The Investor Visa Portugal: Discover your key to Europe

- Key Takeaways

- Exploring the Portugal Golden Visa Program

- Navigating Investment Routes for Your Golden Visa

- The Application Journey: Securing Your Golden Visa Permit

- Financial Considerations: Costs Associated with the Golden Visa

- The Path to Portuguese Citizenship

- Banking and Fiscal Responsibilities

- Boosting the Economy: Impact of the Golden Visa on Portugal

- Family Ties: Including Loved Ones in Your Golden Visa Application

- Living the Dream: Life in Portugal as a Golden Visa Holder

- Overcoming Challenges: Solutions for Common Golden Visa Hurdles

- Summary

- Frequently Asked Questions

Looking to secure residency in Portugal through investment? The investor visa Portugal, also known as the Golden Visa, may be your ideal route. This article cuts through the complexity to outline what you need to consider—the investment thresholds, perks of the program, application steps, and associated costs. Whether you’re considering potential citizenship or simply a European lifestyle, here’s how to unlock your future in Portugal.

Key Takeaways

- The Portugal Golden Visa program, launched in 2012, has drawn significant foreign investment, attracting over 12,000 investors and generating over €6 billion, offering a five-year residency-by-investment for non-EU nationals and allowing free circulation in the Schengen Area.

- Recent changes to the program have removed real estate investments from qualifying activities but introduced other routes such as capital transfer, venture capital fund investments, and contributions to artistic and scientific ventures as alternatives.

- Qualification for Portuguese citizenship via the Golden Visa program requires maintaining the investment for a minimum of five years, adhering to a minimal stay requirement, and fulfilling a basic proficiency in Portuguese language.

Exploring the Portugal Golden Visa Program

The Portuguese Golden Visa program, also known as the Portugal Golden Visa program, is a five-year residency-by-investment scheme for non-EU nationals. Launched in 2012, this innovative program was designed by the Portuguese government to attract foreign investment and stimulate the economy. And, it’s safe to say, the scheme has been a resounding success. Since its launch, the Golden Visa has attracted over 12,000 investors and 20,000 family members, clearly reflecting its appeal among global investors.

This program has not only benefitted the investors but has also played a significant role in driving Portugal’s economy. With over €6 billion of investment attracted, the Golden Visa program has contributed significantly towards preserving Portugal’s national heritage and stimulating its economic growth. However, as with any investment, one must bear in mind the program’s significant costs, as the minimum investment requirements may pose a potential obstacle.

Despite its formal designation as the Portugal Golden Residence Permit Program, it is often called the Portugal Golden Visa Program. This residency-by-investment scheme grants the right to live, work, and study in Portugal and allows free circulation in Europe’s Schengen Area. Interestingly, the program only requires an average of seven days per year stay in Portugal over this period, which can also count towards citizenship eligibility after five years.

The Essence of the Portugal Golden Visa

The Portugal’s Golden Visa, was launched in October 2012 to attract international capital into Portugal. The primary intent of this scheme, also known as the residence permit for investment activity (ARI), is to provide a pathway for non-EU citizens to achieve residency in Portugal via investment. The program was specifically designed in response to the global economic climate following the 2008 economic crisis.

Obtaining the Golden Visa requires making a qualifying investment and sustaining it for at least five years. The eligibility for the Golden Visa is extended to non-EU, non-EEA, and non-Swiss citizens who are 18 years or older and have undertaken a qualifying investment in Portugal.

