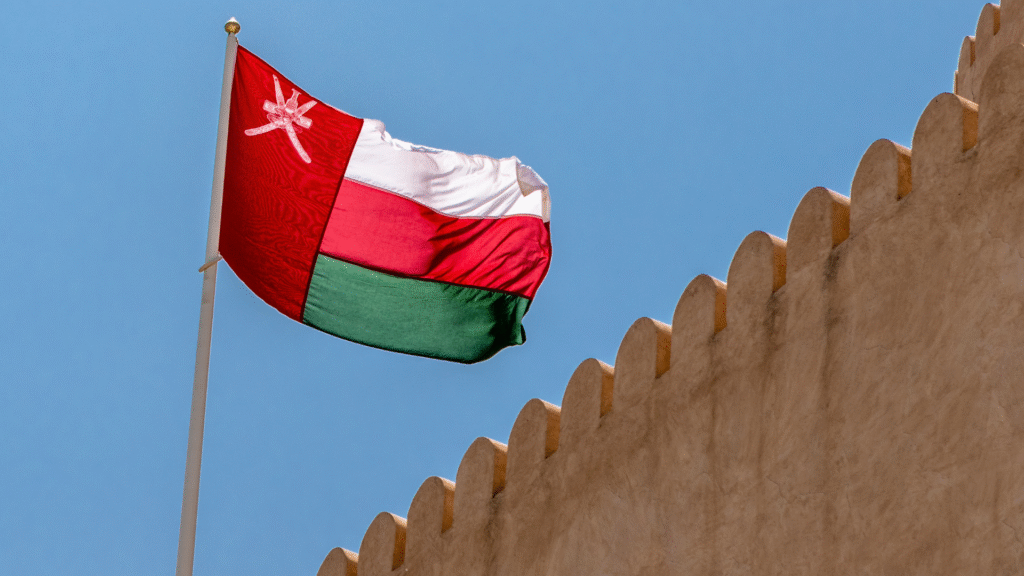

Oman’s Next Big Step: Golden Visa & Digital Trade Reform for Global Investors

1. Multiple Investment Paths with Flexible Terms

- Family inclusion: Residency extends to spouses, children under 25, and dependent parents.

- No sponsorship required: Investors can apply on their own, simplifying the process.

2. Diverse Investment Vehicles—Choose What Works for You

- Property ownership: Buy residential property worth at least 500,000 OMR.

- Business equity: Invest 500,000 OMR in a company or purchase shares worth the same.

- Job creation: Start a business that employs at least 50 Omanis.

- Government bonds: Invest in Omani government development bonds.

3. Transparent Costs—Know What You’ll Pay

- Al Majida (Mujeedah) Companies Initiative: This new programme rewards high-performing Omani businesses with incentives to grow both at home and abroad.

- Digital Commercial Transfers: Through the “Oman Business” (or “Invest Oman”) platform, commercial registration transfers will now be fully digital—cutting time, cost, and red tape.

- Sultan Qaboos University

- German University of Technology

- Oman Energy Association

- Binaa (or Ebinaa) Professional Services

- Long-Term Stability:

Renewable five- and ten-year visas offer peace of mind and family security. - Ownership and Control:

Investors can fully own businesses and properties, with no sponsorship hurdles. - Time & Cost Efficiency:

Digital registration slashes bureaucracy and makes Oman more business-friendly. - Local Growth, Global Integration:

The Al Majida initiative supports Omani firms, while academic ties build a knowledge-driven economy. - Vision 2040 Aligned:

These reforms fit into Oman’s broader plan to diversify its economy into technology, tourism, logistics, and more.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Conclusion

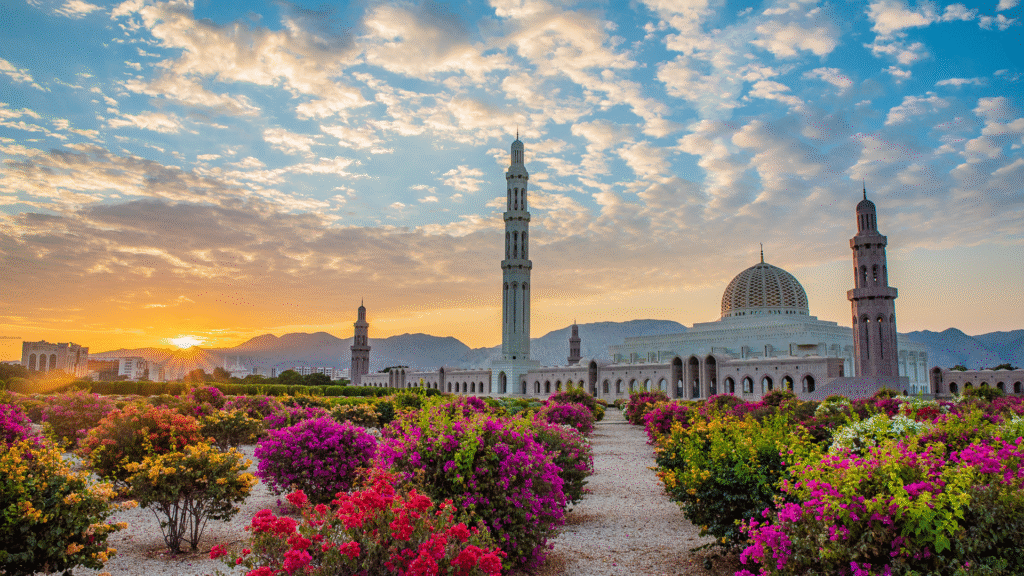

Oman’s Golden Visa relaunch and digital trade transformation signal a new era of openness and strategic planning. By streamlining business processes, expanding investment avenues, and promoting long-term stability, Oman stands out as a thoughtful and forward-looking destination for global capital.

Share this blog

Frequently Asked Questions

Related Articles

Beijing Is Watching Your Wealth; Turkey Offers a Legal Pathway

In an era of rising financial scrutiny, global investors are taking action. Discover why 89% of Chinese HNWIs are exploring…

Saudi Premium Residency for HNWIs: A Middle East Plan B

Saudi Arabia is becoming a serious second pillar for globally mobile investors. Premium Residency options, expanding market access, and a…

$12,000 Homes in Venezuela: Smart Opportunity or High Risk

Venezuela has returned to global headlines, and contrarian investors are watching closely. With some property pricing still deeply discounted, the…

Mercosur Residency: A Smart Second Citizenship Strategy

Mercosur Residency offers structured access to nine South American countries under one regional agreement. For high net worth investors and…

New €150,000 Benchmark for Montenegro Property Residency

Montenegro property residency 2026 introduces a €150,000 real estate threshold for non EU applicants. Rather than limiting access, the reform…

The Growing Importance of Jurisdiction in Wealth Planning

Jurisdictional wealth planning is no longer optional for global investors. As tax laws, political systems, and economic priorities shift, choosing…

Why 29+ Jurisdictions Keep Pension Taxes Below 10 Percent

Why 29+ jurisdictions keep pension taxes below 10 percent reflects a deliberate global policy shift. Governments are attracting stable foreign…