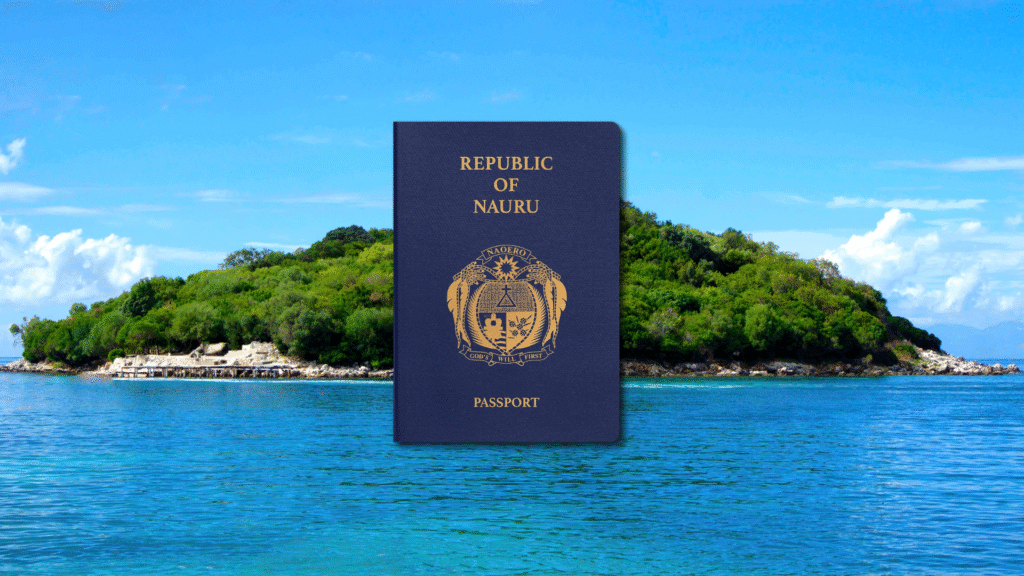

Is Nauru’s Citizenship Program Still Worth It After the UK Visa Ban?

A Wake-Up Call for Citizenship Investors: The Nauru Case

When the United Kingdom abruptly ended visa-free access for citizens of Nauru, many in the investment migration world took notice. For those watching Nauru’s newly launched Citizenship by Investment (CBI) program, this policy shift is more than a bureaucratic update, it’s a clear signal that not all CBI programs are seen as equal on the world stage.

For business owners and high-net-worth individuals (HNWIs) considering alternative citizenships, the Nauru case presents a critical question: What makes a citizenship program resilient and respected in the eyes of global powers?

Let’s break down what’s really happening and what investors should consider before buying in.

What Triggered the UK’s Decision?

The UK government has moved Nauru from its visa-free list to its visa-required category, meaning Nauru passport holders can no longer enter the UK with just an electronic travel authorization. Instead, they must apply for a visa, often requiring interviews, financial checks, and waiting periods.

This isn’t a random decision. According to UK authorities, the structure of Nauru’s CBI program raised concerns about national security, particularly regarding how easily individuals could acquire a new identity without meaningful ties to the issuing country.

This is crucial: global regulators are increasingly wary of programs that appear to offer “citizenship for sale” without serious due diligence. Whether fair or not, perception is everything and it can directly impact the value of a passport in your pocket.

Nauru’s Defense: Is It Enough?

To its credit, Nauru has responded swiftly and strongly.

Officials from the country insist that its CBI program includes multiple levels of background screening, involving third-party due diligence, law enforcement interviews, and rigorous eligibility checks. They argue that the program meets or exceeds international standards on anti-money laundering and counter-terrorist financing.

In short, Nauru says it has done the work, and that the UK’s concerns are misplaced or politically driven.

But here’s the reality for investors: perception still wins. No matter how solid Nauru’s internal processes may be, if major countries don’t trust the program, the value of the passport suffers.

Travel Power vs. Real Power

One of the most common motivations for pursuing alternative citizenship is global mobility, visa-free travel to key markets such as the UK, EU, and Schengen Zone. For many HNWIs, business travel flexibility and fast access to international markets are non-negotiable.

This is where Nauru’s program now faces a serious handicap.

With the UK removed from its visa-free list, the travel power of the Nauru passport is clearly weakened. And although Nauru maintains access to other countries, the loss of one G7 nation often signals potential reviews by others.

The market reality is this: no investor wants a passport that comes with growing travel restrictions. Citizenship is not just about a piece of paper; it’s about confidence and global legitimacy.