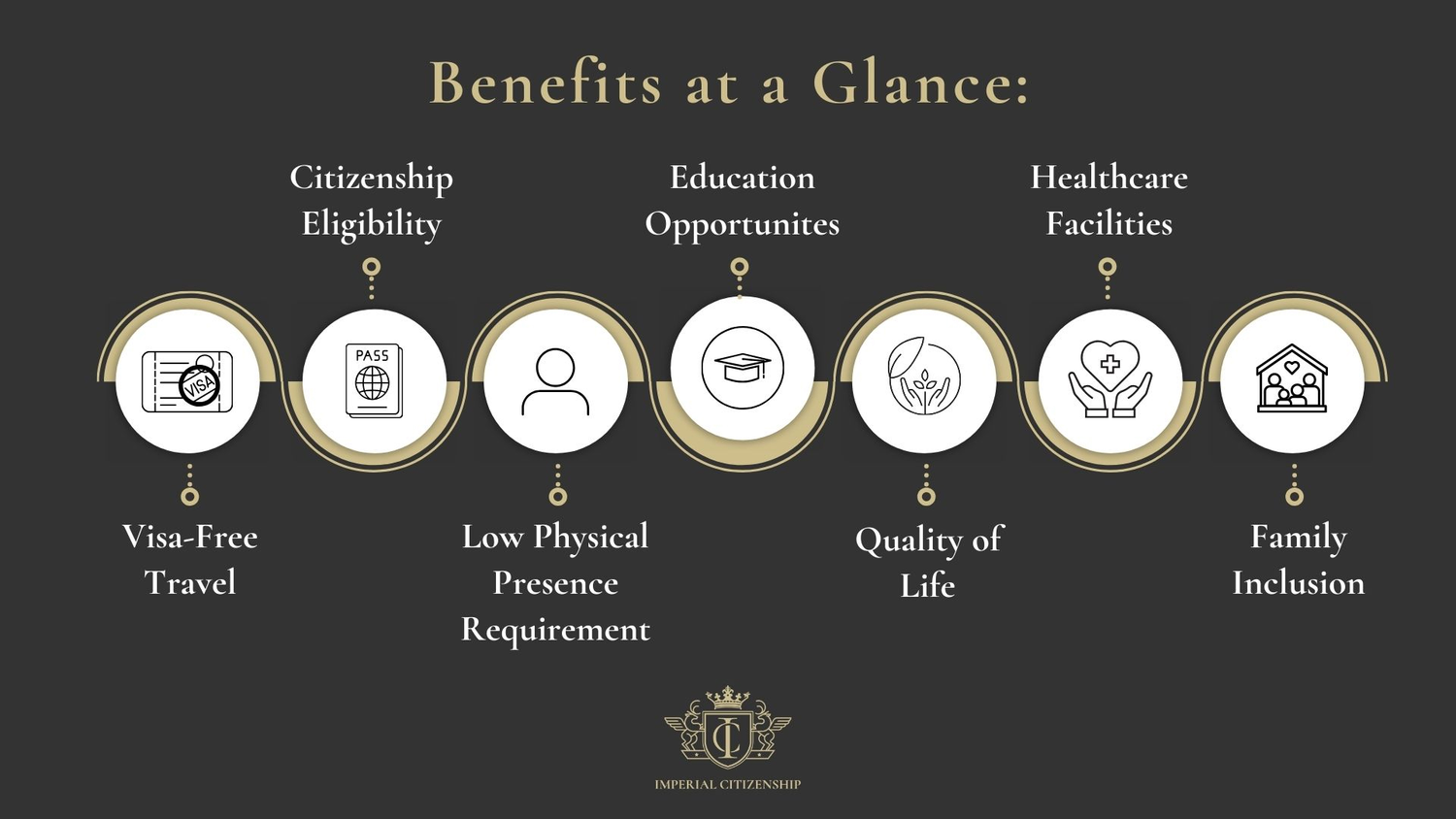

Benefits at a Glance

The Portugal Golden Visa program offers a multitude of advantages, making it an attractive option for investors seeking residency in Portugal and visa-free travel within Europe’s Schengen Area.

- Visa-Free Travel: Gain the right to travel freely within Europe’s Schengen Area, along with the flexibility to live, work, and study in Portugal.

- Citizenship Eligibility: After five years of legal residency, investors can apply for Portuguese citizenship while retaining their existing citizenship(s), offering a pathway to European citizenship.

- Low Physical Presence Requirement: Enjoy the flexibility of meeting minimal physical presence requirements (seven days during the first year and 14 days for the subsequent two years), which can count towards citizenship eligibility after five years.

- Education Opportunities: Access excellent international and Portuguese schools and universities, ensuring quality education for yourself and your family members.

- Quality of Life: Experience Portugal’s renowned high quality of life, enriched by its vibrant culture, mild climate, delectable cuisine, and robust security measures, fostering a desirable living environment.

- Healthcare Facilities: Benefit from internationally acclaimed healthcare clinics and hospitals, providing comprehensive medical care for you and your family.

- Family Inclusion: Extend residency rights to family members, including spouses, children, and dependent parents, facilitating family reunification and unity.

Recent Developments

The Portugal Golden Visa program has undergone some significant changes recently. Starting from October 2023, the program no longer considers real estate purchases and real estate-related funds as qualifying investment options. This change has been implemented. Despite the exclusion of real estate, alternative investment routes remain, including a capital transfer of €500,000 or more into venture capital funds, provided these funds do not engage in direct or indirect real estate investments.

These changes are part of a broader strategy to redirect investment towards:

- developing the property market in less-dense areas of Portugal, implicitly promoting the government’s goal of developing the country’s interior

- supporting the maintenance of artistic production

- supporting scientific research

- supporting cultural heritage

The focus of the program has also been recalibrated to prioritize these areas.

