Are CBI Programs Creating Tax Havens?

- Attractive Tax Policies: Many countries offering CBI programs implement tax-friendly policies to lure foreign investors. This includes no global income tax, no capital gains tax, and lenient corporate tax laws.

- Economic Growth vs. Tax Avoidance: Proponents claim these programs boost local economies by attracting foreign capital. Critics, however, argue they provide legal loopholes for tax avoidance, potentially harming global taxation fairness.

- Impact on Global Tax Systems: Organizations like the OECD warn that tax havens disrupt international tax agreements, leading to reduced tax revenues for many nations.

- No Global Income Tax: Residents are only taxed on income earned within the country.

- Privacy Protections: Strict banking and corporate secrecy laws.

- No Wealth or Inheritance Taxes: Wealth can be transferred without additional tax burdens.

- Double Taxation Treaties: Agreements that prevent being taxed twice on the same income.

- Low Corporate Tax Rates: Favorable for businesses relocating their headquarters.

- Asset Protection: Secure legal frameworks to protect wealth from economic instability.

- Enhanced Global Mobility: Visa-free travel and residency in countries with favorable tax systems.

- Business Opportunities: Access to tax-efficient markets for entrepreneurs.

- Legal Tax Planning: Structured options for reducing tax obligations while complying with international laws.

- Diversification of Assets: Opportunity to hold assets in stable, low-tax environments.

- Wealth Disparity Issues: Critics argue these programs widen the gap between wealthy individuals and average taxpayers. When HNWIs benefit from tax havens, it shifts the tax burden to others.

- Global Policy Responses: Lastly, governments and organizations are implementing measures like the Global Minimum Corporate Tax to counteract the impact of tax havens. This seeks to ensure fair taxation and reduce profit shifting.

Contact us if you are interested in Citizenship by Investment

Our expert advisors will have a 1-on-1 consultation to find the best solutions for you and your family and guide you through the procedure.

Conclusion

In conclusion, CBI programs undeniably provide financial benefits for investors and stimulate local economies. However, their association with tax havens raises concerns about global taxation fairness and economic ethics. As scrutiny grows, countries offering these programs may need to balance their attractiveness with transparency and compliance with international tax standards.

Share this blog

Frequently Asked Questions

Related Articles

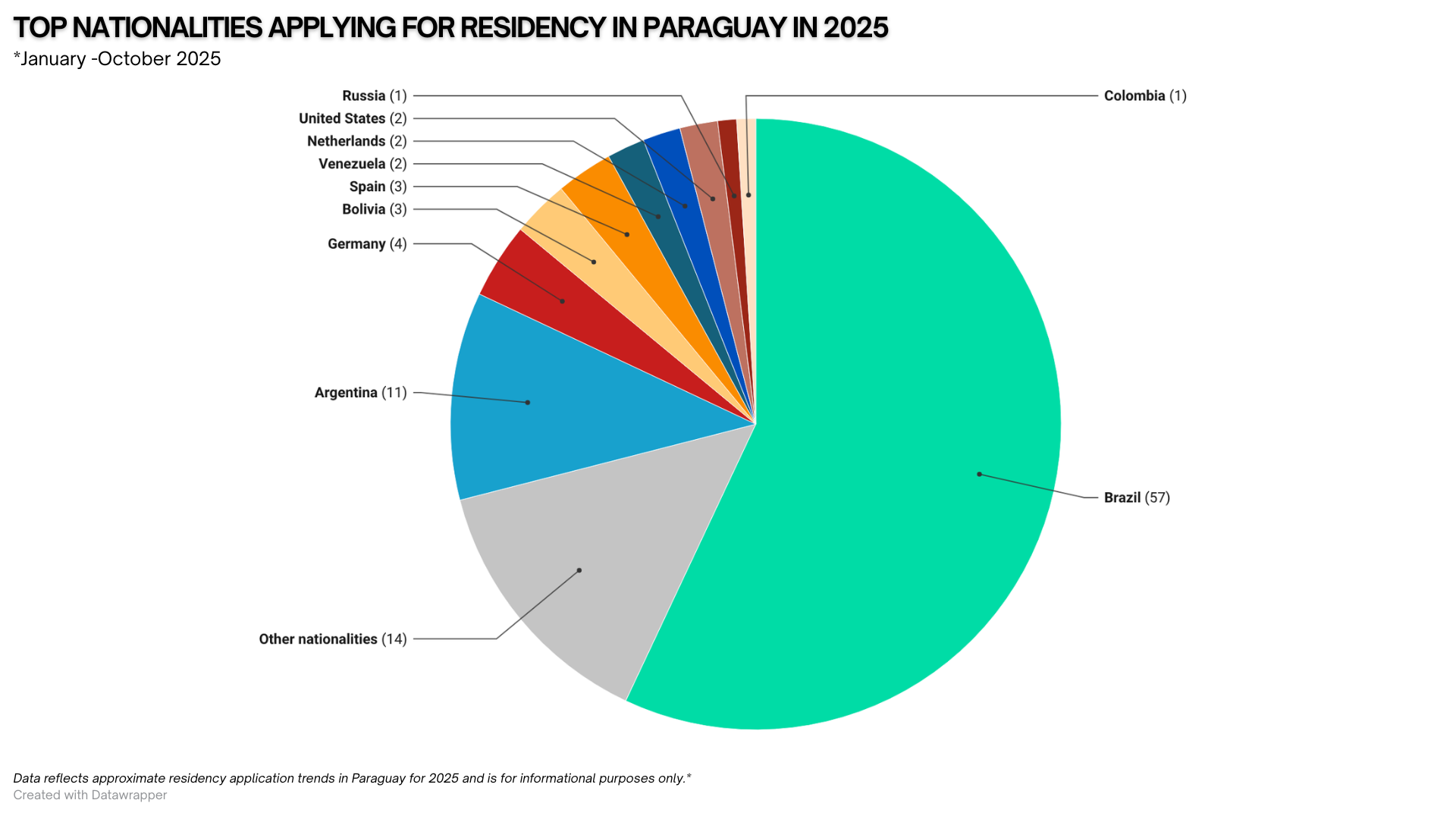

Paraguay Reports 50% Increase in Residency Applications in 2025

Paraguay saw a remarkable 50% surge in residency applications in 2025, drawing growing interest from global investors and high-net-worth individuals….

7,000 Russians Claimed Citizenship Through a Forgotten Treaty

In 2024, over 7,000 Russians secured Kyrgyz citizenship through a long-forgotten treaty, no investment, no residency. This surprising surge reveals…

72% of Countries Now Demand More Than Just a Strong

A strong passport is no longer enough. With 72% of countries now applying political filters to mobility, high-net-worth individuals and…

Keep More Abroad at 29 Countries with No Tax on

Paying tax on income earned outside your home country? You may not need to. Discover 29 countries where foreign income…

UAE Golden Visa Real Estate Delivered Up to 20% Returns

UAE real estate led all Golden Visa markets in 2025, delivering up to 20% total returns. While other countries faced…

Venezuela’s Political Shift and the New Investment Landscape

Venezuela’s post-Maduro era may unlock rare investment and residency opportunities. With political transition underway, early-movers could gain access to undervalued…