What This Means for Serious Investors

Here’s where the conversation becomes more serious.

If you’re an investor or business owner exploring second citizenships, Nauru’s situation offers a valuable lesson in risk management.

Citizenship Is a Long-Term Asset

Think of citizenship the same way you think of other high-value assets, real estate, private equity, or fine art. You don’t just buy for the short-term gain. You buy for its long-term utility, liquidity, and global recognition.

Nauru’s CBI program, while well-intentioned and newly launched, still lacks the track record and diplomatic depth of more established programs. It may offer quick approval and attractive pricing, but if geopolitical events can change its passport value overnight, that’s a red flag.

Due Diligence Goes Both Ways

Many investors focus on the background checks they must go through, but investors must also vet the country offering the citizenship. Who are the program partners? What is the country’s relationship with other global powers? Does it have a strong financial system, political stability, and international respect?

Nauru is a small Pacific island with limited international clout. If its citizenship program is not globally trusted, your investment may not hold value, no matter how good the brochure looks.

Are Other Countries at Risk Too?

Yes. The UK’s decision follows a broader trend. Over the past few years, several countries have reviewed or restricted access to citizens from nations with investor-focused citizenship programs. The common thread? Programs lacking strong residency ties or geopolitical credibility.

It’s not just about Nauru. This is about how the entire investment migration industry is being scrutinized.

As more governments tighten their immigration rules and clamp down on perceived “passport shopping,” only the most transparent, secure, and well-established programs will survive with their reputations intact.

Alternatives with Stronger Reputations

For investors who want both global mobility and long-term security, here are factors to look for in a reputable CBI or residency program:

Features of a Respected Program

- High Due Diligence Standards: Not just advertised, but verified by international partnerships.

- Established History: Programs operating for 5–10+ years with consistent policy.

- Strong Diplomatic Ties: Especially with the EU, UK, and North America.

- Economic and Political Stability: A country with long-term development vision.

- Clear Physical or Economic Links: Programs that require real investments or connections to the country.

While Nauru is still new to the scene, other programs have built years of trust with global powers. For serious investors, it’s better to align with programs that have already passed the test of time and scrutiny.

What Comes Next for Nauru?

Nauru has signaled its intent to engage directly with the UK and explain how its citizenship program works. There may be future negotiations or policy adjustments to rebuild trust.

But for now, the damage is done. The UK’s decision has placed a diplomatic shadow over the program, and other nations may follow.

Reversing that takes more than good intentions. It takes time, transparency, and a clear demonstration of global alignment.

If you’re a business leader, investor, or entrepreneur thinking about second citizenship, you can no longer afford to take these decisions lightly.

The old model, shop for a quick passport with a cheap price tag, is fading fast.

In its place, a new standard is emerging: substance over speed, and credibility over convenience.

That’s why it’s crucial to work with professionals who understand not just the paperwork, but the geopolitics behind the passport.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Secure a Passport That Moves With Power, Not Questions

Don’t invest in uncertainty.

Our team helps business owners and high-net-worth individuals secure second citizenships and residencies that stand the test of time and international scrutiny. We only work with trusted programs that offer both mobility and long-term security.

Let’s start your personalized investment migration plan today. Contact us now to discuss your options with confidence and clarity.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

The Hidden Cost of Staying in High-Tax Countries for Wealth

Staying in a high-tax country could cost you more than just money, it could cost you opportunity, legacy, and control….

$5 Billion in Bilateral Trade Targeted Between Nigeria and Türkiye

Nigeria and Türkiye are deepening economic ties with a $5 billion annual trade target. This strategic move signals trust, investor…

Why Europe Is Tightening Control Over Wealth and Tax Freedom

Governments across Europe are taking a tougher stance on wealth, mobility, and personal tax planning. As proposals tighten, successful investors…

The Hidden Strength Behind CBI Real Estate Resale Rules

CBI real estate resale rules are often misunderstood. Rather than a drawback, these rules provide structure, preserve market stability, and…

Saudi Premium Residency: Unlock Investment & Opportunity

Learn how Saudi Premium Residency is opening powerful pathways for high‑net‑worth investors, entrepreneurs, and business owners. Understand eligibility options, advantages,…

What Nigeria’s Restructuring Debate Signals to Investors

Nigeria’s restructuring debate is not about politics. It is about long-term certainty. For investors and high-net-worth families, repeated reform discussions…