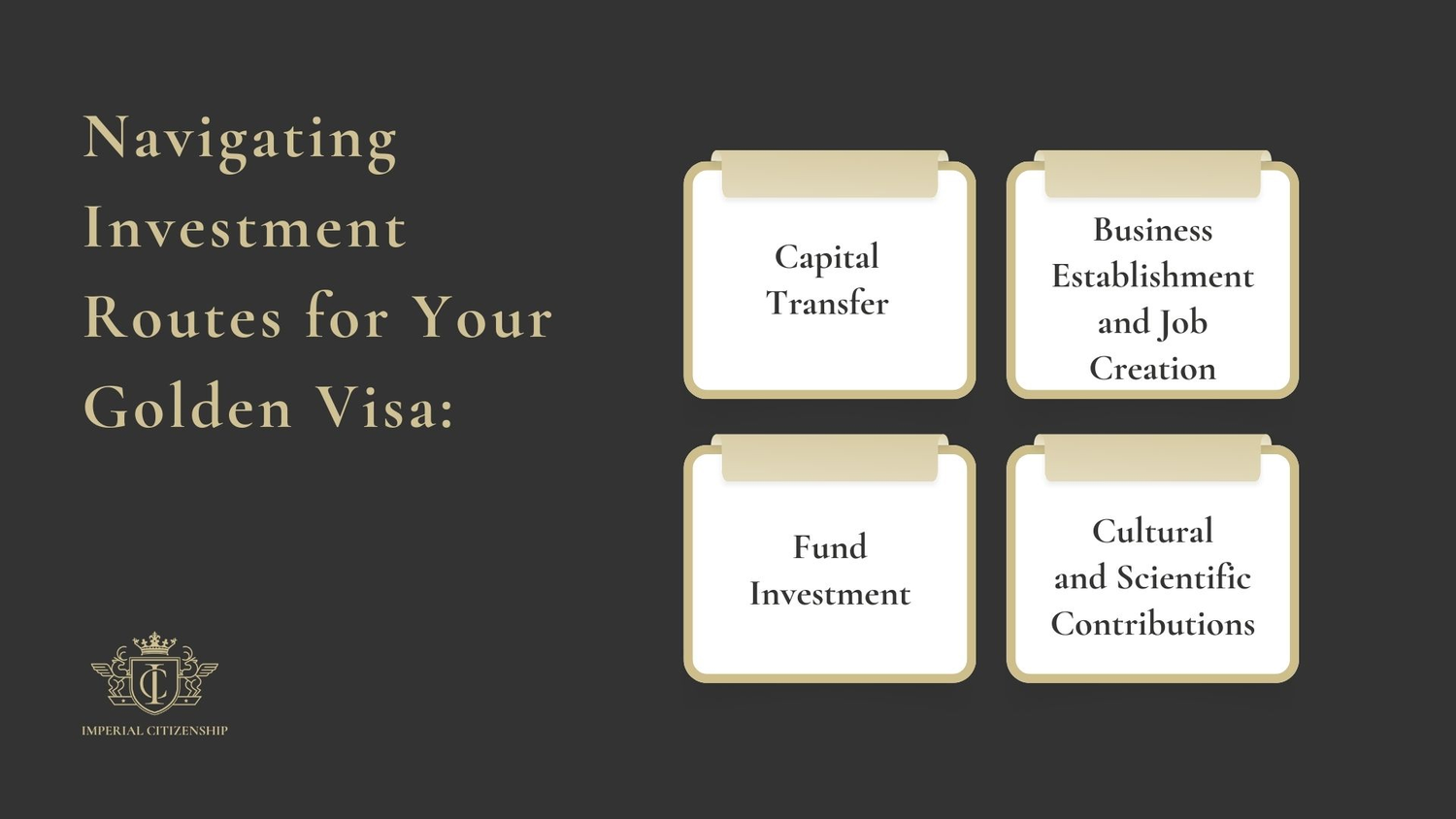

Navigating Investment Routes for Your Golden Visa

Upon getting acquainted with the Portugal Golden Visa program, your subsequent move should be exploring the different investment options at your disposal. The right choice will largely depend on your personal financial situation, risk appetite, and long-term goals. Let’s delve deeper into these options, which include:

- Capital transfer

- Business Establishment and Job Creation

- Fund investment

- Cultural and scientific contributions

The investment fund route, established by an amendment in Portuguese Law no. 102/2017 for the Portugal Golden Visa, necessitates a minimum investment of €500,000 into an approved Golden Visa fund for temporary residence qualification. As of January 1st, 2022, the minimum investment amount for qualifying venture capital funds for the Portugal Golden Visa is €500,000. These funds must be regulated by institutions like the CMVM and the Bank of Portugal to ensure compliance with the country’s legislative and tax laws.

Investing €500,000 in a Portuguese fund provides benefits such as a relatively low minimum investment amount, potential for diversification, and the possibility for higher returns compared to direct real estate investments. While investing across various funds is allowed, concentrating the full €500,000 in a single fund simplifies the process for the Portuguese Immigration and Borders Service (SEF).

