African…

58% of New Trade Growth Happens Outside the U.S.

58% of New Trade Growth Happens Outside the U.S., marking a structural shift in global economic power. As trade momentum…

CBI in Times of Uncertainty: When One Passport Is Not

Global uncertainty has changed the rules of wealth preservation. In today’s environment, one passport may not provide sufficient protection. This…

Nigeria Dangote Refinery Investment Opportunity for Strategic Investors

Nigeria’s Dangote Refinery investment opportunity reflects growing capital market maturity and infrastructure scale. For high net worth individuals and global…

13 CARICOM Nations Attract Over 1 Billion Dollars from 5

13 CARICOM nations attract over 1 billion dollars from 5 global powers, reinforcing regional credibility and investment stability. Sovereign commitments…

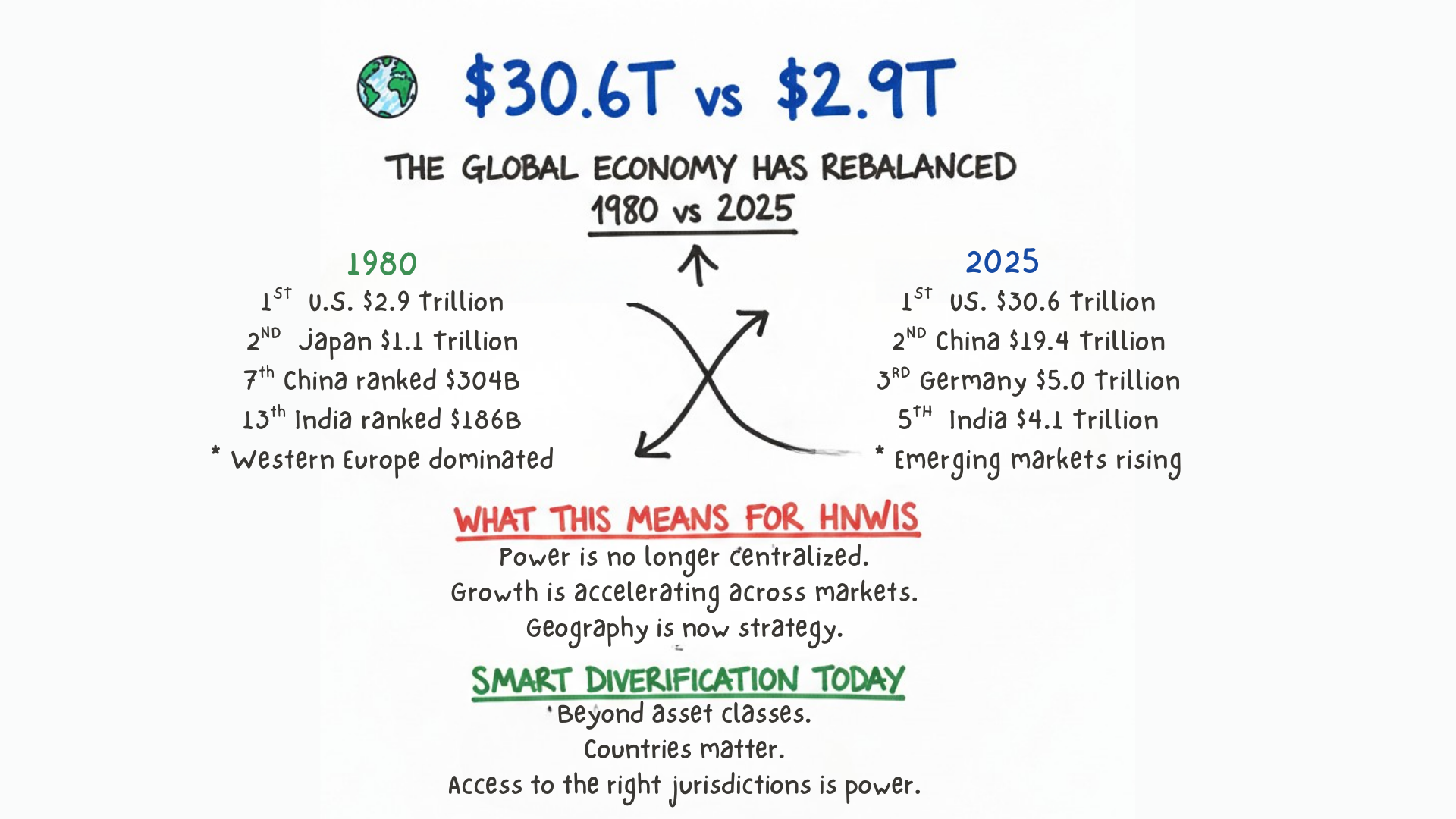

From Western Dominance to a Multipolar Economy (1980–2025)

From 1980 to 2025, global power shifted from Western dominance to a multipolar economy. Economic influence now spans several regions,…