Capital transfer

If you’re considering a capital transfer for the Golden Visa program, there are several options to choose from. You could opt for a €500,000 acquisition of investment fund or venture capital fund units committed to the capitalization of companies incorporated under the Portuguese law. These units should have a maturity of at least five years and at least 60% of the investment portfolio in companies with a registered office in the national territory.

Business Establishment and Job Creation

If business is your forte, you could consider the business investment route for your Golden Visa. This option involves the creation of a minimum of 10 new jobs or 8 new jobs in a low population density area*. Alternatively, you could invest €500,000 for the incorporation of a commercial company that is registered and headquartered in Portugal, creating a minimum of five permanent jobs for a period of three years.

This route could be particularly advantageous if you’re interested in contributing to an existing Portuguese company with the possibility of generating new employment opportunities. Plus, the Golden Visa program offers incentives for business establishment in low-density areas by requiring a reduced number of eight new full-time jobs, facilitating local development and potentially beneficial returns in these regions.

*A low population density area is defined as an area with fewer than 100 inhabitants per square kilometer or a GDP per capita below 75% of the national average.

Fund Investment Insights

Fund investments for the Golden Visa offer several advantages, including professional management and increased asset diversification. This eliminates the need to manage a property and avoids costs associated with real estate. However, challenges may include identifying qualified funds, higher risks, and potential difficulties in exiting the investment before the end of the fund’s lifecycle.

Venture capital funds used for Golden Visa applications can offer higher potential earnings through annual yields and capital appreciation, with a higher cost criterion of €500,000 managed by accredited fund managers. The Portuguese Securities Market Commission (CMVM) regulates approximately fifty eligible Golden Visa funds, ensuring investor protection and proper management.

Investment funds for the Portugal Golden Visa must meet specific qualifications, focusing on sectors excluding real estate assets, with several dozen options currently available in the market. By choosing the right fund, you can make the most of your investment and pave the way towards Portuguese residency.

Cultural and Scientific Contributions

If you have a keen interest in arts, culture, or science, the Golden Visa in Portugal allows for cultural contributions such as a donation of €250,000 to Portuguese arts, national heritage, or culture, or a €500,000 investment in national science or technology research. These options provide an affordable entry point for the Cultural Production Golden Visa.

Investment in scientific and technological research must be a minimum of €500,000 and conducted by an accredited institution in Portugal for the research investment. And if you’re considering an investment in a low-density territory*, the requirements can be reduced by 20%, to €200,000 for culture and €400,000 for science. This investment route not only provides a pathway to Portuguese residency but also contributes to the preservation and advancement of Portuguese culture and science.

*A low-density territory is defined as an area with fewer than 100 inhabitants per square kilometer or a GDP per capita below 75% of the national average.

The Application Journey: Securing Your Golden Visa Permit

Once you’ve chosen your investment route, the next step is to embark on the application journey to secure your Golden Visa permit. The initial steps to apply for the Portugal Golden Visa include:

- Consulting with experts: Begin by consulting with experts in Golden Visa applications to gain valuable insights into the program’s requirements and processes. These professionals can provide tailored advice based on your investment preferences and personal circumstances.

- Preparing the application, which can largely be done remotely: With the guidance of your representative, prepare the necessary documentation for your Golden Visa application. While much of the process can be completed remotely, thorough preparation is essential to ensure the smooth submission of your application.

- Submitting the application online, including copies of supporting documentation: Submit your Golden Visa application online through the designated portal, providing copies of all required documentation. Your representative will assist you in compiling and organizing the necessary paperwork to meet the program’s criteria.

Although the early application steps don’t necessitate travel to Portugal, except for the biometric data collection process, engaging a experts can streamline the remote procedure. It’s crucial to remember that after choosing an investment type, the next crucial step is finalizing the investment to proceed with the Golden Visa application. All supporting documents for the main applicant and dependents must be translated into Portuguese and certified with apostilles and notarizations where necessary.

Following the biometrics appointment, residence cards are generally received within 2-3 months. With the restructuring to AIMA, applicants are advised to follow any new procedures, as these changes may influence application processing times.

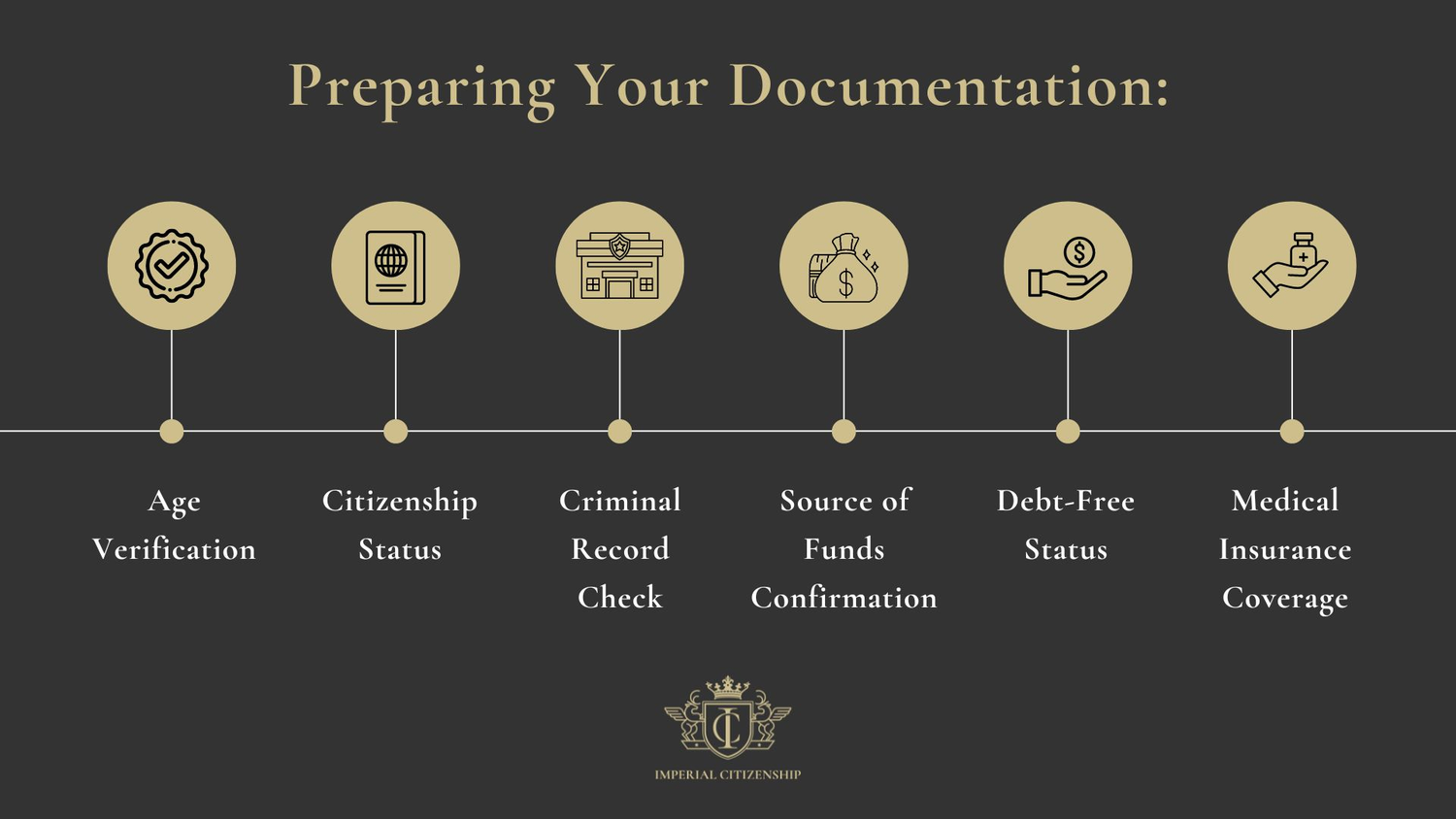

Preparing Your Documentation

As you embark on your journey to obtain the Portugal Golden Visa, meticulous preparation of your documentation is paramount to ensuring a smooth and successful application process.

- Age Verification: Ensure that you meet the age requirement for Golden Visa applicants, which mandates that individuals must be over 18 years old to be eligible for the program.

- Citizenship Status: Confirm that neither you nor any of your dependents hold citizenship in Portugal or any European Union (EU) or European Economic Area (EEA) country, as this is a prerequisite for Golden Visa eligibility.

- Criminal Record Check: Obtain official documentation verifying that you and your dependents have a clean criminal record, with no history of criminal convictions or pending charges.

- Source of Funds Confirmation: Provide evidence to substantiate the legality and legitimacy of the funds you intend to invest in Portugal. This may include bank statements, investment portfolio statements, property sale agreements, or other financial documents.

- Debt-Free Status: Verify that you have no outstanding debts or liabilities in Portugal, as this could impact your eligibility for the Golden Visa program.

- Medical Insurance Coverage: Secure comprehensive medical insurance coverage for yourself and your dependents, as mandated by the Golden Visa requirements. This insurance should provide sufficient coverage for healthcare expenses during your residency in Portugal.

Depending on your chosen investment route, you may need to prepare additional documentation to support your application. This could include property nvestment fund statements, business incorporation documents, or other relevant paperwork.

Ensure that all documentation not originally in Portuguese is accurately translated into Portuguese by a certified translator. Additionally, certain documents may require notarization or authentication to validate their authenticity. By meticulously preparing and organizing your documentation in accordance with these guidelines, you can enhance the efficiency and effectiveness of your Golden Visa application process.

Submission and Approval

The initial Golden Visa application and supporting documents are submitted online to the Portuguese Immigration and Borders Service (SEF).

During the review process, the Portuguese Immigration Office verifies the applicant’s documents before issuing the residence permit cards. To apply for the Portuguese Golden Visa through the Cultural Golden Visa route, one must identify a pre-approved cultural project by entities such as Fundação de Serralves and obtain a declaration from GEPAC after project approval.

The time between the submission of the temporary residency permit application and its final approval now contributes to the legal residency period required for Portuguese nationality, provided the permit is granted.

Biometrics and Finalization

After SEF pre-application approval, investors are notified with available dates to schedule their mandatory biometrics appointment, which can typically be arranged 1-2 months after pre-approval. The biometrics appointment involves the investor and their dependents physically appearing at the SEF office for collecting fingerprints to finalize the Golden Visa application.

At the biometrics session, the following steps are required:

- Submission of original application documents

- Attendance at an in-person appointment for biometrics

- All other steps of the Golden Visa application may be conducted remotely

Once the biometrics appointment is scheduled, it must be attended within approximately two months. The timing is crucial as it forms a key step in the Golden Visa finalization.

Financial Considerations: Costs Associated with the Golden Visa

While the Portugal Golden Visa program provides considerable advantages, it’s imperative to understand the related expenses. The initial application for the Portugal Golden Visa incurs a government fee of approximately €5,325 per person. For each renewal of the Golden Visa, a government fee of €2,663 per person is charged, in addition to a renewal processing fee of approximately €80. An initial processing fee of about €550 is required at the time of submitting the Golden Visa application. It’s essential to factor in these costs when planning your Golden Visa journey.

Government Fees Unveiled

The Portuguese government charges a processing fee of approximately €550 for the initial Golden Visa application, along with an additional one-time application fee of about €5,325 per person. Following the changes in October 2023, the cost for a residence permit card rose to €5,812 per person and the application fee increased to €582 per person.

For the renewal of the Golden Visa, applicants are required to pay a fee of €2,663 per person. Upon approval of the application, a residence permit issuance fee of €5,391.56 is charged for each applicant. Family members applying for the Golden Visa are subjected to an application fee of €539.66 each.

Additional Expenses

In addition to the application, there are other expenses to consider when applying for the Golden Visa. Applicants of the Portugal Golden Visa must provide proof of healthcare coverage, which can be obtained from the National Health System or through an international insurance company. The National Health System (SNS) allows for public healthcare access, but some services may require additional fees, while annual costs for private health insurance in Portugal can exceed €400 per family member.

The price of private health insurance varies significantly, ranging from €300 to €1,000 annually, depending on the insurer and the covered individual’s age. Rental income in Portugal is subject to a 28% tax rate, while the capital gains tax on the sale of assets for non-Portuguese residents is also 28% on the profit. Investors must consider bank account maintenance fees when planning for their golden visa expenses in Portugal.

The Path to Portuguese Citizenship

The Portugal Golden Visa program provides a clear pathway to permanent residency or citizenship in Portugal typically within five to six years. Applicants must adhere to minimal stay requirements, averaging 7 days per year, leading to a total of 14 days for each two-year residence card before citizenship eligibility.

Portuguese citizenship allows the holder to live, work in any EU member state, and have visa-free access to 188 countries worldwide. Recent changes in nationality law, such as the inclusion of residency permit application processing time to count towards the legal residency period, have impacted the path to citizenship.

Residence Requirements

Golden Visa holders must spend an average of seven days per year in Portugal to maintain their residency permit. During each two-year residency card’s validity period, Golden Visa holders are required to spend a total of fourteen days in Portugal.

The five-year residency period, which can lead to citizenship eligibility, begins when the Golden Visa residence cards are issued. Furthermore, recent legal updates account for the time between the submission and approval of the residency permit in the citizenship calculation.

Maintaining the investment and meeting the minimum stay requirement of 7 days in the first year and 14 days in subsequent years are essential practices to uphold Golden Visa residency.

Citizenship Criteria

To qualify for citizenship, the investment for the Golden Visa must be maintained for at least five years. Documentation demonstrating maintenance of investment requirements and good standing with Portugal’s Tax and Customs Authority & Social Security must be provided.

- Investment Maintenance: To be eligible for citizenship, Golden Visa holders must maintain their investment in Portugal for a minimum of five years. This includes retaining ownership of the property or maintaining the capital investment throughout the prescribed period.

- Documentation Verification: Applicants seeking Portuguese citizenship must provide documentation demonstrating compliance with investment maintenance requirements. This documentation should showcase the sustained investment and adherence to Portugal’s Tax and Customs Authority and Social Security regulations.

- Clear Criminal Record: Prospective citizens must possess a clean criminal record, both in Portugal and their country of origin. Any history of criminal convictions or pending charges may impact eligibility for citizenship.

- Genuine Links to Portugal: Applicants must establish genuine ties to Portugal. These links serve to demonstrate a commitment to Portuguese society and integration into the local community.

Passport Privileges

Portuguese passport holders enjoy significant privileges. They can travel visa-free to 159 countries as of February 2024. In addition to visa-free access, Portuguese citizens are eligible for eVisas in 20 countries and can get a visa on arrival in 28 countries.

Portuguese citizens have the right to live, work, and study in any European Union country. This privilege is extended to all members of the EU. A valid visa is required for Portuguese passport holders to enter 19 countries, ensuring they are well-informed when traveling.

Banking and Fiscal Responsibilities

Handling the banking and fiscal obligations forms a significant part of the Golden Visa journey. Here are some key points to keep in mind:

- A Tax Identification Number (NIF) is required in Portugal for various transactions such as opening a bank account, buying property, and settling taxes.

- Becoming a tax resident can occur by spending more than 183 days a year in Portugal.

The Non-Habitual Resident (NHR) tax regime offers tax benefits such as exemptions from tax on foreign income for the first 10 years of residence, for those who become tax residents in Portugal. To qualify for the NHR regime, individuals must either have not been taxed in Portugal for the five years prior to the application or meet the physical presence requirements, such as living in Portugal for more than 183 days within a 12-month period.

Setting Up a Bank Account

Before opening a Portuguese bank account, it’s necessary to obtain a NIF (Número de Identificação Fiscal). Moreover opening a bank account in Portugal typically requires the following:

- Proof of identification

- Proof of address

- Proof of income

- A local phone number for activation

Most banks require a personal visit to open an account, although a few may permit online account creation. An initial cash deposit between €250-300 is generally needed.

Options for banking in Portugal range from leading national banks like Caixa Geral de Depósitos and Banco Santander Totta, to international banks such as Barclays and Deutsche Bank.

Understanding Tax Residency

Tax residency in Portugal is established by residing in the country for at least 183 days within a calendar year. Golden Visa holders become liable for income tax in Portugal only upon choosing to become tax residents. Golden Visa holders who opt for tax residency can apply for the NHR regime, enjoying tax benefits and exemptions for a decade.

Under the NHR, there is an exemption on almost all foreign-source income and a favorable flat tax rate on certain domestic income. Pensions, including early retirement income and lump-sum payments, are taxed at a favorable 10% rate for NHR participants. Interest, dividends, and other qualifying income from foreign sources may be exempt from tax under the NHR scheme.

The NHR status is time-limited, expiring after 10 years, subsequent to which standard tax rates apply.

Navigating Portuguese Tax Obligations

The Non-Habitual Resident (NHR) regime in Portugal provides investors with significant tax benefits, including:

- An exemption on global income for ten years

- A reduced tax rate of 20% for income earned in Portugal from high value-added activities

- Foreign pension income taxed at a flat rate of 10%

- Income from employment and self-employment in high value-added sectors taxed at a flat rate of 20%

These benefits make Portugal an attractive destination for individuals looking to optimize their tax situation.

Tax exemption applies to nearly all foreign sources of income under the NHR scheme, provided the income comes from a country that has a Double Taxation Agreement with Portugal. To be eligible for NHR status, individuals must either have not been taxed in Portugal for the five years prior to the application or meet the physical presence requirements, such as living in Portugal for more than 183 days within a 12-month period.

NHR status confers additional tax advantages such as no wealth or inheritance taxes, and an exemption from taxes on gifts or inheritances between direct family members. For Portuguese source income not eligible for the NHR special rate, non-habitual residents are subject to the standard Portuguese income tax, which applies to other residents. The NHR program has attracted over 20,000 individuals, indicating its effectiveness in drawing foreign residents and optimizing their tax situations while they enjoy living in Portugal.

Boosting the Economy: Impact of the Golden Visa on Portugal

The Portugal Golden Visa program has had a substantial impact on the nation’s economy. Since its inception, the program has raised over €7 billion, benefiting the Portuguese economy by drawing international investments and allowing investors to reside in Portugal.

In 2022 alone, the program garnered more than €530 million in investments, demonstrating its continuing appeal and financial impact.

The Portuguese parliament approved changes to the program to shift investment types towards increasing rental housing supply and reducing real estate speculation. Since the program’s popularity burgeoned, real estate prices have seen significant increases, particularly in areas favored by Golden Visa investors. Studies indicate that Golden Visa holders contribute approximately sixfold the value of their initial investment within five years.

Regions like Madeira, with an influx of high-income foreign residents through the Golden Visa, have experienced substantial economic benefits. Collectively, the program has attracted 12,718 main applicants and 20,424 dependents, funneling roughly €7.3 billion into Portugal’s economy.

Family Ties: Including Loved Ones in Your Golden Visa Application

The Portugal Golden Visa program extends beyond the main applicant, giving due consideration to familial bonds. Family members that can be included in the Portugal Golden Visa application are:

- the main applicant’s spouse or legal partner

- children under 18

- dependent children under 26 who are full-time students

- financially dependent parents over 65 years old.

Children over 18 can qualify for the family reunification visa if they are unmarried, enrolled as full-time students, and financially dependent on the main applicant or their spouse. Siblings under 18 and under the legal supervision of the applicant or their spouse, as well as financially dependent parents under 65 years can be included in the application.

Including family members in the Golden Visa application requires submitting documents at the time of the initial application and for each renewal, demonstrating commitment to maintaining the investment for a five-year period. Proof of a stable and quality relationship must be presented to meet the family reunification criteria, and dependent children must maintain their eligibility status during each renewal application.

The Golden Visa holder must spend an average of 7 days per year in Portugal for the maintenance of the investment required for family reunification. Dependents included in the Golden Visa application are eligible for the same benefits as the main applicant, for an additional fee.

Living the Dream: Life in Portugal as a Golden Visa Holder

Being a Golden Visa holder in Portugal can be a dream realized. Golden Visa holders in Portugal enjoy:

- A high quality of life: Portugal offers a high standard of living, characterized by modern amenities, beautiful landscapes, and a rich cultural heritage.

- The ability to live, work and study in a secure country: Golden Visa holders can live, work, and study in a safe and secure country, providing peace of mind for themselves and their families.

- Hospitable people: Portugal is renowned for its hospitable people, creating a welcoming atmosphere for newcomers to integrate and thrive.

- Excellent climate: Enjoying a Mediterranean climate, Portugal boasts mild winters and long, sunny summers, ideal for outdoor activities year-round.

- Affordable living costs: Compared to other European countries, Portugal offers relatively affordable living costs, allowing Golden Visa holders to enjoy a comfortable lifestyle without breaking the bank.

- Full access to Portugal’s public healthcare services: Golden Visa holders have full access to Portugal’s public healthcare services, ensuring comprehensive medical care when needed. Additionally, they have the option to obtain private medical insurance for enhanced coverage for themselves and their families.

- Education Opportunities: Children of Golden Visa holders can benefit from Portugal’s education system, with tuition fees in public higher education institutions linked to the minimum wage. Private institutions offer varying fee structures, providing options for families seeking alternative educational pathways.

Portugal offers a unique blend of quality living, cultural richness, and opportunities for personal and professional growth. For Golden Visa holders, it’s more than just a residency status—it’s a chance to embrace a fulfilling lifestyle and build a prosperous future for themselves and their loved ones in a country they can proudly call home.

Overcoming Challenges: Solutions for Common Golden Visa Hurdles

Despite the considerable benefits of the Portugal Golden Visa program, it’s not devoid of challenges. Processing times for the Golden Visa can exceed a 2-3 months in larger cities like Lisbon, due to high demand and backlog. Applicants should ensure all required documents are submitted online accurately and completely to avoid delays in processing.

Golden Visa applications, also known as golden visas, cannot be expedited through additional fees and are processed in the order they are received. In rare cases of urgent need, such as medical emergencies, authorities may process applications slightly faster, but proof of force majeure is required.

After submitting the Golden Visa application, applicants have the right to reside in Portugal but are restricted from leaving the country until the permit is granted.

Summary

We’ve taken you on a comprehensive journey through the Portugal Golden Visa program, highlighting its benefits, investment routes, application process, associated costs, and path to Portuguese citizenship. This residency-by-investment scheme presents a unique opportunity for non-EU nationals to gain a foothold in Portugal and the larger European Union, providing potential for significant returns on investment, a high quality of life, and a pathway to Portuguese citizenship.

Taking the first step towards obtaining a Golden Visa can be a transformative decision, opening doors to new opportunities and experiences. As you embark on this journey, remember that thorough research, careful planning, and sound advice the specialists, are your best allies. With the right approach, the Golden Visa can be more than just an investment – it can be a gateway to a new life in one of the most vibrant and welcoming countries in Europe.

Frequently Asked Questions

How do I qualify for a Portugal investor visa?

To qualify for a Portugal investor visa, you need to meet specific requirements, such as having a clear criminal record and making a minimum investment of €500,000.

How much i need to invest in Portugal for citizenship?

To obtain citizenship in Portugal, you need to invest a minimum of €500,000 in various options such as purchasing investment funds or financing scientific research activities.

What is the 5 year visa in Portugal?

The 5 year visa in Portugal is the Golden Residence Permit Program, which allows non-EU nationals to live, work, and study in Portugal and travel freely within the Schengen Area.

How long does it take to process the Golden Visa application?

The Golden Visa application can take anywhere from 2 to 3 months to process, so it’s important to plan accordingly.